444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil geospatial analytics market represents a rapidly evolving sector that combines geographic information systems, satellite imagery, and advanced data analytics to provide location-based insights across multiple industries. Brazil’s vast territory spanning over 8.5 million square kilometers creates unprecedented opportunities for geospatial technology applications, from agricultural monitoring to urban planning and environmental conservation. The market encompasses various technologies including Geographic Information Systems (GIS), remote sensing, global positioning systems, and spatial data analytics platforms.

Market dynamics indicate robust growth driven by increasing government investments in smart city initiatives, expanding agricultural sector digitization, and growing environmental monitoring requirements. The Brazilian market benefits from substantial government support through programs like the National Spatial Data Infrastructure (INDE) and various state-level geospatial initiatives. Agricultural applications dominate the market landscape, with precision farming and crop monitoring representing significant adoption areas.

Regional distribution shows concentrated activity in major metropolitan areas including São Paulo, Rio de Janeiro, and Brasília, while agricultural regions like Mato Grosso and Rio Grande do Sul demonstrate strong adoption in farming applications. The market experiences growing demand from sectors including agriculture, mining, oil and gas, telecommunications, and government agencies seeking enhanced decision-making capabilities through location intelligence.

The Brazil geospatial analytics market refers to the comprehensive ecosystem of technologies, services, and solutions that collect, analyze, and visualize geographic and spatial data to support decision-making processes across various sectors in Brazil. This market encompasses hardware components such as GPS devices, satellite systems, and surveying equipment, alongside software solutions including GIS platforms, mapping applications, and spatial analytics tools.

Geospatial analytics combines traditional geographic information with advanced analytical techniques to extract meaningful insights from location-based data. In the Brazilian context, this technology addresses unique challenges including Amazon rainforest monitoring, extensive agricultural land management, urban sprawl analysis, and natural resource exploration. The market includes both data collection services and analytical platforms that transform raw geographic information into actionable business intelligence.

Key applications span precision agriculture for crop optimization, environmental monitoring for deforestation tracking, urban planning for smart city development, and logistics optimization for supply chain management. The market serves diverse stakeholders including government agencies, agricultural enterprises, mining companies, telecommunications providers, and environmental organizations seeking to leverage location-based insights for strategic advantage.

Brazil’s geospatial analytics market demonstrates exceptional growth potential driven by the country’s unique geographic characteristics and expanding digital transformation initiatives. The market benefits from strong government support through national spatial data infrastructure development and increasing private sector adoption across key industries. Agricultural applications represent the largest market segment, with precision farming techniques gaining widespread acceptance among Brazilian farmers seeking to optimize crop yields and resource utilization.

Technology advancement in satellite imagery, artificial intelligence integration, and cloud-based analytics platforms creates new opportunities for market expansion. The integration of Internet of Things (IoT) devices with geospatial systems enables real-time monitoring and analysis capabilities, particularly valuable for agricultural and environmental applications. Market growth is supported by increasing awareness of geospatial technology benefits and declining costs of satellite data and analytical tools.

Competitive landscape features both international technology providers and emerging Brazilian companies specializing in local market requirements. The market experiences growing investment in research and development activities, particularly in areas related to Amazon monitoring, agricultural optimization, and urban planning solutions. Future prospects indicate continued expansion driven by government digitization initiatives, agricultural modernization, and increasing environmental monitoring requirements.

Market insights reveal several critical trends shaping Brazil’s geospatial analytics landscape:

Market maturity varies significantly across different sectors, with agriculture and government applications showing advanced adoption while sectors like retail and healthcare demonstrate emerging opportunities. Data availability and quality improvements through government initiatives and private sector investments enhance market development prospects.

Primary market drivers propelling Brazil’s geospatial analytics market include extensive agricultural modernization initiatives and government-supported digital transformation programs. Agricultural sector digitization represents the most significant driver, with Brazilian farmers increasingly adopting precision agriculture techniques to optimize crop yields, reduce input costs, and improve sustainability practices. The country’s position as a global agricultural powerhouse creates substantial demand for geospatial solutions supporting crop monitoring, yield prediction, and resource management.

Government initiatives provide strong market momentum through programs like the National Spatial Data Infrastructure (INDE) and various smart city development projects. Environmental monitoring requirements drive significant demand, particularly for Amazon rainforest surveillance, deforestation tracking, and biodiversity conservation efforts. International pressure and regulatory compliance needs create sustained demand for environmental geospatial solutions.

Infrastructure development across Brazil’s vast territory requires comprehensive geospatial planning and monitoring capabilities. Mining sector expansion drives demand for geological surveying, resource exploration, and environmental impact assessment solutions. Urban planning needs in rapidly growing metropolitan areas create opportunities for geospatial analytics in traffic management, infrastructure planning, and public service optimization.

Technological advancement in satellite imagery resolution, artificial intelligence integration, and cloud computing accessibility reduces implementation barriers and expands market opportunities. Cost reduction in geospatial technology makes solutions accessible to smaller organizations and emerging applications.

Market restraints limiting Brazil’s geospatial analytics market growth include significant infrastructure challenges and limited technical expertise availability. Digital infrastructure gaps in rural and remote areas restrict geospatial technology deployment, particularly affecting agricultural applications in less developed regions. Internet connectivity limitations and unreliable telecommunications infrastructure create barriers to cloud-based geospatial solutions adoption.

High implementation costs for comprehensive geospatial systems present challenges for smaller organizations and municipalities with limited budgets. Technical complexity associated with geospatial analytics requires specialized skills that remain scarce in the Brazilian market. Data quality issues and inconsistent spatial data standards across different government agencies create integration challenges for comprehensive geospatial solutions.

Regulatory complexities surrounding data privacy, cross-border data transfer, and spatial data sharing create compliance challenges for market participants. Economic volatility and currency fluctuations impact technology investment decisions and international solution procurement. Limited awareness of geospatial technology benefits among potential users, particularly in traditional industries, restricts market expansion.

Competition from established manual processes and traditional decision-making methods creates resistance to geospatial analytics adoption. Integration challenges with existing enterprise systems and workflows require significant change management efforts that many organizations find difficult to implement effectively.

Market opportunities in Brazil’s geospatial analytics sector present substantial potential across multiple emerging applications and underserved market segments. Smart city development initiatives across major Brazilian metropolitan areas create significant opportunities for integrated geospatial solutions supporting traffic management, public safety, and urban planning. Environmental monitoring requirements driven by international sustainability commitments and regulatory compliance needs offer sustained growth potential.

Agricultural technology advancement opportunities include precision farming expansion, crop insurance applications, and supply chain optimization solutions. Mining sector digitization presents opportunities for geological analysis, resource exploration, and environmental impact monitoring applications. Telecommunications infrastructure expansion creates demand for network planning, coverage optimization, and site selection solutions.

Disaster management and emergency response applications offer significant opportunities given Brazil’s exposure to natural disasters including floods, droughts, and landslides. Healthcare applications including disease surveillance, healthcare facility planning, and public health analytics represent emerging opportunities. Retail and logistics sectors demonstrate growing interest in location intelligence for market analysis, site selection, and delivery optimization.

Integration opportunities with emerging technologies including artificial intelligence, machine learning, and Internet of Things create new application possibilities. Export potential for Brazilian geospatial solutions to other Latin American markets presents international expansion opportunities for local companies.

Market dynamics in Brazil’s geospatial analytics sector reflect complex interactions between technological advancement, government policy, and economic conditions. Supply-side dynamics show increasing competition between international technology providers and emerging Brazilian companies, creating pressure for localized solutions and competitive pricing. Demand-side factors demonstrate growing sophistication among users seeking integrated solutions rather than standalone geospatial tools.

Technology evolution drives market dynamics through continuous improvement in satellite imagery resolution, artificial intelligence integration, and cloud computing capabilities. Government policy changes significantly impact market dynamics, particularly regarding data sharing regulations, environmental monitoring requirements, and public sector procurement processes. Economic conditions influence investment decisions and technology adoption rates across different market segments.

Competitive dynamics show increasing collaboration between technology providers and local partners to address specific Brazilian market requirements. User behavior evolution demonstrates growing demand for real-time analytics, mobile accessibility, and integrated decision-support systems. Market consolidation trends indicate potential for strategic partnerships and acquisitions as the market matures.

Innovation cycles in geospatial technology create opportunities for market disruption and new application development. Regulatory dynamics continue evolving to address data privacy, security, and cross-border data transfer requirements affecting market operations.

Research methodology for analyzing Brazil’s geospatial analytics market employs comprehensive primary and secondary research approaches to ensure accurate market assessment and trend identification. Primary research includes structured interviews with key industry stakeholders including technology providers, end-users, government officials, and academic researchers specializing in geospatial technologies. Survey methodologies capture quantitative data regarding adoption rates, investment patterns, and technology preferences across different market segments.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and company financial statements to establish market baseline data and historical trends. Data triangulation methods ensure research findings accuracy by comparing multiple information sources and validating key insights through cross-reference analysis. Market sizing methodologies utilize bottom-up and top-down approaches to establish comprehensive market scope and segment analysis.

Qualitative research techniques include focus groups with end-users, expert panels with industry professionals, and case study analysis of successful geospatial analytics implementations. Quantitative analysis employs statistical modeling to identify market trends, growth patterns, and correlation factors affecting market development. Geographic analysis considers regional variations in market development, technology adoption, and growth potential across Brazil’s diverse regions.

Technology assessment methodologies evaluate emerging trends, innovation cycles, and competitive positioning within the geospatial analytics ecosystem. Validation processes ensure research accuracy through expert review, data verification, and methodology peer assessment.

Regional analysis of Brazil’s geospatial analytics market reveals significant variations in adoption patterns, technology infrastructure, and growth potential across different geographic areas. Southeast region, including São Paulo and Rio de Janeiro, dominates market activity with approximately 40% of total market share, driven by concentrated urban development, advanced telecommunications infrastructure, and high technology adoption rates among businesses and government agencies.

South region demonstrates strong agricultural applications focus, particularly in Rio Grande do Sul and Paraná states, where precision farming adoption reaches significant penetration rates. Center-West region, including Mato Grosso and Goiás, shows rapid growth in agricultural geospatial applications driven by extensive soybean and corn production requiring precision management techniques. Northeast region presents emerging opportunities in urban planning and environmental monitoring, though infrastructure limitations restrict current market development.

North region, encompassing the Amazon basin, demonstrates unique market characteristics focused on environmental monitoring, deforestation tracking, and biodiversity conservation applications. Government investment in Amazon monitoring systems creates sustained demand for geospatial solutions in this region. Infrastructure development varies significantly across regions, with metropolitan areas showing advanced capabilities while rural regions face connectivity and technical support challenges.

Regional growth patterns indicate expanding opportunities in previously underserved areas as telecommunications infrastructure improves and technology costs decline. Market concentration in major urban centers continues, though agricultural regions demonstrate accelerating adoption rates driven by competitive pressures and productivity requirements.

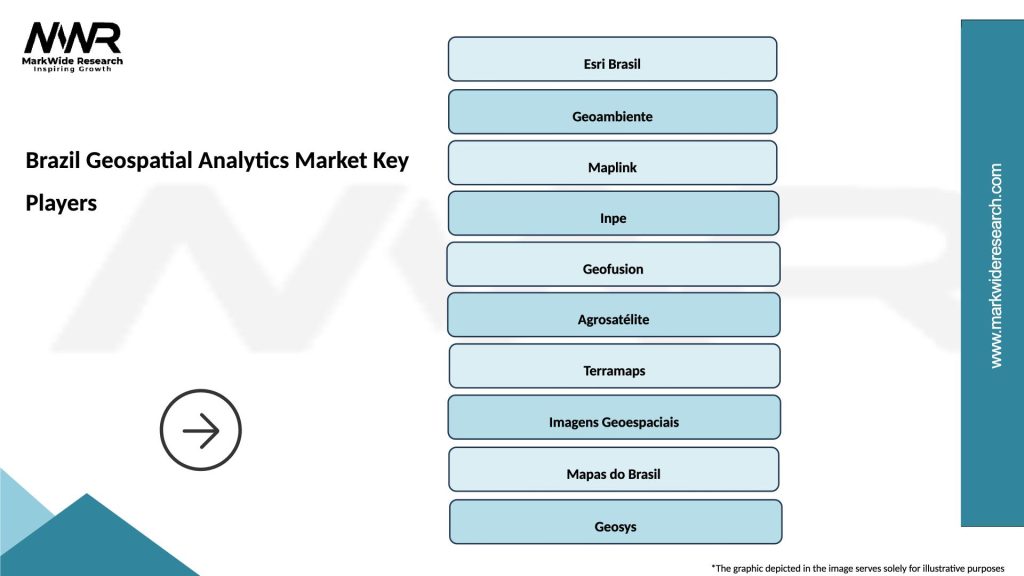

Competitive landscape in Brazil’s geospatial analytics market features diverse participants ranging from global technology leaders to specialized local providers addressing specific market requirements. Market leaders include established international companies with comprehensive solution portfolios and strong local presence:

Emerging Brazilian companies demonstrate growing market presence through specialized solutions addressing local requirements:

Competitive strategies emphasize local partnerships, specialized industry solutions, and integration with existing enterprise systems. Market differentiation occurs through technology innovation, customer service quality, and deep understanding of Brazilian regulatory and business requirements.

Market segmentation analysis reveals distinct categories based on technology type, application area, end-user industry, and deployment model. Technology segmentation includes several key categories:

By Technology:

By Application:

By End-User Industry:

By Deployment Model:

Category-wise analysis provides detailed insights into specific market segments and their unique characteristics within Brazil’s geospatial analytics landscape. Agricultural applications demonstrate the highest growth rates and market penetration, with precision farming solutions showing particularly strong adoption among large-scale agricultural operations. Crop monitoring systems utilizing satellite imagery and IoT sensors provide farmers with real-time insights for irrigation, fertilization, and pest management decisions.

Environmental monitoring category shows sustained growth driven by regulatory requirements and international sustainability commitments. Deforestation tracking systems represent critical applications for Amazon rainforest preservation, while biodiversity monitoring solutions support conservation efforts across Brazil’s diverse ecosystems. Climate change analysis applications gain importance as organizations seek to understand and adapt to environmental changes.

Urban planning applications demonstrate increasing sophistication with smart city initiatives driving demand for integrated geospatial solutions. Traffic management systems utilize real-time location data to optimize transportation networks, while infrastructure planning applications support sustainable urban development. Public safety applications including emergency response and crime analysis show growing adoption among municipal governments.

Natural resource management category benefits from Brazil’s extensive mineral and energy resources, with geological surveying and resource exploration applications supporting mining and oil and gas industries. Environmental impact assessment solutions ensure regulatory compliance and sustainable resource extraction practices.

Industry participants in Brazil’s geospatial analytics market realize substantial benefits through enhanced decision-making capabilities, operational efficiency improvements, and competitive advantage development. Agricultural stakeholders benefit from precision farming applications that optimize crop yields, reduce input costs, and improve sustainability practices. Yield optimization through geospatial analytics enables farmers to achieve productivity improvements while minimizing environmental impact.

Government agencies leverage geospatial analytics for improved public service delivery, urban planning, and environmental monitoring capabilities. Policy makers benefit from data-driven insights supporting evidence-based decision making for infrastructure development, resource allocation, and environmental protection initiatives. Regulatory compliance becomes more efficient through automated monitoring and reporting systems.

Mining and energy companies realize benefits through enhanced resource exploration, environmental impact assessment, and operational optimization. Risk reduction through improved geological analysis and environmental monitoring protects investments and ensures regulatory compliance. Operational efficiency improvements through geospatial analytics reduce costs and improve resource utilization.

Technology providers benefit from expanding market opportunities, partnership development, and innovation potential. Market expansion opportunities enable revenue growth and market share development, while strategic partnerships with local organizations facilitate market penetration and solution customization. Innovation opportunities drive technology advancement and competitive differentiation.

Economic stakeholders benefit from job creation, technology transfer, and economic development through geospatial analytics market growth. Skills development initiatives create employment opportunities while building local technical capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Brazil’s geospatial analytics landscape reflect technological advancement, changing user requirements, and evolving application areas. Artificial intelligence integration represents a dominant trend, with machine learning algorithms enhancing spatial data analysis capabilities and enabling automated pattern recognition in satellite imagery and sensor data. Cloud computing adoption accelerates market accessibility by reducing infrastructure requirements and enabling scalable solution deployment.

Real-time analytics demand increases across applications, with users seeking immediate insights for time-sensitive decision making. Mobile accessibility becomes essential as field workers and decision makers require geospatial analytics capabilities on smartphones and tablets. Internet of Things integration creates opportunities for combining geospatial data with sensor networks for comprehensive monitoring solutions.

Sustainability focus drives demand for environmental monitoring and carbon footprint analysis applications. Precision agriculture evolution incorporates advanced analytics for crop health assessment, yield prediction, and resource optimization. Smart city integration trends show increasing demand for comprehensive urban analytics platforms combining multiple data sources.

Data democratization trends indicate growing demand for user-friendly interfaces that enable non-technical users to access geospatial insights. Collaborative platforms facilitate data sharing and joint analysis among multiple stakeholders. Automation trends reduce manual processing requirements and improve analysis efficiency through algorithmic approaches.

Industry developments in Brazil’s geospatial analytics market demonstrate accelerating innovation and expanding application areas. Government initiatives including the National Spatial Data Infrastructure (INDE) expansion and state-level geospatial programs create foundation for market growth. MarkWide Research analysis indicates increasing collaboration between public and private sectors in developing comprehensive geospatial solutions.

Technology partnerships between international providers and Brazilian companies facilitate market localization and solution customization. Agricultural technology advancement includes development of specialized crop monitoring systems and precision farming platforms tailored to Brazilian agricultural practices. Environmental monitoring expansion encompasses new satellite-based deforestation tracking systems and biodiversity assessment tools.

Infrastructure investments in telecommunications and internet connectivity improve geospatial technology accessibility in previously underserved regions. Educational initiatives including university programs and professional training courses address skills shortage challenges. Regulatory developments establish clearer frameworks for data sharing, privacy protection, and cross-border data transfer.

Innovation centers and research facilities focus on developing solutions specific to Brazilian market requirements. Investment activities show increasing venture capital and private equity interest in geospatial technology companies. International cooperation programs facilitate technology transfer and knowledge sharing with global geospatial analytics leaders.

Analyst recommendations for Brazil’s geospatial analytics market emphasize strategic approaches for maximizing growth opportunities while addressing existing challenges. Technology providers should focus on developing localized solutions that address specific Brazilian market requirements, particularly in agricultural applications and environmental monitoring. Partnership strategies with local companies and government agencies facilitate market penetration and solution customization.

Investment priorities should emphasize infrastructure development, skills training, and technology accessibility improvements. Government agencies should continue expanding spatial data infrastructure initiatives while establishing clear regulatory frameworks for data sharing and privacy protection. Private sector organizations should consider pilot projects and phased implementation approaches to demonstrate geospatial analytics value and build internal capabilities.

Market entry strategies for international companies should emphasize local partnerships, regulatory compliance, and solution adaptation to Brazilian business practices. Innovation focus should address integration challenges, user interface simplification, and mobile accessibility requirements. Training and education investments are essential for building local technical capabilities and expanding market adoption.

Sustainability considerations should guide solution development, particularly for environmental monitoring and agricultural applications. Data quality improvement initiatives require collaboration among government agencies, technology providers, and end users. Long-term planning should consider emerging technologies including artificial intelligence, blockchain, and quantum computing integration possibilities.

Future outlook for Brazil’s geospatial analytics market indicates sustained growth driven by technological advancement, expanding applications, and increasing market maturity. Market expansion is projected to continue at robust growth rates as infrastructure improvements and cost reductions make geospatial technology accessible to broader user bases. Agricultural applications will likely maintain market leadership while new sectors including healthcare, retail, and logistics demonstrate accelerating adoption.

Technology evolution will focus on artificial intelligence integration, real-time analytics capabilities, and mobile accessibility improvements. Government investment in smart city initiatives and environmental monitoring programs will provide sustained market support. Private sector adoption will expand beyond traditional applications to include customer analytics, supply chain optimization, and risk management solutions.

Regional development patterns indicate expanding opportunities in previously underserved areas as telecommunications infrastructure improves. International collaboration will increase through technology partnerships, knowledge sharing, and export opportunities to other Latin American markets. Innovation acceleration will drive new application development and solution sophistication.

Market maturation will result in increased competition, solution standardization, and user sophistication. Regulatory framework development will provide clearer guidelines for market operations while addressing data privacy and security requirements. Skills development initiatives will gradually address technical expertise shortages and support market expansion. MWR projections suggest continued strong performance across all major market segments with particular strength in agricultural and environmental applications.

Brazil’s geospatial analytics market represents a dynamic and rapidly evolving sector with substantial growth potential driven by the country’s unique geographic characteristics, expanding digital transformation initiatives, and increasing recognition of location intelligence value. The market benefits from strong fundamentals including extensive agricultural sector digitization, government support through national spatial data infrastructure programs, and growing environmental monitoring requirements.

Market opportunities span multiple sectors with agricultural applications maintaining leadership while emerging areas including smart cities, disaster management, and healthcare demonstrate significant potential. Technology advancement in artificial intelligence integration, cloud computing, and mobile accessibility creates new possibilities for market expansion and application development. Regional variations provide diverse opportunities for market participants, from urban planning solutions in metropolitan areas to precision farming applications in agricultural regions.

Success factors for market participants include local partnership development, solution customization for Brazilian requirements, and investment in skills development and infrastructure improvements. Future prospects indicate sustained growth supported by continued government investment, private sector adoption expansion, and technological innovation. The Brazil geospatial analytics market is positioned to play an increasingly important role in the country’s digital transformation journey, supporting enhanced decision-making capabilities across multiple sectors while contributing to sustainable development and economic growth objectives.

What is Geospatial Analytics?

Geospatial Analytics refers to the collection, analysis, and visualization of data related to geographic locations. It is used in various applications such as urban planning, environmental monitoring, and transportation management.

What are the key players in the Brazil Geospatial Analytics Market?

Key players in the Brazil Geospatial Analytics Market include companies like Esri, Hexagon AB, and Trimble, which provide advanced geospatial solutions and technologies for various industries, among others.

What are the main drivers of the Brazil Geospatial Analytics Market?

The main drivers of the Brazil Geospatial Analytics Market include the increasing demand for location-based services, the growth of smart city initiatives, and advancements in satellite imagery and data processing technologies.

What challenges does the Brazil Geospatial Analytics Market face?

Challenges in the Brazil Geospatial Analytics Market include data privacy concerns, the high cost of technology implementation, and the need for skilled professionals to analyze and interpret geospatial data.

What opportunities exist in the Brazil Geospatial Analytics Market?

Opportunities in the Brazil Geospatial Analytics Market include the expansion of IoT applications, the integration of AI and machine learning for enhanced data analysis, and the growing interest in environmental sustainability initiatives.

What trends are shaping the Brazil Geospatial Analytics Market?

Trends shaping the Brazil Geospatial Analytics Market include the increasing use of real-time data analytics, the rise of cloud-based geospatial solutions, and the growing importance of mobile geospatial applications.

Brazil Geospatial Analytics Market

| Segmentation Details | Description |

|---|---|

| Application | Urban Planning, Environmental Monitoring, Disaster Management, Transportation |

| Technology | Remote Sensing, Geographic Information Systems, Global Navigation Satellite Systems, Spatial Data Infrastructure |

| End User | Government Agencies, Agriculture, Transportation, Energy |

| Deployment | On-Premises, Cloud-Based, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Geospatial Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at