444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Brazil freight and logistics market is a significant sector within the country’s economy. It plays a crucial role in facilitating trade and commerce both domestically and internationally. The market encompasses various modes of transportation, including road, rail, air, and sea, as well as warehousing and other logistics services. Brazil’s geographical size and diverse economy contribute to the complexity and potential of its freight and logistics market.

Meaning

The Brazil freight and logistics market refers to the industry involved in the movement, storage, and management of goods and materials within the country. It includes the transportation of goods by different modes, such as trucks, trains, planes, and ships. Additionally, it encompasses the handling, storage, and distribution of goods through various logistics operations, including warehousing, inventory management, and supply chain management.

Executive Summary

The Brazil freight and logistics market is a vital component of the country’s economy. It plays a crucial role in supporting domestic and international trade, facilitating the movement of goods across different regions. The market offers a wide range of services, including transportation, warehousing, and logistics solutions, catering to diverse industry sectors. However, it also faces challenges such as infrastructure limitations and regulatory complexities. Despite these challenges, the market presents significant opportunities for growth and expansion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

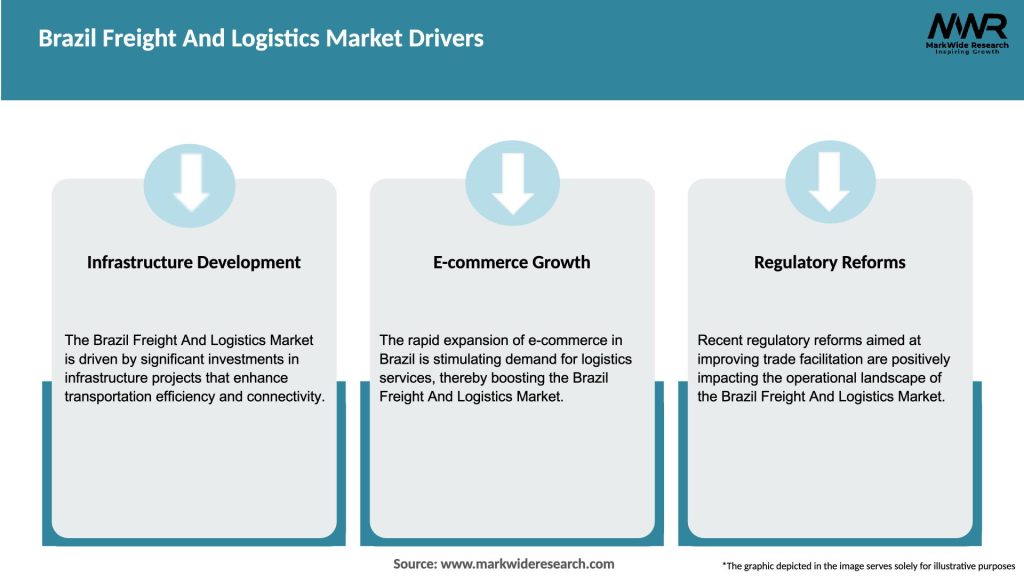

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Brazil freight and logistics market is characterized by intense competition, evolving customer expectations, and technological advancements. Companies in the industry are continuously adapting to changes in market dynamics to remain competitive and meet customer demands. Innovation, process optimization, and strategic partnerships play crucial roles in driving growth and maintaining a strong market position.

Regional Analysis

The freight and logistics market in Brazil exhibits regional variations based on factors such as infrastructure development, industrial concentration, and population density. The southeastern region, including major cities like São Paulo and Rio de Janeiro, is a key logistics hub, benefiting from its economic significance and transportation infrastructure. The northern and northeastern regions face unique challenges due to their geographical remoteness and limited infrastructure development. However, increased investments in these regions are opening up new opportunities for market growth.

Competitive Landscape

Leading Companies in the Brazil Freight And Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Brazil freight and logistics market can be segmented based on various factors, including transportation mode, service type, industry vertical, and geography. The transportation mode segmentation includes road transportation, rail transportation, air transportation, and sea transportation. Service types encompass transportation services, warehousing and distribution, freight forwarding, and value-added services. Industry verticals can include automotive, retail, healthcare, consumer goods, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Brazil freight and logistics market. The initial lockdown measures and restrictions disrupted supply chains, leading to reduced freight volumes and logistical challenges. However, the pandemic also accelerated certain trends, such as the growth of e-commerce and the adoption of contactless delivery solutions. Logistics providers had to adapt to changing demands, implement safety measures, and ensure the continuity of essential supply chains. The pandemic highlighted the importance of resilience, agility, and digital transformation in the freight and logistics industry.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Brazil freight and logistics market is promising, driven by factors such as economic growth, infrastructure development, and evolving customer expectations. Despite existing challenges, opportunities for market expansion are significant. Companies that embrace digital transformation, prioritize sustainability, and adapt to changing market dynamics are likely to thrive. Investments in infrastructure, talent development, and collaborative partnerships will play a crucial role in shaping the future of the freight and logistics industry in Brazil.

Conclusion

The Brazil freight and logistics market is a vital sector within the country’s economy, supporting domestic and international trade and facilitating the movement of goods across diverse regions. The market offers a wide range of services, including transportation, warehousing, and logistics solutions. While infrastructure limitations, complex regulations, and security risks pose challenges, opportunities for growth and innovation are abundant. The industry is evolving through digitalization, sustainability initiatives, and strategic collaborations. To succeed in this dynamic market, companies need to embrace digital transformation, focus on customer-centric solutions, and prioritize sustainability and resilience. With the right strategies and investments, the future of the Brazil freight and logistics market looks promising.

What is Freight And Logistics?

Freight and logistics refer to the processes involved in the transportation, warehousing, and distribution of goods. This includes various activities such as shipping, inventory management, and supply chain coordination.

What are the key players in the Brazil Freight And Logistics Market?

Key players in the Brazil Freight and Logistics Market include companies like JSL, Rumo Logística, and Grupo TNT, which provide a range of services from transportation to warehousing solutions, among others.

What are the main drivers of the Brazil Freight And Logistics Market?

The main drivers of the Brazil Freight and Logistics Market include the growth of e-commerce, increasing demand for efficient supply chain solutions, and investments in infrastructure development.

What challenges does the Brazil Freight And Logistics Market face?

Challenges in the Brazil Freight and Logistics Market include regulatory hurdles, high operational costs, and issues related to infrastructure quality and congestion.

What opportunities exist in the Brazil Freight And Logistics Market?

Opportunities in the Brazil Freight and Logistics Market include the expansion of digital logistics solutions, the rise of sustainable transportation practices, and the potential for increased foreign investment in logistics infrastructure.

What trends are shaping the Brazil Freight And Logistics Market?

Trends shaping the Brazil Freight and Logistics Market include the adoption of automation and technology in logistics operations, the growth of last-mile delivery services, and a focus on sustainability in transportation practices.

Brazil Freight And Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Customs Brokerage |

| End User | Manufacturers, Retailers, E-commerce, Distributors |

| Technology | IoT, Blockchain, AI, Automation |

| Delivery Model | Direct Shipping, Third-Party Logistics, Last-Mile Delivery, Cross-Docking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Brazil Freight And Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at