444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil fisheries and aquaculture industry market represents one of South America’s most dynamic and rapidly evolving sectors, characterized by substantial growth potential and increasing technological adoption. Brazil’s extensive coastline spanning over 7,400 kilometers, combined with abundant freshwater resources, positions the country as a major player in global fish production and aquaculture development. The industry encompasses both traditional fishing practices and modern aquaculture operations, with aquaculture production experiencing particularly robust expansion at a CAGR of 8.2% over recent years.

Market dynamics indicate strong momentum driven by rising domestic consumption, export opportunities, and government initiatives supporting sustainable fishing practices. The sector benefits from Brazil’s diverse aquatic ecosystems, including the Amazon River basin, Atlantic coastal waters, and numerous inland water bodies that support both marine and freshwater species cultivation. Technological advancement in fish farming techniques, feed optimization, and processing capabilities has enhanced productivity while addressing environmental sustainability concerns.

Regional distribution shows significant concentration in northeastern and southern states, with 65% of aquaculture production concentrated in these regions. The industry’s evolution reflects Brazil’s commitment to food security, economic development, and sustainable resource management, positioning it as a key contributor to the country’s agricultural sector and export economy.

The Brazil fisheries and aquaculture industry market refers to the comprehensive ecosystem encompassing commercial fishing operations, fish farming activities, processing facilities, and related support services within Brazil’s territorial waters and inland aquatic systems. This market includes both capture fisheries that harvest wild fish stocks from marine and freshwater environments, and aquaculture operations that involve the controlled cultivation of aquatic organisms including fish, crustaceans, mollusks, and aquatic plants.

Aquaculture activities represent the fastest-growing segment, involving intensive and extensive farming systems that utilize various technologies and methodologies to optimize production efficiency. The market encompasses multiple species including tilapia, tambaqui, catfish, shrimp, and various marine species, each requiring specialized cultivation techniques and market approaches. Processing and value-addition activities form integral components, transforming raw aquatic products into consumer-ready formats for domestic consumption and international export.

Sustainable practices increasingly define market operations, with emphasis on environmental stewardship, responsible resource utilization, and compliance with international standards for food safety and quality assurance.

Brazil’s fisheries and aquaculture industry demonstrates remarkable resilience and growth trajectory, establishing itself as a cornerstone of the country’s food production and economic development strategy. The sector’s expansion reflects successful integration of traditional fishing knowledge with modern aquaculture technologies, creating opportunities for sustainable growth and international competitiveness. Government support initiatives have catalyzed industry development through favorable policies, infrastructure investment, and research funding that promotes innovation and best practices adoption.

Market segmentation reveals diverse opportunities across species categories, production systems, and geographic regions, with aquaculture showing particularly strong performance metrics. The industry benefits from Brazil’s natural advantages including favorable climate conditions, abundant water resources, and established agricultural expertise that translates effectively to aquatic farming operations. Export potential remains substantial, with international demand for Brazilian seafood products growing at 12% annually, driven by quality improvements and sustainable production certifications.

Technological adoption accelerates across the value chain, from automated feeding systems and water quality monitoring to advanced processing equipment and cold chain logistics. These developments enhance productivity, reduce environmental impact, and improve product quality, supporting the industry’s long-term sustainability and competitiveness in global markets.

Strategic analysis reveals several critical insights shaping Brazil’s fisheries and aquaculture industry development. The following key insights provide comprehensive understanding of market dynamics and growth drivers:

Multiple factors drive the robust growth of Brazil’s fisheries and aquaculture industry, creating a favorable environment for sustained expansion and development. Rising protein demand represents the primary growth driver, as Brazil’s growing population and increasing per capita income drive consumption of high-quality protein sources. Fish consumption has increased by 18% over the past five years, reflecting changing dietary preferences and health consciousness among Brazilian consumers.

Government initiatives provide substantial support through the National Aquaculture Development Program, which offers financial incentives, technical assistance, and infrastructure development support to industry participants. These programs specifically target small and medium-scale producers, democratizing access to modern aquaculture technologies and best practices. Export opportunities continue expanding as international markets recognize Brazilian seafood quality and sustainability credentials.

Technological advancement enables more efficient and sustainable production methods, reducing operational costs while improving product quality and environmental performance. The adoption of recirculating aquaculture systems and biofloc technology has increased production efficiency by 35% in participating facilities. Climate advantages allow year-round production in many regions, providing competitive advantages over seasonal production systems in other countries. Investment attraction from both domestic and international sources provides capital for expansion and modernization initiatives.

Several challenges constrain the full potential of Brazil’s fisheries and aquaculture industry, requiring strategic attention and systematic solutions. Environmental concerns related to water quality management, waste disposal, and ecosystem impact create regulatory compliance requirements that increase operational complexity and costs. These environmental considerations necessitate careful site selection, advanced treatment systems, and ongoing monitoring programs.

Infrastructure limitations in rural and remote areas restrict industry expansion, particularly affecting small-scale producers who lack access to reliable electricity, transportation networks, and processing facilities. Technical expertise shortage represents a significant constraint, as the industry requires specialized knowledge in aquaculture management, fish health, nutrition, and processing technologies. Educational institutions and training programs struggle to meet growing demand for qualified professionals.

Market access barriers affect smaller producers who face challenges in meeting quality standards, obtaining certifications, and accessing distribution networks. Financial constraints limit expansion opportunities, particularly for small and medium enterprises that require capital for equipment, infrastructure, and working capital needs. Disease management remains a persistent challenge, with aquatic diseases potentially causing significant production losses and requiring sophisticated prevention and treatment protocols.

Substantial opportunities exist for growth and development within Brazil’s fisheries and aquaculture industry, driven by favorable market conditions and emerging trends. Premium market segments offer significant potential, particularly for organic and sustainably certified products that command higher prices in both domestic and international markets. The growing demand for value-added products creates opportunities for processing companies to develop innovative seafood products that meet evolving consumer preferences.

Technology partnerships with international companies provide access to advanced aquaculture technologies, genetic improvement programs, and management systems that can enhance productivity and sustainability. Export market expansion presents substantial opportunities, particularly in North American and European markets where demand for high-quality, sustainably produced seafood continues growing. Brazilian producers can leverage the country’s reputation for agricultural excellence to establish strong positions in premium seafood markets.

Integrated production systems offer opportunities to optimize resource utilization through aquaponics, integrated multi-trophic aquaculture, and other innovative approaches that combine fish production with other agricultural activities. Research collaborations with universities and research institutions can accelerate innovation in breeding, nutrition, and production technologies. Rural development initiatives create opportunities to establish aquaculture operations in underutilized areas, contributing to regional economic development while expanding production capacity.

Complex interactions between supply and demand factors, regulatory frameworks, and technological developments shape the dynamic landscape of Brazil’s fisheries and aquaculture industry. Supply-side dynamics reflect the industry’s transition from capture-dependent to aquaculture-focused production, with farmed fish production growing at 15% annually while wild capture remains relatively stable. This shift requires different skill sets, technologies, and management approaches that influence market structure and competitive dynamics.

Demand patterns show increasing sophistication, with consumers seeking higher quality, traceable, and sustainably produced seafood products. This evolution drives premium pricing opportunities while requiring enhanced quality control and certification systems. Competitive dynamics intensify as the industry matures, with successful companies differentiating through technology adoption, brand development, and market positioning strategies.

Regulatory evolution continues shaping industry practices, with new standards for environmental protection, food safety, and worker welfare influencing operational requirements and costs. International trade dynamics affect export opportunities and competitive positioning, with trade agreements, tariff structures, and quality standards influencing market access and profitability. Innovation cycles accelerate as research institutions and private companies develop new technologies, species varieties, and production methods that enhance industry capabilities and sustainability.

Comprehensive research methodology underpins the analysis of Brazil’s fisheries and aquaculture industry market, employing multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research involves extensive interviews with industry stakeholders including fish farmers, processing companies, equipment suppliers, government officials, and research institutions to gather firsthand insights on market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government statistics, industry reports, academic publications, and trade association data to establish market baselines and identify trends. MarkWide Research analysts utilize proprietary databases and analytical frameworks to process and interpret collected information, ensuring comprehensive coverage of market segments and geographic regions.

Data validation procedures include cross-referencing multiple sources, conducting follow-up interviews, and applying statistical analysis techniques to verify findings and eliminate inconsistencies. Market modeling employs quantitative and qualitative analysis methods to project future trends and assess the impact of various factors on industry development. Expert consultation with aquaculture specialists, economists, and industry veterans provides additional validation and insight into market dynamics and future prospects.

Regional distribution of Brazil’s fisheries and aquaculture industry reveals distinct patterns reflecting geographic advantages, infrastructure development, and market access considerations. Northeast Region dominates aquaculture production with 42% market share, benefiting from favorable climate conditions, abundant water resources, and established shrimp farming operations. States like Ceará, Rio Grande do Norte, and Bahia lead in marine aquaculture development, particularly for high-value species such as shrimp and marine fish.

South Region contributes 28% of national production, with strong emphasis on freshwater aquaculture including tilapia and catfish farming. The region benefits from advanced agricultural infrastructure, technical expertise, and proximity to major consumer markets. Southeast Region accounts for 18% of production while representing the largest consumer market, creating opportunities for local production expansion and value-added processing activities.

North Region shows emerging potential with 8% current market share but significant growth prospects due to abundant water resources in the Amazon basin. The region faces infrastructure challenges but offers opportunities for sustainable aquaculture development that aligns with environmental conservation goals. Central-West Region contributes 4% of production but demonstrates growing interest in integrated agricultural systems that combine aquaculture with traditional farming activities.

Competitive structure of Brazil’s fisheries and aquaculture industry encompasses diverse participants ranging from large integrated companies to small-scale family operations. The market demonstrates fragmentation with numerous regional players and emerging consolidation trends as successful companies expand operations and acquire smaller competitors.

Market positioning strategies vary significantly, with some companies focusing on cost leadership through scale economies while others pursue differentiation through premium products, sustainability certifications, or technological innovation. Strategic partnerships between producers, processors, and distributors create competitive advantages through improved efficiency and market access.

Market segmentation of Brazil’s fisheries and aquaculture industry reveals multiple dimensions that influence strategic positioning and growth opportunities. By Species: The market divides into freshwater species including tilapia, tambaqui, and catfish, and marine species encompassing shrimp, marine fish, and mollusks. Tilapia represents the largest segment with 45% market share due to favorable growing conditions and strong consumer acceptance.

By Production System: Segmentation includes extensive systems utilizing natural water bodies with minimal intervention, semi-intensive systems incorporating supplemental feeding and management, and intensive systems employing advanced technologies and controlled environments. Intensive systems show the highest growth rates due to superior productivity and quality control capabilities.

By Application: The market serves direct human consumption, industrial processing for value-added products, and feed production for other aquaculture operations. Direct consumption represents the largest application segment, while industrial processing shows strong growth potential. By Distribution Channel: Segmentation includes direct sales, wholesale markets, retail chains, restaurants, and export markets, each requiring different quality standards and logistics capabilities.

Freshwater Aquaculture: This category dominates Brazilian production with tilapia farming leading due to adaptability to local conditions and strong market demand. Tambaqui, a native species, shows increasing commercial potential with 22% annual growth in production volumes. Catfish varieties including pintado and cachara represent emerging opportunities for premium market segments. Technology adoption in freshwater systems focuses on water quality management, automated feeding, and genetic improvement programs.

Marine Aquaculture: Shrimp farming represents the most developed marine aquaculture segment, with established production systems and export market presence. Marine fish farming shows emerging potential, particularly for high-value species such as cobia and pompano that command premium prices. Offshore aquaculture development presents future opportunities but requires significant technological and regulatory advancement.

Integrated Systems: Aquaponics and integrated multi-trophic aquaculture systems gain attention for resource efficiency and sustainability benefits. These systems optimize nutrient utilization while producing multiple products, appealing to environmentally conscious consumers and investors. Rice-fish systems show potential in appropriate regions, combining traditional agriculture with aquaculture for enhanced land productivity.

Economic benefits for industry participants include substantial revenue generation opportunities, employment creation, and contribution to rural development initiatives. Fish farmers benefit from relatively quick production cycles, particularly for species like tilapia that reach market size within 6-8 months, providing faster return on investment compared to traditional livestock. Processing companies gain access to consistent raw material supplies while developing value-added products that command higher margins.

Environmental stakeholders benefit from sustainable aquaculture practices that reduce pressure on wild fish stocks while providing protein production with lower environmental impact than terrestrial livestock. Technology providers find growing markets for specialized equipment, monitoring systems, and management software as the industry modernizes and adopts precision aquaculture techniques.

Government entities benefit from increased tax revenues, export earnings, and rural development outcomes that support broader economic and social objectives. Consumers gain access to fresh, high-quality protein sources at competitive prices while supporting local economic development. Research institutions benefit from industry collaboration opportunities that provide funding for applied research and technology development programs. Financial institutions find attractive investment opportunities in a growing industry with strong fundamentals and government support.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend shaping Brazil’s fisheries and aquaculture industry, with producers increasingly adopting environmentally responsible practices and seeking third-party certifications. Precision aquaculture gains momentum through IoT sensors, automated feeding systems, and data analytics platforms that optimize production efficiency while reducing environmental impact. These technologies enable real-time monitoring of water quality, fish behavior, and feeding patterns, resulting in 25% improvement in feed conversion ratios.

Species diversification accelerates as producers explore high-value native and exotic species that offer premium pricing opportunities. Genetic improvement programs focus on developing faster-growing, disease-resistant varieties that enhance production efficiency and profitability. Vertical integration trends see successful companies expanding along the value chain from breeding and production to processing and distribution.

Digital transformation encompasses blockchain technology for traceability, e-commerce platforms for direct sales, and mobile applications for farm management. Circular economy principles influence production system design, with emphasis on waste reduction, nutrient recycling, and resource optimization. Premium market development focuses on organic certification, sustainable sourcing, and branded product development that commands higher margins and builds consumer loyalty.

Recent developments in Brazil’s fisheries and aquaculture industry reflect accelerating modernization and strategic positioning for future growth. Government initiatives include the launch of the National Aquaculture Development Program 2024-2030, providing substantial funding for infrastructure development, research programs, and technical assistance to producers. This program specifically targets small and medium-scale operations with preferential financing terms and technology transfer support.

Technology partnerships between Brazilian companies and international technology providers have introduced advanced recirculating aquaculture systems, automated feeding technologies, and genetic improvement programs. MWR analysis indicates these partnerships have resulted in 30% productivity improvements in participating facilities while reducing environmental impact through better resource utilization.

Infrastructure investments include new processing facilities, hatchery expansions, and logistics network development that enhance industry capacity and market reach. Research breakthroughs in fish nutrition, disease prevention, and breeding programs contribute to improved production efficiency and product quality. Export market expansion achievements include new market access agreements and quality certifications that open premium international market opportunities for Brazilian producers.

Strategic recommendations for industry participants focus on sustainable growth strategies that balance economic objectives with environmental responsibility. Technology adoption should prioritize systems that provide measurable improvements in production efficiency, environmental performance, and product quality. Companies should invest in precision aquaculture technologies that enable data-driven decision making and optimize resource utilization.

Market positioning strategies should emphasize differentiation through sustainability certifications, premium product development, and brand building initiatives that create competitive advantages. Vertical integration opportunities should be evaluated based on market conditions, available resources, and strategic objectives, with particular attention to processing and distribution capabilities that enhance value capture.

Partnership development with research institutions, technology providers, and international companies can accelerate innovation adoption and market expansion. Risk management strategies should address disease prevention, environmental compliance, and market volatility through diversification, insurance, and contingency planning. Human capital development requires investment in training programs, technical education partnerships, and knowledge transfer initiatives that build industry expertise and capabilities.

Future prospects for Brazil’s fisheries and aquaculture industry appear highly favorable, with multiple growth drivers supporting sustained expansion and development. Production growth is projected to continue at robust rates exceeding 10% annually over the next five years, driven by technology adoption, capacity expansion, and market demand growth. Aquaculture development will likely outpace capture fisheries, with farmed production expected to represent 75% of total output by 2030.

Technology integration will accelerate with widespread adoption of precision aquaculture systems, automated production technologies, and digital management platforms that enhance efficiency and sustainability. Export market expansion presents substantial opportunities, with Brazilian seafood products gaining recognition in premium international markets through quality improvements and sustainability certifications.

Sustainability leadership will become increasingly important as environmental regulations strengthen and consumer preferences shift toward responsibly produced products. Innovation ecosystems will develop around aquaculture research centers, technology incubators, and industry clusters that foster collaboration and knowledge sharing. MarkWide Research projects the industry will play an increasingly important role in Brazil’s food security strategy and economic development objectives, contributing significantly to rural employment and export earnings while maintaining environmental stewardship principles.

Brazil’s fisheries and aquaculture industry stands at a pivotal moment of transformation and growth, positioned to capitalize on favorable market conditions, technological advancement, and strong government support. The industry’s evolution from traditional fishing practices to modern aquaculture operations reflects successful adaptation to changing market demands and environmental considerations. Sustainable development principles increasingly guide industry practices, ensuring long-term viability while addressing environmental and social responsibilities.

Strategic opportunities abound for industry participants willing to invest in technology, sustainability, and market development initiatives. The combination of natural advantages, growing domestic demand, and expanding export opportunities creates a favorable environment for continued growth and development. Success factors will include technology adoption, sustainability leadership, market differentiation, and strategic partnerships that enhance competitive positioning and operational capabilities.

Future success in Brazil’s fisheries and aquaculture industry will require balanced approaches that optimize economic returns while maintaining environmental stewardship and social responsibility. Companies that embrace innovation, sustainability, and market-focused strategies will be best positioned to capitalize on the substantial opportunities ahead in this dynamic and rapidly evolving industry.

What is Brazil Fisheries and Aquaculture?

Brazil Fisheries and Aquaculture refers to the practices and industries involved in the harvesting of fish and aquatic organisms, as well as the farming of species such as shrimp, tilapia, and other fish. This sector plays a crucial role in food production and economic development in Brazil.

What are the key players in the Brazil Fisheries and Aquaculture Industry Market?

Key players in the Brazil Fisheries and Aquaculture Industry Market include companies like Camil Alimentos, Grupo Pão de Açúcar, and Brasil Foods. These companies are involved in various aspects of the industry, from production to distribution, among others.

What are the growth factors driving the Brazil Fisheries and Aquaculture Industry Market?

The growth of the Brazil Fisheries and Aquaculture Industry Market is driven by increasing consumer demand for seafood, advancements in aquaculture technology, and government support for sustainable fishing practices. Additionally, the rising awareness of health benefits associated with fish consumption contributes to market expansion.

What challenges does the Brazil Fisheries and Aquaculture Industry Market face?

The Brazil Fisheries and Aquaculture Industry Market faces challenges such as overfishing, environmental regulations, and competition from imported seafood. These factors can impact sustainability and profitability within the sector.

What opportunities exist in the Brazil Fisheries and Aquaculture Industry Market?

Opportunities in the Brazil Fisheries and Aquaculture Industry Market include the potential for expanding export markets, the development of organic aquaculture, and innovations in sustainable fishing practices. These avenues can enhance the industry’s growth and environmental impact.

What trends are shaping the Brazil Fisheries and Aquaculture Industry Market?

Trends shaping the Brazil Fisheries and Aquaculture Industry Market include the increasing adoption of technology in fish farming, a shift towards sustainable practices, and the growing popularity of plant-based seafood alternatives. These trends reflect changing consumer preferences and environmental considerations.

Brazil Fisheries and Aquaculture Industry Market

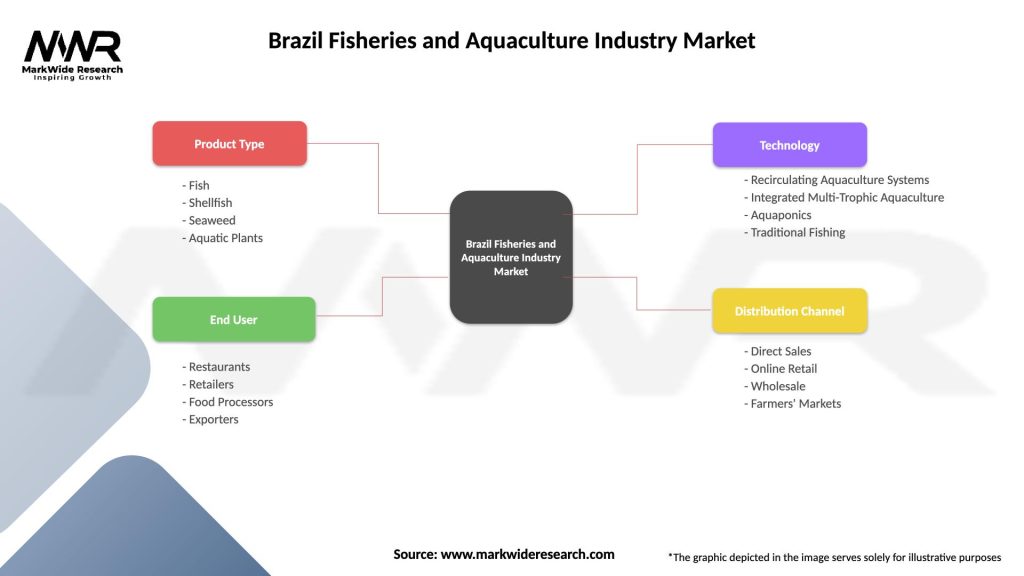

| Segmentation Details | Description |

|---|---|

| Product Type | Fish, Shellfish, Seaweed, Aquatic Plants |

| End User | Restaurants, Retailers, Food Processors, Exporters |

| Technology | Recirculating Aquaculture Systems, Integrated Multi-Trophic Aquaculture, Aquaponics, Traditional Fishing |

| Distribution Channel | Direct Sales, Online Retail, Wholesale, Farmers’ Markets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Fisheries and Aquaculture Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at