444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The fertilizer market in Brazil is a vital component of the country’s agricultural sector, supporting one of the world’s largest and most dynamic agricultural industries. Fertilizers play a crucial role in replenishing soil nutrients, optimizing crop yields, and sustaining Brazil’s position as a leading global producer and exporter of agricultural commodities.

Meaning

The Brazil fertilizer market encompasses the production, distribution, and utilization of fertilizers to enhance soil fertility, promote plant growth, and increase agricultural productivity. Fertilizers serve as essential inputs for Brazilian farmers, enabling them to overcome soil nutrient deficiencies, improve crop yields, and meet domestic and international market demands.

Executive Summary

The fertilizer market in Brazil has experienced robust growth, driven by factors such as favorable climatic conditions, technological advancements in agriculture, government support policies, and rising global demand for agricultural commodities. Despite challenges like environmental concerns and logistical constraints, the market offers significant opportunities for investment, innovation, and sustainable development.

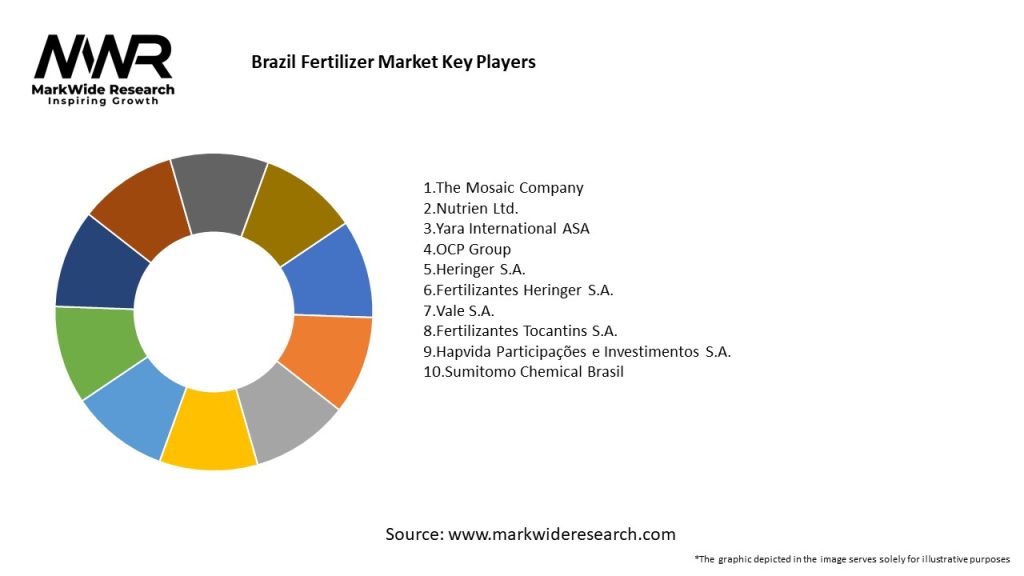

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The fertilizer market in Brazil operates within a dynamic framework shaped by factors such as climatic variability, technological innovation, market globalization, policy interventions, and consumer preferences. Understanding these dynamics is crucial for stakeholders to navigate market trends, capitalize on opportunities, and mitigate risks in Brazil’s evolving agricultural landscape.

Regional Analysis

Brazil’s fertilizer market exhibits regional variations in demand, consumption patterns, and fertilizer usage intensity influenced by factors such as soil fertility, cropping systems, agro-climatic conditions, and farm size. Key agricultural regions, including the Cerrado, Matopiba, and Southern Brazil, drive fertilizer demand and market growth in the country.

Competitive Landscape

Leading Companies in Brazil Fertilizer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Brazil fertilizer market can be segmented based on product type (nitrogen, phosphorus, potassium fertilizers), application method (broadcasting, fertigation, foliar spray), crop type (grains, oilseeds, sugarcane, coffee), and end-user (large-scale farming, smallholder agriculture, horticulture, forestry).

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats shaping the fertilizer market in Brazil:

Understanding these factors enables stakeholders to leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats to sustain market growth and competitiveness in Brazil’s fertilizer industry.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic posed significant challenges and disruptions to Brazil’s fertilizer market, including:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the fertilizer market in Brazil remains optimistic, driven by factors such as population growth, urbanization trends, dietary shifts, technological advancements, and sustainable agriculture imperatives. However, challenges related to environmental sustainability, climate resilience, policy uncertainties, and market volatility require proactive measures and collaborative efforts to ensure long-term growth and resilience in Brazil’s fertilizer industry.

Conclusion

In conclusion, the fertilizer market in Brazil plays a pivotal role in supporting agricultural productivity, food security, and rural livelihoods, contributing to Brazil’s position as a global agricultural powerhouse. Despite challenges posed by environmental concerns, logistical constraints, and market dynamics, the market offers significant opportunities for innovation, sustainability, and market expansion. By embracing technological advancements, adopting sustainable practices, and fostering collaboration across the value chain, stakeholders can navigate challenges and capitalize on emerging trends to realize the market’s full potential.

What is Fertilizer?

Fertilizer refers to substances that are added to soil or plants to supply essential nutrients, enhancing growth and productivity. In Brazil, fertilizers play a crucial role in agriculture, particularly for crops like soybeans, corn, and sugarcane.

What are the key players in the Brazil Fertilizer Market?

Key players in the Brazil Fertilizer Market include companies such as Nutrien, Yara International, and Mosaic Company, which are involved in the production and distribution of various fertilizers. These companies contribute significantly to the agricultural sector by providing essential nutrients for crop production, among others.

What are the growth factors driving the Brazil Fertilizer Market?

The Brazil Fertilizer Market is driven by factors such as the increasing demand for food due to population growth, advancements in agricultural technology, and the expansion of arable land. Additionally, government initiatives to boost agricultural productivity further support market growth.

What challenges does the Brazil Fertilizer Market face?

Challenges in the Brazil Fertilizer Market include fluctuating raw material prices, environmental regulations, and the need for sustainable practices. These factors can impact production costs and the overall availability of fertilizers for farmers.

What opportunities exist in the Brazil Fertilizer Market?

Opportunities in the Brazil Fertilizer Market include the development of eco-friendly fertilizers, precision agriculture technologies, and increased investment in research and development. These innovations can enhance efficiency and sustainability in agricultural practices.

What trends are shaping the Brazil Fertilizer Market?

Trends in the Brazil Fertilizer Market include a shift towards organic fertilizers, the adoption of digital farming solutions, and a focus on nutrient management. These trends reflect a growing awareness of environmental sustainability and the need for efficient resource use in agriculture.

Brazil Fertilizer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Urea, Ammonium Nitrate, Potassium Chloride, Phosphate |

| Application | Crops, Horticulture, Turf, Vegetables |

| End User | Agricultural Producers, Retailers, Cooperatives, Distributors |

| Distribution Channel | Direct Sales, Online Retail, Wholesale, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at