444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil factory automation and industrial control market represents a dynamic and rapidly evolving sector that is transforming the country’s manufacturing landscape. As Brazil continues to modernize its industrial infrastructure, the adoption of advanced automation technologies has become increasingly critical for maintaining competitiveness in global markets. The market encompasses a comprehensive range of solutions including programmable logic controllers (PLCs), distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, and human-machine interfaces (HMIs).

Manufacturing sectors across Brazil are experiencing significant transformation driven by the need for enhanced productivity, improved quality control, and reduced operational costs. The market is witnessing robust growth with a projected CAGR of 8.2% over the forecast period, reflecting the increasing investment in Industry 4.0 technologies and smart manufacturing solutions. Key industries driving this expansion include automotive, oil and gas, food and beverage, pharmaceuticals, and mining operations.

Digital transformation initiatives are reshaping traditional manufacturing processes, with companies increasingly adopting integrated automation solutions that combine operational technology with information technology. This convergence is enabling Brazilian manufacturers to achieve greater operational efficiency, with many facilities reporting productivity improvements of up to 25% following automation implementation.

The Brazil factory automation and industrial control market refers to the comprehensive ecosystem of technologies, systems, and solutions designed to automate manufacturing processes and enhance industrial operations across Brazilian facilities. This market encompasses the deployment of advanced control systems, robotics, sensors, and software platforms that enable manufacturers to optimize production efficiency, ensure consistent quality, and reduce human intervention in critical processes.

Factory automation in the Brazilian context involves the integration of multiple technological components including control systems, motion control devices, industrial networking solutions, and process optimization software. These systems work collectively to create intelligent manufacturing environments where machines communicate seamlessly, processes are monitored in real-time, and decisions are made based on data-driven insights.

Industrial control systems form the backbone of modern manufacturing operations, providing the necessary infrastructure for monitoring, controlling, and optimizing production processes. In Brazil’s diverse industrial landscape, these systems are particularly crucial for managing complex operations in sectors such as petrochemicals, steel production, and food processing, where precision and reliability are paramount.

Brazil’s factory automation and industrial control market is experiencing unprecedented growth driven by the country’s commitment to industrial modernization and digital transformation. The market is characterized by increasing adoption of smart manufacturing technologies, with Brazilian companies investing heavily in automation solutions to enhance competitiveness and operational efficiency.

Key market drivers include the growing need for improved productivity, stringent quality requirements, and the imperative to reduce operational costs in an increasingly competitive global marketplace. The automotive sector leads adoption with approximately 35% market share, followed by oil and gas operations and food processing industries. Government initiatives supporting Industry 4.0 adoption have further accelerated market growth, with various incentive programs encouraging manufacturers to invest in advanced automation technologies.

Technology trends shaping the market include the integration of artificial intelligence, machine learning, and IoT capabilities into traditional control systems. These advancements are enabling Brazilian manufacturers to achieve new levels of operational excellence, with many facilities reporting efficiency gains of 20-30% following comprehensive automation implementations.

Regional distribution shows concentration in Brazil’s industrial heartlands, particularly São Paulo, Rio de Janeiro, and Minas Gerais, which collectively account for over 60% of market activity. The market outlook remains positive, with continued investment in manufacturing infrastructure and growing awareness of automation benefits driving sustained growth.

Strategic insights reveal several critical factors shaping Brazil’s factory automation landscape. The market demonstrates strong momentum across multiple industrial sectors, with particular strength in traditional manufacturing industries that are undergoing digital transformation initiatives.

Primary market drivers propelling Brazil’s factory automation sector stem from both internal operational needs and external competitive pressures. The fundamental driver remains the imperative for Brazilian manufacturers to enhance productivity and maintain competitiveness in global markets through advanced automation technologies.

Productivity enhancement represents the most significant driver, with manufacturers seeking to optimize production processes and reduce operational costs. Brazilian companies are increasingly recognizing that automation investments deliver measurable returns through improved efficiency, reduced waste, and enhanced product quality. Many facilities report productivity improvements exceeding 25% within the first year of automation implementation.

Quality consistency requirements are driving automation adoption across quality-sensitive industries such as pharmaceuticals, food and beverage, and automotive manufacturing. Automated control systems provide the precision and repeatability necessary to meet stringent quality standards while reducing variability in production processes.

Labor market dynamics are influencing automation decisions, with manufacturers facing challenges in finding skilled workers for certain operations. Automation solutions help address these challenges by reducing dependency on manual labor while creating opportunities for workers to develop higher-value skills in system operation and maintenance.

Regulatory compliance requirements in industries such as pharmaceuticals and food processing are necessitating the implementation of sophisticated control and monitoring systems. These systems ensure adherence to safety standards and provide the documentation required for regulatory compliance.

Market restraints affecting Brazil’s factory automation sector include several structural and economic challenges that manufacturers must navigate when implementing automation solutions. These constraints require careful consideration and strategic planning to overcome effectively.

Capital investment requirements represent a significant barrier for many Brazilian manufacturers, particularly small and medium-sized enterprises. The substantial upfront costs associated with automation implementation can strain financial resources and require careful justification through detailed return on investment analysis.

Technical complexity of modern automation systems presents challenges for organizations lacking specialized expertise. The integration of multiple technologies and systems requires skilled personnel and comprehensive planning to ensure successful implementation and ongoing operation.

Infrastructure limitations in certain regions of Brazil can constrain automation deployment, particularly in areas with unreliable power supply or limited telecommunications infrastructure. These challenges require additional investment in supporting infrastructure to ensure reliable system operation.

Skills shortage in automation technologies represents an ongoing challenge, with limited availability of qualified technicians and engineers capable of designing, implementing, and maintaining advanced automation systems. This constraint necessitates significant investment in training and development programs.

Economic volatility and currency fluctuations can impact automation investment decisions, particularly for systems requiring imported components. These factors create uncertainty in project planning and can affect the overall cost-effectiveness of automation initiatives.

Significant opportunities exist within Brazil’s factory automation market, driven by evolving industrial needs and emerging technological capabilities. These opportunities span multiple sectors and technology areas, offering substantial potential for growth and innovation.

Industry 4.0 adoption presents extensive opportunities as Brazilian manufacturers increasingly recognize the benefits of smart manufacturing technologies. The integration of IoT devices, artificial intelligence, and advanced analytics into automation systems creates new possibilities for operational optimization and competitive advantage.

Retrofit and modernization of existing facilities represents a substantial market opportunity, as many Brazilian manufacturers operate aging equipment that can benefit from automation upgrades. These projects often provide attractive returns on investment while extending the useful life of existing assets.

Emerging sectors such as renewable energy, biotechnology, and advanced materials manufacturing are creating new demand for specialized automation solutions. These industries require sophisticated control systems tailored to their unique operational requirements and regulatory environments.

Regional expansion opportunities exist in Brazil’s developing industrial regions, where new manufacturing facilities are being established and existing operations are being modernized. These areas offer potential for comprehensive automation implementations from the ground up.

Service and support opportunities are expanding as the installed base of automation systems grows. Manufacturers require ongoing maintenance, upgrades, and optimization services, creating sustainable revenue streams for automation providers.

Market dynamics in Brazil’s factory automation sector reflect the complex interplay of technological advancement, economic factors, and industrial transformation trends. These dynamics are shaping the competitive landscape and influencing investment decisions across multiple industries.

Technology convergence is a dominant dynamic, with traditional automation systems increasingly incorporating advanced technologies such as artificial intelligence, machine learning, and edge computing. This convergence is enabling new capabilities while creating more sophisticated and capable automation solutions.

Supply chain evolution is influencing market dynamics, with manufacturers seeking greater visibility and control over their supply chains through integrated automation and tracking systems. This trend has accelerated following global supply chain disruptions, with companies reporting supply chain visibility improvements of up to 40% through automation implementation.

Competitive pressures are driving rapid innovation in automation technologies, with providers continuously developing new features and capabilities to differentiate their offerings. This competition benefits end users through improved functionality and more competitive pricing.

Regulatory evolution is shaping market dynamics, with new standards and requirements influencing automation system design and implementation. Manufacturers must ensure their systems comply with evolving regulations while maintaining operational efficiency.

Economic cycles impact investment patterns in automation, with manufacturers adjusting their capital expenditure plans based on economic conditions and market outlook. However, the long-term trend toward automation remains strong regardless of short-term economic fluctuations.

Comprehensive research methodology employed in analyzing Brazil’s factory automation and industrial control market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of findings. The methodology combines quantitative analysis with qualitative insights to provide a complete market perspective.

Primary research activities include extensive interviews with industry executives, automation engineers, and end-user representatives across Brazil’s major industrial regions. These interviews provide firsthand insights into market trends, technology adoption patterns, and future investment plans. Survey data collected from over 200 manufacturing facilities provides quantitative validation of market trends and adoption rates.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements. This research provides historical context and validates primary research findings through independent data sources.

Market modeling techniques incorporate statistical analysis and forecasting methodologies to project market growth and identify emerging trends. These models consider multiple variables including economic indicators, industrial production data, and technology adoption curves.

Expert validation processes ensure research accuracy through review by industry specialists and academic experts in automation technologies. This validation helps identify potential biases and ensures comprehensive coverage of market dynamics.

Regional analysis of Brazil’s factory automation market reveals significant geographic concentration in the country’s established industrial centers, with distinct patterns of adoption and growth across different regions. The distribution reflects Brazil’s industrial heritage and ongoing development patterns.

Southeast region dominates the market with approximately 55% market share, led by São Paulo state’s extensive manufacturing base. This region benefits from established industrial infrastructure, skilled workforce availability, and proximity to major ports and transportation networks. The automotive, chemical, and machinery sectors drive significant automation investment in this region.

South region accounts for roughly 25% of market activity, with strong presence in food processing, textiles, and machinery manufacturing. Rio Grande do Sul and Santa Catarina states show particularly strong adoption of automation technologies, driven by export-oriented industries requiring high efficiency and quality standards.

Northeast region represents an emerging market with approximately 12% market share, showing rapid growth in petrochemical, mining, and renewable energy sectors. Government incentives and industrial development programs are driving increased automation investment in this region.

Central-West region contributes about 8% of market activity, primarily driven by agribusiness and food processing operations. The region’s growing importance in Brazil’s agricultural sector is creating new opportunities for specialized automation solutions.

North region currently represents the smallest market segment but shows potential for growth, particularly in mining and energy sectors. Infrastructure development and industrial expansion programs are expected to drive future automation adoption in this region.

Competitive landscape in Brazil’s factory automation market features a diverse mix of global technology leaders, regional specialists, and emerging local providers. The market structure reflects the complexity and varied requirements of Brazilian industrial operations.

Market competition is intensifying as providers expand their offerings and develop specialized solutions for Brazilian industrial requirements. Local partnerships and manufacturing capabilities are becoming increasingly important competitive differentiators.

Market segmentation analysis reveals distinct patterns of adoption and growth across different technology categories, applications, and end-user industries. This segmentation provides insights into market dynamics and future growth opportunities.

By Technology:

By Application:

By End-User Industry:

Category-wise analysis provides detailed insights into specific segments of Brazil’s factory automation market, revealing unique characteristics, growth patterns, and competitive dynamics within each category.

Process Control Systems represent the largest category, driven by Brazil’s significant process industries including petrochemicals, steel, and food processing. These systems typically involve complex integration requirements and long implementation cycles, but offer substantial operational benefits through improved process optimization and regulatory compliance.

Discrete Manufacturing Automation shows rapid growth, particularly in automotive and machinery sectors. This category benefits from standardized solutions and shorter implementation timelines, making it attractive for manufacturers seeking quick returns on automation investments. The segment is experiencing growth rates of 12-15% annually.

Safety and Security Systems are gaining prominence as manufacturers prioritize worker safety and asset protection. Integration of safety functions into automation systems is becoming standard practice, with many facilities reporting safety incident reductions of 30-40% following implementation.

Industrial Networking solutions are evolving rapidly with the adoption of Industrial Internet of Things (IIoT) technologies. These systems enable greater connectivity and data exchange between automation components, facilitating advanced analytics and optimization capabilities.

Motion Control applications are expanding beyond traditional manufacturing into new areas such as packaging, material handling, and renewable energy systems. This diversification is driving innovation in motion control technologies and creating new market opportunities.

Industry participants and stakeholders in Brazil’s factory automation market realize substantial benefits through strategic engagement with automation technologies and solutions. These benefits extend across multiple dimensions of business performance and operational excellence.

Manufacturers achieve significant operational improvements through automation implementation, including enhanced productivity, improved quality consistency, and reduced operational costs. Many Brazilian manufacturers report overall equipment effectiveness improvements of 20-25% following comprehensive automation deployment.

Technology providers benefit from growing market demand and opportunities for innovation. The expanding market creates revenue growth opportunities while driving continuous improvement in automation technologies and services.

System integrators play crucial roles in successful automation implementations, benefiting from increasing demand for specialized expertise and integration services. These companies often develop long-term relationships with manufacturers, providing ongoing support and optimization services.

Workers and communities benefit through job creation in higher-skilled positions and improved workplace safety. While automation may reduce certain manual labor positions, it typically creates new opportunities in system operation, maintenance, and engineering.

Government and economic development benefit through increased industrial competitiveness, higher productivity, and enhanced export capabilities. Automation investments contribute to Brazil’s industrial modernization and economic growth objectives.

Supply chain partners benefit from improved visibility, coordination, and efficiency in manufacturing operations. Automated systems provide better demand forecasting and production planning capabilities, benefiting entire supply chains.

SWOT analysis provides comprehensive assessment of Brazil’s factory automation market, identifying internal strengths and weaknesses alongside external opportunities and threats that influence market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Brazil’s factory automation landscape reflect global technological developments adapted to local market conditions and requirements. These trends are driving innovation and influencing investment decisions across multiple industries.

Digital Twin Technology is gaining traction among Brazilian manufacturers seeking to optimize operations through virtual modeling and simulation. This technology enables better planning, testing, and optimization of automation systems before physical implementation.

Edge Computing Integration is becoming increasingly important as manufacturers seek to process data closer to production operations. This trend reduces latency and improves system responsiveness while enabling more sophisticated local analytics capabilities.

Artificial Intelligence Integration is transforming traditional automation systems by adding predictive capabilities and autonomous decision-making functions. Brazilian manufacturers are beginning to adopt AI-enhanced automation solutions, with early adopters reporting efficiency improvements of 15-20%.

Cybersecurity Focus has intensified as connected automation systems become more prevalent. Manufacturers are investing in robust cybersecurity measures to protect critical industrial systems from potential threats.

Sustainable Manufacturing initiatives are driving demand for automation solutions that optimize energy consumption and reduce environmental impact. These systems help manufacturers meet sustainability goals while reducing operational costs.

Collaborative Automation is expanding as manufacturers seek to combine human expertise with automated capabilities. Collaborative robots and human-machine interfaces are becoming more sophisticated and user-friendly.

Recent industry developments in Brazil’s factory automation sector demonstrate the dynamic nature of the market and the continuous evolution of technology solutions. These developments reflect both global trends and local market adaptations.

Technology Partnerships between global automation providers and Brazilian companies are expanding, creating opportunities for knowledge transfer and local capability development. These partnerships often involve joint development of solutions tailored to Brazilian market requirements.

Manufacturing Investments by automation companies in Brazil are increasing, with several major providers establishing or expanding local production facilities. These investments improve supply chain efficiency and reduce costs for Brazilian customers.

Skills Development Programs are being launched by industry associations, educational institutions, and automation companies to address the shortage of qualified technicians and engineers. These programs are crucial for supporting market growth and ensuring successful automation implementations.

Government Initiatives supporting Industry 4.0 adoption are providing incentives and resources for manufacturers to invest in advanced automation technologies. These programs are accelerating market development and encouraging innovation.

Research and Development activities are expanding in Brazil, with universities and research institutions collaborating with industry to develop new automation technologies and applications. This research is contributing to innovation and competitive advantage in the global market.

Strategic recommendations from MarkWide Research analysis indicate several key areas where market participants should focus their efforts to maximize success in Brazil’s factory automation market. These suggestions are based on comprehensive market analysis and industry expertise.

Local Partnership Development should be prioritized by international automation providers seeking to establish strong market presence in Brazil. Local partnerships provide market knowledge, customer relationships, and regulatory expertise essential for success in the Brazilian market.

Skills Investment is crucial for all market participants, with companies needing to invest in training and development programs to ensure adequate skilled workforce availability. This investment benefits both individual companies and the overall market development.

Technology Localization efforts should focus on adapting global automation solutions to meet specific Brazilian market requirements and conditions. This includes consideration of local regulations, operating conditions, and customer preferences.

Service Capability Expansion represents a significant opportunity for automation providers to differentiate their offerings and create sustainable competitive advantages. Comprehensive service capabilities are increasingly important for customer satisfaction and retention.

Vertical Market Specialization can provide competitive advantages by developing deep expertise in specific industries and applications. This specialization enables providers to offer more targeted solutions and build stronger customer relationships.

Innovation Investment should focus on emerging technologies such as artificial intelligence, edge computing, and advanced analytics that can provide significant value to Brazilian manufacturers seeking competitive advantages.

Future outlook for Brazil’s factory automation and industrial control market remains highly positive, with multiple factors supporting continued growth and development over the coming years. The market is positioned for sustained expansion driven by ongoing industrial modernization and technological advancement.

Growth trajectory is expected to continue with projected CAGR of 8-10% over the next five years, supported by increasing automation adoption across multiple industries and ongoing investment in manufacturing infrastructure. This growth rate reflects both organic market expansion and the acceleration of digital transformation initiatives.

Technology evolution will continue to drive market development, with emerging technologies such as artificial intelligence, machine learning, and advanced analytics becoming increasingly integrated into automation solutions. These technologies will enable new capabilities and applications that were previously not feasible.

Market maturation is expected to bring greater standardization and interoperability in automation systems, reducing implementation complexity and costs. This maturation will make automation more accessible to smaller manufacturers and enable more comprehensive integration across supply chains.

Regional expansion opportunities will continue to develop as Brazil’s industrial base diversifies geographically. Emerging industrial regions will create new demand for automation solutions while established regions will focus on modernization and optimization.

Sustainability integration will become increasingly important, with automation systems playing crucial roles in helping manufacturers meet environmental goals and regulatory requirements. Energy efficiency and waste reduction capabilities will become standard features in automation solutions.

Brazil’s factory automation and industrial control market represents a dynamic and rapidly evolving sector with substantial growth potential and significant opportunities for market participants. The market is characterized by strong fundamentals, including a diverse industrial base, growing awareness of automation benefits, and supportive government policies that encourage industrial modernization.

Market dynamics indicate continued expansion driven by the need for enhanced productivity, improved quality control, and competitive positioning in global markets. Brazilian manufacturers are increasingly recognizing automation as essential for maintaining competitiveness, with adoption rates accelerating across multiple industries and applications.

Technology trends toward greater integration, intelligence, and connectivity are reshaping the automation landscape, creating new opportunities for innovation and value creation. The convergence of operational technology with information technology is enabling unprecedented levels of operational visibility and control.

Success factors for market participants include developing strong local partnerships, investing in skills development, adapting technologies to local requirements, and building comprehensive service capabilities. Companies that effectively address these factors are well-positioned to capitalize on market opportunities and achieve sustainable growth in Brazil’s expanding factory automation market.

What is Factory Automation and Industrial Control?

Factory Automation and Industrial Control refers to the use of control systems such as computers or robots for handling different processes and machinery in an industry to replace human intervention. This includes systems for controlling equipment in factories, boilers, and heat treating ovens, switching on telephone networks, steering and stabilization of ships, aircraft, and other applications.

What are the key players in the Brazil Factory Automation and Industrial Control Market?

Key players in the Brazil Factory Automation and Industrial Control Market include Siemens, Rockwell Automation, Schneider Electric, and ABB, among others. These companies are known for their innovative solutions and technologies that enhance operational efficiency and productivity in various industries.

What are the main drivers of the Brazil Factory Automation and Industrial Control Market?

The main drivers of the Brazil Factory Automation and Industrial Control Market include the increasing demand for operational efficiency, the need for improved safety standards, and the growing adoption of IoT technologies. Additionally, the push for digital transformation in manufacturing processes is significantly contributing to market growth.

What challenges does the Brazil Factory Automation and Industrial Control Market face?

The Brazil Factory Automation and Industrial Control Market faces challenges such as high initial investment costs and the complexity of integrating new technologies with existing systems. Additionally, there is a shortage of skilled workforce to manage and maintain advanced automation systems.

What opportunities exist in the Brazil Factory Automation and Industrial Control Market?

Opportunities in the Brazil Factory Automation and Industrial Control Market include the expansion of smart manufacturing initiatives and the increasing focus on sustainability and energy efficiency. Furthermore, advancements in artificial intelligence and machine learning present new avenues for innovation and growth.

What trends are shaping the Brazil Factory Automation and Industrial Control Market?

Trends shaping the Brazil Factory Automation and Industrial Control Market include the rise of Industry Four Point Zero, which emphasizes automation and data exchange in manufacturing technologies. Additionally, the integration of robotics and AI in production processes is becoming increasingly prevalent, enhancing productivity and flexibility.

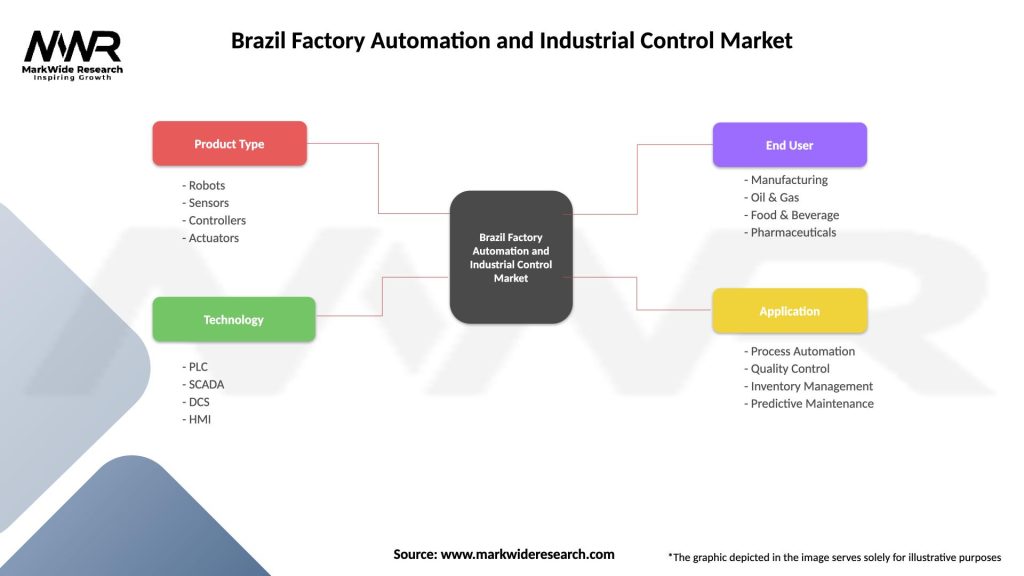

Brazil Factory Automation and Industrial Control Market

| Segmentation Details | Description |

|---|---|

| Product Type | Robots, Sensors, Controllers, Actuators |

| Technology | PLC, SCADA, DCS, HMI |

| End User | Manufacturing, Oil & Gas, Food & Beverage, Pharmaceuticals |

| Application | Process Automation, Quality Control, Inventory Management, Predictive Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Factory Automation and Industrial Control Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at