444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil data center storage market represents a rapidly expanding segment within the country’s digital infrastructure landscape, driven by increasing digitalization, cloud adoption, and growing data generation across industries. Brazil’s position as Latin America’s largest economy has positioned it as a critical hub for data center operations, with storage solutions becoming increasingly sophisticated to meet enterprise and hyperscale requirements.

Market dynamics in Brazil reflect the country’s transition toward digital transformation, with organizations across sectors investing heavily in modernizing their data storage infrastructure. The market encompasses traditional storage systems, software-defined storage, hyper-converged infrastructure, and cloud-integrated storage solutions. Growth momentum continues to accelerate, supported by favorable government policies promoting digital infrastructure development and increasing foreign investment in the technology sector.

Regional characteristics show concentrated development in major metropolitan areas including São Paulo, Rio de Janeiro, and Brasília, where enterprise demand and connectivity infrastructure support large-scale data center deployments. The market demonstrates strong growth potential, with analysts projecting expansion at a compound annual growth rate of 12.3% through the forecast period, driven by increasing data volumes and enterprise cloud migration strategies.

The Brazil data center storage market refers to the comprehensive ecosystem of storage hardware, software, and services deployed within data center facilities across Brazil to store, manage, and retrieve digital information for enterprises, cloud service providers, and government organizations. This market encompasses various storage technologies including traditional disk-based systems, solid-state drives, hybrid storage arrays, and emerging storage-class memory solutions.

Storage infrastructure in Brazilian data centers serves multiple purposes, from supporting enterprise applications and databases to enabling cloud services and big data analytics. The market includes both primary storage for active workloads and secondary storage for backup, archival, and disaster recovery purposes. Modern implementations increasingly integrate artificial intelligence and machine learning capabilities for automated storage management and optimization.

Market scope extends beyond hardware to include storage management software, data protection solutions, and professional services supporting implementation, maintenance, and optimization of storage infrastructure. The definition encompasses both traditional on-premises storage deployments and hybrid cloud storage architectures that bridge local data centers with public cloud services.

Brazil’s data center storage market demonstrates robust expansion driven by accelerating digital transformation initiatives across public and private sectors. The market benefits from increasing enterprise adoption of cloud technologies, growing data generation from IoT devices, and expanding e-commerce activities that require scalable storage infrastructure. Key growth drivers include government digitalization programs, increasing foreign direct investment in technology infrastructure, and rising demand for data localization compliance.

Technology evolution within the market shows strong adoption of flash-based storage systems, with SSD deployment rates increasing by 28% annually as organizations prioritize performance and efficiency. Software-defined storage solutions gain traction among enterprises seeking flexibility and cost optimization, while hyper-converged infrastructure adoption accelerates in mid-market segments. Cloud integration becomes increasingly important, with hybrid storage architectures representing the fastest-growing segment.

Competitive dynamics feature both international technology leaders and emerging local providers, creating a diverse ecosystem that serves various market segments from small businesses to hyperscale operators. The market outlook remains positive, supported by continued infrastructure investment, regulatory frameworks promoting data sovereignty, and increasing recognition of data as a strategic business asset requiring sophisticated storage solutions.

Strategic insights reveal several critical trends shaping Brazil’s data center storage landscape:

Market maturation indicators show increasing sophistication in storage procurement decisions, with organizations evaluating total cost of ownership, performance metrics, and integration capabilities rather than focusing solely on capacity and initial costs.

Digital transformation initiatives across Brazilian enterprises serve as the primary catalyst for data center storage market expansion. Organizations modernizing legacy systems require high-performance storage infrastructure to support cloud-native applications, real-time analytics, and digital customer experiences. Government digitalization programs further accelerate demand, with public sector agencies investing in modern storage solutions to improve service delivery and operational efficiency.

Data generation growth from IoT deployments, mobile applications, and digital business processes creates unprecedented storage requirements. Brazilian companies across industries generate increasing volumes of structured and unstructured data requiring sophisticated storage architectures. Regulatory compliance requirements, particularly the General Data Protection Law (LGPD), drive investments in secure, auditable storage infrastructure with robust data governance capabilities.

Cloud adoption acceleration fuels demand for hybrid storage solutions that integrate seamlessly with public cloud services while maintaining local data control. E-commerce expansion and digital payment system growth require scalable, high-availability storage infrastructure to support transaction processing and customer data management. The rise of remote work and digital collaboration tools further increases storage requirements for document management, video conferencing, and virtual desktop infrastructure.

Economic volatility in Brazil creates budget constraints that can delay or reduce data center storage investments, particularly among small and medium enterprises. Currency fluctuations affect the cost of imported storage hardware and software, making long-term planning challenging for organizations with limited financial resources. Infrastructure limitations in certain regions restrict data center development and storage deployment opportunities.

Skills shortage in storage administration and data management poses significant challenges for organizations implementing advanced storage solutions. The complexity of modern storage architectures requires specialized expertise that remains scarce in the Brazilian market. Legacy system integration difficulties can complicate storage modernization projects, particularly for organizations with extensive existing infrastructure investments.

Regulatory uncertainty regarding data localization requirements and cross-border data transfer restrictions can impact storage architecture decisions and investment timing. Power infrastructure reliability concerns in some regions affect data center operations and storage system deployment strategies. High import duties and taxes on technology equipment increase the total cost of storage solutions, potentially limiting adoption among price-sensitive market segments.

Government infrastructure investments present substantial opportunities for storage solution providers, with public sector digitalization initiatives requiring modern, scalable storage architectures. The smart cities movement across major Brazilian municipalities creates demand for edge storage solutions supporting IoT sensors, traffic management systems, and citizen services platforms. Financial services modernization offers significant growth potential as banks and fintech companies upgrade core systems and implement real-time payment processing capabilities.

Healthcare digitalization accelerates following pandemic-driven telemedicine adoption, creating opportunities for specialized storage solutions supporting medical imaging, electronic health records, and research data management. Manufacturing Industry 4.0 initiatives drive demand for industrial IoT storage solutions and edge computing infrastructure. Educational technology expansion in universities and schools requires storage infrastructure for digital learning platforms and research data management.

Sustainability initiatives create opportunities for energy-efficient storage solutions and green data center technologies. Disaster recovery modernization presents growth potential as organizations recognize the importance of robust backup and recovery capabilities. The emergence of 5G networks will drive edge storage requirements and create new opportunities for distributed storage architectures across Brazil’s telecommunications infrastructure.

Supply chain dynamics in Brazil’s data center storage market reflect global technology trends while addressing local requirements and constraints. International storage vendors establish local partnerships and distribution channels to serve the growing Brazilian market effectively. Demand patterns show increasing preference for subscription-based storage services and as-a-service delivery models that reduce capital expenditure requirements and provide operational flexibility.

Technology adoption cycles demonstrate accelerating acceptance of emerging storage technologies, with NVMe adoption rates reaching 35% among enterprise deployments. Pricing dynamics benefit from global storage cost reductions and increased local competition, making advanced storage solutions more accessible to mid-market organizations. Service delivery models evolve toward managed storage services and cloud-integrated offerings that simplify deployment and ongoing management.

Partnership ecosystems develop between storage vendors, system integrators, and cloud service providers to deliver comprehensive solutions addressing complex customer requirements. Innovation cycles accelerate as vendors introduce AI-powered storage management, automated tiering, and predictive maintenance capabilities. Market consolidation trends show larger vendors acquiring specialized storage companies to expand their solution portfolios and market reach in Brazil.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Brazil’s data center storage market dynamics. Primary research includes structured interviews with storage vendors, system integrators, end-user organizations, and industry experts across various sectors and regions. Survey methodologies capture quantitative data on adoption rates, spending patterns, and technology preferences among Brazilian enterprises.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and vendor financial disclosures to validate primary findings and identify broader market trends. Market sizing methodologies utilize bottom-up and top-down approaches, analyzing storage capacity deployments, replacement cycles, and growth projections across different market segments and geographic regions.

Data validation processes ensure accuracy through triangulation of multiple data sources and expert review of findings and conclusions. Forecasting models incorporate economic indicators, technology adoption curves, and regulatory impact assessments to project future market development. MarkWide Research analytical frameworks provide structured approaches to market segmentation, competitive analysis, and trend identification throughout the research process.

São Paulo region dominates Brazil’s data center storage market, accounting for approximately 45% of total market activity due to its concentration of enterprise headquarters, financial institutions, and technology companies. The region benefits from superior telecommunications infrastructure, skilled workforce availability, and proximity to major business centers. Storage deployments in São Paulo typically feature advanced technologies and large-scale implementations supporting mission-critical applications.

Rio de Janeiro represents the second-largest regional market, driven by government agencies, oil and gas companies, and growing technology sector presence. The region shows strong adoption of cloud-integrated storage solutions and disaster recovery infrastructure. Brasília’s market focuses primarily on government and public sector storage requirements, with emphasis on compliance and security features.

Southern regions including Rio Grande do Sul and Santa Catarina demonstrate growing storage market activity, supported by manufacturing industries and agricultural technology companies. Northern and northeastern regions show emerging opportunities as telecommunications infrastructure improves and local businesses adopt digital technologies. Regional market share distribution indicates Southeast regions capturing 62% of total market activity, while other regions show accelerating growth rates as digital transformation spreads across Brazil’s diverse economy.

Market leadership in Brazil’s data center storage sector features a mix of global technology giants and specialized storage vendors competing across different market segments and customer types. Competitive positioning varies based on technology focus, customer segment, and service delivery approach.

Competitive strategies emphasize local partnerships, flexible financing options, and comprehensive service offerings addressing Brazilian market requirements and regulatory compliance needs.

Technology segmentation reveals diverse storage approaches serving different performance, capacity, and cost requirements across Brazilian data centers:

By Storage Type:

By Application:

By End-User Industry:

All-flash storage systems demonstrate the strongest growth trajectory in Brazil’s data center market, with adoption rates increasing 32% annually as organizations prioritize application performance and user experience. Enterprise adoption accelerates across financial services, e-commerce, and government sectors where transaction processing speed directly impacts business outcomes. Cost considerations become less prohibitive as flash storage prices decline and total cost of ownership benefits become apparent.

Software-defined storage gains significant traction among organizations seeking infrastructure flexibility and vendor independence. Implementation benefits include simplified management, automated provisioning, and ability to leverage commodity hardware while maintaining enterprise-grade features. Hybrid cloud integration capabilities make software-defined storage particularly attractive for organizations pursuing multi-cloud strategies.

Hyper-converged infrastructure appeals to mid-market organizations and remote office deployments where simplified management and reduced infrastructure footprint provide operational advantages. Edge computing requirements drive demand for compact, integrated storage solutions that can operate reliably in distributed environments. Backup and recovery modernization shows strong growth as organizations replace traditional tape-based systems with disk-based and cloud-integrated solutions offering faster recovery times and improved reliability.

Enterprise customers benefit from improved application performance, reduced operational complexity, and enhanced data protection capabilities through modern storage infrastructure investments. Cost optimization opportunities include reduced power consumption, improved space utilization, and simplified management reducing staffing requirements. Scalability advantages enable organizations to respond quickly to changing business requirements without major infrastructure overhauls.

Storage vendors gain access to Brazil’s large and growing market with opportunities for long-term customer relationships and recurring revenue through service contracts and software subscriptions. Channel partners benefit from increasing demand for storage expertise and implementation services as organizations modernize their infrastructure. System integrators find opportunities in complex storage projects requiring custom integration and ongoing management services.

Cloud service providers leverage advanced storage infrastructure to offer competitive services and support growing customer demands for performance and reliability. Government agencies achieve improved citizen services and operational efficiency through modern storage supporting digital transformation initiatives. Technology ecosystem participants including software vendors and consulting firms benefit from increased demand for complementary solutions and services supporting storage infrastructure deployments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend in Brazil’s data center storage market, with AI-powered management systems providing automated optimization, predictive maintenance, and intelligent data placement. Storage systems increasingly incorporate machine learning algorithms to analyze usage patterns and optimize performance without human intervention. Predictive analytics capabilities help organizations anticipate storage requirements and prevent performance issues before they impact applications.

Sustainability focus drives adoption of energy-efficient storage technologies and green data center practices. Organizations prioritize storage solutions with lower power consumption, reduced cooling requirements, and environmentally responsible manufacturing processes. Circular economy principles influence storage procurement decisions, with emphasis on equipment lifecycle management and responsible disposal practices.

Edge computing expansion creates demand for distributed storage architectures supporting IoT applications, content delivery, and real-time processing requirements. 5G network deployment accelerates edge storage adoption as applications require ultra-low latency data access. Container-based applications drive demand for persistent storage solutions supporting modern application architectures and DevOps practices. Data fabric architectures gain traction as organizations seek unified data management across hybrid and multi-cloud environments.

Major cloud providers continue expanding their Brazilian data center presence, with significant investments in local infrastructure driving demand for hyperscale storage solutions. Microsoft Azure and Amazon Web Services establish additional availability zones, requiring massive storage deployments to support growing customer demands. Google Cloud announces plans for expanded Brazilian operations, further increasing hyperscale storage requirements.

Storage vendor consolidation continues with strategic acquisitions aimed at expanding solution portfolios and market reach. Technology partnerships between storage vendors and cloud providers create integrated solutions addressing hybrid cloud requirements. Local manufacturing initiatives by international vendors aim to reduce costs and improve supply chain reliability for Brazilian customers.

Government initiatives supporting digital infrastructure development include tax incentives for data center investments and simplified regulations for technology imports. MarkWide Research analysis indicates that regulatory frameworks increasingly favor local data storage and processing, creating opportunities for domestic data center expansion. Financial services modernization accelerates with major banks implementing core system upgrades requiring advanced storage infrastructure. Healthcare digitalization receives government support through funding programs for hospital technology modernization and telemedicine infrastructure.

Storage vendors should prioritize local partnerships and channel development to effectively serve Brazil’s diverse market segments and geographic regions. Investment strategies should focus on building local technical support capabilities and customer success programs addressing Brazilian market requirements. Product positioning should emphasize total cost of ownership benefits and compliance capabilities rather than focusing solely on technical specifications.

Enterprise customers should develop comprehensive storage strategies addressing both current requirements and future growth projections, considering hybrid cloud integration and edge computing needs. Procurement approaches should evaluate subscription-based and as-a-service models that provide operational flexibility and reduce capital expenditure requirements. Skills development investments in storage administration and data management capabilities will become increasingly critical for successful implementations.

System integrators should expand their storage expertise and develop specialized capabilities in emerging technologies including AI-powered management and edge storage solutions. Service portfolios should include ongoing managed services and optimization consulting to address the growing complexity of modern storage environments. Government agencies should prioritize storage infrastructure investments supporting digital transformation initiatives while ensuring compliance with evolving data protection regulations.

Long-term market prospects for Brazil’s data center storage sector remain highly positive, supported by continued digital transformation momentum and increasing recognition of data as a strategic business asset. Growth projections indicate sustained expansion at double-digit annual rates through the next five years, driven by cloud adoption, IoT deployment, and government digitalization initiatives. Technology evolution will continue toward more intelligent, automated storage systems with enhanced integration capabilities.

Emerging technologies including storage-class memory, computational storage, and quantum-safe encryption will gradually enter the Brazilian market as early adopters seek competitive advantages. Edge computing growth will create new market segments for distributed storage solutions supporting autonomous vehicles, smart manufacturing, and augmented reality applications. Sustainability requirements will increasingly influence storage procurement decisions as organizations commit to environmental responsibility goals.

Market maturation will lead to more sophisticated customer requirements and increased focus on business outcomes rather than technical specifications. MWR projections suggest that by 2028, software-defined storage will represent over 40% of new deployments as organizations prioritize flexibility and automation. Regulatory evolution will continue shaping market dynamics, with data sovereignty requirements potentially creating additional opportunities for local storage infrastructure investments. Innovation cycles will accelerate as vendors compete to address evolving customer needs in an increasingly digital economy.

Brazil’s data center storage market stands at a pivotal moment of transformation, driven by accelerating digitalization across industries and growing recognition of data as a critical business asset. Market dynamics reflect strong fundamentals including government support for digital infrastructure, increasing cloud adoption, and evolving regulatory frameworks that favor local data storage and processing capabilities.

Growth opportunities remain substantial across multiple market segments, from hyperscale cloud deployments to edge computing applications supporting IoT and Industry 4.0 initiatives. Technology trends toward AI-powered management, sustainability focus, and hybrid cloud integration create new possibilities for storage vendors and service providers willing to adapt to changing customer requirements. Competitive landscapes will continue evolving as global vendors establish stronger local presence while emerging technologies reshape storage architectures and delivery models.

Success factors for market participants include developing deep understanding of Brazilian business requirements, building local partnerships and support capabilities, and maintaining flexibility to adapt to regulatory changes and economic conditions. The Brazil data center storage market represents one of Latin America’s most promising technology sectors, offering significant opportunities for organizations positioned to serve the country’s growing digital economy with innovative, reliable, and compliant storage solutions.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store, manage, and protect data within data centers. This includes various storage solutions such as hard drives, solid-state drives, and cloud storage services that support enterprise applications and data management needs.

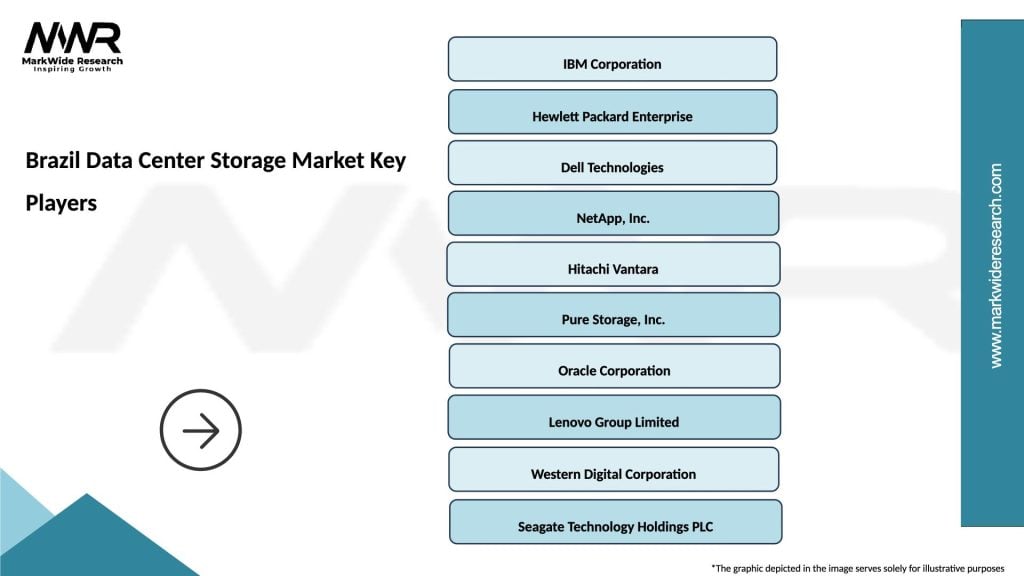

What are the key players in the Brazil Data Center Storage Market?

Key players in the Brazil Data Center Storage Market include companies like Dell Technologies, IBM, and NetApp, which provide a range of storage solutions and services tailored for data centers. These companies focus on innovation and efficiency to meet the growing demands of data storage and management, among others.

What are the main drivers of growth in the Brazil Data Center Storage Market?

The main drivers of growth in the Brazil Data Center Storage Market include the increasing demand for data storage due to digital transformation, the rise of cloud computing, and the need for enhanced data security. Additionally, the expansion of e-commerce and online services contributes to the growing storage requirements.

What challenges does the Brazil Data Center Storage Market face?

The Brazil Data Center Storage Market faces challenges such as high operational costs, data security concerns, and the complexity of managing diverse storage solutions. Additionally, regulatory compliance and the need for skilled personnel can hinder market growth.

What opportunities exist in the Brazil Data Center Storage Market?

Opportunities in the Brazil Data Center Storage Market include the adoption of advanced technologies like artificial intelligence and machine learning for data management, as well as the growth of hybrid cloud solutions. These trends can enhance efficiency and scalability for businesses looking to optimize their data storage.

What trends are shaping the Brazil Data Center Storage Market?

Trends shaping the Brazil Data Center Storage Market include the shift towards cloud-based storage solutions, the increasing use of software-defined storage, and the focus on sustainability in data center operations. These trends reflect the evolving needs of businesses for flexibility and efficiency in data management.

Brazil Data Center Storage Market

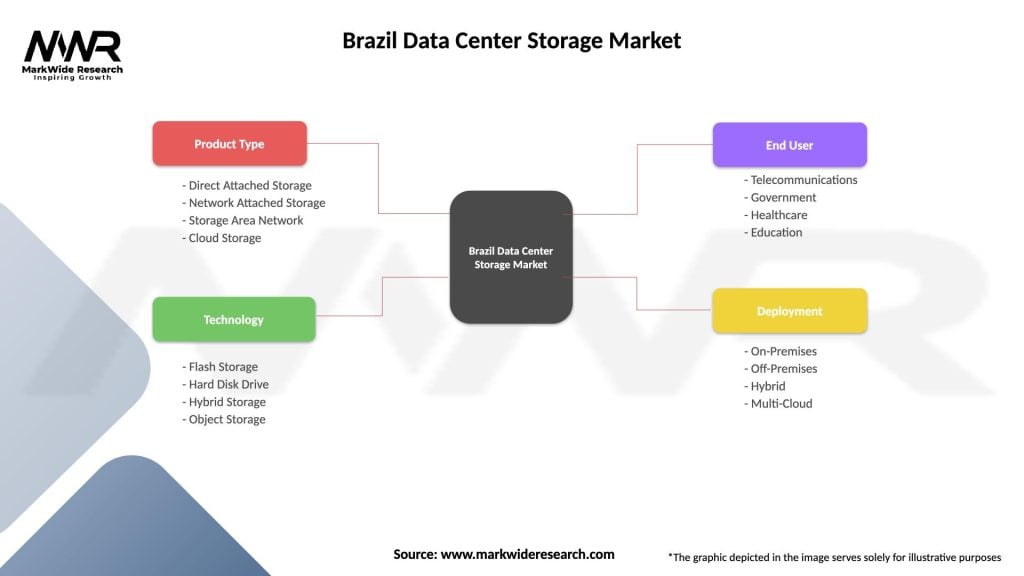

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Technology | Flash Storage, Hard Disk Drive, Hybrid Storage, Object Storage |

| End User | Telecommunications, Government, Healthcare, Education |

| Deployment | On-Premises, Off-Premises, Hybrid, Multi-Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at