444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil data center power market represents a rapidly expanding segment within the country’s digital infrastructure landscape, driven by increasing demand for cloud computing services, digital transformation initiatives, and the growing need for reliable power solutions. Brazil’s position as Latin America’s largest economy has positioned it as a critical hub for data center development, with power infrastructure serving as the backbone of this technological revolution.

Market dynamics indicate that Brazil’s data center power sector is experiencing unprecedented growth, with adoption rates reaching 42% annually among enterprise customers seeking enhanced digital capabilities. The country’s strategic location, combined with government initiatives supporting digital infrastructure development, has created a favorable environment for data center power market expansion.

Key market characteristics include the integration of renewable energy sources, implementation of advanced power management systems, and increasing focus on energy efficiency solutions. The market encompasses various power components including uninterruptible power supplies (UPS), power distribution units (PDUs), generators, and cooling systems that ensure continuous operation of critical data center facilities.

Regional concentration remains primarily focused in major metropolitan areas such as São Paulo, Rio de Janeiro, and Brasília, where digital infrastructure demand is highest. However, emerging markets in secondary cities are beginning to show significant growth potential as businesses expand their digital footprint across the country.

The Brazil data center power market refers to the comprehensive ecosystem of electrical infrastructure, power management systems, and energy solutions specifically designed to support data center operations throughout Brazil. This market encompasses all power-related components, services, and technologies required to ensure reliable, efficient, and scalable electrical supply for data processing facilities.

Core components of this market include primary power systems such as electrical distribution infrastructure, backup power solutions including diesel and gas generators, uninterruptible power supply systems for seamless power transition, and advanced power monitoring and management software platforms that optimize energy consumption and ensure operational continuity.

Market scope extends beyond traditional hardware to include comprehensive power services such as installation, maintenance, monitoring, and consulting services that help organizations optimize their data center power infrastructure. The market also encompasses emerging technologies like renewable energy integration, smart grid connectivity, and energy storage solutions that enhance sustainability and operational efficiency.

Brazil’s data center power market is experiencing robust expansion driven by accelerating digital transformation across industries and increasing demand for cloud-based services. The market demonstrates strong fundamentals with enterprise adoption growing at 38% year-over-year, reflecting the critical importance of reliable power infrastructure in supporting Brazil’s digital economy.

Key growth drivers include the proliferation of edge computing deployments, increasing regulatory requirements for data localization, and growing awareness of the importance of power reliability in maintaining business continuity. Organizations across sectors are investing heavily in modernizing their power infrastructure to support expanding data center operations.

Market segmentation reveals diverse opportunities across multiple categories including power capacity ranges, deployment models, and industry verticals. Enterprise customers represent the largest segment, while small and medium businesses are emerging as significant growth drivers as they increasingly adopt cloud-first strategies.

Competitive landscape features both international technology leaders and domestic solution providers, creating a dynamic environment that fosters innovation and competitive pricing. The market benefits from strong government support for digital infrastructure development and favorable policies encouraging foreign investment in technology sectors.

Strategic market insights reveal several critical trends shaping the Brazil data center power market landscape:

Market maturation is evident through the increasing sophistication of power management solutions and the growing adoption of artificial intelligence and machine learning technologies for predictive maintenance and optimization of power systems.

Digital transformation acceleration serves as the primary catalyst driving Brazil’s data center power market growth. Organizations across industries are rapidly digitizing their operations, creating unprecedented demand for reliable and scalable data center infrastructure supported by robust power systems.

Cloud computing adoption continues to surge as businesses recognize the strategic advantages of cloud-first approaches. This trend directly translates to increased demand for data center facilities and the sophisticated power infrastructure required to support them. Enterprise migration to cloud platforms is driving infrastructure investment growth of approximately 45% annually.

Government digitalization initiatives represent another significant driver, with Brazilian federal and state governments implementing comprehensive digital transformation programs that require substantial data center capacity. These initiatives include e-government services, digital identity programs, and smart city developments that necessitate reliable power infrastructure.

Regulatory requirements for data localization and sovereignty are compelling international organizations to establish local data center presence in Brazil. These compliance mandates create sustained demand for data center power infrastructure as companies seek to meet regulatory obligations while maintaining operational efficiency.

Economic recovery following recent challenges has renewed business confidence and investment in technology infrastructure. Organizations are prioritizing digital capabilities as competitive differentiators, driving increased spending on data center power solutions that enable reliable and scalable operations.

High capital investment requirements present significant barriers to market entry and expansion. Data center power infrastructure demands substantial upfront investment in equipment, installation, and ongoing maintenance, which can be challenging for smaller organizations or those with limited capital resources.

Skilled workforce shortage represents a critical constraint affecting market growth. The specialized nature of data center power systems requires highly trained technicians and engineers, but Brazil faces a shortage of qualified professionals with expertise in advanced power management technologies and systems integration.

Regulatory complexity and bureaucratic processes can slow project implementation and increase costs. Navigating Brazil’s complex regulatory environment for electrical infrastructure, environmental permits, and construction approvals requires significant time and resources that can delay market entry or expansion plans.

Economic volatility and currency fluctuations create uncertainty for long-term infrastructure investments. Organizations may delay or reduce data center power investments during periods of economic instability, affecting overall market growth momentum.

Grid reliability challenges in certain regions of Brazil can complicate data center power planning and increase infrastructure costs. Areas with less reliable electrical grid infrastructure require more robust backup power systems and redundancy measures, increasing overall project complexity and cost.

Renewable energy integration presents substantial opportunities for market expansion as organizations increasingly prioritize sustainability and environmental responsibility. The growing availability of solar and wind power in Brazil creates opportunities for data center operators to reduce operating costs while meeting corporate sustainability goals.

Edge computing proliferation is creating new market segments requiring distributed power infrastructure solutions. As applications demand lower latency and improved performance, edge data centers are emerging throughout Brazil, each requiring specialized power systems tailored to smaller-scale deployments.

5G network deployment across Brazil will drive significant demand for edge computing infrastructure and associated power systems. Telecommunications providers are investing heavily in 5G infrastructure, creating opportunities for power solution providers to support this network expansion.

Smart city initiatives in major Brazilian metropolitan areas are generating demand for distributed data center infrastructure with sophisticated power management capabilities. These projects require innovative power solutions that can support various smart city applications while maintaining high reliability and efficiency standards.

International expansion by global technology companies into the Brazilian market creates opportunities for local power infrastructure providers to partner with established players and gain access to advanced technologies and best practices.

Supply chain evolution is reshaping the Brazil data center power market as manufacturers and suppliers adapt to changing demand patterns and technological requirements. Local manufacturing capabilities are expanding, reducing dependence on imports and improving cost competitiveness while supporting faster project delivery timelines.

Technology convergence is driving innovation in power management solutions, with artificial intelligence, Internet of Things (IoT), and advanced analytics being integrated into power systems to enable predictive maintenance, optimize energy consumption, and improve overall system reliability. These technological advances are achieving efficiency improvements of up to 35% in modern installations.

Partnership ecosystems are becoming increasingly important as organizations seek comprehensive solutions that combine power infrastructure with complementary technologies and services. Strategic alliances between power equipment manufacturers, system integrators, and service providers are creating more robust and competitive market offerings.

Customer expectations are evolving toward more sophisticated and integrated power solutions that provide real-time monitoring, predictive analytics, and automated management capabilities. Organizations are demanding power systems that not only ensure reliability but also contribute to operational efficiency and cost optimization.

Market consolidation trends are emerging as larger players acquire specialized companies to expand their capabilities and market reach. This consolidation is creating opportunities for enhanced service delivery while potentially reducing competition in certain market segments.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy and completeness of market insights. The research framework incorporated quantitative and qualitative analysis techniques to provide a holistic view of the Brazil data center power market.

Primary research activities included extensive interviews with industry executives, technology leaders, and key stakeholders across the data center power ecosystem. These interviews provided valuable insights into market trends, challenges, opportunities, and competitive dynamics from practitioners actively engaged in the market.

Secondary research encompassed analysis of industry reports, government publications, regulatory documents, and company financial statements to gather comprehensive market data and validate primary research findings. This approach ensured broad market coverage and historical context for trend analysis.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews with key respondents, and applying statistical analysis techniques to ensure data accuracy and reliability. Market projections were developed using established forecasting methodologies and validated through expert consultation.

Market segmentation analysis employed detailed categorization frameworks to identify distinct market segments and analyze their individual characteristics, growth patterns, and competitive dynamics. This segmentation approach enables more precise market understanding and strategic planning.

São Paulo region dominates Brazil’s data center power market, accounting for approximately 48% of total market activity. The region’s concentration of financial services, manufacturing, and technology companies creates substantial demand for data center infrastructure and associated power systems. São Paulo’s mature electrical grid infrastructure and proximity to major business centers make it the preferred location for large-scale data center deployments.

Rio de Janeiro represents the second-largest regional market, driven by government institutions, oil and gas companies, and growing technology sector presence. The region benefits from strategic location advantages and government support for digital infrastructure development, contributing to steady market growth and investment attraction.

Brasília and surrounding areas are experiencing rapid growth due to government digitalization initiatives and the concentration of federal institutions requiring secure and reliable data center services. The region’s focus on e-government services and digital transformation creates sustained demand for power infrastructure solutions.

Southern Brazil including cities like Porto Alegre and Curitiba is emerging as a significant market driven by industrial digitalization and growing technology sector presence. The region’s stable electrical grid and favorable business environment are attracting data center investments and associated power infrastructure development.

Northern and Northeastern regions represent emerging opportunities as digital infrastructure expands beyond traditional metropolitan centers. Government initiatives to reduce digital divide and improve connectivity in these regions are creating new market opportunities for data center power solutions.

Market leadership is distributed among several key categories of providers, each bringing distinct capabilities and market positioning:

Competitive differentiation is increasingly based on technological innovation, service capabilities, and ability to provide integrated solutions that address multiple customer requirements. Companies are investing heavily in research and development to create more efficient, reliable, and intelligent power management systems.

Local partnerships and distribution networks play crucial roles in market success, as customers value local support capabilities and rapid response times for critical infrastructure components. International providers are strengthening their local presence through partnerships and direct investment in Brazilian operations.

By Power Capacity:

By Component Type:

By End-User Industry:

UPS Systems segment represents the largest category within Brazil’s data center power market, driven by the critical importance of uninterrupted power supply for data center operations. Modern UPS systems are incorporating advanced features such as lithium-ion batteries, intelligent monitoring, and grid-interactive capabilities that enhance efficiency and reliability.

Power Distribution Units are experiencing significant innovation with smart PDUs gaining market share at approximately 52% adoption rate among new installations. These intelligent systems provide real-time monitoring, remote management capabilities, and enhanced safety features that appeal to organizations seeking operational visibility and control.

Generator systems remain essential components of data center power infrastructure, with natural gas generators gaining popularity due to environmental considerations and fuel availability. The segment is seeing increased demand for modular and containerized solutions that offer faster deployment and greater flexibility.

Power monitoring and management solutions are becoming increasingly sophisticated, incorporating artificial intelligence and machine learning capabilities to optimize energy consumption and predict maintenance requirements. These systems are achieving operational efficiency improvements of up to 28% through intelligent power management.

Cooling system power represents a growing category as data centers seek to optimize cooling efficiency and reduce overall power consumption. Advanced cooling technologies including liquid cooling and free cooling systems are gaining adoption as organizations focus on improving power usage effectiveness.

Data center operators benefit from enhanced operational reliability, reduced downtime risks, and improved energy efficiency through advanced power management solutions. Modern power infrastructure enables operators to achieve higher service level agreements while reducing operational costs and environmental impact.

Enterprise customers gain access to more reliable and scalable IT infrastructure that supports their digital transformation initiatives. Robust power systems enable organizations to confidently migrate critical applications to data centers while maintaining business continuity and operational performance.

Technology providers can expand their market reach and develop innovative solutions that address evolving customer requirements. The growing market creates opportunities for both established companies and emerging players to capture market share through differentiated offerings and superior customer service.

Government entities benefit from improved digital service delivery capabilities and enhanced citizen engagement through reliable data center infrastructure. Robust power systems support e-government initiatives and smart city projects that improve public service efficiency and accessibility.

Economic development is enhanced through job creation, technology transfer, and increased foreign investment in Brazil’s digital infrastructure sector. The data center power market contributes to broader economic growth while supporting the country’s digital competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus is driving significant changes in data center power system design and operation. Organizations are increasingly prioritizing renewable energy sources, energy-efficient equipment, and carbon footprint reduction initiatives. This trend is reshaping procurement decisions and creating demand for innovative power solutions that support environmental objectives.

Edge computing proliferation is creating new requirements for distributed power infrastructure that can support smaller-scale deployments while maintaining high reliability standards. Edge data centers require power systems that are compact, efficient, and capable of remote management, driving innovation in modular and prefabricated solutions.

Artificial intelligence integration is transforming power management capabilities through predictive analytics, automated optimization, and intelligent fault detection. AI-powered systems are achieving maintenance cost reductions of approximately 31% while improving overall system reliability and performance.

Hybrid cloud adoption is influencing data center power infrastructure requirements as organizations implement multi-cloud strategies that require flexible and scalable power systems. This trend is driving demand for modular power solutions that can adapt to changing capacity requirements.

Regulatory compliance requirements are becoming more stringent, particularly regarding data sovereignty and environmental standards. These regulations are influencing power system design and creating opportunities for providers that can deliver compliant solutions efficiently.

Major infrastructure investments by global cloud service providers are transforming Brazil’s data center landscape. These investments include substantial commitments to advanced power infrastructure that meets international standards while supporting local market growth and development.

Technology partnerships between international providers and local companies are accelerating market development and knowledge transfer. These collaborations are creating more competitive offerings while building local capabilities and expertise in advanced power management technologies.

Regulatory framework updates are streamlining approval processes and creating more favorable conditions for data center development. Recent policy changes have reduced bureaucratic barriers while maintaining necessary safety and environmental standards.

Renewable energy projects specifically designed to support data center operations are emerging across Brazil. These initiatives include solar and wind power installations that provide clean energy for data center facilities while reducing operational costs and environmental impact.

Innovation centers and research facilities focused on data center technologies are being established in major Brazilian cities. These facilities are advancing local expertise while fostering innovation in power management and energy efficiency solutions.

MarkWide Research analysis indicates that organizations entering or expanding in Brazil’s data center power market should prioritize local partnerships and regulatory compliance expertise. Understanding Brazil’s complex regulatory environment and building relationships with local stakeholders are critical success factors for market entry and expansion.

Investment in local capabilities including technical support, training programs, and service infrastructure will be essential for long-term market success. Organizations that can provide rapid response and local expertise will have significant competitive advantages in this market.

Sustainability initiatives should be integrated into product development and market positioning strategies. As environmental consciousness grows among Brazilian organizations, power solutions that demonstrate clear sustainability benefits will have enhanced market appeal and competitive positioning.

Technology innovation focusing on artificial intelligence, IoT integration, and predictive analytics will be crucial for maintaining competitive differentiation. Organizations should invest in research and development to create next-generation power management solutions that address evolving customer requirements.

Market segmentation strategies should recognize the diverse needs of different customer segments and geographic regions. Tailored solutions that address specific market segment requirements will be more successful than one-size-fits-all approaches.

Long-term growth prospects for Brazil’s data center power market remain highly positive, driven by continued digital transformation, increasing cloud adoption, and expanding edge computing requirements. MWR projections indicate sustained growth momentum with market expansion rates expected to reach 41% annually over the next five years.

Technology evolution will continue to reshape market dynamics with artificial intelligence, machine learning, and advanced analytics becoming standard features in power management systems. These technologies will enable more efficient operations, predictive maintenance, and automated optimization that reduces costs while improving reliability.

Regulatory environment is expected to become more supportive of data center development while maintaining focus on environmental sustainability and energy efficiency. New policies may provide additional incentives for renewable energy adoption and advanced power management technologies.

Market consolidation trends may accelerate as larger players seek to expand their capabilities and market reach through strategic acquisitions. This consolidation could create opportunities for enhanced service delivery while potentially affecting competitive dynamics in certain market segments.

International expansion by Brazilian companies into regional markets may create new growth opportunities as local expertise and capabilities mature. Brazilian providers may leverage their market experience to expand into other Latin American countries with similar infrastructure requirements.

Brazil’s data center power market represents a dynamic and rapidly expanding sector with substantial growth potential driven by digital transformation, cloud adoption, and increasing demand for reliable IT infrastructure. The market benefits from strong fundamentals including government support, strategic geographic positioning, and a large domestic economy that creates sustained demand for data center services.

Key success factors for market participants include understanding local regulatory requirements, building strong partnerships, investing in advanced technologies, and developing comprehensive service capabilities that address diverse customer needs. Organizations that can navigate Brazil’s complex business environment while delivering innovative and reliable power solutions will be well-positioned for long-term success.

Future market development will be shaped by technological innovation, sustainability requirements, and evolving customer expectations for more intelligent and efficient power management solutions. The integration of renewable energy sources, artificial intelligence, and advanced analytics will create new opportunities while potentially disrupting traditional market approaches and competitive dynamics.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, including servers, storage, and networking equipment. It encompasses various aspects such as power distribution, backup systems, and energy efficiency measures.

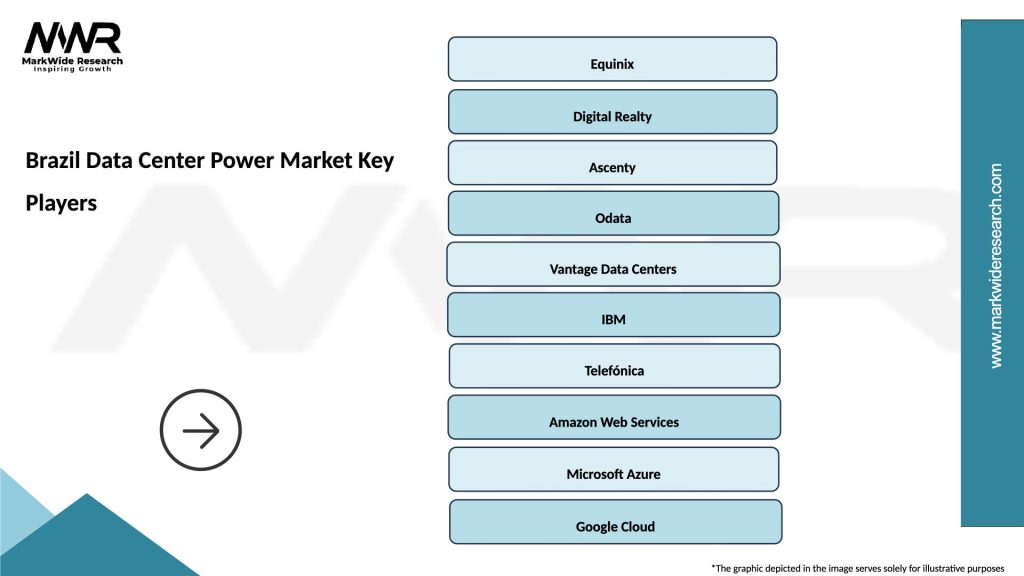

What are the key players in the Brazil Data Center Power Market?

Key players in the Brazil Data Center Power Market include companies like Schneider Electric, Vertiv, and Eaton, which provide power management solutions and infrastructure for data centers. These companies focus on enhancing energy efficiency and reliability, among others.

What are the main drivers of growth in the Brazil Data Center Power Market?

The main drivers of growth in the Brazil Data Center Power Market include the increasing demand for cloud computing services, the rise in data generation, and the need for energy-efficient solutions. Additionally, the expansion of digital infrastructure is contributing to market growth.

What challenges does the Brazil Data Center Power Market face?

The Brazil Data Center Power Market faces challenges such as high energy costs, regulatory compliance issues, and the need for continuous upgrades to meet technological advancements. These factors can hinder the growth and efficiency of data center operations.

What opportunities exist in the Brazil Data Center Power Market?

Opportunities in the Brazil Data Center Power Market include the adoption of renewable energy sources, advancements in energy storage technologies, and the growing trend of edge computing. These factors can enhance sustainability and operational efficiency in data centers.

What trends are shaping the Brazil Data Center Power Market?

Trends shaping the Brazil Data Center Power Market include the increasing focus on energy efficiency, the integration of artificial intelligence for power management, and the shift towards modular data center designs. These trends aim to optimize power usage and reduce operational costs.

Brazil Data Center Power Market

| Segmentation Details | Description |

|---|---|

| Type | Uninterruptible Power Supply, Power Distribution Unit, Generator, Cooling System |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | Modular, Flywheel, Lithium-ion, Diesel |

| Capacity | Below 500 kW, 500 kW to 1 MW, 1 MW to 5 MW, Above 5 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at