444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil cosmetics market represents one of the most dynamic and rapidly expanding beauty sectors in Latin America, characterized by exceptional growth potential and evolving consumer preferences. Brazilian consumers demonstrate remarkable enthusiasm for beauty products, driving substantial demand across skincare, haircare, makeup, and personal care categories. The market exhibits robust growth trajectory with increasing urbanization, rising disposable income, and growing awareness of premium beauty solutions contributing to market expansion.

Market dynamics indicate that Brazil’s cosmetics industry benefits from a unique combination of local manufacturing capabilities, international brand presence, and indigenous beauty traditions. The country’s diverse climate conditions and multicultural population create distinct regional preferences, fostering innovation in product formulations and marketing strategies. Growth rates consistently outpace many global markets, with the sector experiencing 8.2% annual growth driven by expanding middle-class demographics and increasing beauty consciousness among consumers.

Regional distribution shows concentrated market activity in major metropolitan areas including São Paulo, Rio de Janeiro, and Brasília, while emerging opportunities exist in secondary cities and rural regions. The market demonstrates strong resilience against economic fluctuations, with beauty products maintaining essential status among Brazilian consumers regardless of economic conditions.

The Brazil cosmetics market refers to the comprehensive ecosystem of beauty and personal care products manufactured, distributed, and consumed within Brazilian territory, encompassing skincare, haircare, makeup, fragrances, and personal hygiene products. This market includes both domestic and international brands serving diverse consumer segments through multiple distribution channels including retail stores, e-commerce platforms, direct sales, and professional beauty services.

Market scope extends beyond traditional cosmetic products to include organic and natural beauty solutions, men’s grooming products, anti-aging treatments, and specialized formulations designed for Brazil’s tropical climate and diverse ethnic demographics. The definition encompasses the entire value chain from raw material sourcing and product development to manufacturing, marketing, distribution, and consumer engagement across urban and rural markets throughout Brazil.

Brazil’s cosmetics market stands as a cornerstone of the country’s consumer goods sector, demonstrating exceptional resilience and growth potential despite economic challenges. The market benefits from strong domestic consumption patterns, with Brazilian consumers allocating significant portions of their disposable income to beauty and personal care products. Key market drivers include increasing urbanization rates, growing female workforce participation, and rising awareness of personal grooming among male consumers.

Competitive landscape features a balanced mix of international beauty giants and successful domestic brands, creating dynamic market conditions that foster innovation and competitive pricing. The sector demonstrates 72% market penetration across urban areas, with substantial growth opportunities remaining in rural regions and emerging consumer segments. Digital transformation accelerates market evolution, with e-commerce channels experiencing rapid adoption and social media influencing purchasing decisions across demographic groups.

Future projections indicate sustained market expansion driven by demographic trends, economic recovery, and evolving beauty standards that emphasize natural ingredients and sustainable packaging solutions.

Strategic analysis reveals several critical insights shaping Brazil’s cosmetics market trajectory and competitive dynamics:

Economic factors propel Brazil’s cosmetics market growth through multiple interconnected mechanisms that strengthen consumer demand and market expansion. Rising disposable income among middle-class households enables increased spending on beauty and personal care products, while urbanization trends concentrate consumers in metropolitan areas with better access to diverse product offerings and retail channels.

Demographic trends create favorable market conditions, with Brazil’s young population demonstrating high beauty consciousness and willingness to experiment with new products and brands. Female workforce participation increases demand for professional appearance products, while growing male grooming awareness expands the addressable market significantly. Social media penetration reaches exceptional levels, with beauty influencers and digital content driving product discovery and purchase decisions.

Cultural factors reinforce the market’s growth trajectory, as Brazilian society places considerable emphasis on personal appearance and beauty standards. The country’s beach culture and tropical climate create year-round demand for skincare, sun protection, and body care products. Innovation in formulations specifically designed for humid conditions and diverse skin types addresses unique local market needs while attracting international attention and investment.

Economic volatility presents significant challenges for Brazil’s cosmetics market, with currency fluctuations affecting import costs and pricing strategies for international brands. Regulatory complexities create barriers for new product launches and market entry, requiring extensive testing and approval processes that delay innovation and increase development costs. High taxation levels on cosmetic products impact affordability and limit market penetration among price-sensitive consumer segments.

Supply chain disruptions affect product availability and distribution efficiency, particularly for imported ingredients and finished products. Infrastructure limitations in certain regions restrict market access and increase logistics costs, creating uneven market development across Brazilian territories. Counterfeit products pose ongoing challenges, undermining brand integrity and consumer confidence while creating unfair competition for legitimate manufacturers.

Environmental regulations increasingly impact product formulations and packaging requirements, necessitating significant investments in sustainable alternatives and compliance measures. Economic inequality limits market expansion potential, as significant portions of the population lack sufficient disposable income for regular cosmetics purchases beyond basic necessities.

Emerging market segments present substantial growth opportunities for cosmetics companies operating in Brazil. Natural and organic beauty products represent rapidly expanding categories, with consumers increasingly seeking formulations featuring indigenous Brazilian ingredients like açaí, cupuaçu, and Brazil nut oil. Men’s grooming market offers exceptional potential, with male consumers showing growing interest in skincare, haircare, and grooming products traditionally associated with female demographics.

E-commerce expansion creates new distribution channels and customer engagement opportunities, particularly in regions with limited physical retail presence. Subscription-based models and personalized beauty solutions gain traction among tech-savvy consumers seeking convenience and customization. Professional beauty services integration with retail cosmetics creates synergistic opportunities for brands to expand their market presence and customer relationships.

Export potential emerges as Brazilian cosmetics brands develop international recognition for quality and innovation, particularly in natural ingredient formulations. Sustainable packaging solutions address environmental concerns while differentiating brands in competitive markets. Rural market penetration offers significant untapped potential as infrastructure improvements and economic development expand access to beauty products in previously underserved regions.

Competitive intensity shapes Brazil’s cosmetics market through dynamic interactions between established international brands and emerging domestic players. Market consolidation trends create opportunities for strategic acquisitions and partnerships, while innovation cycles accelerate as companies compete for consumer attention and market share. Price competition intensifies across multiple segments, driving efficiency improvements and value proposition enhancements.

Consumer preferences evolve rapidly, influenced by global beauty trends, social media exposure, and changing lifestyle patterns. Seasonal demand fluctuations create planning challenges and inventory management complexities, particularly for products tied to specific weather conditions or cultural events. Regulatory changes impact product formulations, marketing claims, and distribution strategies, requiring continuous adaptation and compliance investments.

Technology integration transforms market dynamics through digital marketing, e-commerce platforms, and data-driven customer insights. Supply chain optimization becomes increasingly critical as companies seek to reduce costs and improve product availability while maintaining quality standards. Sustainability initiatives influence competitive positioning as environmentally conscious consumers reward brands demonstrating genuine commitment to ecological responsibility.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Brazil’s cosmetics market dynamics. Primary research includes extensive consumer surveys, industry expert interviews, and retailer feedback collection across major Brazilian metropolitan areas and secondary cities. Secondary research incorporates government statistics, industry association reports, and company financial disclosures to validate market trends and competitive positioning.

Data collection methods utilize both quantitative and qualitative approaches, including focus groups, online surveys, and in-depth interviews with key stakeholders throughout the cosmetics value chain. Market segmentation analysis examines consumer behavior patterns across demographic groups, geographic regions, and product categories to identify growth opportunities and market gaps.

Analytical frameworks incorporate statistical modeling, trend analysis, and competitive benchmarking to generate actionable insights for market participants. Validation processes ensure data accuracy through cross-referencing multiple sources and expert review panels comprising industry professionals and academic researchers specializing in Brazilian consumer markets.

Southeast Region dominates Brazil’s cosmetics market, accounting for 45% of total consumption concentrated primarily in São Paulo and Rio de Janeiro metropolitan areas. This region benefits from higher disposable incomes, extensive retail infrastructure, and strong presence of both domestic and international beauty brands. Consumer sophistication levels remain highest in this region, driving demand for premium and luxury cosmetic products.

Northeast Region demonstrates rapid market growth with 22% market share, fueled by economic development and urbanization trends. Regional preferences favor products addressing tropical climate challenges, including sun protection, oil control, and humidity-resistant formulations. Local beauty traditions influence product development, with companies incorporating regional ingredients and cultural elements into their offerings.

South Region represents 18% of market consumption, characterized by strong European cultural influences and preference for natural and organic beauty products. Climate variations create seasonal demand patterns different from tropical regions, requiring adapted product portfolios and marketing strategies. Central-West and North Regions combine for 15% market share, representing significant growth opportunities as infrastructure development and economic expansion increase market accessibility and consumer purchasing power.

Market leadership in Brazil’s cosmetics sector features a diverse mix of international corporations and successful domestic brands competing across multiple product categories and price segments:

Product Category Segmentation reveals distinct market dynamics across major cosmetics segments:

Distribution Channel Segmentation shows evolving retail landscape:

Skincare Category demonstrates exceptional growth driven by increasing awareness of skin health and anti-aging benefits. Brazilian consumers show strong preference for products containing natural ingredients sourced from Amazon rainforest and other indigenous botanical sources. Sun protection products maintain year-round demand due to tropical climate conditions, while anti-aging treatments gain popularity among aging population demographics.

Haircare Segment reflects Brazil’s diverse ethnic composition, with products designed for different hair textures and styling preferences. Keratin treatments and smoothing products remain highly popular, addressing humidity-related hair challenges common in tropical climates. Natural and sulfate-free formulations gain market traction as consumers become more ingredient-conscious and environmentally aware.

Color Cosmetics experience seasonal fluctuations tied to cultural events, festivals, and social gatherings that emphasize personal appearance. Long-wearing and waterproof formulations address climate-specific needs, while vibrant colors and bold looks reflect Brazilian cultural preferences for expressive beauty styles. Inclusive shade ranges become increasingly important as brands recognize Brazil’s diverse skin tone demographics.

Manufacturers benefit from Brazil’s large domestic market providing substantial revenue opportunities and economies of scale for production operations. Local manufacturing capabilities reduce import dependencies and currency exposure while enabling faster response to market trends and consumer preferences. Access to natural ingredients from Brazilian biodiversity creates competitive advantages in global markets increasingly focused on natural and sustainable beauty solutions.

Retailers enjoy strong consumer demand and relatively stable market growth that supports business expansion and profitability. Diverse product categories enable cross-selling opportunities and customer loyalty development through comprehensive beauty solutions. Digital integration opportunities allow traditional retailers to expand their market reach and customer engagement capabilities.

Consumers benefit from increased product variety, competitive pricing, and improved quality standards driven by market competition. Innovation in formulations addresses specific local needs while incorporating global beauty trends and technologies. Enhanced accessibility through multiple distribution channels ensures product availability across different geographic regions and economic segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Movement transforms Brazil’s cosmetics market as consumers increasingly prioritize environmentally responsible products and packaging solutions. Brands respond by developing refillable containers, biodegradable formulations, and carbon-neutral production processes that appeal to eco-conscious consumers. Circular economy principles gain adoption throughout the industry, with companies implementing recycling programs and sustainable sourcing practices.

Personalization Technology enables customized beauty solutions tailored to individual skin types, preferences, and lifestyle factors. AI-powered skin analysis and virtual try-on technologies enhance customer experience while reducing product return rates. Subscription models deliver personalized product selections based on consumer profiles and feedback, creating recurring revenue streams and customer loyalty.

Inclusive Beauty becomes a central focus as brands expand shade ranges and develop products for diverse skin tones and beauty needs. Representation in marketing reflects Brazil’s multicultural population, while product development addresses specific requirements of different ethnic groups. Gender-neutral products emerge as traditional beauty categories expand to serve all consumers regardless of gender identity.

Clean Beauty Movement drives demand for products with transparent ingredient lists, minimal processing, and proven safety profiles. MarkWide Research indicates that 58% of Brazilian consumers actively seek products free from controversial ingredients like parabens, sulfates, and synthetic fragrances.

Strategic partnerships between international brands and local distributors accelerate market expansion and improve product accessibility across Brazilian regions. Acquisition activities consolidate market position as larger companies acquire successful domestic brands with strong consumer loyalty and market knowledge. Technology investments enhance manufacturing capabilities, product quality, and supply chain efficiency throughout the industry.

Regulatory updates streamline approval processes for certain product categories while maintaining safety standards and consumer protection measures. Sustainability initiatives gain industry-wide adoption as companies commit to environmental goals and transparent reporting on ecological impact. Digital transformation projects integrate e-commerce platforms, social media marketing, and data analytics to improve customer engagement and market responsiveness.

Innovation laboratories established by major companies focus on developing products specifically designed for Brazilian climate conditions and consumer preferences. Ingredient sourcing partnerships with local communities ensure sustainable supply chains while supporting biodiversity conservation and economic development in rural regions. Export expansion programs promote Brazilian cosmetics brands in international markets, leveraging the country’s reputation for natural ingredients and innovative formulations.

Market entry strategies should prioritize understanding regional preferences and cultural nuances that influence consumer behavior across different Brazilian markets. Companies entering the market benefit from partnerships with established local distributors who possess market knowledge and retail relationships. Product adaptation remains crucial for success, with formulations requiring adjustment for tropical climate conditions and diverse consumer demographics.

Investment priorities should focus on digital capabilities, sustainable packaging solutions, and supply chain optimization to remain competitive in evolving market conditions. Brand positioning strategies must balance global appeal with local relevance, incorporating Brazilian cultural elements while maintaining international quality standards. Pricing strategies require careful consideration of economic volatility and consumer price sensitivity across different market segments.

Innovation focus should emphasize natural ingredients, multifunctional products, and sustainable formulations that address both consumer needs and environmental concerns. Distribution channel diversification reduces market risk while maximizing customer reach through traditional retail, e-commerce, and direct sales models. Regulatory compliance investments ensure smooth market operations and avoid costly delays in product launches and market expansion initiatives.

Long-term projections for Brazil’s cosmetics market indicate sustained growth driven by favorable demographic trends, economic recovery, and evolving consumer preferences toward premium and sustainable beauty products. Market expansion will likely accelerate as infrastructure improvements increase accessibility in underserved regions while digital commerce continues transforming retail landscapes. Innovation cycles are expected to accelerate, with companies investing heavily in research and development to meet changing consumer demands.

Emerging technologies including artificial intelligence, augmented reality, and biotechnology will reshape product development, marketing strategies, and customer engagement approaches. Sustainability requirements will become increasingly stringent, driving industry-wide adoption of circular economy principles and environmental responsibility measures. MWR analysis suggests the market will experience consistent growth rates above 7% annually over the next five years, supported by expanding middle-class demographics and increasing beauty consciousness.

Competitive dynamics will intensify as new entrants challenge established players while technological disruption creates opportunities for innovative business models. Consumer expectations will continue evolving toward personalized, sustainable, and technologically enhanced beauty solutions that deliver measurable results and positive environmental impact.

Brazil’s cosmetics market represents a compelling opportunity for industry participants, characterized by strong consumer demand, cultural emphasis on beauty, and substantial growth potential across multiple product categories and distribution channels. Market dynamics favor companies that can successfully navigate regulatory requirements, adapt to local preferences, and invest in sustainable innovation while maintaining competitive pricing strategies.

Success factors include understanding regional variations, embracing digital transformation, and developing products that address Brazil’s unique climate and demographic characteristics. Sustainability initiatives and natural ingredient formulations will become increasingly important as environmentally conscious consumers drive market evolution and brand differentiation opportunities.

Future growth depends on continued economic development, infrastructure improvements, and industry adaptation to changing consumer preferences and technological capabilities. Companies positioned to capitalize on emerging trends while maintaining operational excellence and customer focus will achieve sustainable competitive advantages in this dynamic and promising market environment.

What is Brazil Cosmetics?

Brazil Cosmetics refers to a wide range of beauty and personal care products, including skincare, haircare, makeup, and fragrances, that are produced and consumed in Brazil. This sector is known for its vibrant and diverse offerings, catering to various consumer preferences and cultural influences.

What are the key players in the Brazil Cosmetics Market?

Key players in the Brazil Cosmetics Market include Natura & Co, O Boticário, and Avon, which are known for their innovative products and strong market presence. These companies focus on sustainability and local sourcing, appealing to the environmentally conscious consumer, among others.

What are the growth factors driving the Brazil Cosmetics Market?

The Brazil Cosmetics Market is driven by increasing consumer awareness of personal grooming, a growing middle class, and the rising influence of social media on beauty trends. Additionally, the demand for natural and organic products is shaping the market landscape.

What challenges does the Brazil Cosmetics Market face?

The Brazil Cosmetics Market faces challenges such as intense competition, regulatory hurdles, and economic fluctuations that can impact consumer spending. Additionally, counterfeit products pose a significant threat to brand integrity and consumer trust.

What opportunities exist in the Brazil Cosmetics Market?

Opportunities in the Brazil Cosmetics Market include the expansion of e-commerce platforms and the growing demand for personalized beauty products. Furthermore, the increasing focus on sustainability presents avenues for brands to innovate and attract eco-conscious consumers.

What trends are shaping the Brazil Cosmetics Market?

Trends shaping the Brazil Cosmetics Market include the rise of clean beauty, the popularity of multifunctional products, and the incorporation of technology in beauty applications. Additionally, there is a growing emphasis on inclusivity and diversity in product offerings.

Brazil Cosmetics Market

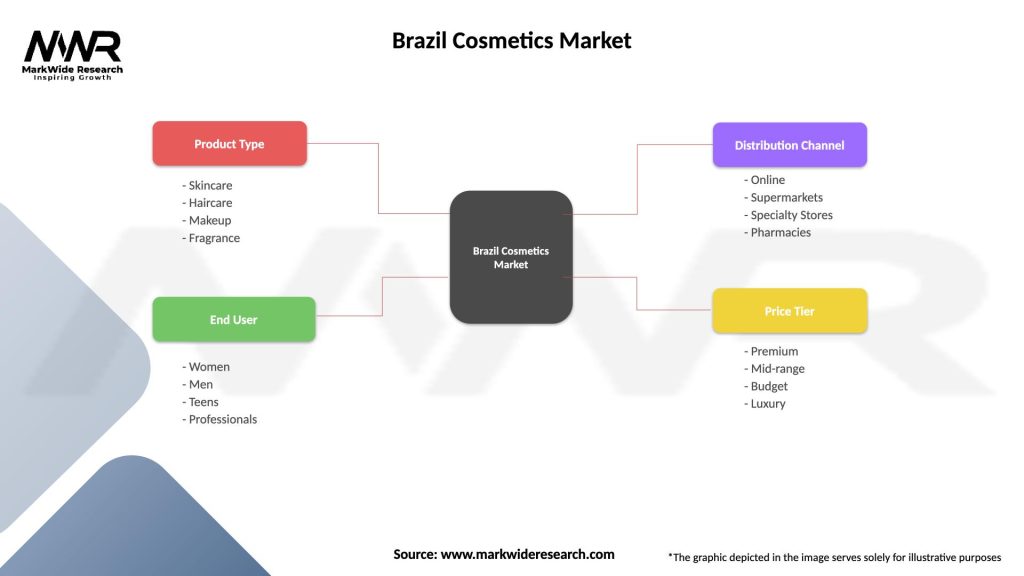

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Haircare, Makeup, Fragrance |

| End User | Women, Men, Teens, Professionals |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

| Price Tier | Premium, Mid-range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Cosmetics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at