444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil construction equipment market represents one of South America’s most dynamic and rapidly evolving industrial sectors, driven by substantial infrastructure development initiatives and urbanization trends. Brazil’s construction equipment industry encompasses a comprehensive range of machinery including excavators, bulldozers, cranes, loaders, and specialized construction vehicles that support both residential and commercial building projects across the nation.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over the recent forecast period. This expansion reflects Brazil’s commitment to modernizing its infrastructure, including transportation networks, energy facilities, and urban development projects that require advanced construction machinery and equipment solutions.

Regional distribution shows that São Paulo and Rio de Janeiro states collectively account for approximately 45% of total equipment demand, while emerging markets in the Northeast and Center-West regions demonstrate increasing adoption rates. The market encompasses both domestic manufacturing capabilities and international equipment imports, creating a diverse ecosystem of suppliers and technological solutions.

Infrastructure investment from both government and private sectors continues to fuel demand for construction equipment, with particular emphasis on sustainable and technologically advanced machinery that can meet Brazil’s evolving environmental standards and operational efficiency requirements.

The Brazil construction equipment market refers to the comprehensive ecosystem of heavy machinery, tools, and specialized vehicles used in construction, infrastructure development, mining, and related industrial activities throughout Brazil. This market encompasses the manufacturing, distribution, sales, rental, and maintenance of construction equipment ranging from compact utility vehicles to large-scale earthmoving machinery.

Construction equipment in the Brazilian context includes excavators, bulldozers, wheel loaders, backhoe loaders, motor graders, compactors, cranes, concrete mixers, and specialized machinery designed for specific construction applications. The market also encompasses related services such as equipment financing, operator training, maintenance support, and technological upgrades that enhance operational efficiency.

Market participants include international manufacturers with local operations, domestic equipment producers, authorized dealers, rental companies, and service providers who collectively support Brazil’s construction and infrastructure development needs across various sectors including residential, commercial, industrial, and public works projects.

Brazil’s construction equipment market demonstrates remarkable resilience and growth potential, supported by government infrastructure initiatives, private sector investments, and increasing urbanization demands. The market benefits from Brazil’s position as Latin America’s largest economy and its ongoing commitment to modernizing transportation, energy, and urban infrastructure systems.

Key market drivers include the federal government’s infrastructure investment programs, which allocate significant resources toward highway construction, port modernization, and urban development projects. Additionally, the growing emphasis on sustainable construction practices has increased demand for environmentally efficient and technologically advanced equipment solutions.

Market segmentation reveals strong performance across multiple equipment categories, with excavators and loaders representing the largest demand segments. The rental equipment sector shows particularly robust growth, with rental penetration rates increasing by 12% annually as construction companies seek flexible and cost-effective equipment access solutions.

Competitive landscape features a mix of global manufacturers and regional players, with companies focusing on localization strategies, financing solutions, and comprehensive service networks to capture market share in Brazil’s diverse geographic and economic environment.

Market intelligence reveals several critical insights that shape Brazil’s construction equipment landscape and influence strategic decision-making across the industry:

Infrastructure development initiatives serve as the primary catalyst for Brazil’s construction equipment market growth, with government programs focusing on transportation networks, energy infrastructure, and urban modernization projects. The federal government’s commitment to improving Brazil’s logistics infrastructure creates sustained demand for heavy construction machinery across multiple regions.

Urbanization trends continue driving construction equipment demand as Brazil’s growing urban population requires expanded housing, commercial facilities, and supporting infrastructure. Metropolitan areas experience ongoing development pressure, necessitating advanced construction equipment for high-rise buildings, transportation systems, and utility infrastructure projects.

Economic recovery following previous downturns has restored confidence in Brazil’s construction sector, encouraging private investment in commercial and residential development projects. This economic stabilization supports equipment purchases and rental activities across various construction market segments.

Mining sector expansion contributes significantly to construction equipment demand, as Brazil’s rich mineral resources require specialized machinery for extraction, processing, and transportation activities. The mining industry’s growth creates opportunities for heavy-duty construction equipment manufacturers and service providers.

Agricultural modernization drives demand for construction equipment in rural infrastructure development, including storage facilities, processing plants, and transportation infrastructure that support Brazil’s agricultural export economy. This sector requires specialized equipment for both construction and ongoing maintenance activities.

Economic volatility remains a significant challenge for Brazil’s construction equipment market, as currency fluctuations, inflation concerns, and political uncertainty can impact investment decisions and equipment purchasing patterns. These economic factors create cautious approaches among construction companies regarding major equipment investments.

High equipment costs present barriers for smaller construction companies and contractors who may struggle to afford new machinery purchases. The substantial capital requirements for advanced construction equipment can limit market participation and slow adoption rates among price-sensitive market segments.

Import dependency for certain specialized equipment and components creates vulnerability to international supply chain disruptions and currency exchange rate fluctuations. This dependency can result in increased costs and delivery delays that affect project timelines and profitability.

Skilled operator shortage challenges the effective utilization of advanced construction equipment, as the industry faces difficulties in training and retaining qualified machinery operators. This skills gap can limit equipment productivity and create operational inefficiencies across construction projects.

Environmental regulations impose additional compliance costs and operational constraints on construction equipment usage, requiring investments in emission control technologies and environmental monitoring systems that increase overall project costs and complexity.

Smart construction technologies present significant opportunities for equipment manufacturers to differentiate their offerings through IoT integration, predictive maintenance capabilities, and automated operation features. These technological advances can improve equipment efficiency and reduce operational costs for construction companies.

Sustainable equipment solutions offer growth potential as environmental consciousness increases among construction companies and regulatory requirements become more stringent. Equipment featuring reduced emissions, improved fuel efficiency, and recyclable components can capture environmentally focused market segments.

Equipment-as-a-Service models create new revenue streams and market access opportunities, allowing construction companies to access advanced equipment without large capital investments. These service-based approaches can expand market reach and improve customer relationships through ongoing service engagement.

Regional market expansion opportunities exist in Brazil’s developing interior regions, where infrastructure development and economic growth create demand for construction equipment and related services. Companies can establish strategic positions in these emerging markets before competition intensifies.

Public-private partnerships in infrastructure development create opportunities for equipment suppliers to participate in large-scale, long-term projects that provide stable demand and revenue predictability. These partnerships can support equipment manufacturers’ growth strategies and market positioning efforts.

Supply chain dynamics in Brazil’s construction equipment market reflect the complex interplay between domestic manufacturing capabilities, international imports, and regional distribution networks. Local assembly operations have expanded significantly, with international manufacturers establishing production facilities to serve both domestic and regional export markets.

Demand fluctuations correlate closely with Brazil’s economic cycles and government infrastructure spending patterns. Construction equipment demand typically shows seasonal variations, with peak activity during dry seasons when construction projects can proceed without weather-related delays.

Technology integration accelerates across the market as construction companies recognize the competitive advantages of digitally enabled equipment. Telematics adoption rates have increased by 18% annually, enabling remote monitoring, predictive maintenance, and operational optimization capabilities.

Competitive dynamics intensify as both established international brands and emerging local manufacturers compete for market share through pricing strategies, financing options, and service differentiation. This competition benefits customers through improved product offerings and competitive pricing structures.

Regulatory influences shape market dynamics through environmental standards, safety requirements, and import regulations that affect equipment specifications and operational parameters. Companies must navigate these regulatory frameworks while maintaining competitive positioning and profitability.

Primary research methodologies employed in analyzing Brazil’s construction equipment market include comprehensive surveys of equipment manufacturers, dealers, rental companies, and end-user construction firms across major Brazilian markets. These surveys capture current market conditions, purchasing patterns, and future investment intentions.

Secondary research incorporates analysis of government infrastructure spending data, construction industry statistics, equipment import/export records, and economic indicators that influence construction equipment demand. This data provides quantitative foundations for market size estimations and growth projections.

Industry expert interviews with construction equipment manufacturers, distributors, and industry association representatives provide qualitative insights into market trends, competitive dynamics, and emerging opportunities. These interviews validate quantitative findings and provide strategic context for market analysis.

Market observation techniques include attendance at industry trade shows, construction site visits, and equipment demonstration events that provide direct insights into product innovations, customer preferences, and competitive positioning strategies within Brazil’s construction equipment market.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of data consistency, and expert review of findings to maintain research reliability and credibility for strategic decision-making purposes.

Southeast region dominates Brazil’s construction equipment market, with São Paulo and Rio de Janeiro states accounting for approximately 42% of total market demand. This concentration reflects the region’s economic importance, urban density, and ongoing infrastructure development projects that require substantial construction equipment deployment.

Northeast region demonstrates accelerating growth in construction equipment adoption, driven by government infrastructure investments and industrial development initiatives. The region’s equipment market share has increased to 22%, supported by port modernization projects and renewable energy installations.

South region maintains steady construction equipment demand, particularly in Rio Grande do Sul, Santa Catarina, and Paraná states, where agricultural infrastructure, industrial facilities, and urban development projects create consistent equipment requirements. The region represents approximately 18% of national demand.

Center-West region shows remarkable growth potential, with construction equipment demand increasing as agricultural expansion and infrastructure development accelerate. The region’s strategic importance for Brazil’s agricultural exports drives investment in storage facilities, processing plants, and transportation infrastructure.

North region presents emerging opportunities despite challenging logistics and infrastructure constraints. Mining activities, energy projects, and urban development in cities like Manaus create specialized equipment demand, though market penetration remains relatively limited compared to other regions.

Market leadership in Brazil’s construction equipment sector features a diverse mix of international manufacturers and domestic players, each employing distinct strategies to capture market share and build customer loyalty across various equipment segments and regional markets.

Competitive strategies focus on localization, financing solutions, service network expansion, and technology integration to differentiate offerings and build sustainable competitive advantages in Brazil’s dynamic construction equipment market.

By Equipment Type:

By Application:

By End User:

Excavator segment maintains market leadership with approximately 35% market share, driven by versatile applications across construction, mining, and infrastructure projects. Mini excavators show particularly strong growth as urban construction projects require compact, maneuverable equipment for confined spaces and precision work.

Loader category demonstrates consistent demand growth, particularly wheel loaders used in material handling, site preparation, and loading operations. The segment benefits from Brazil’s infrastructure development focus and the versatility of loader equipment across multiple construction applications.

Bulldozer segment serves specialized applications in large-scale earthmoving, mining, and infrastructure projects. While representing a smaller market share, bulldozers command premium pricing and generate significant revenue for manufacturers serving Brazil’s major construction and mining projects.

Crane market shows robust growth driven by urban construction projects, industrial facility development, and infrastructure modernization. Mobile cranes particularly benefit from Brazil’s construction boom, while tower cranes support high-rise development in major metropolitan areas.

Compact equipment category experiences accelerating adoption as construction companies recognize the benefits of smaller, more efficient machinery for urban projects, maintenance work, and specialized applications requiring precision and maneuverability in constrained environments.

Equipment manufacturers benefit from Brazil’s large domestic market, growing infrastructure investment, and opportunities for local production that reduce costs and improve market responsiveness. The market provides scale advantages and regional export opportunities to neighboring South American countries.

Construction companies gain access to advanced equipment technologies, flexible financing options, and comprehensive service support that enhance project efficiency and competitiveness. Modern equipment enables faster project completion, improved safety, and reduced operational costs.

Equipment dealers capitalize on growing demand through expanded service offerings, parts distribution, and rental services that create multiple revenue streams. Strong dealer networks provide competitive advantages and customer relationship opportunities in Brazil’s diverse regional markets.

Rental companies experience robust growth as construction firms increasingly prefer equipment rental over ownership for project flexibility and capital efficiency. The rental model provides steady revenue streams and opportunities for fleet expansion and service diversification.

Financial institutions benefit from equipment financing opportunities that support both equipment purchases and rental operations. The construction equipment market provides secured lending opportunities with tangible asset backing and growing demand fundamentals.

Technology providers find opportunities in equipment digitization, telematics integration, and automation solutions that enhance equipment performance and operational efficiency. These technology partnerships create new revenue streams and competitive differentiation opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across Brazil’s construction equipment market as manufacturers integrate IoT sensors, telematics systems, and predictive analytics capabilities into their machinery. These technologies enable remote monitoring, preventive maintenance scheduling, and operational optimization that improve equipment utilization and reduce downtime.

Sustainability initiatives drive demand for environmentally efficient construction equipment featuring reduced emissions, improved fuel economy, and recyclable components. MarkWide Research indicates that environmental compliance requirements influence approximately 28% of equipment purchasing decisions as companies prioritize sustainable operations.

Equipment rental growth continues as construction companies seek operational flexibility and capital efficiency. The rental model allows access to latest equipment technologies without large capital investments, supporting project-based operations and seasonal demand fluctuations.

Autonomous operation technologies emerge in specialized applications, with semi-autonomous and remotely operated equipment gaining acceptance for dangerous or repetitive tasks. These innovations improve safety, productivity, and operational consistency in construction and mining applications.

Electrification trends begin influencing equipment design as battery technologies improve and environmental regulations tighten. Electric and hybrid construction equipment options expand, particularly for urban applications where noise and emission restrictions apply.

Service integration becomes increasingly important as equipment manufacturers expand beyond product sales to offer comprehensive service packages including maintenance, training, financing, and operational support that create ongoing customer relationships and revenue streams.

Manufacturing expansion continues as international equipment manufacturers invest in Brazilian production facilities to serve domestic and regional markets. These investments include technology transfer, local supplier development, and workforce training programs that strengthen Brazil’s construction equipment manufacturing capabilities.

Technology partnerships emerge between equipment manufacturers and technology companies to develop advanced digital solutions, automation capabilities, and connectivity features that differentiate products and improve customer value propositions in competitive markets.

Financing innovations include new equipment leasing programs, flexible payment structures, and performance-based financing options that make advanced construction equipment more accessible to small and medium-sized construction companies throughout Brazil.

Service network expansion focuses on improving parts availability, maintenance support, and technical assistance across Brazil’s diverse geographic regions. Companies invest in training programs, service facilities, and mobile maintenance capabilities to enhance customer support.

Sustainability initiatives include equipment recycling programs, remanufacturing services, and environmental impact reduction efforts that align with corporate sustainability goals and regulatory requirements while creating new business opportunities.

Market consolidation activities include strategic acquisitions, dealer network expansions, and partnership agreements that strengthen market positions and improve competitive capabilities in Brazil’s evolving construction equipment landscape.

Market entry strategies should prioritize local partnerships, dealer network development, and service capability establishment to succeed in Brazil’s construction equipment market. Companies must understand regional preferences, financing requirements, and service expectations to build sustainable market positions.

Technology investment recommendations focus on digital integration, connectivity features, and automation capabilities that provide competitive differentiation and customer value. Equipment manufacturers should balance advanced technology with cost-effectiveness and ease of operation for Brazilian market conditions.

Service excellence emerges as a critical success factor, with companies needing comprehensive parts availability, technical support, and maintenance services across Brazil’s vast geographic area. Investment in service infrastructure and technician training programs supports long-term customer relationships.

Financing solutions require innovation and flexibility to address diverse customer needs and economic conditions. Companies should develop creative financing options, leasing programs, and payment structures that make equipment accessible while managing credit risks effectively.

Sustainability positioning becomes increasingly important as environmental regulations strengthen and customer preferences shift toward eco-friendly solutions. Companies should invest in fuel-efficient technologies, emission reduction capabilities, and sustainable manufacturing practices.

Regional expansion opportunities exist in Brazil’s developing interior markets where infrastructure investment and economic growth create new demand centers. Early market entry and relationship building in these regions can provide competitive advantages as markets mature.

Long-term growth prospects for Brazil’s construction equipment market remain positive, supported by ongoing infrastructure development needs, urbanization trends, and economic modernization initiatives. MWR analysis projects sustained market expansion with annual growth rates averaging 7.5% over the next five years.

Technology evolution will continue transforming the construction equipment landscape through advanced automation, artificial intelligence integration, and enhanced connectivity features. These technological advances will improve equipment productivity, safety, and operational efficiency while creating new service opportunities.

Market maturation trends indicate increasing sophistication in customer requirements, with construction companies demanding more comprehensive solutions that combine equipment, services, and technology integration. This evolution favors companies that can provide holistic value propositions beyond traditional equipment sales.

Sustainability imperatives will increasingly influence equipment design, manufacturing processes, and operational practices as environmental regulations strengthen and corporate sustainability commitments expand. Companies must prepare for stricter emission standards and growing demand for environmentally responsible solutions.

Regional development patterns suggest continued growth in Brazil’s interior regions as infrastructure investment and economic activity expand beyond traditional coastal centers. This geographic diversification will create new market opportunities and require adapted distribution and service strategies.

Industry consolidation may accelerate as companies seek scale advantages, technology capabilities, and market coverage improvements. Strategic partnerships, acquisitions, and alliance formations will likely reshape competitive dynamics and market structure over the forecast period.

Brazil’s construction equipment market presents compelling opportunities for manufacturers, dealers, and service providers willing to invest in understanding local market dynamics and customer requirements. The market’s substantial size, growth potential, and diverse application segments create multiple pathways for success across various equipment categories and regional markets.

Success factors include comprehensive service capabilities, innovative financing solutions, technology integration, and deep understanding of Brazil’s unique economic and regulatory environment. Companies that can combine quality equipment with exceptional service and customer support will be best positioned to capture market share and build sustainable competitive advantages.

Future market evolution will be shaped by technology advancement, sustainability requirements, and changing customer preferences toward more integrated solutions and service-based relationships. The Brazil construction equipment market offers significant potential for companies prepared to adapt to these evolving dynamics while maintaining focus on operational excellence and customer value creation.

What is Construction Equipment?

Construction equipment refers to heavy machinery and vehicles used for construction activities, including excavation, lifting, and transportation. Common types include bulldozers, cranes, and excavators, which are essential for various construction projects.

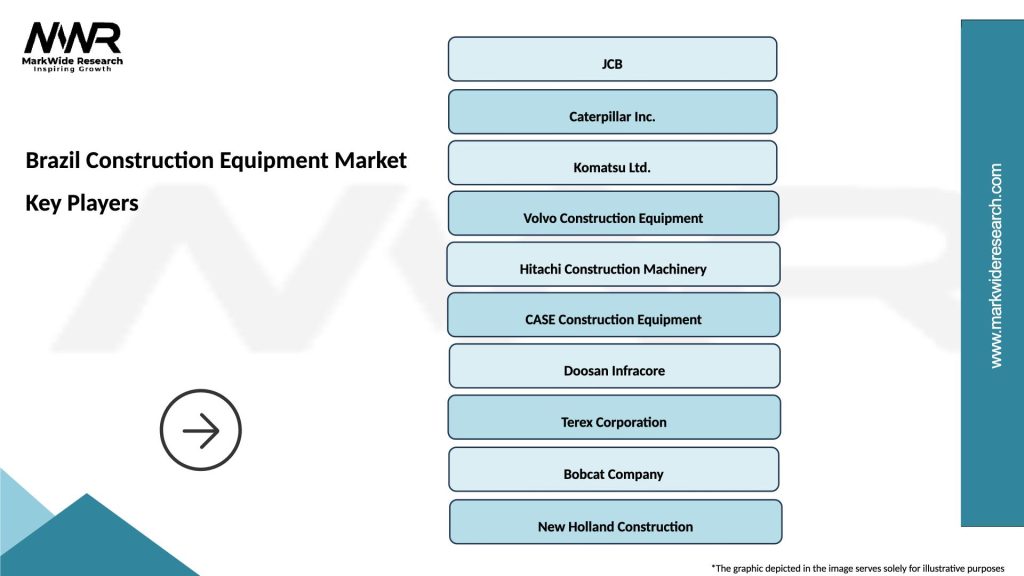

What are the key players in the Brazil Construction Equipment Market?

Key players in the Brazil Construction Equipment Market include Caterpillar, Komatsu, and Volvo Construction Equipment, which provide a range of machinery for construction and infrastructure projects, among others.

What are the growth factors driving the Brazil Construction Equipment Market?

The Brazil Construction Equipment Market is driven by increasing urbanization, infrastructure development projects, and a growing demand for efficient construction processes. Additionally, government investments in public works are contributing to market growth.

What challenges does the Brazil Construction Equipment Market face?

The Brazil Construction Equipment Market faces challenges such as fluctuating raw material prices, economic instability, and regulatory hurdles. These factors can impact the availability and cost of construction equipment.

What opportunities exist in the Brazil Construction Equipment Market?

Opportunities in the Brazil Construction Equipment Market include advancements in technology, such as automation and telematics, which enhance equipment efficiency. Additionally, the push for sustainable construction practices is creating demand for eco-friendly machinery.

What trends are shaping the Brazil Construction Equipment Market?

Trends in the Brazil Construction Equipment Market include the increasing adoption of electric and hybrid machinery, as well as the integration of smart technologies for better operational efficiency. These trends are reshaping how construction projects are executed.

Brazil Construction Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Loaders, Cranes, Bulldozers |

| Technology | Hydraulic, Electric, Pneumatic, Mechanical |

| End User | Construction Companies, Contractors, Government, Infrastructure Developers |

| Application | Road Construction, Building Construction, Mining, Demolition |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Construction Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at