444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil commercial real estate market represents one of South America’s most dynamic and rapidly evolving property sectors, encompassing office buildings, retail spaces, industrial facilities, and mixed-use developments across major metropolitan areas. Market dynamics in Brazil’s commercial real estate landscape reflect the country’s economic resilience and growing urbanization trends, with significant investment flowing into modern infrastructure and sustainable building technologies.

São Paulo and Rio de Janeiro continue to dominate the commercial real estate landscape, accounting for approximately 45% of total market activity across the nation. The sector has demonstrated remarkable adaptability following recent economic challenges, with developers and investors increasingly focusing on flexible workspace solutions, logistics hubs, and technology-integrated properties that meet evolving business requirements.

Foreign investment has played a crucial role in market expansion, with international real estate investment trusts and institutional investors recognizing Brazil’s potential for long-term growth. The market has experienced a compound annual growth rate of 6.2% over the past five years, driven by infrastructure improvements, favorable government policies, and increasing demand for modern commercial spaces that support Brazil’s growing service and technology sectors.

The Brazil commercial real estate market refers to the comprehensive ecosystem of non-residential property development, investment, leasing, and management activities across Brazil’s major urban centers, encompassing office complexes, retail centers, industrial warehouses, and mixed-use developments that serve business and commercial purposes.

Commercial real estate in Brazil includes various property categories designed to generate income through rental or capital appreciation. This sector encompasses traditional office buildings in central business districts, modern corporate campuses in suburban areas, shopping centers and retail complexes, industrial and logistics facilities, and innovative mixed-use developments that combine commercial, residential, and entertainment components.

Market participants include domestic and international developers, real estate investment funds, institutional investors, corporate tenants, and specialized service providers who collectively drive property development, financing, and management activities. The sector serves as a critical component of Brazil’s economic infrastructure, supporting business growth, employment creation, and urban development initiatives across the country’s major metropolitan regions.

Brazil’s commercial real estate market has emerged as a resilient and attractive investment destination, characterized by steady growth, increasing institutional participation, and evolving tenant preferences toward flexible and sustainable workspace solutions. The market demonstrates strong fundamentals across multiple property sectors, with office, retail, and industrial segments each contributing to overall market stability and growth potential.

Key market drivers include Brazil’s expanding service economy, growing e-commerce sector requiring modern logistics facilities, and increasing corporate focus on employee wellness and sustainability. The market has benefited from government infrastructure investments, improved financing mechanisms, and growing interest from international investors seeking exposure to Latin America’s largest economy.

Regional diversification has become increasingly important, with secondary cities like Belo Horizonte, Porto Alegre, and Recife experiencing significant commercial development activity. The market shows strong potential for continued expansion, supported by demographic trends, urbanization patterns, and evolving business requirements that favor modern, technology-enabled commercial properties.

Market insights reveal several critical trends shaping Brazil’s commercial real estate landscape:

Economic growth serves as the primary driver of Brazil’s commercial real estate market, with the country’s expanding service sector creating sustained demand for modern office spaces and business facilities. GDP growth has translated directly into increased corporate real estate requirements, as companies seek larger, more efficient spaces to accommodate growing workforces and evolving business operations.

Urbanization trends continue to fuel commercial real estate development, with approximately 87% of Brazil’s population now living in urban areas. This demographic shift creates ongoing demand for retail centers, office buildings, and mixed-use developments that serve growing urban populations and support economic activity in major metropolitan regions.

Infrastructure improvements have significantly enhanced the attractiveness of commercial real estate investments across Brazil. Government investments in transportation networks, telecommunications infrastructure, and urban development projects have improved property accessibility and connectivity, making previously underdeveloped areas viable for commercial development.

Foreign investment flows have provided crucial capital for market expansion, with international investors attracted by Brazil’s economic potential and relatively attractive yields compared to developed markets. This capital influx has supported the development of institutional-quality properties and improved overall market standards and professionalism.

Economic volatility remains a significant challenge for Brazil’s commercial real estate market, with currency fluctuations, inflation concerns, and political uncertainty creating periodic disruptions to investment flows and development activity. These macroeconomic factors can impact tenant demand, rental rates, and overall market confidence.

Regulatory complexity presents ongoing challenges for developers and investors, with complex zoning laws, environmental regulations, and bureaucratic processes potentially delaying project approvals and increasing development costs. Permitting processes can extend project timelines and create uncertainty for market participants.

Financing constraints occasionally limit development activity, particularly for smaller developers who may struggle to access capital markets or secure favorable lending terms. High interest rates during certain economic cycles can impact project feasibility and investor returns, affecting overall market activity levels.

Infrastructure limitations in some regions continue to constrain commercial real estate development opportunities. Inadequate transportation networks, utility capacity constraints, and limited telecommunications infrastructure can limit the viability of commercial projects in certain locations, particularly in secondary markets.

Sustainable development presents significant opportunities for market participants, with growing corporate demand for environmentally certified buildings and energy-efficient properties. Green building adoption is expected to accelerate, creating opportunities for developers who can deliver LEED-certified or equivalent sustainable commercial properties.

Technology integration offers substantial growth potential, with smart building systems, IoT connectivity, and advanced property management platforms becoming increasingly important to tenants. Properties that incorporate cutting-edge technology solutions can command premium rents and attract high-quality tenants seeking modern, efficient workspace environments.

Secondary market expansion represents a major opportunity for diversification and growth, with cities beyond São Paulo and Rio de Janeiro offering attractive development prospects. These markets often provide more favorable land costs, less competition, and growing local economies that support commercial real estate demand.

Logistics and industrial development opportunities continue to expand, driven by e-commerce growth and supply chain modernization requirements. The need for modern distribution centers, last-mile delivery facilities, and integrated logistics hubs creates substantial development opportunities across Brazil’s major metropolitan areas.

Supply and demand dynamics in Brazil’s commercial real estate market reflect the complex interplay between economic growth, corporate expansion, and development activity. Office vacancy rates have stabilized at approximately 18% in São Paulo and 22% in Rio de Janeiro, indicating a balanced market with opportunities for both tenants and landlords.

Rental rate trends vary significantly by property type and location, with prime office spaces in central business districts commanding premium rates while suburban and secondary market properties offer more competitive pricing. The market has demonstrated resilience in maintaining rental levels despite economic challenges, supported by limited high-quality supply in key locations.

Investment activity has shown consistent growth, with institutional investors increasingly active in acquiring stabilized properties and development sites. Real estate investment trusts have gained popularity among Brazilian investors, providing increased liquidity and professional management for commercial real estate assets.

Development cycles typically span 24-36 months for major commercial projects, with pre-leasing becoming increasingly important for securing construction financing. Developers are adapting to changing tenant requirements by incorporating flexible design elements and advanced building systems that can accommodate evolving business needs.

Market analysis for Brazil’s commercial real estate sector employs comprehensive research methodologies combining quantitative data collection, qualitative industry insights, and expert interviews with market participants. Primary research includes surveys of developers, investors, brokers, and corporate tenants to understand market trends, preferences, and future requirements.

Data collection encompasses transaction records, rental rate surveys, vacancy statistics, and development pipeline tracking across major metropolitan markets. MarkWide Research utilizes proprietary databases and industry partnerships to ensure comprehensive coverage of market activity and accurate trend identification.

Secondary research incorporates government statistics, industry reports, economic indicators, and demographic data to provide context for commercial real estate market performance. This approach ensures that market analysis reflects broader economic and social trends that influence property demand and investment patterns.

Analytical frameworks include comparative market analysis, risk assessment models, and forecasting methodologies that account for economic cycles, regulatory changes, and evolving tenant preferences. Regular market monitoring and data updates ensure that research findings remain current and relevant for market participants.

São Paulo metropolitan area dominates Brazil’s commercial real estate market, accounting for approximately 35% of total market activity and serving as the country’s primary financial and business center. The region offers the largest concentration of multinational corporations, financial institutions, and professional services firms, creating sustained demand for high-quality office and retail spaces.

Rio de Janeiro represents the second-largest commercial real estate market, with particular strength in the energy sector and growing technology industry presence. The city’s commercial market benefits from its role as a regional headquarters location and its attractive quality of life factors that help companies attract and retain talent.

Belo Horizonte has emerged as an important secondary market, with growing mining, technology, and manufacturing sectors driving commercial real estate demand. The city offers attractive development costs and growing corporate presence, making it an increasingly popular location for companies seeking alternatives to higher-cost primary markets.

Southern region markets including Porto Alegre and Curitiba have shown strong growth potential, supported by diverse local economies and strategic locations for companies serving regional markets. These cities offer modern infrastructure, educated workforces, and competitive real estate costs that attract both domestic and international businesses.

Market leadership in Brazil’s commercial real estate sector is characterized by a mix of large domestic developers, international real estate companies, and specialized investment funds. The competitive landscape includes both established players with extensive local market knowledge and newer entrants bringing international expertise and capital.

Competitive strategies focus on differentiation through sustainable building practices, technology integration, and superior property management services. Companies are increasingly emphasizing tenant experience, building efficiency, and flexible space solutions to maintain competitive advantages in evolving market conditions.

By Property Type:

By Location:

By Investment Type:

Office sector performance reflects changing workplace trends, with companies increasingly seeking flexible, technology-enabled spaces that support hybrid work models. Class A office buildings continue to outperform older properties, with tenants willing to pay premiums for modern amenities, efficient layouts, and sustainable building features.

Retail real estate has adapted to e-commerce challenges by emphasizing experiential retail concepts, food and beverage offerings, and entertainment components. Shopping center occupancy rates have stabilized at approximately 92% nationally, with successful centers focusing on tenant mix optimization and customer experience enhancement.

Industrial and logistics properties represent the fastest-growing segment, driven by e-commerce expansion and supply chain modernization. Modern warehouse facilities with advanced automation capabilities and strategic locations near major transportation hubs command premium rents and attract institutional investment interest.

Mixed-use developments have gained popularity as developers seek to create integrated environments that combine work, retail, and residential components. These projects often achieve higher returns and provide more stable income streams through diversified tenant bases and multiple revenue sources.

Investors benefit from Brazil’s commercial real estate market through attractive yields, portfolio diversification opportunities, and exposure to Latin America’s largest economy. The market offers various investment strategies ranging from stable income-producing properties to higher-return development opportunities.

Corporate tenants gain access to modern, efficient workspace solutions that support business growth and employee satisfaction. The market provides options ranging from traditional long-term leases to flexible workspace arrangements that accommodate changing business requirements.

Developers and property owners benefit from growing demand for high-quality commercial properties and opportunities to create value through strategic development and property improvement initiatives. The market rewards innovation in building design, sustainability, and tenant services.

Local communities benefit from commercial real estate development through job creation, increased tax revenues, and improved local infrastructure. Well-planned commercial developments can serve as catalysts for broader economic development and urban revitalization efforts.

Service providers including brokers, property managers, and construction companies benefit from increased market activity and growing demand for professional real estate services. The market’s growth creates opportunities for specialized service providers and technology companies serving the real estate industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flexible workspace adoption continues to accelerate, with companies seeking lease arrangements that provide operational flexibility and cost optimization. Coworking spaces and flexible office solutions have gained significant traction, particularly among technology companies and startups that value agility and collaborative environments.

Sustainability initiatives have become increasingly important, with tenants and investors prioritizing environmentally responsible buildings. Green building certifications are becoming standard requirements for institutional-grade properties, driving demand for energy-efficient systems and sustainable design features.

Technology integration is transforming commercial properties, with smart building systems, IoT connectivity, and advanced security features becoming essential amenities. Properties that offer high-speed internet, mobile connectivity, and integrated technology platforms attract premium tenants and command higher rents.

Mixed-use development trends reflect changing lifestyle preferences and urban planning concepts that emphasize walkable, integrated communities. These projects combine commercial, residential, and retail components to create vibrant, self-contained environments that appeal to both tenants and investors.

Major development projects across Brazil’s primary markets have introduced new supply of institutional-quality commercial properties, with several landmark office towers and mixed-use complexes completed in recent years. These developments have raised market standards and attracted international tenants seeking modern, efficient workspace solutions.

Real estate investment trust expansion has provided new investment vehicles for both institutional and individual investors, improving market liquidity and professional management standards. REIT listings have increased significantly, offering investors diversified exposure to commercial real estate assets.

International investment activity has intensified, with global real estate firms and sovereign wealth funds acquiring significant Brazilian commercial properties. This foreign capital has supported market development and introduced international best practices in property management and development.

Technology adoption initiatives have accelerated across the industry, with property owners investing in smart building systems, energy management platforms, and tenant experience applications. These technological improvements enhance property competitiveness and operational efficiency while reducing operating costs.

Market participants should focus on developing properties that meet evolving tenant requirements for flexibility, sustainability, and technology integration. MWR analysis suggests that successful developers will differentiate themselves through innovative design solutions and superior tenant services rather than competing solely on price.

Investors should consider diversification strategies that include exposure to secondary markets and emerging property sectors such as logistics and data centers. Geographic diversification beyond São Paulo and Rio de Janeiro can provide attractive risk-adjusted returns while supporting portfolio growth objectives.

Corporate tenants should evaluate their real estate strategies to ensure alignment with changing workforce preferences and business requirements. Long-term lease commitments should incorporate flexibility provisions that accommodate future growth and operational changes.

Policy makers should continue supporting infrastructure development and regulatory streamlining to enhance Brazil’s competitiveness as a commercial real estate investment destination. Improved transportation networks and simplified approval processes would benefit all market participants and support continued sector growth.

Long-term growth prospects for Brazil’s commercial real estate market remain positive, supported by demographic trends, economic diversification, and ongoing urbanization. The market is expected to maintain steady growth with a projected compound annual growth rate of 5.8% over the next five years, driven by continued corporate expansion and infrastructure development.

Emerging trends including sustainability requirements, technology integration, and flexible workspace solutions will continue shaping market development. Properties that successfully incorporate these elements are expected to outperform traditional commercial real estate assets in terms of occupancy, rental growth, and investment returns.

Regional expansion opportunities will likely accelerate as secondary cities develop their economic bases and infrastructure capabilities. MarkWide Research projects that secondary markets will account for an increasing share of total commercial real estate investment activity, potentially reaching 40% of total market activity by 2028.

Investment flows are expected to remain strong, with both domestic and international capital supporting market growth. The development of more sophisticated financing mechanisms and continued REIT market expansion will provide additional liquidity and professional management capabilities that support long-term market development.

Brazil’s commercial real estate market represents a dynamic and evolving sector with significant growth potential driven by economic expansion, urbanization trends, and changing business requirements. The market has demonstrated resilience through various economic cycles while adapting to emerging trends in workplace design, sustainability, and technology integration.

Key success factors for market participants include focus on quality, flexibility, and innovation in property development and management. Companies that can deliver modern, efficient properties with superior tenant services and sustainable features are well-positioned to capitalize on continued market growth and evolving tenant preferences.

Future opportunities exist across multiple property sectors and geographic markets, with particular potential in secondary cities, logistics facilities, and mixed-use developments. The market’s continued maturation and increasing institutional participation provide a solid foundation for sustained growth and improved investment returns for all stakeholders in Brazil’s commercial real estate ecosystem.

What is Brazil Commercial Real Estate?

Brazil Commercial Real Estate refers to properties used for business purposes, including office buildings, retail spaces, warehouses, and industrial facilities. This sector plays a crucial role in the country’s economy by providing spaces for various industries and services.

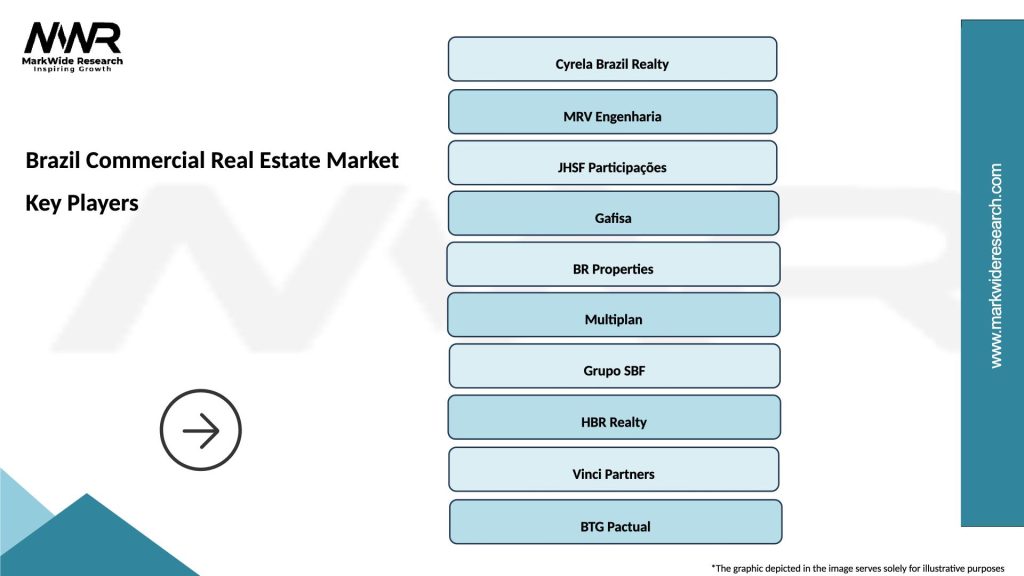

What are the key players in the Brazil Commercial Real Estate Market?

Key players in the Brazil Commercial Real Estate Market include companies like Cyrela Brazil Realty, BR Properties, and JHSF Participações. These firms are involved in the development, management, and leasing of commercial properties, among others.

What are the main drivers of the Brazil Commercial Real Estate Market?

The main drivers of the Brazil Commercial Real Estate Market include urbanization, economic growth, and increased foreign investment. Additionally, the demand for modern office spaces and logistics facilities is rising due to e-commerce growth.

What challenges does the Brazil Commercial Real Estate Market face?

The Brazil Commercial Real Estate Market faces challenges such as regulatory hurdles, economic fluctuations, and high vacancy rates in certain areas. These factors can impact investment decisions and property values.

What opportunities exist in the Brazil Commercial Real Estate Market?

Opportunities in the Brazil Commercial Real Estate Market include the development of sustainable buildings and the growth of co-working spaces. Additionally, the increasing demand for logistics and distribution centers presents significant potential for investors.

What trends are shaping the Brazil Commercial Real Estate Market?

Trends shaping the Brazil Commercial Real Estate Market include the rise of flexible workspaces, increased focus on sustainability, and the integration of technology in property management. These trends are influencing how spaces are designed and utilized.

Brazil Commercial Real Estate Market

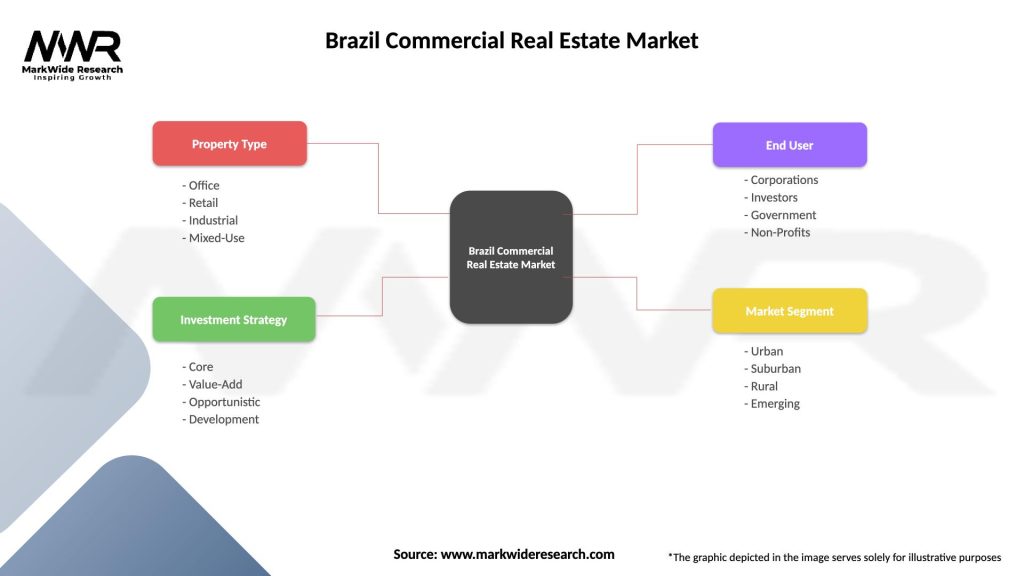

| Segmentation Details | Description |

|---|---|

| Property Type | Office, Retail, Industrial, Mixed-Use |

| Investment Strategy | Core, Value-Add, Opportunistic, Development |

| End User | Corporations, Investors, Government, Non-Profits |

| Market Segment | Urban, Suburban, Rural, Emerging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Commercial Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at