444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil car loan market represents a dynamic and rapidly evolving financial services sector that plays a crucial role in the country’s automotive industry ecosystem. Brazil’s automotive financing landscape has experienced significant transformation over the past decade, driven by changing consumer preferences, technological advancements, and evolving regulatory frameworks. The market encompasses various financing solutions including traditional bank loans, dealer financing, leasing options, and emerging digital lending platforms.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This growth trajectory reflects increasing vehicle affordability programs, expanding credit access, and rising consumer confidence in automotive purchases. The market serves diverse customer segments, from first-time car buyers seeking entry-level financing to premium customers requiring sophisticated leasing arrangements.

Financial institutions operating in this space include major commercial banks, specialized automotive finance companies, credit unions, and fintech startups. These players compete across multiple dimensions including interest rates, loan terms, digital capabilities, and customer service excellence. The market’s competitive landscape continues to evolve as traditional lenders adapt to digital transformation while new entrants leverage technology to capture market share.

The Brazil car loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate vehicle purchases through credit arrangements. This market encompasses all forms of automotive financing, including secured loans where the vehicle serves as collateral, unsecured personal loans for car purchases, lease-to-own arrangements, and specialized financing programs for commercial vehicles.

Automotive financing in Brazil operates through multiple channels, with borrowers accessing credit through banks, automotive dealerships, independent finance companies, and digital platforms. The market includes both new and used vehicle financing, with distinct product offerings tailored to different customer segments and risk profiles. Interest rates, loan terms, and approval criteria vary significantly based on borrower creditworthiness, vehicle type, and market conditions.

Market participants include traditional banking institutions, captive finance companies owned by automotive manufacturers, independent finance companies, and emerging fintech lenders. Each category brings unique advantages, from established banking relationships to specialized automotive expertise and innovative digital solutions.

Brazil’s car loan market demonstrates remarkable resilience and growth potential despite economic volatility and regulatory changes. The sector benefits from strong domestic automotive production, increasing vehicle accessibility, and expanding credit availability across diverse consumer segments. Digital transformation has emerged as a key differentiator, with leading players investing heavily in online platforms, mobile applications, and automated underwriting systems.

Market penetration continues expanding, with automotive financing accounting for approximately 72% of new vehicle purchases and 58% of used vehicle transactions. This high penetration rate reflects both consumer preference for financing and the effectiveness of industry marketing and distribution strategies. The market serves over 15 million active borrowers across various income segments and geographic regions.

Competitive intensity remains high, with market leaders continuously innovating to maintain their positions while new entrants challenge established players through technology-driven solutions. The market’s evolution toward digital-first experiences, personalized offerings, and streamlined approval processes positions it for continued growth and transformation.

Strategic market insights reveal several critical trends shaping Brazil’s automotive financing landscape:

Economic recovery serves as a primary market driver, with improving employment rates and consumer confidence supporting vehicle purchase decisions. Brazil’s economic stabilization following previous volatility has restored consumer spending power and encouraged long-term financial commitments like car loans. Government policies promoting automotive industry growth, including tax incentives and infrastructure development, create favorable conditions for financing demand.

Demographic trends significantly influence market expansion, with a growing middle class seeking vehicle ownership for mobility and status. Urbanization patterns create transportation needs that drive car purchases, while younger demographics embrace digital-first financial services. The emergence of gig economy workers requiring vehicles for income generation represents a substantial growth opportunity.

Technological advancement enables more efficient lending processes, reducing approval times from days to hours while improving risk assessment accuracy. Digital platforms expand market reach, particularly in underserved geographic areas where traditional banking infrastructure is limited. Mobile technology adoption facilitates loan applications, payments, and customer service interactions, enhancing overall market accessibility.

Competitive dynamics drive continuous product innovation and service improvement, benefiting consumers through better terms, faster approvals, and enhanced customer experiences. Market competition encourages lenders to expand credit availability and develop specialized products for niche segments.

Economic volatility remains a significant market constraint, with inflation concerns and currency fluctuations affecting both lender risk appetite and borrower payment capacity. Interest rate sensitivity impacts loan affordability, with higher rates reducing demand and limiting market expansion. Economic uncertainty can trigger more conservative lending practices, restricting credit availability for marginal borrowers.

Regulatory complexity creates operational challenges and compliance costs for market participants. Frequent regulatory changes require continuous adaptation of systems, processes, and procedures, diverting resources from growth initiatives. Consumer protection regulations, while beneficial for borrowers, can increase operational complexity and limit product flexibility.

Credit risk concerns constrain lending to certain segments, particularly during economic downturns when default rates may increase. High default rates in specific regions or customer segments can lead to tighter underwriting standards and reduced market access. Collection challenges in Brazil’s complex legal environment can impact lender profitability and willingness to extend credit.

Infrastructure limitations in certain regions restrict market penetration, particularly for digital lending platforms requiring reliable internet connectivity. Limited financial literacy among some consumer segments creates barriers to loan understanding and appropriate product selection.

Digital transformation presents substantial opportunities for market expansion and efficiency improvement. Lenders investing in advanced technology platforms can capture market share through superior customer experiences and operational efficiency. Artificial intelligence and machine learning applications enable more sophisticated risk assessment, personalized product offerings, and automated decision-making processes.

Underserved market segments represent significant growth potential, including rural populations, informal economy workers, and young professionals. Developing specialized products and distribution channels for these segments can drive substantial market expansion. Commercial vehicle financing offers opportunities as Brazil’s logistics and delivery sectors continue growing.

Partnership opportunities with automotive manufacturers, dealers, and technology companies can create competitive advantages and market access. Strategic alliances enable resource sharing, risk distribution, and enhanced customer value propositions. Cross-selling opportunities with insurance, maintenance, and other automotive services can increase customer lifetime value.

Sustainable finance initiatives, including green loans for electric and hybrid vehicles, align with environmental trends and government incentives. This emerging segment offers differentiation opportunities and access to environmentally conscious consumers.

Supply and demand dynamics in Brazil’s car loan market reflect complex interactions between economic conditions, regulatory environment, and consumer behavior. Credit supply fluctuates based on lender risk appetite, funding costs, and regulatory requirements, while demand responds to economic confidence, vehicle prices, and financing terms. Market equilibrium shifts continuously as these factors evolve.

Competitive dynamics intensify as traditional banks face challenges from specialized finance companies and fintech startups. Each player type brings distinct advantages: banks offer established customer relationships and funding access, specialized lenders provide automotive expertise, and fintechs deliver technological innovation. This competition drives product innovation and service improvement across the market.

Regulatory dynamics significantly influence market structure and operations. Central bank policies on interest rates and credit requirements directly impact lending capacity and terms. Consumer protection regulations shape product design and sales processes, while prudential regulations affect lender capital requirements and risk management practices.

Technology dynamics transform traditional lending models through automation, data analytics, and digital channels. According to MarkWide Research analysis, technology adoption has improved loan processing efficiency by 35% while reducing operational costs. These improvements enable more competitive pricing and expanded market access.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness. Primary research includes extensive interviews with industry executives, lending professionals, automotive dealers, and consumers across diverse market segments. Survey methodologies capture quantitative data on market trends, customer preferences, and competitive positioning.

Secondary research incorporates analysis of regulatory filings, industry reports, financial statements, and market databases. Government statistics, central bank data, and automotive industry publications provide essential market context and historical trends. Data triangulation ensures consistency and reliability across multiple information sources.

Market modeling techniques include statistical analysis, trend extrapolation, and scenario planning to project future market developments. Econometric models incorporate macroeconomic variables, demographic trends, and industry-specific factors to forecast market growth and evolution patterns.

Expert validation processes involve review and feedback from industry specialists, academic researchers, and market practitioners. This validation ensures research findings accurately reflect market realities and provide actionable insights for stakeholders.

São Paulo region dominates Brazil’s car loan market, accounting for approximately 38% of total lending volume due to its economic concentration and population density. The region benefits from high automotive production, extensive dealer networks, and sophisticated financial services infrastructure. Competition intensity is highest in São Paulo, driving innovation and competitive pricing.

Rio de Janeiro represents the second-largest regional market, with 15% market share and strong presence of both traditional banks and specialized lenders. The region’s economic diversity and tourism industry create unique financing needs and opportunities. Digital adoption rates in Rio de Janeiro exceed national averages, supporting online lending growth.

Southern Brazil, including Rio Grande do Sul, Paraná, and Santa Catarina, collectively accounts for 22% of market activity. This region benefits from agricultural prosperity and industrial development, supporting strong vehicle demand. Credit quality in southern states typically exceeds national averages, enabling more favorable lending terms.

Northeastern Brazil represents an emerging growth opportunity, with improving economic conditions and expanding middle class driving increased vehicle financing demand. While currently representing 18% of market volume, growth rates in this region exceed national averages. Infrastructure development and government programs support continued expansion.

Central-West region, including Brasília and agricultural centers, shows strong growth potential driven by agribusiness prosperity and government employment. The region’s 7% market share is expected to expand as economic development continues.

Market leadership is distributed among several major players, each bringing distinct competitive advantages and market positioning strategies:

Competitive strategies vary significantly across market participants. Traditional banks leverage existing customer relationships and funding advantages, while specialized lenders focus on automotive expertise and dealer partnerships. Fintech companies compete through technological innovation, streamlined processes, and enhanced customer experiences.

Market consolidation trends include strategic acquisitions, partnership formations, and technology investments. Leading players continuously evaluate opportunities to expand market presence, enhance capabilities, and achieve operational efficiencies through scale advantages.

By Vehicle Type:

By Customer Segment:

By Distribution Channel:

By Loan Term:

New Vehicle Financing represents the premium segment of Brazil’s car loan market, characterized by competitive interest rates and favorable terms. Manufacturer incentives and dealer partnerships create attractive financing packages that drive sales volume. Credit quality in this segment typically exceeds market averages, as new vehicle buyers generally demonstrate higher creditworthiness and income stability.

Used Vehicle Financing constitutes the largest market segment by volume, serving diverse customer needs across price points and vehicle ages. This segment requires sophisticated risk assessment due to vehicle depreciation and condition variability. Market growth in used vehicle financing outpaces new vehicle lending, driven by affordability considerations and expanding credit access.

Commercial Vehicle Financing serves business customers requiring trucks, vans, and fleet vehicles for operational purposes. This specialized segment demands industry expertise and customized financing solutions. Risk assessment incorporates business cash flow analysis and industry-specific factors, requiring specialized underwriting capabilities.

Motorcycle Financing represents a growing market segment, particularly in urban areas where motorcycles provide cost-effective transportation solutions. This segment exhibits unique risk characteristics and requires specialized collection and recovery procedures. Market penetration continues expanding as lenders develop expertise in motorcycle financing.

Financial Institutions benefit from automotive lending through diversified revenue streams, secured collateral positions, and cross-selling opportunities. Car loans typically offer attractive risk-adjusted returns while building customer relationships that support additional product sales. Portfolio diversification reduces concentration risk and provides stable income streams during economic cycles.

Automotive Manufacturers gain significant advantages through financing partnerships that facilitate vehicle sales and customer acquisition. Captive finance companies enable manufacturers to influence pricing, terms, and customer experience while capturing additional profit margins. Sales volume increases substantially when attractive financing options are available at point of purchase.

Automotive Dealers benefit from financing partnerships through increased sales conversion, higher transaction values, and additional revenue streams from finance charges and insurance sales. Customer satisfaction improves when dealers can offer comprehensive financing solutions and immediate approval decisions.

Consumers access vehicle ownership through manageable monthly payments, competitive interest rates, and flexible terms. Financing enables customers to purchase newer, safer, and more reliable vehicles than cash purchases would allow. Credit building opportunities help consumers establish or improve credit histories through successful loan performance.

Economic Development benefits include job creation in financial services, automotive, and related industries. Increased vehicle ownership supports economic mobility and productivity while generating tax revenue and economic activity throughout the supply chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Lending has emerged as the dominant trend, with leading lenders investing heavily in online platforms, mobile applications, and automated underwriting systems. Customer expectations increasingly favor instant approvals, seamless application processes, and digital account management capabilities. This trend accelerated significantly following the pandemic, with digital originations growing by 67% year-over-year.

Alternative Credit Scoring gains traction as lenders seek to expand market access while maintaining risk discipline. Advanced analytics incorporating non-traditional data sources enable more accurate risk assessment and broader credit availability. Machine learning algorithms continuously improve prediction accuracy and reduce manual underwriting requirements.

Personalized Product Offerings reflect growing customer expectations for customized financing solutions. Lenders develop sophisticated segmentation strategies and product variations to meet diverse customer needs and preferences. Dynamic pricing models enable real-time rate adjustments based on market conditions and customer profiles.

Sustainability Focus influences product development as lenders introduce green financing options for electric and hybrid vehicles. Environmental considerations increasingly impact customer decisions and regulatory requirements. ESG initiatives become important differentiators in competitive markets.

Partnership Ecosystems expand as lenders collaborate with automotive manufacturers, dealers, technology companies, and fintech startups. These partnerships enable resource sharing, risk distribution, and enhanced customer value propositions. Platform strategies create comprehensive automotive financing ecosystems.

Regulatory Evolution continues shaping market structure and operations, with recent changes focusing on consumer protection, data privacy, and fair lending practices. The Central Bank of Brazil has implemented new guidelines for digital lending platforms and alternative credit scoring methodologies. Open banking initiatives enable greater data sharing and competition among financial service providers.

Technology Integration accelerates across the industry, with major lenders launching comprehensive digital transformation programs. Artificial intelligence applications expand beyond credit scoring to include fraud detection, customer service, and portfolio management. Blockchain technology pilots explore applications in loan documentation and asset verification.

Market Consolidation activities include strategic acquisitions and partnership formations as companies seek scale advantages and enhanced capabilities. Recent transactions demonstrate industry focus on technology acquisition and market expansion strategies. Fintech acquisitions by traditional lenders accelerate digital transformation efforts.

Product Innovation introduces new financing structures including subscription-based models, usage-based pricing, and flexible payment arrangements. Lenders experiment with innovative approaches to meet evolving customer preferences and competitive pressures. Embedded finance solutions integrate lending capabilities directly into automotive purchase processes.

International Expansion sees Brazilian lenders exploring opportunities in other Latin American markets, leveraging expertise and technology platforms developed domestically. Cross-border partnerships enable knowledge sharing and market access strategies.

Technology Investment should remain a top priority for market participants seeking competitive advantage and operational efficiency. MWR analysis suggests that lenders investing in advanced digital platforms achieve 25% higher customer acquisition rates and 30% lower operational costs compared to traditional approaches. Successful technology strategies require comprehensive planning, adequate resources, and strong execution capabilities.

Risk Management Enhancement becomes increasingly critical as market competition intensifies and economic uncertainty persists. Lenders should invest in sophisticated analytics, alternative data sources, and automated decision-making systems to improve risk assessment accuracy. Portfolio diversification across customer segments, geographic regions, and vehicle types can reduce concentration risk.

Customer Experience Focus differentiates successful lenders in competitive markets. Investment in user interface design, process simplification, and customer service excellence drives acquisition and retention. Omnichannel strategies ensure consistent experiences across digital and traditional touchpoints.

Partnership Development enables resource sharing, market access, and capability enhancement. Strategic alliances with automotive manufacturers, dealers, and technology companies create competitive advantages and growth opportunities. Ecosystem participation positions lenders for future market evolution.

Regulatory Compliance requires proactive monitoring and adaptation to evolving requirements. Lenders should invest in compliance infrastructure, staff training, and regulatory relationship management to ensure continued market participation and avoid penalties.

Market growth prospects remain positive despite economic uncertainties, with the sector expected to maintain robust expansion driven by demographic trends, technology adoption, and expanding credit access. Digital transformation will continue reshaping competitive dynamics, with technology-enabled lenders gaining market share through superior customer experiences and operational efficiency.

Credit expansion into previously underserved segments will drive volume growth, supported by improved risk assessment capabilities and alternative data sources. The market’s ability to serve informal economy workers, young professionals, and rural populations will determine long-term growth potential. Financial inclusion initiatives align with both business objectives and social impact goals.

Product evolution will introduce increasingly sophisticated financing solutions, including flexible payment structures, usage-based pricing, and integrated service packages. Lenders will develop specialized products for electric vehicles, commercial applications, and emerging mobility solutions. Innovation cycles will accelerate as competition intensifies and customer expectations evolve.

Regulatory development will continue influencing market structure, with potential changes in consumer protection, data privacy, and prudential requirements. Industry adaptation to regulatory evolution will determine competitive positioning and market access. Policy coordination between financial and automotive sector regulations will shape future market development.

International integration may increase as Brazilian lenders explore regional expansion opportunities and global partnerships. Cross-border collaboration in technology, risk management, and product development could accelerate innovation and market growth. Global trends in automotive financing will increasingly influence Brazilian market development.

Brazil’s car loan market demonstrates remarkable resilience and growth potential, positioning itself as a critical component of the country’s financial services and automotive sectors. The market’s evolution from traditional banking-dominated lending to a diverse ecosystem including specialized finance companies and innovative fintech platforms reflects broader economic and technological transformation trends.

Digital transformation emerges as the defining characteristic of market evolution, with successful participants investing heavily in technology platforms, data analytics, and customer experience enhancement. This technological shift enables expanded market access, improved operational efficiency, and enhanced risk management capabilities while meeting evolving customer expectations for convenience and speed.

Market opportunities remain substantial, particularly in underserved segments and emerging vehicle categories. The combination of demographic trends, economic development, and technology advancement creates favorable conditions for continued growth and innovation. However, success requires careful attention to risk management, regulatory compliance, and competitive positioning in an increasingly dynamic market environment.

Strategic success in Brazil’s car loan market will depend on balancing growth ambitions with prudent risk management, embracing technological innovation while maintaining operational excellence, and developing comprehensive customer solutions that address evolving mobility needs. The market’s future belongs to participants who can effectively integrate these elements while adapting to changing economic, regulatory, and competitive conditions.

What is Car Loan?

A car loan is a type of financing that allows individuals to borrow money to purchase a vehicle, which they then repay over time with interest. In Brazil, car loans are commonly used to facilitate the purchase of both new and used cars, making vehicle ownership more accessible.

What are the key players in the Brazil Car Loan Market?

Key players in the Brazil Car Loan Market include major banks and financial institutions such as Banco do Brasil, Bradesco, and Itaú Unibanco. These companies offer various financing options tailored to consumers’ needs, among others.

What are the main drivers of the Brazil Car Loan Market?

The main drivers of the Brazil Car Loan Market include increasing consumer demand for personal vehicles, favorable financing conditions, and the growth of the middle class. Additionally, the expansion of digital banking services has made it easier for consumers to access car loans.

What challenges does the Brazil Car Loan Market face?

The Brazil Car Loan Market faces challenges such as high-interest rates, economic instability, and regulatory changes that can affect lending practices. These factors can create barriers for potential borrowers and impact overall market growth.

What opportunities exist in the Brazil Car Loan Market?

Opportunities in the Brazil Car Loan Market include the rise of electric vehicles, which may attract new financing products, and the potential for partnerships between traditional banks and fintech companies to enhance customer experience. Additionally, increasing online loan applications can streamline the borrowing process.

What trends are shaping the Brazil Car Loan Market?

Trends shaping the Brazil Car Loan Market include the growing popularity of online lending platforms, the integration of technology in loan processing, and a shift towards more flexible repayment options. These trends are making car loans more accessible and appealing to a broader range of consumers.

Brazil Car Loan Market

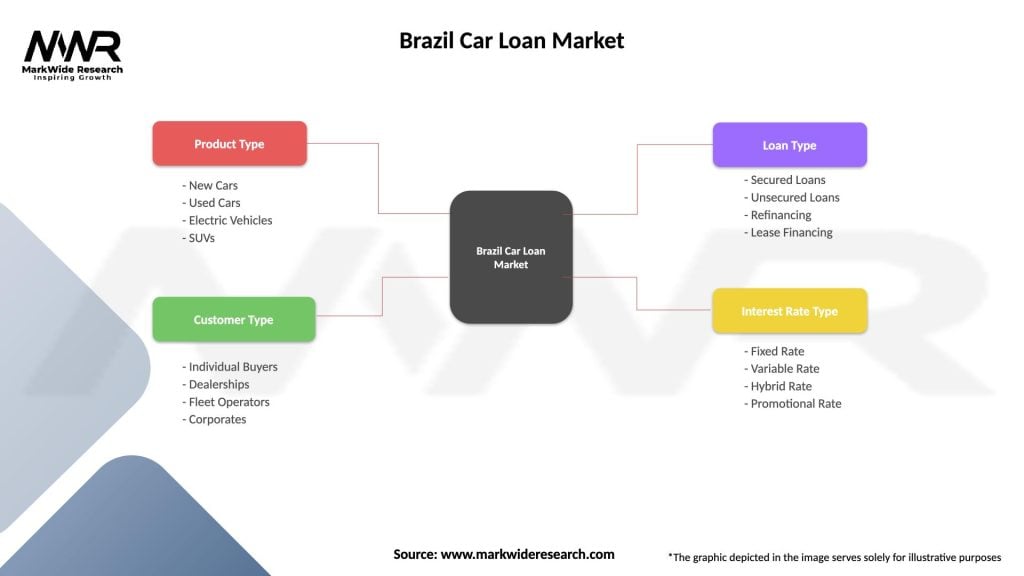

| Segmentation Details | Description |

|---|---|

| Product Type | New Cars, Used Cars, Electric Vehicles, SUVs |

| Customer Type | Individual Buyers, Dealerships, Fleet Operators, Corporates |

| Loan Type | Secured Loans, Unsecured Loans, Refinancing, Lease Financing |

| Interest Rate Type | Fixed Rate, Variable Rate, Hybrid Rate, Promotional Rate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Car Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at