444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil automotive OEM coatings market represents a dynamic and rapidly evolving sector within South America’s largest automotive manufacturing hub. Brazil’s automotive industry has established itself as a cornerstone of the country’s industrial landscape, driving substantial demand for high-performance original equipment manufacturer coatings. The market encompasses a comprehensive range of coating solutions including primer coatings, basecoat systems, clearcoat applications, and specialized anti-corrosion treatments designed specifically for automotive manufacturing processes.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% compound annual growth rate driven by increasing vehicle production, technological advancement, and evolving consumer preferences for enhanced vehicle aesthetics and durability. The Brazilian market benefits from a strong domestic automotive manufacturing base, with major international automakers maintaining significant production facilities throughout the country, particularly concentrated in the São Paulo metropolitan region and surrounding industrial corridors.

Technological innovation continues to reshape the competitive landscape, with manufacturers increasingly adopting water-based coating systems, powder coating technologies, and advanced electrocoat processes to meet stringent environmental regulations and improve operational efficiency. The market demonstrates strong integration with global automotive supply chains while maintaining distinct regional characteristics that reflect local manufacturing requirements, climate considerations, and regulatory frameworks specific to the Brazilian automotive sector.

The Brazil automotive OEM coatings market refers to the comprehensive ecosystem of specialized coating products, technologies, and services specifically designed for original equipment manufacturer applications within Brazil’s automotive manufacturing industry. This market encompasses all coating solutions applied during the vehicle manufacturing process, including protective primers, decorative topcoats, functional specialty coatings, and corrosion-resistant treatments that ensure vehicle durability, aesthetic appeal, and performance standards required by automotive manufacturers.

OEM coatings differ significantly from aftermarket coating solutions, as they are integrated directly into the vehicle manufacturing process and must meet stringent quality standards, environmental regulations, and performance specifications established by automotive manufacturers. These coatings serve multiple critical functions including corrosion protection, weather resistance, aesthetic enhancement, and substrate adhesion, while also contributing to overall vehicle safety and longevity in Brazil’s diverse climatic conditions.

Brazil’s automotive OEM coatings market demonstrates remarkable resilience and growth potential within the broader South American automotive manufacturing landscape. The market benefits from a well-established automotive production infrastructure, strategic geographic positioning, and strong relationships with global automotive manufacturers who have invested heavily in Brazilian production facilities over the past several decades.

Key market drivers include increasing vehicle production volumes, growing consumer demand for premium vehicle finishes, and the ongoing transition toward more environmentally sustainable coating technologies. The market shows particular strength in passenger vehicle coatings, which account for approximately 72% of total market demand, while commercial vehicle applications represent a growing segment with significant expansion potential.

Technological advancement remains a critical factor, with manufacturers increasingly adopting advanced coating application systems, robotic spray technologies, and intelligent quality control processes to enhance efficiency and reduce environmental impact. The market demonstrates strong integration with international supply chains while maintaining competitive advantages through local manufacturing capabilities, skilled workforce availability, and favorable cost structures that support both domestic consumption and export opportunities.

Market segmentation analysis reveals several critical insights that define the competitive landscape and growth opportunities within Brazil’s automotive OEM coatings sector:

Automotive production growth serves as the primary catalyst driving demand for OEM coatings throughout Brazil’s manufacturing sector. The country’s position as a major automotive production hub for both domestic consumption and export markets creates sustained demand for high-quality coating solutions that meet international standards and performance requirements.

Consumer preferences increasingly favor vehicles with superior finish quality, enhanced durability, and distinctive aesthetic characteristics that require advanced coating technologies. This trend drives automotive manufacturers to invest in premium coating systems that deliver exceptional visual appeal while providing long-term protection against Brazil’s diverse environmental conditions, including high humidity, intense UV radiation, and coastal salt exposure.

Environmental regulations continue to strengthen, compelling coating manufacturers and automotive producers to adopt more sustainable technologies. The transition toward low-VOC coating systems, water-based formulations, and energy-efficient application processes creates opportunities for innovative coating solutions that meet both performance and environmental requirements.

Technological advancement in coating application equipment, quality control systems, and product formulations enables manufacturers to achieve higher efficiency, improved consistency, and reduced waste generation. These improvements support cost optimization while enhancing product quality and environmental performance across automotive manufacturing operations.

Economic volatility presents ongoing challenges for Brazil’s automotive OEM coatings market, with currency fluctuations, inflation pressures, and changing economic conditions affecting both production costs and consumer demand for new vehicles. These factors create uncertainty that can impact investment decisions and long-term planning for coating manufacturers and automotive producers.

Raw material costs represent a significant constraint, particularly for specialized coating ingredients and advanced additives that are often imported and subject to currency exchange rate variations. Price volatility in key raw materials including titanium dioxide, specialty resins, and performance additives can significantly impact coating manufacturers’ profitability and pricing strategies.

Regulatory complexity creates challenges for coating manufacturers who must navigate evolving environmental standards, safety requirements, and quality certifications while maintaining competitive pricing and product performance. Compliance costs and the need for ongoing product reformulation can strain resources and limit market entry for smaller manufacturers.

Infrastructure limitations in certain regions may restrict market expansion opportunities, particularly for coating manufacturers seeking to establish production facilities or distribution networks in emerging automotive manufacturing areas outside traditional industrial centers.

Electric vehicle adoption creates substantial opportunities for specialized coating solutions designed to meet the unique requirements of electric and hybrid vehicles. These applications often require enhanced thermal management properties, electromagnetic interference shielding, and lightweight coating systems that support overall vehicle efficiency and performance objectives.

Export market expansion presents significant growth potential, with Brazilian automotive manufacturers increasingly serving regional and global markets. This trend creates demand for coating solutions that meet diverse international standards and performance requirements while leveraging Brazil’s competitive manufacturing advantages.

Sustainable technology development offers opportunities for coating manufacturers to differentiate their products through bio-based formulations, recyclable coating systems, and energy-efficient application processes that align with automotive manufacturers’ sustainability goals and regulatory requirements.

Digital integration and Industry 4.0 technologies enable coating manufacturers to develop smart coating solutions with integrated sensors, self-healing properties, and advanced monitoring capabilities that enhance vehicle performance and provide new value propositions for automotive manufacturers and consumers.

Competitive intensity within Brazil’s automotive OEM coatings market reflects the presence of both international coating giants and specialized regional manufacturers who compete on technology innovation, service quality, and cost effectiveness. Market leaders maintain advantages through comprehensive product portfolios, technical support capabilities, and established relationships with major automotive manufacturers.

Supply chain integration plays a crucial role in market dynamics, with successful coating manufacturers developing close partnerships with automotive producers to ensure seamless product delivery, quality consistency, and responsive technical support. These relationships often involve collaborative product development, on-site technical services, and integrated inventory management systems.

Technology evolution continues to reshape competitive positioning, with manufacturers investing heavily in advanced coating formulations, application equipment, and quality control systems that deliver superior performance while reducing environmental impact. Innovation cycles are accelerating as manufacturers seek to differentiate their offerings and capture market share in high-growth segments.

Market consolidation trends reflect the industry’s maturation, with larger manufacturers acquiring specialized coating companies to expand their technology portfolios and market reach. This consolidation creates opportunities for enhanced operational efficiency while potentially reducing competitive options for automotive manufacturers seeking coating solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Brazil’s automotive OEM coatings market dynamics. Primary research activities include extensive interviews with industry executives, coating manufacturers, automotive producers, and technology specialists who provide firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses detailed analysis of industry publications, government statistics, trade association reports, and regulatory documentation that provide quantitative data and contextual information about market size, growth patterns, and competitive dynamics. This research foundation supports comprehensive understanding of market structure and evolution patterns.

Data validation processes ensure information accuracy through cross-referencing multiple sources, statistical analysis, and expert review procedures. Market projections and trend analysis incorporate both quantitative modeling and qualitative assessment to provide balanced and realistic market insights that reflect actual industry conditions and future potential.

Industry collaboration with coating manufacturers, automotive producers, and technology suppliers provides ongoing market intelligence and validation of research findings. These relationships enable continuous monitoring of market developments and emerging trends that influence strategic planning and investment decisions.

São Paulo region dominates Brazil’s automotive OEM coatings market, accounting for approximately 58% of total market activity due to the concentration of major automotive manufacturing facilities and supporting industrial infrastructure. The region benefits from established supply chains, skilled workforce availability, and proximity to key transportation networks that support efficient distribution and logistics operations.

Minas Gerais represents the second-largest regional market, with significant automotive production facilities and growing coating manufacturing capabilities. The region demonstrates strong growth potential driven by continued automotive industry expansion and favorable business conditions that attract both domestic and international investment in coating production facilities.

Rio Grande do Sul maintains an important position in the market, particularly for commercial vehicle coatings and specialized automotive applications. The region’s strategic location near major export ports supports both domestic market service and international trade opportunities for coating manufacturers and automotive producers.

Emerging regions including Bahia, Goiás, and Paraná demonstrate growing market potential as automotive manufacturers expand production facilities beyond traditional industrial centers. These regions offer opportunities for coating manufacturers to establish local presence and capture market share in developing automotive manufacturing clusters.

Market leadership is characterized by the presence of several major international coating manufacturers who maintain strong positions through comprehensive product portfolios, advanced technology capabilities, and established relationships with automotive producers throughout Brazil.

Competitive strategies focus on technology innovation, customer service excellence, and sustainable product development that meets evolving automotive manufacturer requirements and environmental regulations. Market leaders invest heavily in local production capabilities, technical support infrastructure, and collaborative relationships with automotive producers to maintain competitive advantages.

By Technology Type:

By Application:

By Vehicle Type:

Primer coating systems represent the foundation of automotive OEM coating applications, providing essential corrosion protection, substrate adhesion, and surface preparation for subsequent coating layers. This category demonstrates steady growth driven by increasing vehicle production and enhanced performance requirements for corrosion resistance in Brazil’s diverse climate conditions.

Basecoat technologies focus on delivering exceptional color accuracy, appearance quality, and aesthetic properties that meet automotive manufacturers’ design specifications. Advanced metallic basecoats, pearl effect systems, and color-matching technologies enable manufacturers to achieve distinctive vehicle appearances while maintaining production efficiency and quality consistency.

Clearcoat applications provide critical protection against environmental damage while delivering the gloss, durability, and appearance retention that consumers expect from modern vehicles. Innovation in scratch-resistant formulations, UV protection systems, and self-healing technologies continues to advance clearcoat performance capabilities.

Specialty coating solutions address specific automotive requirements including anti-chip protection, sound dampening, thermal management, and electromagnetic shielding that support overall vehicle performance and functionality. These applications often command premium pricing due to their specialized nature and performance requirements.

Automotive manufacturers benefit from advanced OEM coating systems that enhance vehicle quality, reduce production costs, and improve manufacturing efficiency. Modern coating technologies enable faster application processes, reduced waste generation, and improved quality consistency that supports lean manufacturing objectives and competitive positioning in global markets.

Coating manufacturers gain opportunities for revenue growth, technology differentiation, and market expansion through participation in Brazil’s dynamic automotive sector. The market provides platforms for innovation development, customer relationship building, and operational scale that support long-term business success and competitive advantage.

Consumers receive enhanced vehicle value through improved appearance quality, durability, and protection that extends vehicle life and maintains resale value. Advanced coating systems provide superior resistance to environmental damage, enhanced aesthetic appeal, and reduced maintenance requirements that improve overall ownership experience.

Environmental stakeholders benefit from the industry’s ongoing transition toward more sustainable coating technologies that reduce volatile organic compound emissions, minimize waste generation, and improve energy efficiency throughout the coating application process. These improvements support broader environmental protection goals while maintaining industrial competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend reshaping Brazil’s automotive OEM coatings market, with manufacturers increasingly adopting water-based formulations, bio-based raw materials, and energy-efficient application processes that reduce environmental impact while maintaining performance standards. This trend reflects both regulatory requirements and automotive manufacturers’ sustainability commitments.

Digital transformation is revolutionizing coating application processes through automated spray systems, real-time quality monitoring, and predictive maintenance technologies that enhance efficiency and consistency. According to MarkWide Research analysis, digital integration improves coating application efficiency by approximately 23% while reducing waste generation and quality variations.

Color innovation continues to drive market development, with automotive manufacturers demanding increasingly sophisticated color effects, texture variations, and appearance characteristics that require advanced coating technologies. Pearlescent effects, color-shifting properties, and matte finishes represent growing segments within the premium vehicle market.

Performance enhancement focuses on developing coating systems with superior durability, scratch resistance, and environmental protection that extend vehicle appearance retention and reduce maintenance requirements. These improvements support automotive manufacturers’ quality objectives and consumer satisfaction goals.

Technology partnerships between coating manufacturers and automotive producers are expanding, with collaborative development programs focusing on next-generation coating systems that meet evolving performance requirements and sustainability objectives. These partnerships enable faster innovation cycles and more effective technology transfer from research laboratories to production facilities.

Production capacity expansion continues throughout Brazil’s automotive regions, with both international and domestic coating manufacturers investing in new production facilities and equipment upgrades that support market growth and improved service capabilities. These investments demonstrate confidence in Brazil’s long-term automotive market potential.

Regulatory compliance initiatives are driving industry-wide adoption of more sustainable coating technologies and application processes that meet strengthening environmental standards. Manufacturers are investing in emission control systems, waste reduction programs, and energy efficiency improvements that support regulatory compliance while reducing operational costs.

Quality certification programs are expanding, with coating manufacturers pursuing international quality standards and automotive industry certifications that demonstrate their capability to meet global automotive manufacturers’ requirements. These certifications support export market development and competitive positioning in premium market segments.

Strategic investment in sustainable coating technologies represents the most critical priority for manufacturers seeking long-term success in Brazil’s automotive OEM coatings market. Companies should focus on developing water-based systems, low-VOC formulations, and energy-efficient application processes that meet evolving environmental regulations while delivering superior performance characteristics.

Market diversification through electric vehicle coating solutions offers significant growth opportunities, with manufacturers advised to develop specialized products addressing the unique requirements of electric and hybrid vehicles. This includes thermal management coatings, electromagnetic shielding systems, and lightweight formulations that support overall vehicle efficiency objectives.

Digital integration should be prioritized to enhance operational efficiency and customer service capabilities. Manufacturers should invest in automated application systems, quality monitoring technologies, and predictive maintenance capabilities that improve consistency while reducing costs and environmental impact.

Partnership development with automotive manufacturers enables more effective market penetration and technology development. Companies should focus on building collaborative relationships that support joint product development, technical service integration, and long-term supply agreements that provide market stability and growth opportunities.

Market expansion prospects remain positive for Brazil’s automotive OEM coatings sector, with continued growth expected driven by increasing vehicle production, technology advancement, and expanding export opportunities. MWR projections indicate sustained market development with particular strength in sustainable coating technologies and electric vehicle applications.

Technology evolution will continue reshaping the competitive landscape, with manufacturers investing heavily in advanced coating formulations, application equipment, and quality control systems that deliver superior performance while meeting environmental requirements. Innovation cycles are expected to accelerate as manufacturers seek competitive differentiation and market share growth.

Regional development opportunities will expand beyond traditional automotive manufacturing centers, with emerging regions offering growth potential for coating manufacturers willing to invest in local presence and market development. This geographic expansion supports both domestic market growth and regional export opportunities.

Sustainability requirements will intensify, driving continued investment in environmentally friendly coating technologies and application processes. Manufacturers who successfully develop and commercialize sustainable coating solutions will gain competitive advantages and market leadership positions in the evolving automotive industry landscape.

Brazil’s automotive OEM coatings market demonstrates robust growth potential and strategic importance within South America’s automotive manufacturing ecosystem. The market benefits from established automotive production infrastructure, skilled workforce capabilities, and strong relationships with international automotive manufacturers who continue investing in Brazilian production facilities.

Key success factors include technology innovation, sustainability integration, and customer relationship development that enable coating manufacturers to meet evolving automotive industry requirements while maintaining competitive positioning. The transition toward more environmentally friendly coating systems creates opportunities for manufacturers who can successfully balance performance requirements with environmental compliance.

Future market development will be shaped by electric vehicle adoption, digital technology integration, and expanding export opportunities that provide growth platforms for innovative coating manufacturers. Companies that invest strategically in sustainable technologies, customer partnerships, and operational excellence will be best positioned to capture market opportunities and achieve long-term success in Brazil’s dynamic automotive OEM coatings market.

What is Automotive OEM Coatings?

Automotive OEM Coatings refer to the specialized paints and finishes applied to vehicles during the manufacturing process. These coatings enhance the aesthetic appeal, durability, and protection of vehicles against environmental factors.

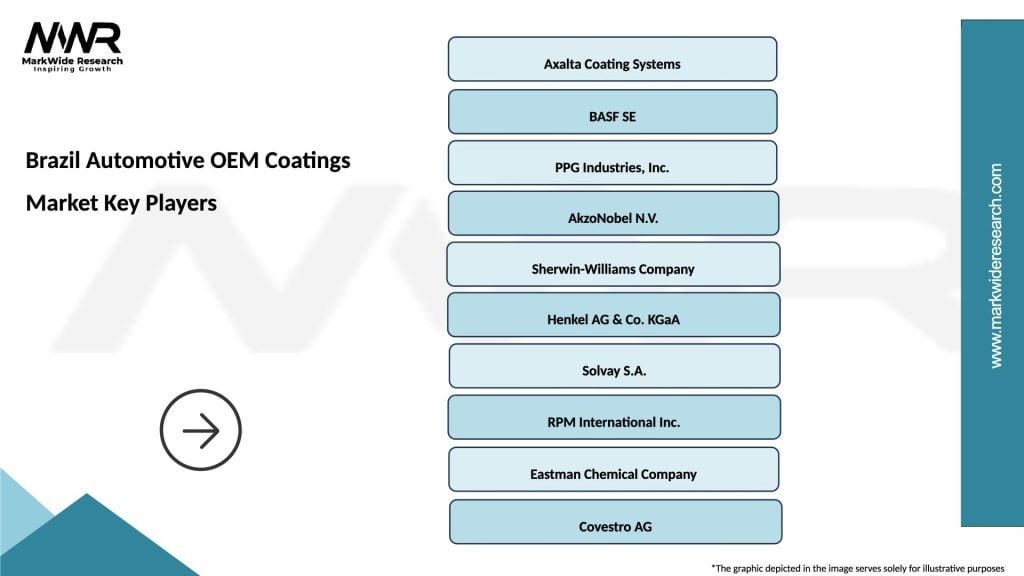

What are the key players in the Brazil Automotive OEM Coatings Market?

Key players in the Brazil Automotive OEM Coatings Market include PPG Industries, BASF, AkzoNobel, and Sherwin-Williams, among others. These companies are known for their innovative coating solutions and extensive product portfolios.

What are the growth factors driving the Brazil Automotive OEM Coatings Market?

The growth of the Brazil Automotive OEM Coatings Market is driven by increasing vehicle production, rising consumer demand for aesthetic vehicle finishes, and advancements in coating technologies. Additionally, the push for sustainable and eco-friendly coatings is also contributing to market growth.

What challenges does the Brazil Automotive OEM Coatings Market face?

The Brazil Automotive OEM Coatings Market faces challenges such as stringent environmental regulations, fluctuating raw material prices, and competition from alternative coating technologies. These factors can impact production costs and market dynamics.

What opportunities exist in the Brazil Automotive OEM Coatings Market?

Opportunities in the Brazil Automotive OEM Coatings Market include the development of innovative, high-performance coatings and the increasing adoption of electric vehicles. Additionally, the growing trend towards customization in vehicle finishes presents new avenues for growth.

What trends are shaping the Brazil Automotive OEM Coatings Market?

Trends shaping the Brazil Automotive OEM Coatings Market include the rise of waterborne coatings, advancements in nanotechnology for improved durability, and a focus on sustainable practices. These trends are influencing product development and consumer preferences.

Brazil Automotive OEM Coatings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Waterborne, Solventborne, Powder Coatings, UV-Cured |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Heavy-Duty Trucks |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | Electrostatic Spray, Manual Spray, Dip Coating, Roller Coating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Automotive OEM Coatings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at