444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The bottled water market in UAE represents one of the most dynamic and rapidly expanding segments within the country’s beverage industry. Market dynamics in the UAE reflect the unique combination of extreme climate conditions, growing health consciousness, and substantial expatriate population that drives consistent demand for premium hydration solutions. The market has experienced robust growth with consumption rates reaching 8.2% annual increase over recent years, positioning the UAE among the highest per capita bottled water consumers globally.

Regional characteristics significantly influence market development, with the UAE’s arid climate and limited natural freshwater resources creating sustained demand for bottled water products. The market encompasses various segments including premium spring water, purified water, flavored variants, and functional water products enriched with minerals and vitamins. Consumer preferences have evolved toward premium and sustainable packaging options, with glass bottles and recyclable materials gaining significant market traction.

Distribution networks across the UAE have expanded considerably, with modern retail channels, hypermarkets, convenience stores, and online platforms contributing to market accessibility. The hospitality sector, including hotels, restaurants, and tourism facilities, represents a substantial portion of bulk consumption, while residential demand continues growing at steady rates driven by health-conscious consumers and expatriate communities.

The bottled water market in UAE refers to the comprehensive industry encompassing production, distribution, and retail of packaged drinking water products across the United Arab Emirates. This market includes various water types such as natural spring water, purified tap water, mineral water, and enhanced water products sold in different packaging formats ranging from small individual bottles to large commercial containers.

Market scope extends beyond basic hydration needs to include premium water brands, functional beverages with added minerals, flavored water variants, and specialized products targeting specific consumer segments. The industry encompasses both domestic production facilities and imported brands, creating a diverse competitive landscape that serves various price points and consumer preferences throughout the UAE’s seven emirates.

Strategic analysis of the UAE bottled water market reveals exceptional growth potential driven by demographic trends, climate factors, and evolving consumer behaviors. The market demonstrates resilient performance with consistent demand across residential, commercial, and institutional segments, supported by the country’s position as a regional business hub and tourist destination.

Key market drivers include the UAE’s extreme summer temperatures, limited natural freshwater resources, growing health awareness among consumers, and substantial expatriate population with diverse hydration preferences. Premium segment growth has accelerated at 12.5% annually, reflecting consumer willingness to invest in high-quality water products and sustainable packaging solutions.

Competitive dynamics feature both international brands and local producers, with market leaders focusing on product innovation, sustainable packaging, and strategic distribution partnerships. The market benefits from robust infrastructure, efficient supply chains, and supportive regulatory frameworks that facilitate business operations and consumer access to quality products.

Market intelligence reveals several critical insights that define the UAE bottled water landscape and future growth trajectory:

Primary growth drivers propelling the UAE bottled water market stem from fundamental geographic, demographic, and lifestyle factors that create sustained demand across multiple consumer segments.

Climate conditions represent the most significant driver, with the UAE’s arid desert climate and extreme summer temperatures reaching above 45°C creating consistent hydration needs. Water scarcity concerns and limited natural freshwater resources reinforce consumer reliance on bottled water products as a reliable and safe hydration source.

Population dynamics contribute substantially to market expansion, with the UAE hosting a diverse expatriate community comprising over 85% of the total population. This demographic brings varied cultural preferences for water types, brands, and consumption patterns, creating multiple market niches and opportunities for specialized products.

Health and wellness trends drive premium segment growth as consumers increasingly prioritize hydration quality and seek functional water products with added minerals, electrolytes, and vitamins. Lifestyle changes toward active living and fitness consciousness further amplify demand for specialized hydration solutions.

Economic prosperity and high disposable income levels enable consumers to choose premium water brands and sustainable packaging options, supporting market value growth beyond volume increases. Tourism industry expansion brings millions of visitors annually, creating substantial commercial demand through hotels, restaurants, and entertainment venues.

Market challenges facing the UAE bottled water industry include environmental concerns, regulatory pressures, and competitive intensity that may limit growth potential in certain segments.

Environmental sustainability concerns regarding plastic waste and packaging disposal create regulatory pressures and consumer resistance toward traditional bottled water products. Government initiatives promoting tap water quality improvements and public awareness campaigns about plastic pollution may influence consumer behavior toward alternative hydration sources.

Cost pressures from raw materials, packaging, and transportation expenses impact profit margins, particularly for premium products requiring specialized packaging and quality assurance processes. Supply chain disruptions and logistics challenges can affect product availability and distribution efficiency across the UAE’s diverse geographic regions.

Regulatory compliance requirements for water quality standards, labeling regulations, and import procedures create operational complexities and costs for market participants. Competitive intensity among numerous brands leads to pricing pressures and increased marketing expenses to maintain market share and brand visibility.

Growth opportunities within the UAE bottled water market present significant potential for innovation, market expansion, and value creation across multiple dimensions.

Sustainable packaging innovation offers substantial opportunities for companies developing eco-friendly alternatives to traditional plastic bottles. Biodegradable materials, aluminum cans, and glass packaging solutions appeal to environmentally conscious consumers and align with government sustainability initiatives.

Functional water products represent a high-growth opportunity segment, with consumers seeking enhanced hydration solutions containing vitamins, minerals, electrolytes, and natural flavors. Sports and fitness water products targeting the UAE’s active lifestyle demographic show particular promise for market expansion.

Digital commerce platforms provide opportunities for direct-to-consumer sales, subscription services, and personalized water delivery solutions. Smart packaging technologies incorporating QR codes, freshness indicators, and interactive features can enhance consumer engagement and brand differentiation.

Premium positioning opportunities exist for luxury water brands targeting high-income consumers and hospitality sector clients seeking exclusive products. Private label development for major retailers and hotel chains offers partnership opportunities for production companies.

Market forces shaping the UAE bottled water industry reflect complex interactions between supply-side capabilities, demand-side preferences, and external environmental factors that influence competitive positioning and growth strategies.

Supply chain efficiency has become increasingly critical, with companies investing in advanced logistics networks, temperature-controlled storage, and rapid distribution systems to ensure product quality and availability. Production capacity expansion by local manufacturers reduces import dependency and improves cost competitiveness against international brands.

Consumer behavior evolution toward premium products and sustainable choices drives product innovation and packaging development. Brand loyalty patterns show increasing importance of quality perception, environmental responsibility, and health benefits in purchase decisions.

Technological integration enhances operational efficiency through automated production lines, quality monitoring systems, and inventory management solutions. Digital marketing strategies leverage social media platforms and influencer partnerships to reach diverse consumer segments effectively.

Regulatory landscape continues evolving with stricter quality standards, environmental regulations, and consumer protection measures that influence market entry strategies and operational compliance requirements.

Comprehensive analysis of the UAE bottled water market employs multiple research methodologies to ensure accurate market assessment and reliable insights for strategic decision-making.

Primary research includes extensive consumer surveys, industry expert interviews, and focus group discussions across different emirates to understand consumption patterns, brand preferences, and purchasing behaviors. Retail channel analysis involves direct observation and data collection from hypermarkets, convenience stores, and online platforms to track sales trends and product positioning.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and company financial statements to establish market baselines and competitive benchmarks. MarkWide Research methodology incorporates both quantitative data analysis and qualitative insights to provide comprehensive market understanding.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review panels to ensure accuracy and reliability of market findings. Trend analysis utilizes historical data patterns and forward-looking indicators to project future market developments and growth opportunities.

Geographic distribution of bottled water consumption across the UAE reveals distinct regional patterns influenced by population density, economic activity, and infrastructure development.

Dubai emirate dominates market consumption with approximately 42% market share, driven by its large expatriate population, extensive tourism industry, and commercial activity. The emirate’s diverse retail landscape and high disposable income levels support premium product segments and innovative water brands.

Abu Dhabi region accounts for 28% of total consumption, reflecting its status as the capital emirate with substantial government sector employment and oil industry presence. Corporate consumption through office buildings and industrial facilities contributes significantly to bulk water demand.

Sharjah and Northern Emirates collectively represent 30% market share, with growing residential populations and expanding retail infrastructure driving steady demand growth. Price-sensitive segments show stronger performance in these regions compared to premium products.

Seasonal variations across all regions show peak consumption increases of 25-35% during summer months, with coastal areas experiencing slightly higher year-round consumption due to humidity and outdoor activities.

Market competition in the UAE bottled water industry features a diverse mix of international brands, regional players, and local producers competing across multiple price segments and product categories.

Competitive strategies emphasize brand differentiation through quality positioning, sustainable packaging, and targeted marketing campaigns. Market leaders invest heavily in distribution networks, retail partnerships, and consumer education to maintain competitive advantages.

Market segmentation analysis reveals multiple dimensions for categorizing the UAE bottled water market based on product types, packaging formats, distribution channels, and consumer demographics.

By Product Type:

By Packaging Size:

By Distribution Channel:

Premium water category demonstrates the strongest growth momentum, with consumers increasingly willing to pay higher prices for perceived quality, natural sourcing, and sustainable packaging. Natural spring water brands command premium pricing and show consistent market share gains among affluent consumer segments.

Functional water products represent an emerging high-growth category, with sports drinks, vitamin-enhanced water, and electrolyte solutions gaining significant traction among health-conscious consumers and fitness enthusiasts. Innovation focus on natural ingredients and sugar-free formulations drives category expansion.

Sustainable packaging initiatives across all categories reflect growing environmental consciousness, with glass bottles, aluminum cans, and biodegradable materials gaining consumer acceptance despite higher costs. Brand positioning increasingly emphasizes environmental responsibility alongside product quality.

Bulk water segment serves commercial and institutional clients with cost-effective solutions for offices, schools, and hospitality venues. Service integration including delivery, equipment rental, and maintenance creates competitive differentiation and customer loyalty.

Industry participants in the UAE bottled water market enjoy multiple strategic advantages and growth opportunities that support sustainable business development and market expansion.

Market stability provides predictable demand patterns driven by climate conditions and demographic factors that ensure consistent revenue streams. Premium positioning opportunities allow companies to achieve higher profit margins through quality differentiation and brand building strategies.

Distribution advantages include access to well-developed retail networks, efficient logistics infrastructure, and growing e-commerce platforms that facilitate market reach and customer acquisition. Regulatory support through clear quality standards and business-friendly policies creates favorable operating conditions.

Innovation potential in product development, packaging solutions, and service offerings enables companies to differentiate their offerings and capture emerging market segments. Partnership opportunities with retailers, hospitality providers, and corporate clients create multiple revenue channels and market expansion possibilities.

Export opportunities to regional markets leverage UAE’s strategic location and established trade relationships to expand business beyond domestic consumption. Investment attraction from international companies seeking market entry creates partnership and acquisition opportunities for local players.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability revolution dominates current market trends, with companies investing heavily in recyclable packaging, carbon-neutral production, and circular economy initiatives. Consumer awareness of environmental impact drives demand for eco-friendly alternatives and influences brand selection criteria significantly.

Health and wellness integration transforms product development, with functional water products incorporating vitamins, minerals, probiotics, and natural extracts gaining substantial market traction. Sports nutrition and recovery-focused hydration solutions target active lifestyle consumers and fitness enthusiasts.

Digital transformation reshapes distribution and customer engagement through e-commerce platforms, subscription services, and mobile applications. Smart packaging technologies provide product information, freshness indicators, and interactive features that enhance consumer experience and brand differentiation.

Premium positioning continues expanding as consumers prioritize quality over price, driving growth in luxury water brands, artesian sources, and exclusive packaging formats. Personalization trends include customized labels, flavor profiles, and delivery schedules that cater to individual preferences and lifestyle requirements.

Recent industry developments highlight significant investments in production capacity, sustainability initiatives, and market expansion strategies that shape the competitive landscape and future growth trajectory.

Production facility expansion by major players includes new bottling plants, advanced purification technologies, and automated packaging systems that improve efficiency and quality control. Local manufacturing investments reduce import dependency and enhance supply chain resilience.

Sustainability initiatives encompass plastic reduction programs, renewable energy adoption, and water conservation measures that address environmental concerns and regulatory requirements. Circular economy projects focus on bottle recycling, reusable packaging, and waste reduction throughout the value chain.

Strategic partnerships between water companies and retailers, hospitality providers, and technology firms create integrated solutions and expanded market reach. Acquisition activities consolidate market positions and enable companies to access new distribution channels and consumer segments.

Product innovation includes new flavor variants, functional formulations, and premium packaging options that differentiate brands and capture emerging consumer preferences. MWR analysis indicates that innovation investments show positive correlation with market share growth and customer loyalty metrics.

Strategic recommendations for UAE bottled water market participants focus on sustainable growth, innovation leadership, and competitive positioning in an evolving market environment.

Sustainability leadership should become a core strategic priority, with companies investing in eco-friendly packaging, carbon-neutral operations, and circular economy initiatives that address environmental concerns while differentiating their brands. Early adoption of sustainable practices creates competitive advantages and regulatory compliance benefits.

Product portfolio diversification into functional water segments, premium offerings, and specialized formulations can capture higher-value market segments and reduce dependence on commodity water products. Innovation investment in health-focused products aligns with consumer wellness trends and supports premium pricing strategies.

Digital transformation initiatives should encompass e-commerce capabilities, direct-to-consumer platforms, and data analytics systems that enhance customer relationships and operational efficiency. Technology integration enables personalized marketing, demand forecasting, and supply chain optimization.

Regional expansion strategies leveraging UAE market success can access broader GCC markets and capitalize on established distribution networks and brand recognition. Partnership development with local distributors and retailers facilitates market entry and reduces operational risks.

Long-term prospects for the UAE bottled water market remain highly positive, supported by fundamental demand drivers, innovation opportunities, and market expansion potential that create sustainable growth trajectories.

Market evolution toward premium and functional products is expected to accelerate, with health-conscious consumers driving demand for enhanced hydration solutions and sustainable packaging options. Growth projections indicate continued expansion at robust annual rates across multiple product segments and distribution channels.

Sustainability transformation will reshape industry practices, with companies adopting circular economy principles, renewable energy sources, and innovative packaging materials that address environmental challenges while maintaining product quality and consumer appeal. Regulatory support for sustainable practices creates favorable conditions for responsible industry development.

Technology integration will enhance operational efficiency, customer engagement, and product innovation through artificial intelligence, IoT applications, and advanced manufacturing systems. Digital commerce expansion is projected to capture increasing market share as consumer preferences shift toward convenient and personalized purchasing experiences.

Regional market expansion opportunities through GCC integration and international partnerships will enable UAE-based companies to leverage their market expertise and operational capabilities across broader geographic markets, supporting revenue diversification and growth acceleration.

The UAE bottled water market represents a dynamic and resilient industry with exceptional growth potential driven by climate conditions, demographic trends, and evolving consumer preferences toward premium and sustainable hydration solutions. Market fundamentals remain strong, supported by consistent demand patterns, high purchasing power, and excellent infrastructure that facilitates efficient distribution and customer access.

Strategic opportunities in sustainability innovation, functional product development, and digital transformation provide multiple pathways for market participants to achieve competitive differentiation and sustainable growth. MarkWide Research analysis indicates that companies embracing environmental responsibility, product innovation, and customer-centric strategies are best positioned to capture emerging market opportunities and build long-term market leadership.

Future success in the UAE bottled water market will depend on companies’ ability to balance traditional quality and reliability expectations with evolving demands for environmental sustainability, health benefits, and personalized consumer experiences. The market’s continued evolution toward premium segments and sustainable practices creates favorable conditions for industry participants committed to innovation and responsible business practices.

What is Bottled Water?

Bottled water refers to water that is packaged in bottles for consumption. It can include spring water, mineral water, purified water, and flavored water, catering to various consumer preferences and health trends.

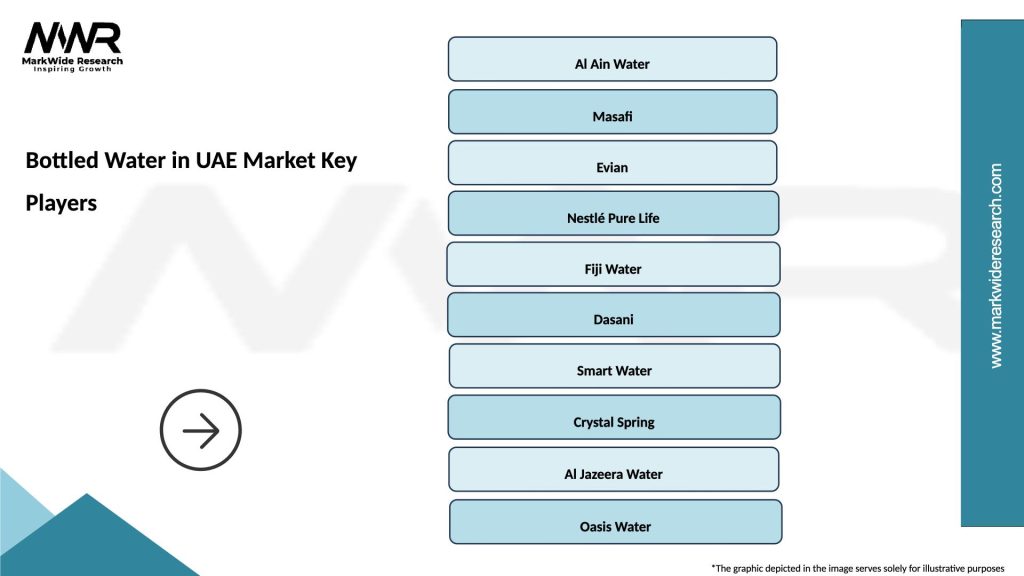

What are the key companies in the Bottled Water in UAE Market?

Key companies in the Bottled Water in UAE Market include Masafi, Aquafina, and Al Ain Water, among others.

What are the growth factors driving the Bottled Water in UAE Market?

The growth of the Bottled Water in UAE Market is driven by increasing health consciousness, rising disposable incomes, and a growing preference for convenient hydration options among consumers.

What challenges does the Bottled Water in UAE Market face?

The Bottled Water in UAE Market faces challenges such as environmental concerns regarding plastic waste, competition from tap water, and regulatory pressures on packaging and sourcing.

What opportunities exist in the Bottled Water in UAE Market?

Opportunities in the Bottled Water in UAE Market include the introduction of eco-friendly packaging, flavored and functional water products, and expanding distribution channels to reach more consumers.

What trends are shaping the Bottled Water in UAE Market?

Trends in the Bottled Water in UAE Market include a shift towards premium bottled water brands, increased demand for sustainable packaging solutions, and the rise of flavored and enhanced water products.

Bottled Water in UAE Market

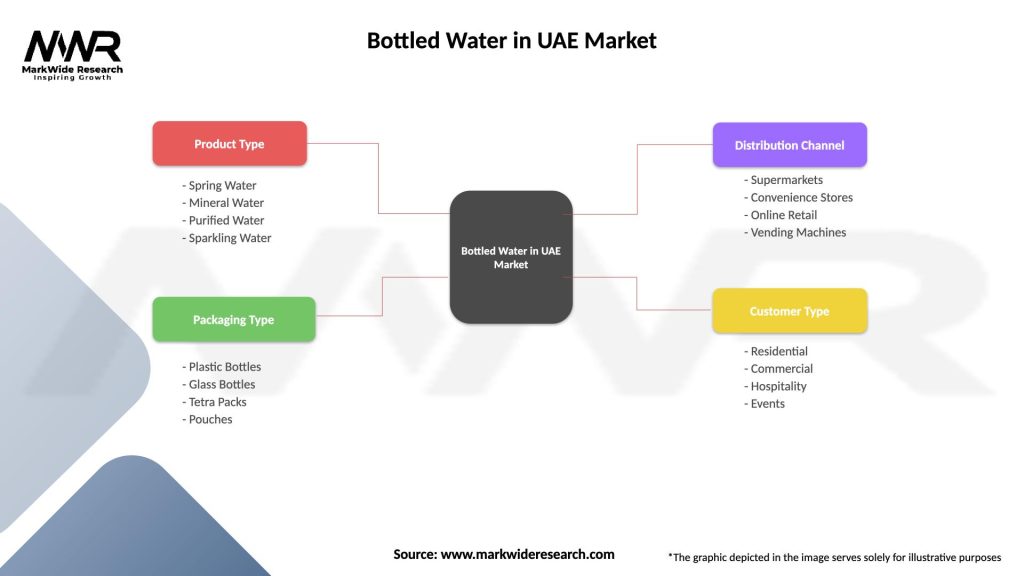

| Segmentation Details | Description |

|---|---|

| Product Type | Spring Water, Mineral Water, Purified Water, Sparkling Water |

| Packaging Type | Plastic Bottles, Glass Bottles, Tetra Packs, Pouches |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Vending Machines |

| Customer Type | Residential, Commercial, Hospitality, Events |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bottled Water in UAE Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at