444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Blow Out Preventer (BOP) oil and gas market represents a critical safety infrastructure segment within the global energy industry, focusing on essential equipment designed to prevent uncontrolled release of crude oil or natural gas from wells during drilling operations. This specialized market encompasses various types of preventive systems, including ram BOPs, annular BOPs, and subsea BOPs, each engineered to provide multiple layers of protection against catastrophic well blowouts. The market demonstrates robust growth momentum driven by increasing offshore drilling activities, stringent safety regulations, and technological advancements in deepwater exploration.

Market dynamics indicate sustained expansion across key regions, with North America, Europe, and Asia-Pacific leading adoption rates. The industry benefits from growing energy demand, enhanced safety protocols following major incidents, and continuous innovation in BOP technology. Offshore drilling operations particularly drive market growth, with subsea BOPs experiencing significant demand increases as operators venture into deeper waters. The market shows strong resilience despite oil price volatility, reflecting the non-negotiable nature of safety equipment in drilling operations.

Technological evolution within the BOP market focuses on improved reliability, faster response times, and enhanced monitoring capabilities. Modern systems integrate advanced sensors, real-time data transmission, and automated control mechanisms to ensure optimal performance under extreme conditions. The market experiences steady growth rates supported by regulatory mandates, insurance requirements, and industry best practices that prioritize operational safety above cost considerations.

The Blow Out Preventer (BOP) oil and gas market refers to the comprehensive industry segment encompassing the design, manufacturing, installation, and maintenance of critical safety systems used in oil and gas drilling operations to prevent uncontrolled release of hydrocarbons from wellbores. These sophisticated mechanical devices serve as the primary safety barrier between drilling operations and potential environmental disasters, incorporating multiple sealing mechanisms, hydraulic controls, and emergency shutdown capabilities.

BOP systems function as large, specialized valves installed at the wellhead during drilling operations, capable of sealing off the well bore in emergency situations. The market includes various configurations such as ram-type BOPs that use steel rams to seal around drill pipe or completely close the wellbore, and annular BOPs that utilize flexible rubber elements to seal around various pipe sizes. Subsea BOPs represent the most complex category, designed for deepwater operations where the equipment operates remotely on the seafloor under extreme pressure conditions.

Market scope extends beyond equipment manufacturing to include comprehensive service packages, maintenance contracts, testing services, and technological upgrades. The industry serves diverse end-users including major oil companies, independent drilling contractors, offshore drilling specialists, and national oil companies across global markets. Regulatory compliance drives significant market activity, as operators must meet stringent safety standards established by agencies such as the Bureau of Safety and Environmental Enforcement (BSEE) and similar international regulatory bodies.

Strategic market analysis reveals the Blow Out Preventer oil and gas market as a fundamental component of global energy infrastructure, characterized by steady demand growth and continuous technological advancement. The market benefits from non-discretionary spending patterns, as safety equipment represents essential operational requirements rather than optional investments. Key growth drivers include expanding offshore drilling activities, increasingly complex well designs, and heightened regulatory scrutiny following major industry incidents.

Regional distribution shows North America maintaining market leadership, driven by extensive shale drilling operations and stringent safety regulations. The Gulf of Mexico represents a particularly active market segment, with deepwater drilling operations requiring sophisticated subsea BOP systems. Asia-Pacific emerges as a high-growth region, supported by increasing energy exploration activities in countries such as China, India, and Southeast Asian nations. Europe maintains steady market presence through North Sea operations and renewable energy transition investments.

Competitive landscape features established industry leaders alongside specialized technology providers, creating a dynamic market environment focused on innovation and reliability. Market participants invest heavily in research and development to enhance system performance, reduce maintenance requirements, and improve operational efficiency. Service integration becomes increasingly important, with manufacturers expanding beyond equipment supply to offer comprehensive lifecycle support, predictive maintenance, and digital monitoring solutions.

Critical market insights reveal several transformative trends shaping the BOP oil and gas industry landscape:

Market intelligence indicates that operators increasingly prioritize system reliability over initial cost considerations, recognizing that BOP failures can result in catastrophic consequences far exceeding equipment investments. This trend supports premium product segments and comprehensive service offerings that ensure optimal system performance throughout operational lifecycles.

Primary market drivers propelling the Blow Out Preventer oil and gas market include escalating global energy demand, which necessitates continued exploration and production activities across increasingly challenging environments. The transition toward deepwater and ultra-deepwater drilling operations creates substantial demand for advanced BOP systems capable of withstanding extreme pressure conditions and providing reliable safety protection in remote locations.

Regulatory enforcement serves as a fundamental market driver, with government agencies worldwide implementing stricter safety standards and mandatory equipment upgrades following major industry incidents. These regulations require operators to invest in state-of-the-art BOP systems, regular testing protocols, and comprehensive maintenance programs. Insurance requirements further reinforce market demand, as coverage providers mandate specific safety equipment standards and performance certifications before providing operational insurance.

Technological advancement drives market growth through the development of more sophisticated, reliable, and efficient BOP systems. Innovations in hydraulic systems, control mechanisms, and monitoring technologies enable operators to achieve higher safety standards while improving operational efficiency. Digital transformation initiatives within the oil and gas industry create opportunities for smart BOP systems that integrate with broader digital oilfield technologies, providing enhanced data analytics and predictive maintenance capabilities.

Economic factors including oil price stabilization and increased exploration investments support sustained market growth. As energy companies resume drilling activities and expand into new regions, demand for BOP systems increases correspondingly. Infrastructure development in emerging markets creates additional growth opportunities, particularly in regions with developing offshore drilling capabilities and expanding energy exploration programs.

Significant market restraints affecting the BOP oil and gas industry include substantial capital investment requirements associated with advanced BOP systems, particularly for deepwater and ultra-deepwater applications. These high-specification systems require considerable upfront investments, which can strain project budgets and delay implementation timelines. Complex procurement processes within large oil and gas companies often extend decision-making cycles, creating market volatility and unpredictable demand patterns.

Technical complexity presents ongoing challenges, as modern BOP systems require specialized expertise for installation, operation, and maintenance. The shortage of qualified technicians and engineers familiar with advanced BOP technologies creates operational bottlenecks and increases service costs. Maintenance requirements for sophisticated systems demand regular inspections, component replacements, and performance testing, adding to operational expenses and potential downtime.

Oil price volatility significantly impacts market dynamics, as energy companies adjust exploration and production investments based on commodity price fluctuations. During periods of low oil prices, operators may defer non-essential equipment upgrades or delay new drilling projects, reducing BOP system demand. Environmental concerns and the global transition toward renewable energy sources create long-term uncertainty about future oil and gas exploration activities, potentially limiting market growth prospects.

Regulatory compliance costs continue to increase as safety standards become more stringent, requiring operators to invest in frequent equipment upgrades, enhanced testing procedures, and comprehensive documentation systems. These evolving requirements create ongoing compliance burdens that can strain operational budgets and complicate project planning processes.

Emerging market opportunities within the BOP oil and gas sector include the rapid expansion of offshore drilling activities in previously underexplored regions, particularly in Africa, South America, and Southeast Asia. These markets present substantial growth potential as local energy companies and international operators invest in new exploration projects requiring advanced BOP systems. Technology transfer opportunities enable established manufacturers to expand their global footprint while supporting developing markets with essential safety infrastructure.

Digital transformation initiatives create significant opportunities for BOP manufacturers to develop smart systems incorporating IoT connectivity, artificial intelligence, and predictive analytics capabilities. These advanced systems offer enhanced monitoring, automated diagnostics, and proactive maintenance scheduling, providing substantial value propositions for operators seeking to optimize safety and operational efficiency. Data monetization opportunities emerge as BOP systems generate valuable operational data that can inform broader drilling optimization strategies.

Service market expansion represents a major growth opportunity, as operators increasingly prefer comprehensive service packages over traditional equipment-only transactions. Manufacturers can develop recurring revenue streams through maintenance contracts, performance guarantees, and lifecycle management services. Training and certification programs offer additional revenue opportunities while addressing the industry’s skilled workforce shortage.

Retrofit and upgrade markets provide substantial opportunities as existing BOP systems require modernization to meet evolving safety standards and performance requirements. Modular system designs enable cost-effective upgrades that extend equipment lifecycles while improving safety capabilities. Environmental monitoring integration creates opportunities for BOP systems that contribute to broader environmental protection initiatives within drilling operations.

Complex market dynamics characterize the BOP oil and gas industry, with multiple interconnected factors influencing demand patterns, pricing structures, and competitive positioning. The market demonstrates cyclical behavior aligned with broader oil and gas industry cycles, experiencing growth during periods of increased exploration activity and contraction during market downturns. However, the essential nature of safety equipment provides relative stability compared to other oilfield equipment segments.

Supply chain dynamics play crucial roles in market performance, with manufacturers maintaining strategic inventory levels to support rapid deployment requirements while managing working capital efficiently. Global supply chain disruptions can significantly impact delivery schedules and project timelines, creating opportunities for suppliers with robust logistics capabilities and regional manufacturing presence. Raw material costs for specialized steels and hydraulic components influence pricing strategies and profit margins across the industry.

Technological evolution creates dynamic competitive landscapes as manufacturers invest in research and development to maintain market leadership. Innovation cycles typically span several years, requiring sustained investment commitments and strategic partnerships with technology providers. Patent landscapes influence competitive positioning, with intellectual property protection playing important roles in maintaining technological advantages and market differentiation.

Customer relationship dynamics emphasize long-term partnerships over transactional relationships, as BOP systems require ongoing support throughout their operational lifecycles. Performance track records become critical differentiators, with operators preferring suppliers demonstrating proven reliability and responsive service capabilities. According to MarkWide Research analysis, customer loyalty in the BOP market shows strong correlation with service quality and technical support responsiveness rather than initial equipment pricing.

Comprehensive research methodology employed for analyzing the BOP oil and gas market incorporates multiple data collection approaches, primary research initiatives, and analytical frameworks to ensure accurate market assessment and reliable forecasting. The methodology combines quantitative analysis of market data with qualitative insights from industry experts, regulatory officials, and end-user organizations across global markets.

Primary research activities include structured interviews with key market participants, including BOP manufacturers, oil and gas operators, drilling contractors, and regulatory agencies. These interviews provide valuable insights into market trends, technology developments, competitive dynamics, and future growth prospects. Survey methodologies capture quantitative data regarding market preferences, purchasing criteria, and investment priorities across different market segments and geographic regions.

Secondary research encompasses comprehensive analysis of industry reports, regulatory filings, company financial statements, patent databases, and technical publications. This research provides historical market data, competitive intelligence, and technology trend analysis essential for understanding market evolution and future development patterns. Database analysis includes examination of drilling activity statistics, safety incident reports, and regulatory compliance data to identify market drivers and growth opportunities.

Analytical frameworks employ statistical modeling techniques, trend analysis, and scenario planning to develop market forecasts and identify key success factors. The methodology incorporates risk assessment models to evaluate market uncertainties and develop probability-weighted projections for different market scenarios. Validation processes ensure data accuracy through cross-referencing multiple sources and expert review of findings and conclusions.

North America maintains market leadership in the BOP oil and gas sector, driven by extensive offshore drilling operations in the Gulf of Mexico and robust shale drilling activities across major basins. The region benefits from stringent safety regulations, advanced technology adoption, and substantial investment in drilling infrastructure. United States represents the largest individual market, with approximately 35% market share globally, supported by both offshore and onshore drilling activities requiring sophisticated BOP systems.

Europe demonstrates steady market performance, primarily driven by North Sea drilling operations and ongoing energy exploration activities. The region emphasizes environmental protection and safety standards, creating demand for advanced BOP technologies with enhanced reliability and monitoring capabilities. Norway and United Kingdom lead regional market activity, with established offshore drilling industries and comprehensive regulatory frameworks supporting continued BOP system investments.

Asia-Pacific emerges as the fastest-growing regional market, experiencing significant expansion rates driven by increasing energy exploration activities in China, India, Australia, and Southeast Asian countries. The region benefits from growing energy demand, expanding offshore drilling capabilities, and substantial investments in energy infrastructure development. China represents the largest individual market within the region, with aggressive offshore exploration programs and substantial domestic energy requirements driving BOP system demand.

Middle East and Africa maintain important market positions, with established oil and gas industries requiring ongoing BOP system investments for both maintenance and expansion activities. The region shows moderate growth rates supported by continued exploration activities and infrastructure modernization programs. Latin America presents emerging opportunities, particularly in Brazil’s offshore markets and Mexico’s expanding energy sector following regulatory reforms and increased foreign investment.

Competitive landscape within the BOP oil and gas market features established industry leaders alongside specialized technology providers, creating a dynamic environment characterized by continuous innovation and strategic partnerships. Market leadership positions are determined by technological capabilities, service quality, global reach, and proven performance records in critical applications.

Strategic positioning within the competitive landscape emphasizes differentiation through technology innovation, service excellence, and geographic coverage. Companies invest heavily in research and development to maintain technological leadership while expanding service capabilities to provide comprehensive lifecycle support. Partnership strategies enable market participants to combine complementary capabilities and expand market reach through strategic alliances and joint ventures.

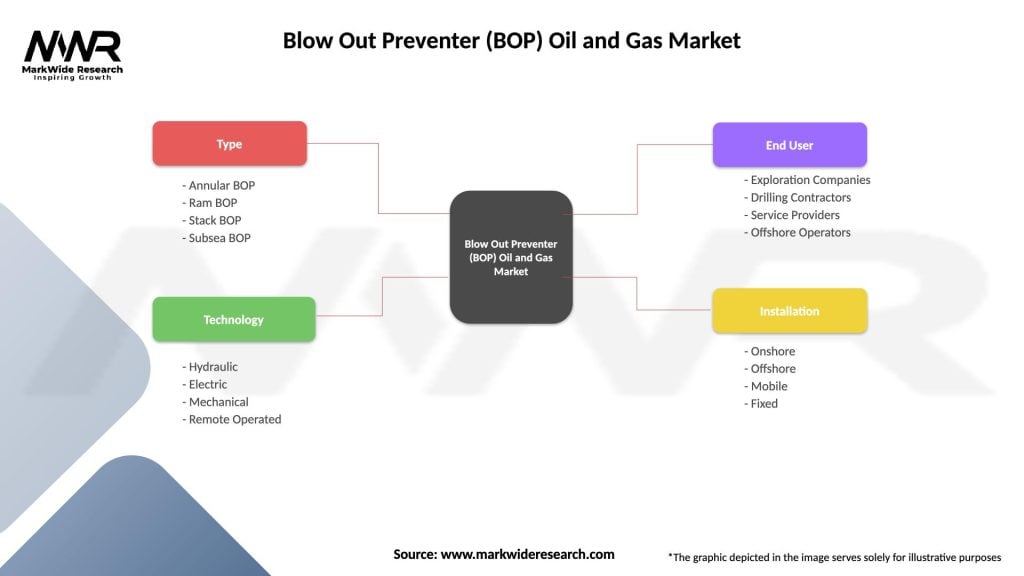

Market segmentation within the BOP oil and gas industry encompasses multiple classification approaches based on product type, application, end-user, and geographic distribution. This comprehensive segmentation enables detailed analysis of market dynamics and growth opportunities across different market categories.

By Product Type:

By Application:

By End-User:

Ram BOP systems represent the largest market category, accounting for significant market share due to their versatility and reliability in various drilling applications. These systems offer precise control over wellbore sealing and can accommodate different pipe sizes through interchangeable ram configurations. Double ram BOPs gain popularity for their redundancy features and enhanced safety capabilities, particularly in high-risk drilling environments.

Subsea BOP category demonstrates the highest growth rates, driven by expanding deepwater drilling activities and increasing complexity of offshore operations. These sophisticated systems require advanced engineering, specialized materials, and comprehensive testing protocols to ensure reliable performance under extreme pressure conditions. Technology integration within subsea BOPs includes real-time monitoring systems, automated control mechanisms, and enhanced communication capabilities for remote operation management.

Annular BOP systems provide essential flexibility in drilling operations, offering the ability to seal around various pipe configurations and irregular shapes. These systems complement ram BOPs in comprehensive safety configurations, providing multiple sealing options for different operational scenarios. Material innovations in annular BOP rubber elements improve durability and extend service intervals, reducing maintenance requirements and operational costs.

Service categories experience rapid growth as operators seek comprehensive lifecycle support beyond equipment supply. Installation services, maintenance contracts, testing programs, and performance optimization services create recurring revenue streams for manufacturers while ensuring optimal system performance throughout operational lifecycles. Digital service offerings incorporate predictive maintenance, remote monitoring, and data analytics to enhance system reliability and reduce unplanned downtime.

Oil and gas operators benefit significantly from advanced BOP systems through enhanced safety protection, regulatory compliance assurance, and reduced operational risks. Modern BOP technologies provide multiple layers of safety protection, ensuring well control under various emergency scenarios and protecting personnel, equipment, and environmental resources. Operational efficiency improvements result from faster response times, automated control systems, and reduced maintenance requirements that minimize drilling downtime and optimize project schedules.

Drilling contractors gain competitive advantages through reliable BOP systems that demonstrate safety commitment to clients and regulatory agencies. Advanced systems enable contractors to bid on high-value projects requiring sophisticated safety equipment while reducing insurance costs and liability exposure. Performance tracking capabilities provide valuable data for optimizing drilling operations and demonstrating safety performance to potential clients.

Equipment manufacturers benefit from stable demand patterns driven by regulatory requirements and safety priorities that transcend oil price cycles. The essential nature of BOP systems provides revenue stability while service expansion opportunities create additional growth avenues. Technology leadership positions enable premium pricing and long-term customer relationships based on performance and reliability rather than cost competition alone.

Regulatory agencies achieve improved industry safety standards through advanced BOP technologies that reduce incident risks and enhance emergency response capabilities. Modern systems provide better monitoring and documentation capabilities that support regulatory oversight and compliance verification. Environmental protection benefits result from more reliable well control systems that prevent hydrocarbon releases and minimize environmental impact risks during drilling operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the BOP oil and gas market, with manufacturers integrating IoT sensors, real-time monitoring systems, and predictive analytics capabilities into traditional mechanical systems. These smart BOPs provide continuous performance monitoring, automated diagnostics, and proactive maintenance scheduling that enhance reliability while reducing operational costs. Data connectivity enables remote monitoring and control capabilities that improve safety oversight and emergency response coordination.

Automation advancement continues transforming BOP operations through sophisticated control systems that reduce human error risks and improve emergency response times. Modern systems incorporate automated sequences for routine operations, intelligent decision-making algorithms for emergency situations, and fail-safe mechanisms that ensure proper system function under adverse conditions. Machine learning integration enables systems to optimize performance based on operational experience and environmental conditions.

Environmental focus drives development of more reliable and environmentally friendly BOP systems that minimize the risk of hydrocarbon releases and reduce environmental impact during drilling operations. Manufacturers invest in advanced sealing technologies, improved materials, and enhanced monitoring systems that provide early warning of potential failures. Sustainability initiatives include recyclable materials, energy-efficient hydraulic systems, and reduced maintenance requirements that minimize environmental footprint throughout system lifecycles.

Service evolution transforms the market from equipment-centric to service-centric business models, with manufacturers expanding beyond hardware supply to provide comprehensive lifecycle support. Performance-based contracts align manufacturer incentives with customer operational success, creating partnerships focused on system reliability and uptime optimization rather than traditional transactional relationships.

Recent industry developments highlight significant technological advancements and strategic initiatives shaping the BOP oil and gas market landscape. Major manufacturers continue investing in research and development programs focused on improving system reliability, reducing maintenance requirements, and enhancing operational efficiency through advanced technologies and innovative design approaches.

Technological breakthroughs include development of next-generation hydraulic systems with faster response times and improved reliability under extreme conditions. Advanced materials research produces specialized alloys and coatings that extend component lifecycles and reduce maintenance frequency in harsh operating environments. Control system innovations incorporate artificial intelligence and machine learning capabilities that optimize BOP performance and predict maintenance requirements before failures occur.

Strategic partnerships between BOP manufacturers and technology companies accelerate digital transformation initiatives and expand service capabilities. These collaborations combine traditional mechanical expertise with advanced digital technologies to create comprehensive solutions that address evolving customer requirements. Acquisition activities consolidate market capabilities and expand geographic reach for major industry participants seeking to strengthen competitive positions.

Regulatory developments continue influencing market dynamics through updated safety standards and enhanced testing requirements. Recent initiatives focus on improving BOP system reliability, standardizing performance metrics, and enhancing emergency response protocols. MWR analysis indicates that regulatory changes typically drive equipment upgrade cycles that create substantial market opportunities for manufacturers offering compliant solutions with enhanced capabilities.

Strategic recommendations for BOP market participants emphasize the importance of investing in digital transformation initiatives that differentiate products and services in an increasingly competitive marketplace. Companies should prioritize development of smart BOP systems incorporating IoT connectivity, predictive analytics, and automated control capabilities that provide substantial value propositions for operators seeking to optimize safety and operational efficiency.

Market expansion strategies should focus on emerging regions with growing energy exploration activities, particularly in Asia-Pacific, Africa, and Latin America. Establishing local partnerships, service capabilities, and manufacturing presence enables companies to capture growth opportunities while providing responsive customer support. Technology transfer programs can accelerate market penetration while building long-term relationships with local energy industries.

Service development represents a critical success factor, with companies advised to expand beyond traditional equipment supply to offer comprehensive lifecycle support including installation, maintenance, training, and performance optimization services. Performance-based contracting models align manufacturer incentives with customer success while creating predictable revenue streams that reduce business cyclicality.

Innovation investment should concentrate on areas with highest customer impact, including system reliability improvements, maintenance reduction technologies, and enhanced safety capabilities. Companies should also explore opportunities in adjacent markets such as renewable energy infrastructure and carbon capture systems that may require similar safety equipment and expertise. Collaborative research with customers and technology partners can accelerate innovation while ensuring market relevance of new developments.

Future market prospects for the BOP oil and gas industry remain positive despite evolving energy landscapes and increasing focus on renewable energy sources. The essential nature of safety equipment ensures continued demand for BOP systems as long as oil and gas exploration and production activities continue globally. Market evolution will likely emphasize technological sophistication, service integration, and environmental responsibility as key differentiating factors.

Technology advancement will continue driving market transformation through digital integration, automation enhancement, and materials innovation. Future BOP systems will likely feature comprehensive digital connectivity, artificial intelligence-powered optimization, and autonomous operation capabilities that minimize human intervention while maximizing safety and reliability. Predictive maintenance technologies will become standard features, enabling proactive system management and reducing unplanned downtime.

Regional growth patterns indicate continued expansion in emerging markets as developing countries increase energy exploration activities and modernize drilling infrastructure. Asia-Pacific markets show particular promise, with projected growth rates exceeding global averages driven by increasing energy demand and substantial infrastructure investments. MarkWide Research projections suggest that emerging markets will account for growing market share over the next decade as established markets mature.

Industry consolidation may accelerate as companies seek to achieve economies of scale, expand technological capabilities, and strengthen global market positions. Strategic partnerships and acquisitions will likely focus on combining complementary technologies and expanding service capabilities to create comprehensive solutions for evolving customer requirements. Sustainability initiatives will increasingly influence market dynamics as environmental considerations become more prominent in equipment selection and operational decisions.

The Blow Out Preventer oil and gas market represents a critical and resilient segment of the global energy infrastructure, characterized by steady demand growth, continuous technological advancement, and essential safety requirements that transcend industry cycles. The market benefits from non-discretionary spending patterns, regulatory mandates, and increasing complexity of drilling operations that require sophisticated safety equipment and comprehensive service support.

Market dynamics indicate sustained growth opportunities driven by expanding offshore drilling activities, deepwater exploration expansion, and emerging market development. Digital transformation initiatives create new value propositions through smart systems, predictive maintenance, and performance optimization capabilities that enhance safety while reducing operational costs. Service evolution transforms traditional equipment-centric business models toward comprehensive lifecycle partnerships that align manufacturer success with customer operational excellence.

Strategic success in the BOP market requires balanced investment in technological innovation, service capability development, and global market expansion. Companies that effectively combine advanced engineering capabilities with comprehensive service offerings and strong customer relationships will be best positioned to capitalize on growth opportunities while navigating industry challenges. The market’s fundamental importance to energy industry safety ensures continued relevance and growth potential despite evolving energy landscapes and increasing environmental consciousness.

What is Blow Out Preventer (BOP)?

A Blow Out Preventer (BOP) is a critical safety device used in the oil and gas industry to prevent uncontrolled releases of crude oil or natural gas from a well. It is designed to seal, control, and monitor oil and gas wells to ensure safe drilling operations.

What are the key companies in the Blow Out Preventer (BOP) Oil and Gas Market?

Key companies in the Blow Out Preventer (BOP) Oil and Gas Market include Schlumberger, Halliburton, Baker Hughes, and National Oilwell Varco, among others.

What are the growth factors driving the Blow Out Preventer (BOP) Oil and Gas Market?

The growth of the Blow Out Preventer (BOP) Oil and Gas Market is driven by increasing offshore drilling activities, the need for enhanced safety measures in oil extraction, and rising investments in oil and gas exploration.

What challenges does the Blow Out Preventer (BOP) Oil and Gas Market face?

Challenges in the Blow Out Preventer (BOP) Oil and Gas Market include high operational costs, stringent regulatory requirements, and the need for regular maintenance and testing of BOP systems.

What opportunities exist in the Blow Out Preventer (BOP) Oil and Gas Market?

Opportunities in the Blow Out Preventer (BOP) Oil and Gas Market include advancements in technology for more efficient BOP systems, increasing demand for deepwater drilling, and the potential for new markets in emerging economies.

What trends are shaping the Blow Out Preventer (BOP) Oil and Gas Market?

Trends in the Blow Out Preventer (BOP) Oil and Gas Market include the integration of digital technologies for monitoring and control, a focus on sustainability and environmental safety, and the development of more compact and efficient BOP designs.

Blow Out Preventer (BOP) Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Type | Annular BOP, Ram BOP, Stack BOP, Subsea BOP |

| Technology | Hydraulic, Electric, Mechanical, Remote Operated |

| End User | Exploration Companies, Drilling Contractors, Service Providers, Offshore Operators |

| Installation | Onshore, Offshore, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Blow Out Preventer (BOP) Oil and Gas Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at