444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview: The blood purification consumable market comprises a range of medical devices and consumables used in extracorporeal blood purification therapies, including hemodialysis, hemofiltration, and plasmapheresis. These consumables are essential components of blood purification systems, facilitating the removal of toxins, metabolic waste products, and excess fluids from the bloodstream in patients with renal failure, sepsis, and other critical illnesses.

Meaning: Blood purification consumables refer to disposable components and accessories utilized in extracorporeal blood purification therapies to remove toxins, solutes, and other harmful substances from the bloodstream. These consumables include hemodialysis filters, dialysis membranes, blood tubing sets, dialysate solutions, and anticoagulant solutions, among others. They play a crucial role in ensuring the safety, efficacy, and efficiency of blood purification treatments.

Executive Summary: The blood purification consumable market is driven by the increasing prevalence of chronic kidney disease, rising demand for renal replacement therapies, and technological advancements in blood purification systems. Blood purification consumables are vital for the delivery of extracorporeal therapies, providing patients with life-sustaining treatments and improving clinical outcomes. Market players are focused on innovation, product development, and strategic collaborations to address unmet needs and enhance the quality of care for patients undergoing blood purification therapies.

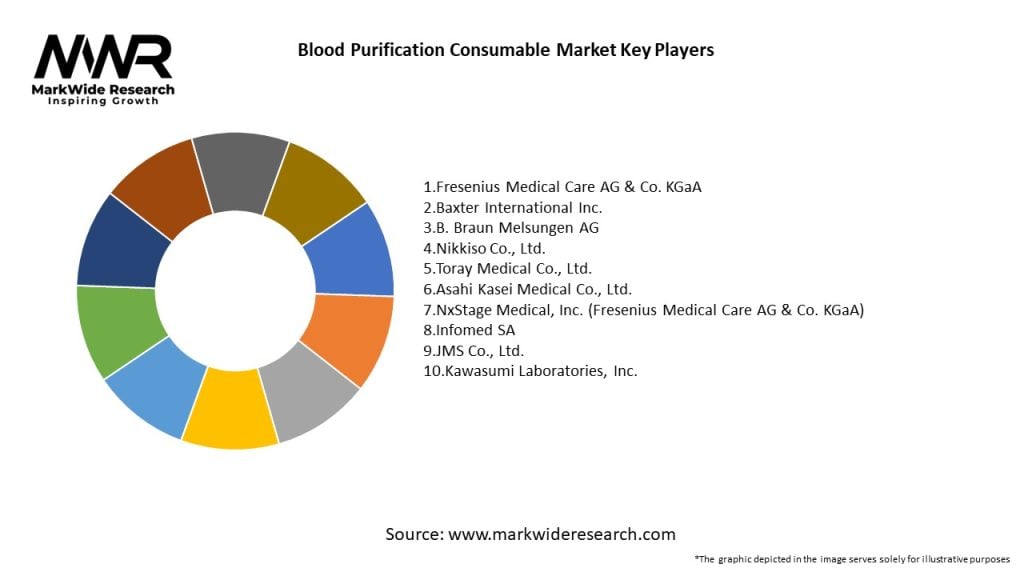

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The blood purification consumable market is characterized by dynamic factors such as technological innovation, regulatory landscape changes, competitive dynamics, and evolving patient demographics. Market players need to navigate these dynamics, adapt to changing market conditions, and invest in strategies that address market needs and opportunities.

Regional Analysis: The blood purification consumable market exhibits regional variations in terms of market size, growth potential, regulatory landscape, and healthcare infrastructure. North America and Europe are the largest markets for blood purification consumables, driven by established healthcare systems, favorable reimbursement policies, and high prevalence of kidney disease. However, Asia Pacific is witnessing rapid market growth due to increasing healthcare investments, rising prevalence of CKD, and expanding dialysis services.

Competitive Landscape:

Leading Companies in Blood Purification Consumable Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The blood purification consumable market can be segmented based on product type, application, end-user, and geography. Product types include hemodialysis filters, dialysis membranes, blood tubing sets, dialysate solutions, and anticoagulant solutions. Applications encompass hemodialysis, hemofiltration, plasmapheresis, and other extracorporeal therapies. End-users comprise hospitals, dialysis centers, ambulatory surgical centers, and home care settings.

Category-wise Insights: Blood purification consumables offer various features and benefits such as biocompatibility, sterilizability, and compatibility with different dialysis systems. Different categories of consumables cater to specific clinical requirements, patient populations, and treatment modalities, with options available for both conventional and advanced blood purification therapies.

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing blood purification consumable manufacturers and market participants.

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has underscored the importance of blood purification therapies in managing critically ill patients with acute kidney injury (AKI) and sepsis-related organ dysfunction. While the pandemic initially disrupted supply chains and clinical operations, it also highlighted the resilience of blood purification consumable manufacturers and the critical role of extracorporeal therapies in critical care settings.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The blood purification consumable market is poised for steady growth driven by factors such as increasing prevalence of kidney disease, growing demand for renal replacement therapies, and technological advancements in blood purification systems. Market players need to focus on innovation, collaboration, and strategic investments to capitalize on growth opportunities and address evolving market dynamics.

Conclusion: Blood purification consumables are integral components of extracorporeal blood purification therapies, enabling the removal of toxins, metabolic waste products, and excess fluids from the bloodstream in patients with renal failure and critical illnesses. The market for blood purification consumables is characterized by technological innovation, market expansion, and regulatory complexities. Manufacturers need to focus on innovation, market expansion, and digital transformation to drive growth and differentiation in the competitive landscape of the global blood purification consumable market.

What is Blood Purification Consumable?

Blood purification consumables refer to the materials and products used in processes that remove toxins, waste, and impurities from the blood. These consumables are essential in various medical treatments, including dialysis and therapeutic apheresis.

What are the key players in the Blood Purification Consumable Market?

Key players in the Blood Purification Consumable Market include Fresenius Medical Care, Baxter International, and B. Braun Melsungen AG. These companies are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the Blood Purification Consumable Market?

The Blood Purification Consumable Market is driven by the increasing prevalence of chronic kidney diseases and the rising demand for dialysis treatments. Additionally, advancements in technology and growing awareness about blood purification therapies contribute to market growth.

What challenges does the Blood Purification Consumable Market face?

The Blood Purification Consumable Market faces challenges such as high costs associated with advanced purification technologies and regulatory hurdles in product approvals. Furthermore, the availability of alternative treatments can also impact market growth.

What opportunities exist in the Blood Purification Consumable Market?

Opportunities in the Blood Purification Consumable Market include the development of innovative and cost-effective products, as well as expanding into emerging markets. The increasing focus on personalized medicine and home-based therapies also presents significant growth potential.

What trends are shaping the Blood Purification Consumable Market?

Trends in the Blood Purification Consumable Market include the integration of smart technologies in devices, such as remote monitoring and data analytics. Additionally, there is a growing emphasis on sustainability and eco-friendly materials in product development.

Blood Purification Consumable Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dialyzers, Blood Filters, Apheresis Kits, Hemoperfusion Cartridges |

| Application | Chronic Kidney Disease, Acute Kidney Injury, Liver Disease, Autoimmune Disorders |

| End User | Hospitals, Dialysis Centers, Home Care, Research Laboratories |

| Technology | Conventional, High-Flux, Online Hemodiafiltration, Continuous Renal Replacement Therapy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Blood Purification Consumable Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at