444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The blood plasma fractionation technology market encompasses a range of processes used to separate and purify plasma proteins from donated blood plasma for therapeutic use. This market plays a crucial role in producing essential plasma-derived products such as immunoglobulins, albumin, clotting factors, and alpha-1 proteinase inhibitors used in the treatment of various medical conditions. The demand for plasma-derived therapies is driven by factors such as the increasing prevalence of chronic diseases, advancements in biotechnology, and growing awareness of the therapeutic benefits of plasma products.

Meaning

Blood plasma fractionation technology refers to the process of fractionating or separating plasma proteins from donated human blood plasma to produce therapeutic products. Plasma fractionation involves several steps, including separation, purification, and viral inactivation, to obtain highly purified plasma-derived proteins suitable for therapeutic use. These plasma-derived products serve as critical treatments for patients with immune deficiencies, bleeding disorders, autoimmune diseases, and other medical conditions.

Executive Summary

The blood plasma fractionation technology market is experiencing significant growth driven by the increasing demand for plasma-derived therapies worldwide. Key market players are investing in research and development initiatives to enhance manufacturing processes, improve product quality, and expand therapeutic indications. With the rising prevalence of chronic diseases and the growing aging population, the market for plasma-derived products is poised for continued expansion in the coming years.

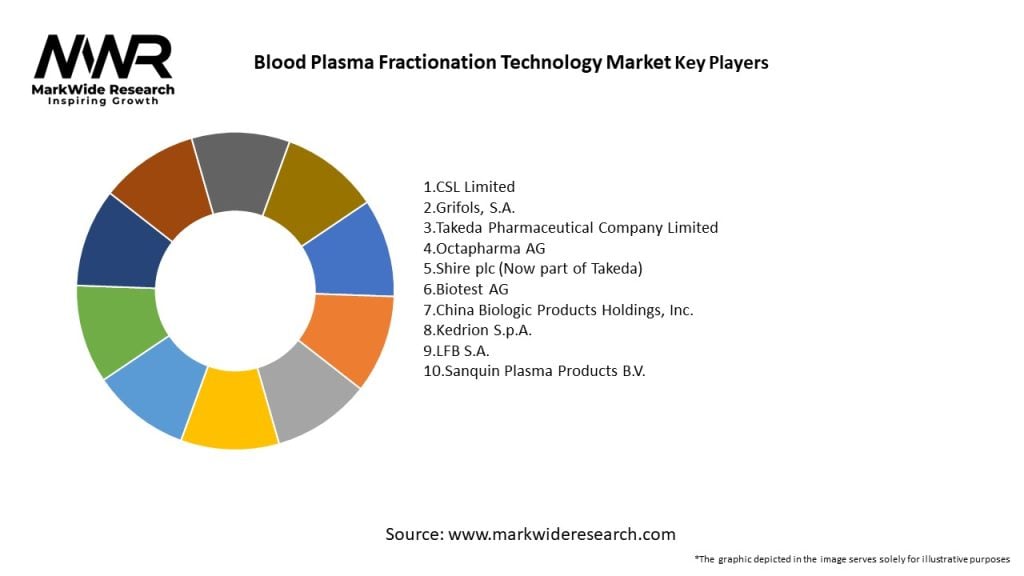

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The blood plasma fractionation technology market is characterized by complex interactions between scientific advancements, regulatory frameworks, market dynamics, and patient needs. Market participants must navigate these dynamics by fostering collaborations, embracing innovation, and prioritizing patient-centered care to address evolving challenges and opportunities in plasma therapy.

Regional Analysis

The blood plasma fractionation technology market exhibits regional variations influenced by factors such as population demographics, healthcare infrastructure, regulatory environments, and market dynamics. North America and Europe dominate the market due to established plasma fractionation facilities, robust regulatory oversight, and high demand for plasma-derived therapies. Emerging economies in Asia Pacific, Latin America, and the Middle East offer significant growth potential driven by increasing healthcare investments and rising patient awareness of plasma products.

Competitive Landscape

The blood plasma fractionation technology market is highly competitive, with key players including CSL Behring LLC, Grifols, S.A., Takeda Pharmaceutical Company Limited, Octapharma AG, and Kedrion S.p.A. Competitive strategies focus on product innovation, regulatory compliance, market expansion, and strategic alliances to maintain market leadership and meet the diverse needs of patients worldwide.

Segmentation

The blood plasma fractionation technology market can be segmented based on product type, application, end-user, and geography. Product types include immunoglobulins, albumin, coagulation factors, and specialty plasma products. Applications range from primary immunodeficiency disorders and bleeding disorders to autoimmune diseases, neurological conditions, and infectious diseases. End-users encompass hospitals, clinics, specialty pharmacies, and home healthcare settings.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has highlighted the importance of plasma-derived therapies in managing infectious diseases, immune disorders, and critical care conditions. The crisis has led to increased demand for convalescent plasma, hyperimmune globulins, and monoclonal antibodies for treating Covid-19 patients and preventing severe disease outcomes. While the pandemic has strained plasma collection efforts and disrupted supply chains, it has also underscored the resilience of the plasma industry and the value of plasma therapies in public health emergencies.

Key Industry Developments

Analyst Suggestions

Future Outlook

The blood plasma fractionation technology market is expected to witness sustained growth driven by the increasing demand for plasma-derived therapies, advancements in biotechnology, and evolving healthcare needs worldwide. Continued investment in research, innovation, and regulatory compliance will drive market expansion, therapeutic innovation, and patient access to life-saving plasma products in the years to come.

Conclusion

The blood plasma fractionation technology market plays a critical role in providing essential plasma-derived therapies for patients with rare diseases, chronic conditions, and life-threatening illnesses. As the global demand for plasma products continues to rise, stakeholders must prioritize patient safety, regulatory compliance, and supply chain resilience to ensure uninterrupted access to plasma-derived treatments and support the health and well-being of individuals worldwide. By embracing innovation, collaboration, and patient-centered care, the blood plasma fractionation technology market can fulfill its mission of saving lives, improving health outcomes, and advancing medical science for generations to come.

Blood Plasma Fractionation Technology Market

| Segmentation Details | Description |

|---|---|

| Product Type | Immunoglobulins, Albumin, Coagulation Factors, Proteins |

| Application | Therapeutic, Diagnostic, Research, Clinical |

| End User | Hospitals, Blood Banks, Research Laboratories, Clinics |

| Technology | Chromatography, Precipitation, Filtration, Centrifugation |

Leading Companies in Blood Plasma Fractionation Technology Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at