444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The blockchain in oil and gas market is experiencing significant growth as the industry seeks innovative solutions to improve transparency, efficiency, and security in operations and transactions. Blockchain technology offers decentralized, tamper-proof data management, enabling stakeholders to streamline processes, reduce costs, mitigate risks, and enhance trust and collaboration across the oil and gas value chain. With increasing adoption of digitalization and industry 4.0 technologies, blockchain is poised to revolutionize various aspects of the oil and gas industry, including supply chain management, trading, logistics, compliance, and asset management.

Meaning

Blockchain technology is a decentralized digital ledger that records transactions across multiple computers in a secure and transparent manner. Each transaction, or “block,” is cryptographically linked to the previous block, forming a chain of immutable records. In the oil and gas industry, blockchain enables secure, transparent, and efficient management of data and transactions, facilitating trust and collaboration among stakeholders such as producers, suppliers, traders, regulators, and consumers. By providing a single source of truth and eliminating the need for intermediaries, blockchain enhances transparency, reduces costs, and accelerates decision-making in complex, global supply chains.

Executive Summary

The blockchain in oil and gas market is poised for rapid growth driven by increasing digitalization, globalization, and regulatory scrutiny in the industry. Key players in the market are leveraging blockchain technology to address challenges such as data silos, inefficient processes, and fraud risks, enabling stakeholders to unlock new value and opportunities in areas such as supply chain management, trading, logistics, compliance, and asset management. With a focus on interoperability, scalability, and security, blockchain solutions are reshaping the future of the oil and gas industry, enabling greater transparency, efficiency, and sustainability in operations and transactions.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The blockchain in oil and gas market is influenced by a combination of factors, including technological advancements, regulatory requirements, industry standards, and market dynamics shaping demand, supply, and adoption of blockchain solutions. Key players in the market must navigate these dynamics, collaborate with stakeholders, and invest in innovation to drive blockchain adoption, interoperability, and scalability in the oil and gas industry, enabling greater transparency, efficiency, and sustainability in operations and transactions.

Regional Analysis

The blockchain in oil and gas market is global in nature, with companies, organizations, and stakeholders located in regions around the world with varying levels of digitalization, regulatory frameworks, and market dynamics. While regions such as North America, Europe, and Asia-Pacific are leading markets for blockchain adoption in the oil and gas industry, emerging markets in Latin America, Africa, and the Middle East offer significant growth opportunities for companies seeking to expand their global footprint and address the needs of stakeholders in diverse geographies and sectors.

Competitive Landscape

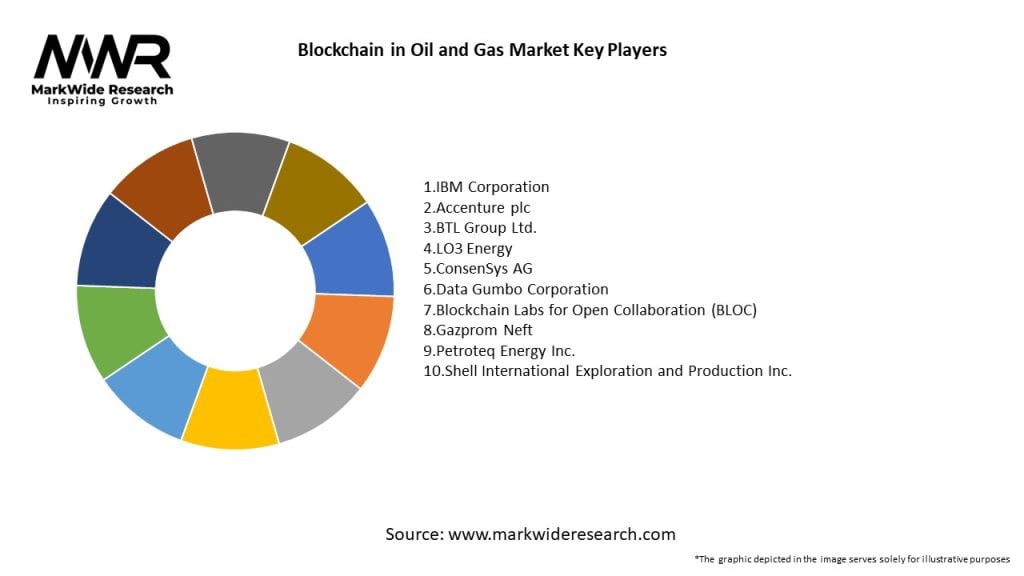

The blockchain in oil and gas market is characterized by intense competition among technology providers, service providers, and industry players offering a wide range of blockchain solutions, platforms, and services to meet the diverse needs and preferences of stakeholders across the value chain. Key players in the market include IBM Corporation, Accenture PLC, SAP SE, Microsoft Corporation, and Oracle Corporation, among others. These companies compete on factors such as technology innovation, product development, scalability, security, and customer service to gain a competitive edge and capture market share in the rapidly growing blockchain in oil and gas market.

Segmentation

The blockchain in oil and gas market can be segmented based on technology, application, end-user industry, and geographic region. By technology, the market includes public blockchains, private blockchains, and hybrid blockchains. By application, the market includes supply chain management, trading and logistics, compliance and regulatory reporting, asset management, and others. By end-user industry, the market includes upstream exploration and production, midstream transportation and logistics, downstream refining and distribution, and supporting services such as trading, financing, and regulatory compliance.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated digital transformation and innovation in the oil and gas industry, driving demand for blockchain solutions to address challenges such as supply chain disruptions, remote operations, and regulatory compliance. While the pandemic has disrupted global supply chains, reduced energy demand, and impacted oil prices, it has also highlighted the importance of resilient, efficient, and transparent supply chains, leading companies to invest in digital technologies such as blockchain to enhance agility, visibility, and trust in operations and transactions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for blockchain in oil and gas is promising, with strong growth expected driven by increasing digitalization, globalization, and regulatory scrutiny in the industry. As companies seek to enhance transparency, efficiency, and trust in operations and transactions, blockchain technology will play a critical role in reshaping the future of the oil and gas industry, enabling stakeholders to streamline processes, reduce costs, mitigate risks, and unlock new value propositions across the value chain. With a focus on interoperability, scalability, and security, blockchain solutions will continue to drive innovation, collaboration, and transformation in the oil and gas industry, enabling greater transparency, efficiency, and sustainability in operations and transactions.

Conclusion

In conclusion, blockchain technology offers significant opportunities for innovation, collaboration, and value creation in the oil and gas industry, enabling stakeholders to streamline processes, reduce costs, mitigate risks, and enhance trust and transparency across the value chain. By leveraging blockchain for supply chain management, trading, compliance, and asset management, companies can unlock new value propositions, improve efficiency, and reduce costs, leading to greater competitiveness, resilience, and sustainability in the oil and gas industry. With increasing adoption of digitalization and industry 4.0 technologies, blockchain is poised to revolutionize various aspects of the oil and gas industry, enabling stakeholders to navigate challenges, seize opportunities, and drive transformation in a dynamic and evolving market landscape.

What is Blockchain in Oil and Gas?

Blockchain in Oil and Gas refers to the application of blockchain technology to enhance transparency, security, and efficiency in the oil and gas sector. It enables secure transactions, improves supply chain management, and facilitates data sharing among stakeholders.

What are the key companies in the Blockchain in Oil and Gas Market?

Key companies in the Blockchain in Oil and Gas Market include IBM, Accenture, and Chevron, which are actively developing blockchain solutions for supply chain management and data integrity, among others.

What are the drivers of growth in the Blockchain in Oil and Gas Market?

Drivers of growth in the Blockchain in Oil and Gas Market include the need for enhanced transparency in transactions, the demand for improved supply chain efficiency, and the increasing focus on data security and integrity.

What challenges does the Blockchain in Oil and Gas Market face?

Challenges in the Blockchain in Oil and Gas Market include regulatory uncertainties, the need for industry-wide standards, and the integration of blockchain with existing legacy systems.

What opportunities exist in the Blockchain in Oil and Gas Market?

Opportunities in the Blockchain in Oil and Gas Market include the potential for smart contracts to automate transactions, the ability to track and verify the provenance of resources, and the growing interest in decentralized finance solutions.

What trends are shaping the Blockchain in Oil and Gas Market?

Trends shaping the Blockchain in Oil and Gas Market include the increasing adoption of decentralized applications, the rise of collaborative platforms among industry players, and the integration of blockchain with IoT for real-time data tracking.

Blockchain in Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Application | Supply Chain Management, Smart Contracts, Asset Tracking, Regulatory Compliance |

| Technology | Private Blockchain, Public Blockchain, Consortium Blockchain, Hybrid Blockchain |

| End User | Exploration Companies, Production Firms, Service Providers, Regulatory Bodies |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

Leading Companies in the Blockchain in Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at