444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Bitcoin pooling platform market serves as a vital component of the cryptocurrency ecosystem, providing miners with an avenue to combine their computational resources and collectively mine Bitcoin. These platforms enable miners to pool their resources, share rewards, and increase their chances of successfully mining blocks, thereby contributing to the security and stability of the Bitcoin network. The Bitcoin pooling platform market has witnessed significant growth alongside the expansion of the cryptocurrency mining industry, driven by factors such as increasing Bitcoin adoption, technological advancements, and the growing complexity of mining operations.

Meaning

Bitcoin pooling platforms, also known as mining pools, allow individual miners to collaborate and work together to mine Bitcoin more efficiently. In the decentralized Bitcoin network, miners compete to solve complex mathematical puzzles and validate transactions by adding them to the blockchain. However, the increasing difficulty of these puzzles and the rise of specialized mining hardware have made solo mining less profitable for individual miners. Bitcoin pooling platforms address this challenge by pooling together the hash power of multiple miners, increasing their collective chances of mining new blocks and earning rewards.

Executive Summary

The Bitcoin pooling platform market has experienced rapid growth in recent years, driven by the increasing complexity of Bitcoin mining, the proliferation of mining hardware, and the desire for miners to maximize their earnings. These platforms offer various benefits to miners, including increased mining efficiency, reduced variance in rewards, and access to advanced mining tools and technologies. However, the market also faces challenges such as centralization concerns, security risks, and regulatory uncertainty. Understanding the key market trends, challenges, and opportunities is essential for participants in the Bitcoin pooling platform market to navigate the evolving landscape and make informed decisions.

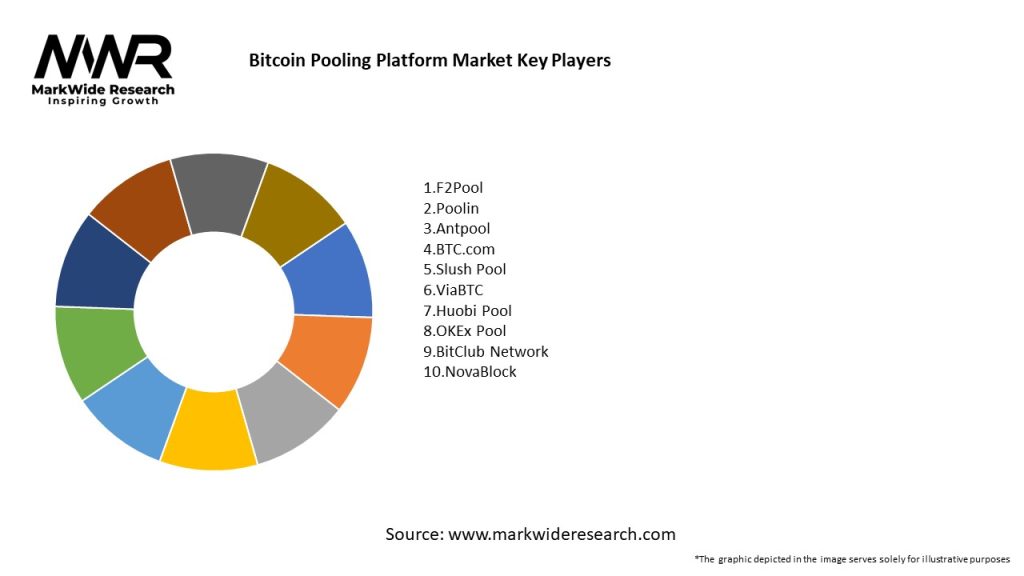

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Bitcoin pooling platform market is influenced by several key factors:

Market Drivers

Several factors drive the growth of the Bitcoin pooling platform market:

Market Restraints

Despite its growth potential, the Bitcoin pooling platform market faces several challenges:

Market Opportunities

Despite the challenges, the Bitcoin pooling platform market presents several opportunities for growth and innovation:

Market Dynamics

The Bitcoin pooling platform market operates in a dynamic environment shaped by technological advancements, regulatory developments, market competition, and investor sentiment. These dynamics influence market trends, participant behavior, and the evolution of pooling platforms:

Regional Analysis

The Bitcoin pooling platform market exhibits regional variations influenced by factors such as electricity costs, regulatory environments, mining infrastructure, and market maturity:

Competitive Landscape

Leading Companies in the Bitcoin Pooling Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Bitcoin pooling platform market can be segmented based on various factors such as:

Category-wise Insights

Bitcoin pooling platforms offer various services and features to miners:

Key Benefits for Miners

Bitcoin pooling platforms offer several benefits to miners:

SWOT Analysis

A SWOT analysis of the Bitcoin pooling platform market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors through a SWOT analysis helps miners and platform operators identify market trends, assess risks, and capitalize on opportunities in the Bitcoin pooling platform market.

Market Key Trends

The Bitcoin pooling platform market is influenced by several key trends:

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the Bitcoin pooling platform market:

Key Industry Developments

Several key developments are shaping the future of the Bitcoin pooling platform market:

Analyst Suggestions

Based on market trends and developments, analysts offer the following suggestions for participants in the Bitcoin pooling platform market:

Future Outlook

The Bitcoin pooling platform market is expected to witness continued growth and evolution in the coming years, driven by technological advancements, regulatory developments, market competition, and investor demand. Key factors shaping the market’s future outlook include:

Understanding these trends and developments is essential for participants in the Bitcoin pooling platform market to navigate the evolving landscape, seize opportunities, and mitigate risks in an increasingly competitive and dynamic market environment.

Conclusion

The Bitcoin pooling platform market plays a crucial role in the cryptocurrency ecosystem, providing miners with an avenue to collaborate and collectively mine Bitcoin more efficiently. Despite challenges such as centralization concerns, security risks, and regulatory uncertainty, the market offers significant opportunities for growth and innovation. Decentralized pooling models, specialized services, regulatory compliance solutions, and technological innovation are driving the evolution of the market, shaping its future outlook and sustainability. By staying informed, adapting to market trends, and embracing technological advancements, participants in the Bitcoin pooling platform market can position themselves for success and contribute to the growth and resilience of the Bitcoin network.

What is Bitcoin Pooling Platform?

A Bitcoin Pooling Platform is a service that allows multiple users to combine their computational resources to mine Bitcoin more efficiently. This collaborative approach increases the chances of earning Bitcoin rewards by pooling resources and sharing the rewards among participants.

What are the key players in the Bitcoin Pooling Platform Market?

Key players in the Bitcoin Pooling Platform Market include companies like Slush Pool, F2Pool, and Antpool, which provide various mining services and features. These platforms cater to different user needs, such as ease of use, payout structures, and mining strategies, among others.

What are the growth factors driving the Bitcoin Pooling Platform Market?

The Bitcoin Pooling Platform Market is driven by factors such as the increasing popularity of cryptocurrency mining, the rising number of Bitcoin users, and advancements in mining technology. Additionally, the potential for higher returns through pooled resources attracts more participants to these platforms.

What challenges does the Bitcoin Pooling Platform Market face?

Challenges in the Bitcoin Pooling Platform Market include regulatory uncertainties, high competition among platforms, and the volatility of Bitcoin prices. These factors can impact user trust and participation in mining activities.

What opportunities exist in the Bitcoin Pooling Platform Market?

Opportunities in the Bitcoin Pooling Platform Market include the development of innovative mining algorithms, the integration of advanced security features, and the expansion into emerging markets. These advancements can enhance user experience and attract new miners.

What trends are shaping the Bitcoin Pooling Platform Market?

Trends in the Bitcoin Pooling Platform Market include the rise of decentralized mining pools, increased focus on energy-efficient mining practices, and the use of artificial intelligence to optimize mining operations. These trends reflect the evolving landscape of cryptocurrency mining.

Bitcoin Pooling Platform Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mining Pool, Staking Pool, Yield Farming, Liquidity Pool |

| Technology | Proof of Work, Proof of Stake, Hybrid, Centralized |

| End User | Individual Miners, Institutional Investors, Crypto Enthusiasts, Developers |

| Deployment | Cloud-Based, On-Premises, Hybrid, Decentralized |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Bitcoin Pooling Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at