444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The bioreactors and fermenters market is witnessing significant growth and is expected to continue its upward trajectory in the coming years. Bioreactors and fermenters are essential equipment used in various industries such as pharmaceuticals, biotechnology, food and beverages, and agriculture, among others. These devices provide controlled environments for the cultivation of microorganisms or cells, allowing for the production of a wide range of products, including therapeutic proteins, vaccines, enzymes, biofuels, and fermented foods.

Meaning

Bioreactors and fermenters are specialized vessels designed to support the growth and reproduction of microorganisms or cells under carefully controlled conditions. They provide the necessary environment for the cultivation of cells, enabling the production of various products through biological processes. Bioreactors are commonly used in industries where large-scale production of biological substances is required, such as pharmaceuticals and biotechnology.

Executive Summary

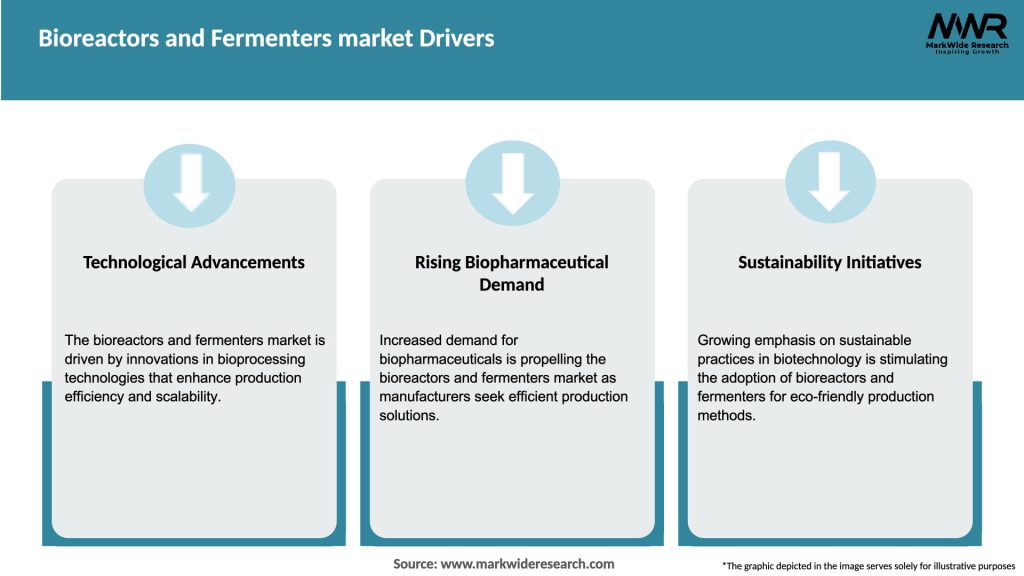

The bioreactors and fermenters market is experiencing substantial growth due to the increasing demand for biopharmaceuticals, advancements in bioprocess technology, and the rising adoption of single-use systems. The market is characterized by the presence of key players offering a wide range of products and technologies. The increasing focus on personalized medicine and the growing trend of outsourcing bioprocessing activities are further driving market growth. However, stringent regulations and the high cost of bioreactors and fermenters pose challenges to market expansion.

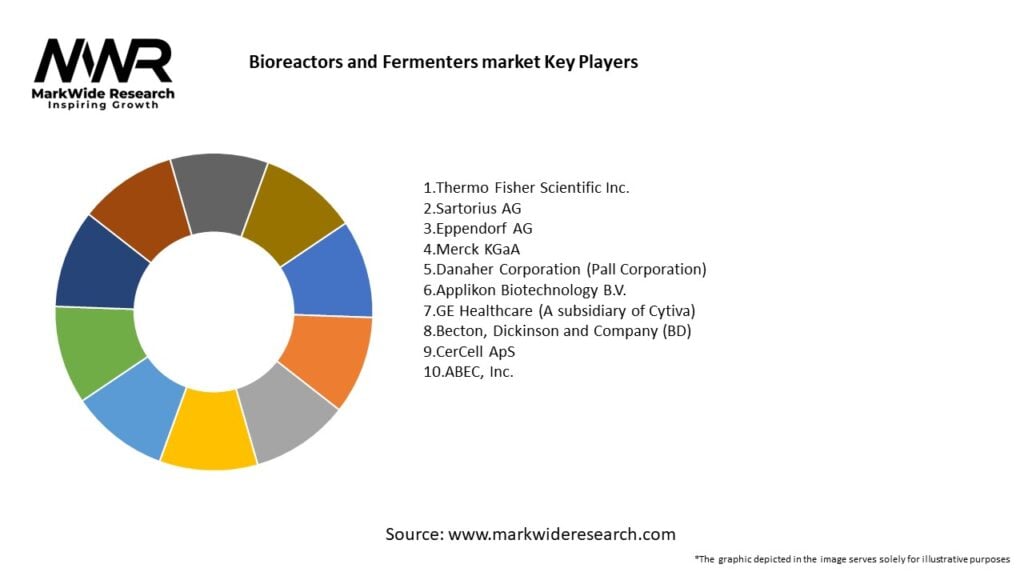

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The bioreactors and fermenters market is characterized by dynamic factors that influence its growth and development. These dynamics include market drivers, restraints, opportunities, and challenges that shape the industry landscape.

Market drivers, such as the growing demand for biopharmaceuticals and advancements in bioprocess technology, propel market growth. The rising adoption of single-use systems and the outsourcing of bioprocessing activities further contribute to the expansion of the market.

On the other hand, market restraints, including stringent regulations, the high cost of bioreactors and fermenters, and the scarcity of skilled professionals, pose challenges to market growth. However, these challenges also create opportunities for innovation and development in the industry.

The market dynamics are influenced by various external factors, such as government policies, regulatory frameworks, technological advancements, economic conditions, and consumer preferences. Staying updated with these dynamics is crucial for market participants to capitalize on emerging trends and seize growth opportunities.

Regional Analysis

The bioreactors and fermenters market exhibits significant regional variations, influenced by factors such as technological advancements, healthcare infrastructure, government initiatives, and economic conditions. The key regions analyzed in the market include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America and Europe dominate the market due to their well-established healthcare infrastructure, substantial investments in research and development, and favorable regulatory frameworks. These regions are at the forefront of technological advancements in bioprocessing, driving the demand for bioreactors and fermenters.

Asia Pacific is expected to witness substantial growth in the market due to the increasing investments in biotechnology, pharmaceuticals, and contract manufacturing. Countries like China and India are emerging as major players in the global bioreactors and fermenters market, fueled by a large consumer base, favorable government policies, and the presence of skilled labor.

Latin America and the Middle East and Africa are also experiencing growth in the bioreactors and fermenters market, driven by the expansion of the pharmaceutical and biotechnology sectors and increasing healthcare expenditure in these regions.

Leading Companies in the Bioreactors and Fermenters Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

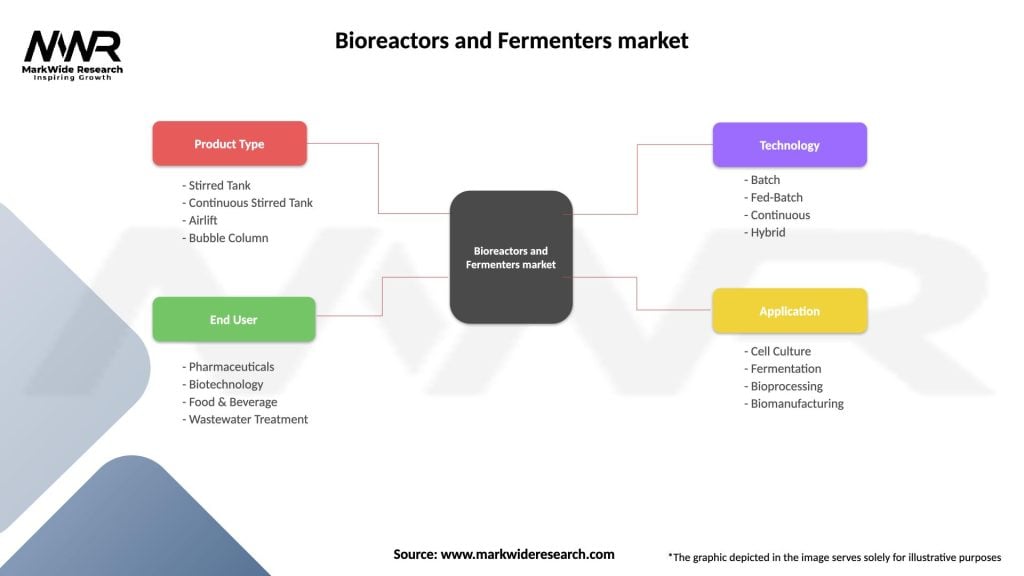

Segmentation

The bioreactors and fermenters market can be segmented based on various factors, including product type, application, end-user, and geography. Segmentation provides a deeper understanding of the market dynamics and allows companies to tailor their strategies to specific customer segments. The following are some common segmentation categories in the market:

Segmentation helps market participants understand the specific needs and preferences of different customer segments, enabling them to develop targeted marketing strategies and product offerings.

Category-wise Insights

Each category of bioreactors has its own advantages and considerations, and the selection depends on factors such as scale of production, application requirements, budget, and regulatory compliance.

Key Benefits for Industry Participants and Stakeholders

The bioreactors and fermenters market offers numerous benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The bioreactors and fermenters market is influenced by several key trends that shape its trajectory. Understanding these trends helps market participants stay ahead of the curve and make informed business decisions. Some key trends in the market include:

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the bioreactors and fermenters market. The global healthcare crisis led to an unprecedented demand for vaccines, therapeutic proteins, and diagnostic reagents, driving the need for bioprocessing technologies. The market witnessed a surge in investments and collaborations to accelerate the development and production of Covid-19 vaccines and treatments.

The pandemic highlighted the importance of agile and scalable bioprocessing capabilities to respond effectively to emerging infectious diseases. It further emphasized the need for flexible manufacturing systems, such as single-use bioreactors, to enable rapid process development and scale-up.

Additionally, the pandemic led to disruptions in global supply chains, highlighting the importance of localized bioprocessing capabilities to ensure continuity of essential healthcare products. This has prompted governments and companies to invest in strengthening domestic biomanufacturing capacities.

While the pandemic presented challenges such as supply chain disruptions and regulatory hurdles, it also created opportunities for innovation and collaboration within the bioreactors and fermenters market. The lessons learned from the pandemic are likely to shape the future of bioprocessing, with a greater focus on flexibility, adaptability, and preparedness for future health crises.

Key Industry Developments

The bioreactors and fermenters market has witnessed several key industry developments in recent years, including:

Analyst Suggestions

Based on market trends and developments, industry analysts suggest the following strategies for market participants:

Future Outlook

The future outlook for the bioreactors and fermenters market is promising, driven by the increasing demand for biopharmaceuticals, advancements in bioprocessing technologies, and the expanding applications of bioreactors and fermenters in various industries.

Conclusion

The bioreactors and fermenters market is witnessing substantial growth and is expected to continue its upward trajectory in the coming years. The demand for biopharmaceuticals, advancements in bioprocessing technologies, and the expanding applications of bioreactors and fermenters in various industries are driving market expansion.

The market offers numerous opportunities for industry participants and stakeholders, including increased productivity, cost savings, enhanced product quality, flexibility, and scalability. The adoption of single-use systems, focus on personalized medicine, and the expansion of biotechnology and pharmaceutical industries in emerging markets present significant growth prospects. Market participants that embrace innovation, collaboration, and regulatory compliance will be well-positioned to capitalize on the opportunities and shape the future of the bioreactors and fermenters market.

What is a Bioreactor and Fermenter?

A bioreactor and fermenter is a vessel or container used to cultivate microorganisms, cells, or enzymes under controlled conditions. These systems are essential in various applications, including pharmaceuticals, food production, and biofuels.

What are the key companies in the Bioreactors and Fermenters market?

Key companies in the Bioreactors and Fermenters market include Sartorius AG, Thermo Fisher Scientific, Eppendorf AG, and Merck KGaA, among others.

What are the growth factors driving the Bioreactors and Fermenters market?

The growth of the Bioreactors and Fermenters market is driven by the increasing demand for biopharmaceuticals, advancements in biotechnology, and the rising need for sustainable production methods in various industries.

What challenges does the Bioreactors and Fermenters market face?

The Bioreactors and Fermenters market faces challenges such as high initial investment costs, the complexity of bioprocessing, and regulatory hurdles that can delay product development.

What opportunities exist in the Bioreactors and Fermenters market?

Opportunities in the Bioreactors and Fermenters market include the development of advanced bioreactor technologies, increasing investments in research and development, and the growing trend towards personalized medicine.

What trends are shaping the Bioreactors and Fermenters market?

Trends in the Bioreactors and Fermenters market include the integration of automation and digital technologies, the shift towards single-use systems, and the increasing focus on sustainability and eco-friendly practices.

Bioreactors and Fermenters market

| Segmentation Details | Description |

|---|---|

| Product Type | Stirred Tank, Continuous Stirred Tank, Airlift, Bubble Column |

| End User | Pharmaceuticals, Biotechnology, Food & Beverage, Wastewater Treatment |

| Technology | Batch, Fed-Batch, Continuous, Hybrid |

| Application | Cell Culture, Fermentation, Bioprocessing, Biomanufacturing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Bioreactors and Fermenters Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at