444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The biopharmaceutical excipients market plays a crucial role in the development and production of pharmaceutical products. Excipients are inert substances used in combination with active pharmaceutical ingredients (APIs) to enhance drug stability, bioavailability, and patient acceptability. They are essential for maintaining the integrity and functionality of pharmaceutical formulations. Biopharmaceutical excipients offer unique properties that are particularly suited for biologic drugs, which include vaccines, monoclonal antibodies, and cell therapies. These excipients contribute to the overall efficacy and safety of biopharmaceutical products.

Meaning

Biopharmaceutical excipients are substances used alongside active pharmaceutical ingredients to facilitate the manufacturing, stability, and delivery of biologic drugs. Unlike small-molecule drugs, biopharmaceuticals are large, complex molecules derived from living organisms. These excipients help maintain the structural integrity, stability, and activity of the biologic drug, ensuring its safe and effective use. They can improve the solubility, shelf life, and controlled release of the drug, enhancing its therapeutic performance.

Executive Summary

The biopharmaceutical excipients market has witnessed significant growth in recent years, driven by the increasing demand for biologic drugs and the advancements in biotechnology. The market is characterized by a wide range of excipients, including sugars, polymers, surfactants, and amino acids, among others. These excipients offer various functionalities, such as stabilizing proteins, enhancing solubility, and improving drug delivery. The market is highly competitive, with several key players vying for market share. The COVID-19 pandemic has also had a significant impact on the market, with increased focus on vaccine development and production.

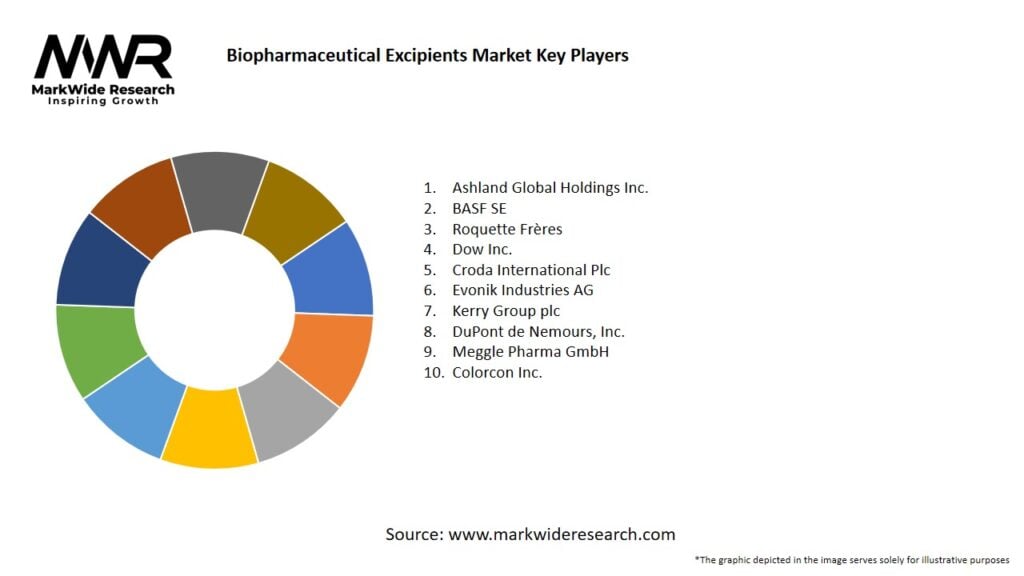

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The biopharmaceutical excipients market is highly dynamic, driven by technological advancements, regulatory landscape, and market trends. The market is influenced by the demand for biologic drugs, the development of advanced drug delivery systems, and the regulatory guidelines governing the safety and quality of excipients. Continuous research and development efforts, collaborations, and strategic partnerships among industry players contribute to market growth. The market dynamics are also shaped by factors such as pricing strategies, patent expirations, and the competitive landscape.

Regional Analysis

The biopharmaceutical excipients market exhibits regional variations based on factors such as healthcare infrastructure, regulatory policies, and the presence of key market players. North America, led by the United States, dominates the market due to the well-established biopharmaceutical industry and the presence of major pharmaceutical companies. Europe also holds a significant market share, driven by advancements in biotechnology and supportive regulatory frameworks. Asia-Pacific is expected to witness rapid growth, fueled by the increasing healthcare expenditure and rising demand for biopharmaceuticals in countries like China and India. Latin America and the Middle East and Africa regions offer untapped market potential, with improving healthcare infrastructure and growing awareness of biologic therapies.

Competitive Landscape

Leading Companies in the Biopharmaceutical Excipients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

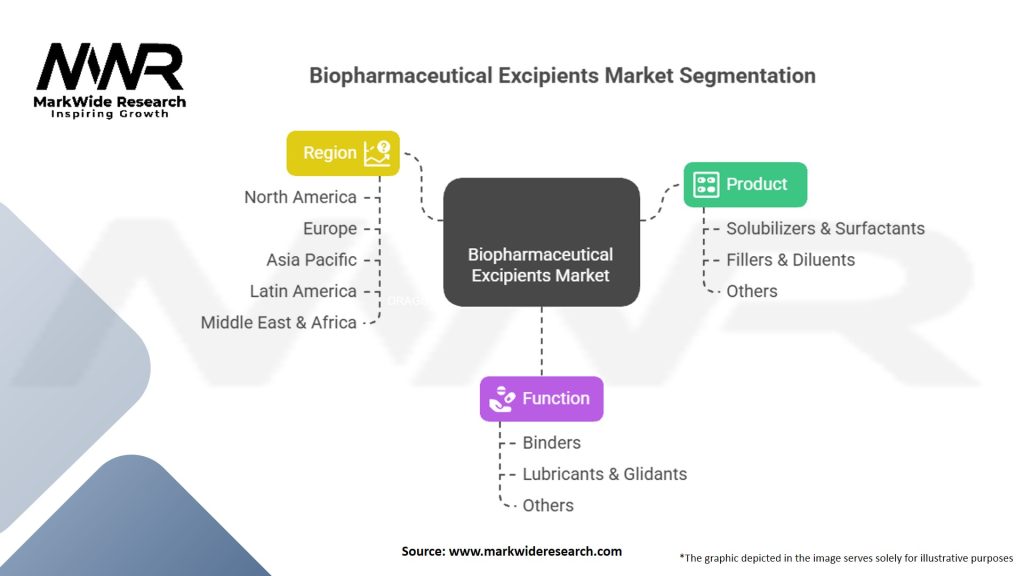

Segmentation

The biopharmaceutical excipients market can be segmented based on type, function, and end-user.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the biopharmaceutical excipients market. The development and production of vaccines and therapeutics to combat the virus have led to a surge in demand for excipients. Excipients such as stabilizers, preservatives, and adjuvants have played a crucial role in vaccine development, storage, and administration. The rapid development and emergency use authorization of COVID-19 vaccines have accelerated the adoption of excipients in the pharmaceutical industry.

The pandemic has also highlighted the importance of excipient quality and safety. Regulatory authorities have emphasized the need for stringent quality control measures and adherence to Good Manufacturing Practices (GMP) for excipient manufacturing. Excipient manufacturers have focused on ensuring a continuous supply of high-quality excipients while addressing any disruptions in the supply chain.

Furthermore, the pandemic has accelerated digitalization and automation in the pharmaceutical industry. Excipient manufacturers have increasingly adopted digital technologies for process optimization, quality control, and supply chain management. Remote monitoring and automation technologies have improved operational efficiency and ensured the uninterrupted production of excipients.

Key Industry Developments

Analyst Suggestions

Future Outlook

The biopharmaceutical excipients market is expected to witness continued growth in the coming years. The increasing demand for biologic drugs, advancements in drug delivery systems, and the focus on personalized medicine are key factors driving market expansion. Excipient manufacturers will continue to invest in research and development to develop innovative excipients and meet the evolving needs of the biopharmaceutical industry. However, companies should remain vigilant of regulatory challenges, safety concerns, and the competitive landscape to sustain their growth in the market.

Conclusion

The biopharmaceutical excipients market is witnessing significant growth due to the increasing demand for biologic drugs and advancements in biotechnology. These excipients play a crucial role in ensuring the stability, solubility, and delivery of biologic drugs, thereby enhancing their efficacy and patient acceptability. The market is characterized by a wide range of excipients with diverse functionalities. Excipient manufacturers should focus on innovation, regulatory compliance, strategic partnerships, and sustainability to capitalize on the market opportunities and contribute to the development of safe and effective biopharmaceutical formulations. The future outlook for the market is promising, driven by the continuous advancements in the biopharmaceutical industry and the growing need for personalized medicine.

What are biopharmaceutical excipients?

Biopharmaceutical excipients are inactive substances used in the formulation of biopharmaceutical products. They serve various roles, including stabilizing active ingredients, enhancing solubility, and improving the overall efficacy of the drug delivery system.

Who are the key players in the biopharmaceutical excipients market?

Key players in the biopharmaceutical excipients market include BASF SE, Evonik Industries AG, and Dow Chemical Company, among others. These companies are known for their innovative excipient solutions and extensive product portfolios.

What are the main drivers of growth in the biopharmaceutical excipients market?

The growth of the biopharmaceutical excipients market is driven by the increasing demand for biologics, advancements in drug formulation technologies, and the rising prevalence of chronic diseases. Additionally, the need for improved drug delivery systems is contributing to market expansion.

What challenges does the biopharmaceutical excipients market face?

The biopharmaceutical excipients market faces challenges such as stringent regulatory requirements, the complexity of excipient manufacturing processes, and the need for extensive testing to ensure safety and efficacy. These factors can hinder the development and approval of new excipients.

What opportunities exist in the biopharmaceutical excipients market?

Opportunities in the biopharmaceutical excipients market include the development of novel excipients tailored for specific drug formulations and the growing trend towards personalized medicine. Additionally, the increasing focus on sustainable excipients presents new avenues for innovation.

What trends are shaping the biopharmaceutical excipients market?

Current trends in the biopharmaceutical excipients market include the shift towards natural and plant-based excipients, advancements in nanotechnology for drug delivery, and the integration of smart excipients that respond to environmental stimuli. These trends are enhancing the functionality and effectiveness of biopharmaceutical products.

Biopharmaceutical Excipients Market:

| Segmentation | Details |

|---|---|

| Product | Solubilizers & Surfactants, Fillers & Diluents, Others |

| Function | Binders, Lubricants & Glidants, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Biopharmaceutical Excipients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at