444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Biological Assets Valuation market serves as a critical component within the broader agricultural and agribusiness sectors, facilitating the assessment and valuation of living organisms and biological resources used in agricultural production. These assets include crops, livestock, forests, fisheries, and other biological resources with economic value. The valuation of biological assets is essential for financial reporting, investment decision-making, risk management, and regulatory compliance purposes. With the increasing importance of sustainable agriculture, environmental conservation, and natural resource management, the demand for biological assets valuation services is on the rise.

Meaning

Biological Assets Valuation involves the estimation of the fair value of living organisms and biological resources used in agricultural production. This process includes assessing factors such as the age, health, productivity, market demand, and future potential of biological assets to determine their economic value. Valuation methods may vary depending on the type of biological asset and industry standards, but common approaches include discounted cash flow analysis, market comparisons, net realizable value, and biological transformation models. Accurate valuation of biological assets is crucial for financial reporting, taxation, insurance, investment, and transactional purposes.

Executive Summary

The Biological Assets Valuation market is experiencing growth and evolution driven by factors such as increasing demand for sustainable agriculture, growing awareness of environmental stewardship, and regulatory requirements for fair value accounting. Valuation professionals, agricultural experts, financial institutions, and government agencies play essential roles in the assessment and valuation of biological assets. While challenges such as valuation complexity, data availability, and market volatility exist, the market presents significant opportunities for innovation, technology adoption, and collaboration to address emerging needs and trends.

Key Market Insights

Key insights shaping the Biological Assets Valuation market include:

Market Drivers

Drivers fueling the growth of the Biological Assets Valuation market include:

Market Restraints

Challenges restraining market growth include:

Market Opportunities

Opportunities for growth and innovation in the Biological Assets Valuation market include:

Market Dynamics

Dynamic factors shaping the Biological Assets Valuation market include regulatory changes, technological innovations, market trends, and stakeholder expectations. Valuation professionals, agricultural producers, investors, policymakers, and civil society organizations must collaborate to address challenges, seize opportunities, and ensure the sustainable management and valuation of biological assets.

Regional Analysis

Regional variations in agricultural practices, climate conditions, land use patterns, and regulatory frameworks influence the demand for Biological Assets Valuation services. While developed economies have well-established valuation standards, data infrastructure, and institutional capacity, emerging markets offer growth opportunities driven by agricultural modernization, natural resource management, and sustainable development priorities.

Competitive Landscape

The Biological Assets Valuation market comprises a diverse ecosystem of valuation firms, agricultural consultants, financial institutions, research organizations, and government agencies. Competition revolves around factors such as expertise, reputation, service quality, innovation, and geographic coverage. Differentiation through specialized knowledge, technology adoption, and stakeholder engagement is essential for market success.

Segmentation

Segmentation of the Biological Assets Valuation market can be based on factors such as asset type, valuation purpose, industry sector, and geographic region. Understanding the unique characteristics and valuation requirements of different biological assets enables valuation professionals to tailor their services and solutions to meet client needs effectively.

Category-wise Insights

Biological Assets Valuation encompasses a range of asset categories and valuation methods, including:

Key Benefits for Industry Participants and Stakeholders

Benefits of Biological Assets Valuation services include:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats of Biological Assets Valuation services, guiding strategic decision-making for industry participants.

Market Key Trends

Trends shaping the Biological Assets Valuation market’s trajectory include:

Covid-19 Impact

The Covid-19 pandemic has had significant implications for the Biological Assets Valuation market, including:

Key Industry Developments

Recent developments in the Biological Assets Valuation market include:

Analyst Suggestions

Recommendations for stakeholders in the Biological Assets Valuation market include:

Future Outlook

The Biological Assets Valuation market is poised for continued growth and innovation as stakeholders seek to address sustainability challenges, embrace technological advancements, and adapt to changing market dynamics. Key trends such as ESG integration, digital transformation, and impact investing will shape the future of biological assets valuation, driving demand for holistic approaches, interdisciplinary expertise, and collaborative solutions to support sustainable agriculture and natural resource management.

Conclusion

Biological Assets Valuation plays a critical role in assessing the economic, environmental, and social value of living organisms and biological resources used in agriculture, forestry, fisheries, and conservation. Despite challenges such as valuation complexity, data availability, and market volatility, the market presents significant opportunities for innovation, technology adoption, and collaboration to address emerging needs and trends. By embracing interdisciplinary approaches, integrating sustainability considerations, and leveraging technology-driven solutions, stakeholders can promote responsible land stewardship, sustainable agriculture, and ecosystem resilience while delivering value for clients, communities, and future generations.

Biological Assets Valuation Market

| Segmentation Details | Description |

|---|---|

| Asset Type | Livestock, Crops, Timber, Aquaculture |

| Valuation Method | Market Approach, Income Approach, Cost Approach, Discounted Cash Flow |

| End User | Agricultural Producers, Investors, Financial Institutions, Appraisers |

| Regulatory Framework | IFRS, GAAP, Local Standards, International Standards |

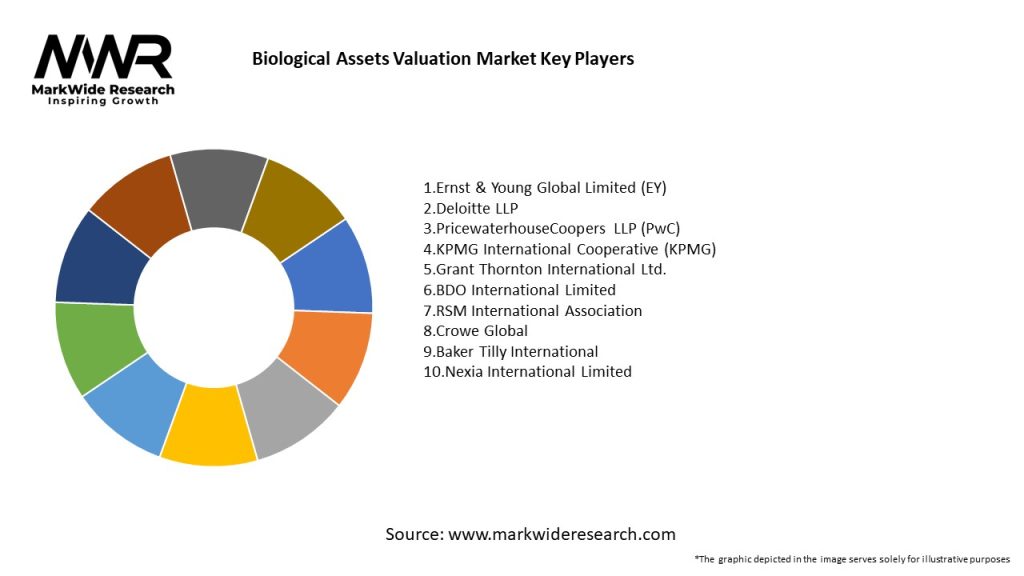

Leading Companies in the Biological Assets Valuation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at