444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Bio-insecticide market has witnessed significant growth in recent years, driven by the increasing demand for sustainable and eco-friendly pest control solutions. Bio-insecticides are derived from natural sources, such as plants, bacteria, and fungi, and are considered safer alternatives to conventional chemical insecticides. These products are gaining popularity among farmers, gardeners, and other end-users who are concerned about the harmful effects of synthetic pesticides on human health and the environment.

Meaning

Bio-insecticides, also known as biological insecticides, are pest control agents derived from natural sources. Unlike chemical insecticides, which are synthetic and often toxic, bio-insecticides are formulated using living organisms or their byproducts. These products offer effective pest management while minimizing the negative impact on non-target organisms, beneficial insects, and the environment as a whole. Bio-insecticides are considered an integral part of integrated pest management (IPM) strategies, which aim to promote sustainable agriculture and reduce reliance on conventional pesticides.

The Bio-insecticide market is experiencing rapid growth due to the increasing adoption of organic farming practices and the growing awareness of environmental sustainability. The market is witnessing a surge in demand for bio-insecticides across various end-use sectors, including agriculture, horticulture, and forestry. Manufacturers in the bio-insecticide market are focusing on research and development activities to enhance the efficacy and shelf life of their products, further fueling market growth.

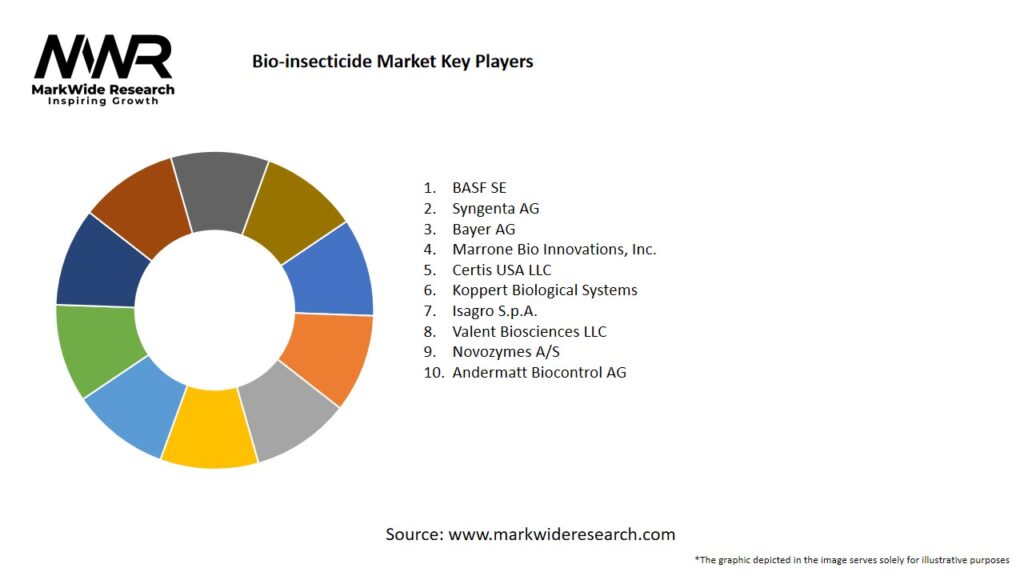

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Bio-insecticide market is characterized by intense competition among key players, leading to continuous product innovation and development. Manufacturers are investing in research activities to discover new sources of bio-insecticides and improve the production processes. Additionally, strategic collaborations and partnerships are being formed to expand the market presence and enhance distribution networks. The market is also witnessing the entry of new players, contributing to increased product offerings and market competition.

Regional Analysis

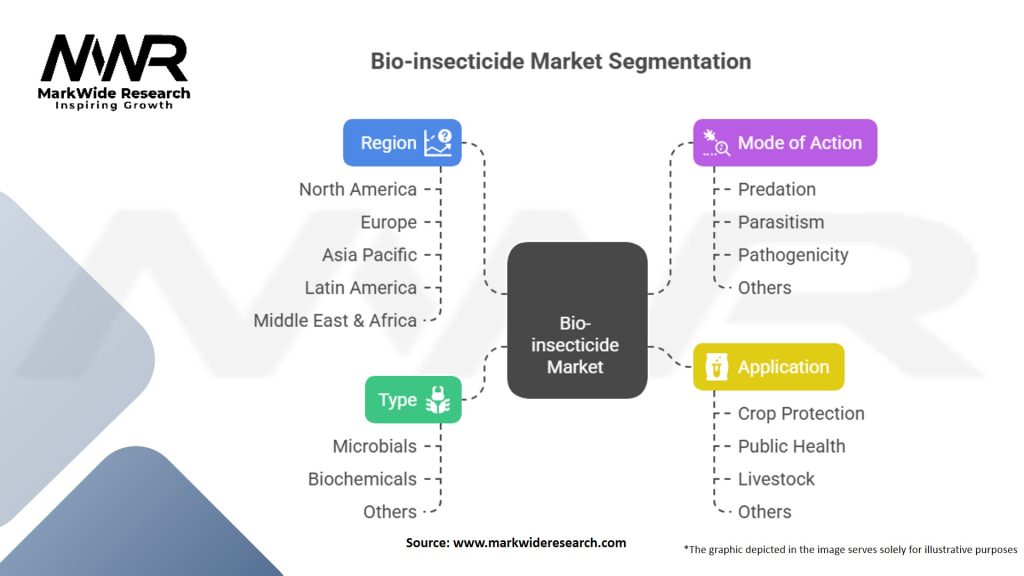

The Bio-insecticide market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe are currently the largest markets for bio-insecticides, driven by the increasing demand for organic products and strict regulations on chemical pesticide usage. The Asia Pacific region is expected to witness significant growth due to the rising adoption of organic farming practices and the increasing awareness of sustainable pest control methods.

Competitive Landscape

Leading Companies in the Bio-insecticide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Bio-insecticide market can be segmented based on product type, formulation, crop type, application, and region. By product type, the market can be categorized into microbial pesticides, plant-incorporated protectants, and biochemical pesticides. Formulation types include liquid, powder, and granular formulations. Crop types encompass cereals and grains, fruits and vegetables, oilseeds and pulses, and others. Applications of bio-insecticides are seen in agriculture, horticulture, forestry, public health, and residential pest control.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Bio-insecticide market. While the initial disruptions in the supply chain and logistics affected the market growth, the pandemic also highlighted the importance of sustainable and resilient agriculture systems. The demand for organic products has witnessed an upsurge during the pandemic, leading to increased adoption of bio-insecticides by farmers and growers. The focus on food security and safety has further emphasized the need for eco-friendly pest control solutions, positioning bio-insecticides for long-term growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Bio-insecticide market is poised for significant growth in the coming years, driven by the increasing demand for sustainable pest control solutions and organic products. The market is expected to witness advancements in formulation techniques, leading to improved product efficacy and longer shelf life. With favorable government regulations and growing awareness about the environmental and health benefits of bio-insecticides, the market is likely to attract investments and witness increased research and development activities. The expansion of bio-insecticide applications beyond agriculture, coupled with the rise of integrated pest management practices, will further propel market growth.

Conclusion

The Bio-insecticide market is experiencing robust growth as the demand for sustainable and eco-friendly pest control solutions continues to rise. Bio-insecticides offer an effective alternative to chemical insecticides, minimizing the impact on the environment, human health, and non-target organisms. With increasing adoption in agriculture, horticulture, forestry, and other sectors, bio-insecticides are becoming an integral part of pest management strategies worldwide. The market is characterized by intense competition, innovation, and collaborations among key players. As the global focus on organic farming and sustainable agriculture intensifies, the Bio-insecticide market is expected to witness significant expansion in the foreseeable future.

What is Bio-insecticide?

Bio-insecticides are natural or biologically derived substances used to control insect pests. They are derived from microorganisms, plants, or minerals and are considered environmentally friendly alternatives to chemical insecticides.

What are the key players in the Bio-insecticide Market?

Key players in the Bio-insecticide Market include companies like Bayer AG, Syngenta AG, and BASF SE, which are known for their innovative solutions in pest management, among others.

What are the growth factors driving the Bio-insecticide Market?

The Bio-insecticide Market is driven by increasing demand for organic farming, rising awareness of environmental sustainability, and the need for safer pest control methods in agriculture.

What challenges does the Bio-insecticide Market face?

Challenges in the Bio-insecticide Market include regulatory hurdles, limited shelf life of products, and competition from synthetic insecticides that may offer quicker results.

What opportunities exist in the Bio-insecticide Market?

Opportunities in the Bio-insecticide Market include the expansion of organic farming practices, advancements in biotechnology, and increasing consumer preference for sustainable agricultural products.

What trends are shaping the Bio-insecticide Market?

Trends in the Bio-insecticide Market include the development of new formulations, integration of bio-insecticides with precision agriculture technologies, and growing investments in research and development for innovative pest control solutions.

Bio-insecticide Market:

| Segmentation | Details |

|---|---|

| Type | Microbials, Biochemicals, Others |

| Mode of Action | Predation, Parasitism, Pathogenicity, Others |

| Application | Crop Protection, Public Health, Livestock, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Bio-insecticide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at