444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The big data in oil and gas exploration and production market represents a transformative technological frontier that is revolutionizing how energy companies discover, extract, and optimize hydrocarbon resources. This rapidly evolving sector leverages advanced analytics, machine learning algorithms, and massive data processing capabilities to enhance operational efficiency across upstream activities. Industry leaders are increasingly adopting sophisticated data analytics platforms to process seismic data, optimize drilling operations, and improve reservoir management strategies.

Market dynamics indicate substantial growth potential driven by the increasing complexity of exploration projects and the need for enhanced operational efficiency. The integration of Internet of Things (IoT) sensors, satellite imagery, and real-time monitoring systems generates unprecedented volumes of data that require advanced processing capabilities. Oil and gas companies are experiencing significant improvements in exploration success rates, with some operators reporting 25-30% increases in drilling efficiency through data-driven decision making.

Technological advancement in cloud computing, artificial intelligence, and predictive analytics is enabling energy companies to process and analyze complex geological data sets more effectively than ever before. The market encompasses various applications including seismic data interpretation, reservoir characterization, production optimization, and predictive maintenance of equipment. Digital transformation initiatives across the energy sector are driving increased investment in big data solutions, with companies recognizing the strategic importance of data-driven operations in maintaining competitive advantages.

The big data in oil and gas exploration and production market refers to the comprehensive ecosystem of technologies, platforms, and services that enable energy companies to collect, process, analyze, and derive actionable insights from massive volumes of structured and unstructured data generated throughout upstream operations. This market encompasses advanced analytics software, data management platforms, machine learning algorithms, and specialized consulting services designed to optimize exploration activities, enhance production efficiency, and reduce operational risks in the petroleum industry.

Core components of this market include seismic data processing systems, reservoir simulation software, drilling optimization platforms, and production monitoring solutions. These technologies work synergistically to transform raw data from various sources including geological surveys, well logs, production sensors, and satellite imagery into valuable intelligence that guides strategic decision-making processes.

Strategic market analysis reveals that the big data revolution in oil and gas exploration and production is fundamentally reshaping industry operations through enhanced data-driven decision making capabilities. The convergence of advanced analytics, artificial intelligence, and cloud computing technologies is enabling energy companies to achieve unprecedented levels of operational efficiency and exploration success rates.

Key market drivers include the increasing complexity of unconventional resource extraction, growing demand for operational efficiency improvements, and the need to reduce exploration risks in challenging environments. Companies implementing comprehensive big data strategies report 15-20% improvements in overall operational efficiency and significant reductions in non-productive time during drilling operations.

Technology adoption trends show accelerating implementation of machine learning algorithms for predictive maintenance, real-time drilling optimization, and automated anomaly detection systems. The market is characterized by strong collaboration between traditional oil and gas companies and technology providers, resulting in innovative solutions tailored specifically for upstream operations.

Fundamental market insights highlight the transformative impact of big data analytics on traditional oil and gas operations:

Primary market drivers propelling the adoption of big data solutions in oil and gas exploration and production stem from both operational necessities and strategic competitive advantages. The increasing complexity of unconventional resource extraction, particularly in shale formations and deepwater environments, requires sophisticated data analysis capabilities to optimize drilling parameters and maximize recovery rates.

Operational efficiency demands are driving companies to implement comprehensive data analytics platforms that can process real-time information from multiple sources simultaneously. The integration of IoT sensors across drilling rigs, production facilities, and pipeline networks generates massive data volumes that require advanced processing capabilities to extract meaningful insights for operational optimization.

Cost optimization pressures in the current energy market environment are compelling companies to leverage data analytics for identifying inefficiencies and reducing operational expenses. Companies utilizing advanced analytics report 12-18% reductions in drilling costs through optimized drilling parameters and reduced non-productive time.

Regulatory compliance requirements are increasingly demanding comprehensive data collection and analysis capabilities for environmental monitoring, safety protocols, and operational reporting. Big data solutions enable automated compliance monitoring and real-time alerting systems that help companies maintain regulatory standards while optimizing operations.

Significant market restraints continue to challenge widespread adoption of big data solutions in oil and gas exploration and production operations. The substantial capital investment requirements for implementing comprehensive data analytics platforms represent a primary barrier, particularly for smaller independent operators with limited technology budgets.

Data security concerns pose considerable challenges as companies must protect sensitive geological data, proprietary drilling techniques, and operational information from cyber threats and industrial espionage. The integration of cloud-based analytics platforms raises additional security considerations that require robust cybersecurity frameworks and compliance protocols.

Technical complexity associated with integrating diverse data sources, legacy systems, and new analytics platforms creates implementation challenges that require specialized expertise and extensive training programs. Many organizations struggle with data quality issues, inconsistent data formats, and the need for standardized data management protocols across operations.

Skilled workforce shortages in data science and analytics represent a critical constraint, as the oil and gas industry competes with technology companies for qualified professionals capable of developing and implementing advanced analytics solutions. The need for domain expertise that combines petroleum engineering knowledge with data science skills creates additional recruitment challenges.

Emerging market opportunities in big data applications for oil and gas exploration and production are expanding rapidly as technological capabilities advance and industry acceptance grows. The development of edge computing solutions enables real-time data processing at remote drilling locations, reducing latency and improving decision-making speed for critical operations.

Artificial intelligence integration presents substantial opportunities for automated decision-making systems that can optimize drilling parameters, predict equipment failures, and enhance reservoir management strategies. Machine learning algorithms are becoming increasingly sophisticated in processing complex geological data and identifying patterns that human analysts might overlook.

Digital twin technology offers significant potential for creating comprehensive virtual models of oil and gas assets, enabling advanced simulation capabilities and predictive analytics for production optimization. These digital replicas allow companies to test various scenarios and optimize operations without physical intervention.

Collaborative data platforms present opportunities for industry-wide data sharing initiatives that can improve exploration success rates and reduce duplicate efforts across the sector. Blockchain technology is emerging as a potential solution for secure data sharing while maintaining proprietary information protection.

Complex market dynamics shape the evolution of big data applications in oil and gas exploration and production through the interplay of technological advancement, economic pressures, and regulatory requirements. The cyclical nature of the energy industry creates varying demand patterns for technology investments, with companies increasing big data spending during high commodity price periods and focusing on efficiency improvements during downturns.

Competitive pressures are driving rapid innovation as companies seek to gain advantages through superior data analytics capabilities. MarkWide Research analysis indicates that companies with advanced analytics capabilities achieve 8-12% higher production efficiency compared to those relying on traditional methods.

Technology convergence is creating new possibilities as artificial intelligence, machine learning, IoT, and cloud computing technologies mature and become more accessible to oil and gas operators. The integration of these technologies enables comprehensive data ecosystems that provide holistic views of operations and facilitate data-driven decision making across all aspects of exploration and production activities.

Partnership dynamics between traditional oil and gas companies and technology providers are evolving toward more strategic collaborations that combine domain expertise with technological innovation. These partnerships are resulting in specialized solutions designed specifically for upstream operations rather than generic analytics platforms adapted for oil and gas applications.

Comprehensive research methodology employed in analyzing the big data in oil and gas exploration and production market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, technology providers, and subject matter experts across various segments of the upstream oil and gas sector.

Secondary research components include analysis of industry reports, company financial statements, technology patents, and regulatory filings to understand market trends and competitive dynamics. Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and market insights.

Quantitative analysis incorporates statistical modeling techniques to identify market trends, growth patterns, and correlation factors affecting big data adoption in oil and gas operations. Market sizing methodologies consider technology spending patterns, implementation timelines, and adoption rates across different company sizes and geographic regions.

Qualitative assessment focuses on understanding market drivers, challenges, and opportunities through in-depth analysis of industry dynamics, competitive positioning, and technology evolution trends. Expert opinions and industry insights provide context for quantitative findings and help identify emerging trends that may impact future market development.

North American markets dominate big data adoption in oil and gas exploration and production, driven by the extensive shale oil and gas development activities and the presence of leading technology companies. The United States leads in implementation of advanced analytics solutions, with 45-50% market share globally, particularly in unconventional resource development where data analytics provide significant competitive advantages.

European markets show strong growth in offshore exploration applications, with Norway and the United Kingdom leading in deepwater drilling optimization and reservoir management solutions. European companies are particularly focused on environmental compliance and safety applications of big data analytics, driven by stringent regulatory requirements.

Asia-Pacific regions represent rapidly growing markets for big data solutions, with China, Australia, and Southeast Asian countries increasing investments in exploration and production technologies. The region accounts for approximately 25-30% market share and shows strong growth potential driven by increasing energy demand and exploration activities.

Middle Eastern markets are adopting big data solutions primarily for enhanced oil recovery applications and production optimization in mature fields. Countries like Saudi Arabia and the UAE are investing heavily in digital transformation initiatives that incorporate advanced analytics for maximizing recovery from existing reservoirs.

Competitive market dynamics feature a diverse ecosystem of technology providers ranging from established software companies to specialized oil and gas technology firms and emerging startups focused on specific analytics applications.

Market segmentation analysis reveals distinct categories based on application areas, technology types, and deployment models that serve different aspects of oil and gas exploration and production operations.

By Application:

By Technology:

Seismic data processing represents the largest application segment, accounting for significant market share due to the critical importance of geological data interpretation in exploration activities. Advanced machine learning algorithms are revolutionizing seismic interpretation by identifying subtle geological features and reducing interpretation time significantly.

Drilling optimization solutions show the highest growth rates as companies focus on improving drilling efficiency and reducing costs. Real-time data analytics enable dynamic adjustment of drilling parameters, resulting in 20-25% improvements in drilling speed and reduced equipment wear.

Production optimization platforms are gaining traction as companies seek to maximize recovery from existing wells and reservoirs. These solutions integrate production data, reservoir models, and surface facility information to optimize production strategies and enhance oil recovery techniques.

Predictive maintenance applications demonstrate strong return on investment by reducing unplanned downtime and extending equipment life. Companies implementing predictive maintenance report 30-35% reductions in maintenance costs and significant improvements in equipment reliability.

Oil and gas operators benefit from enhanced exploration success rates, improved production efficiency, and reduced operational costs through data-driven decision making. Advanced analytics enable better understanding of reservoir dynamics and optimization of production strategies, resulting in increased recovery rates and extended field life.

Service companies gain competitive advantages by offering advanced analytics capabilities that differentiate their services and provide additional value to clients. Data analytics platforms enable service providers to optimize their operations and improve service quality while reducing costs.

Technology providers benefit from growing demand for specialized analytics solutions and the opportunity to develop industry-specific platforms that address unique challenges in oil and gas operations. The market provides opportunities for both established technology companies and innovative startups.

Investors and stakeholders benefit from improved operational transparency, better risk management, and enhanced return on investment through more efficient operations and reduced operational risks. Data analytics provide better visibility into operational performance and enable more informed investment decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming big data applications in oil and gas exploration and production. Machine learning algorithms are becoming increasingly sophisticated in processing complex geological data, optimizing drilling parameters, and predicting equipment failures with remarkable accuracy.

Edge computing adoption is enabling real-time data processing at remote drilling locations, reducing latency and improving decision-making speed for critical operations. This trend is particularly important for offshore and remote onshore operations where connectivity limitations previously hindered real-time analytics capabilities.

Digital twin technology is gaining momentum as companies create comprehensive virtual models of their assets to enable advanced simulation and optimization capabilities. These digital replicas allow operators to test various scenarios and optimize operations without physical intervention or risk.

Collaborative analytics platforms are emerging as companies recognize the benefits of sharing certain types of data to improve industry-wide efficiency while maintaining competitive advantages. Blockchain technology is being explored as a mechanism for secure data sharing and collaboration.

Strategic partnerships between major oil companies and technology providers are accelerating innovation and development of specialized analytics solutions. These collaborations combine deep industry expertise with advanced technology capabilities to create more effective and targeted solutions.

Cloud platform expansion by major technology companies is making advanced analytics capabilities more accessible to smaller oil and gas operators. Cloud-based solutions reduce the barrier to entry and enable scalable implementation of big data analytics across organizations of various sizes.

Regulatory framework development is providing clearer guidelines for data management, cybersecurity, and privacy protection in oil and gas operations. These frameworks are helping companies implement comprehensive data governance strategies while maintaining compliance with evolving regulations.

Startup ecosystem growth is bringing innovative solutions and fresh perspectives to traditional oil and gas challenges. Many startups are focusing on specific niche applications where they can provide specialized expertise and agile development capabilities.

Strategic recommendations for companies considering big data investments in oil and gas exploration and production emphasize the importance of developing comprehensive data strategies that align with business objectives and operational requirements. MWR analysis suggests that successful implementations require strong executive support, clear ROI metrics, and phased implementation approaches.

Technology selection criteria should prioritize solutions that can integrate with existing systems, scale with business growth, and provide measurable operational improvements. Companies should focus on platforms that offer proven results in similar operational environments and have strong vendor support capabilities.

Implementation strategies should begin with pilot projects that demonstrate clear value and build organizational confidence in big data capabilities. Successful pilots can then be scaled across operations while incorporating lessons learned and best practices developed during initial implementations.

Workforce development initiatives are critical for successful big data adoption, requiring investment in training programs and recruitment of qualified data science professionals. Companies should consider partnerships with universities and training organizations to develop the specialized skills needed for effective analytics implementation.

Market evolution in big data applications for oil and gas exploration and production is expected to accelerate significantly over the coming years, driven by continued technological advancement and increasing industry acceptance of data-driven operations. The integration of artificial intelligence, machine learning, and advanced analytics will become standard practice across upstream operations.

Technology convergence will create new possibilities as IoT, edge computing, and cloud platforms mature and become more sophisticated. The combination of these technologies will enable comprehensive data ecosystems that provide real-time insights and automated decision-making capabilities across all aspects of exploration and production operations.

Industry transformation toward fully digital operations will require substantial investments in data infrastructure, analytics platforms, and workforce development. Companies that successfully navigate this transformation will gain significant competitive advantages through improved efficiency, reduced costs, and enhanced operational capabilities.

Growth projections indicate continued strong expansion in big data adoption, with industry experts predicting compound annual growth rates of 12-15% over the next five years. This growth will be driven by increasing data volumes, advancing technology capabilities, and growing recognition of the strategic value of data-driven operations in the oil and gas industry.

The big data revolution in oil and gas exploration and production represents a fundamental shift toward data-driven operations that is transforming how energy companies discover, extract, and optimize hydrocarbon resources. Advanced analytics, machine learning, and artificial intelligence technologies are enabling unprecedented levels of operational efficiency and exploration success rates across the upstream sector.

Market dynamics indicate strong growth potential driven by increasing operational complexity, cost optimization pressures, and the need for enhanced decision-making capabilities. Companies implementing comprehensive big data strategies are achieving significant improvements in drilling efficiency, production optimization, and equipment reliability while reducing operational costs and risks.

Future success in this evolving market will depend on companies’ ability to develop comprehensive data strategies, invest in appropriate technologies, and build the specialized workforce capabilities needed to leverage advanced analytics effectively. The big data in oil and gas exploration and production market will continue to evolve rapidly as technology advances and industry adoption accelerates, creating substantial opportunities for companies that embrace data-driven transformation.

What is Big Data in Oil & Gas Exploration and Production?

Big Data in Oil & Gas Exploration and Production refers to the vast volumes of data generated during the exploration and extraction processes. This data includes geological surveys, drilling data, and production metrics, which can be analyzed to improve efficiency and decision-making in the industry.

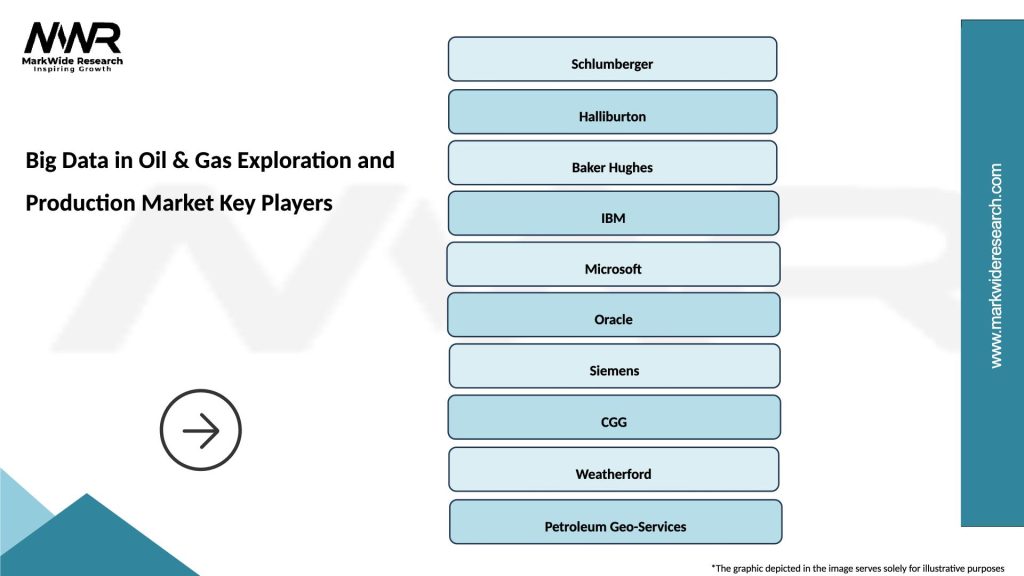

What are the key companies in the Big Data in Oil & Gas Exploration and Production Market?

Key companies in the Big Data in Oil & Gas Exploration and Production Market include Schlumberger, Halliburton, and Baker Hughes, among others. These companies leverage big data analytics to enhance exploration accuracy and optimize production processes.

What are the drivers of growth in the Big Data in Oil & Gas Exploration and Production Market?

The growth of the Big Data in Oil & Gas Exploration and Production Market is driven by the increasing need for operational efficiency, the rise in data generation from advanced drilling technologies, and the demand for real-time data analytics to enhance decision-making.

What challenges does the Big Data in Oil & Gas Exploration and Production Market face?

Challenges in the Big Data in Oil & Gas Exploration and Production Market include data security concerns, the complexity of integrating diverse data sources, and the need for skilled personnel to analyze and interpret the data effectively.

What opportunities exist in the Big Data in Oil & Gas Exploration and Production Market?

Opportunities in the Big Data in Oil & Gas Exploration and Production Market include the potential for predictive analytics to forecast equipment failures, the use of machine learning for enhanced data interpretation, and the growing trend of digital transformation in the oil and gas sector.

What trends are shaping the Big Data in Oil & Gas Exploration and Production Market?

Trends shaping the Big Data in Oil & Gas Exploration and Production Market include the increasing adoption of cloud computing for data storage, the integration of IoT devices for real-time data collection, and advancements in artificial intelligence for data analysis.

Big Data in Oil & Gas Exploration and Production Market

| Segmentation Details | Description |

|---|---|

| Service Type | Data Analytics, Predictive Maintenance, Reservoir Modeling, Asset Management |

| Technology | Cloud Computing, Machine Learning, IoT Solutions, Data Visualization |

| End User | Exploration Companies, Production Firms, Service Providers, Regulatory Bodies |

| Application | Drilling Optimization, Production Forecasting, Environmental Monitoring, Safety Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Big Data in Oil & Gas Exploration and Production Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at