444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The oil and gas sector has always been at the forefront of technological advancements, and the advent of big data has further revolutionized the industry. Big data refers to the vast amount of structured and unstructured information generated from various sources within the sector. From exploration and production to refining and distribution, big data has the potential to transform the entire value chain.

Meaning

In the context of the oil and gas sector, big data refers to the massive volume of data generated from sources such as drilling operations, production sensors, seismic surveys, supply chain logistics, customer interactions, and more. This data is then processed, analyzed, and leveraged to derive valuable insights, optimize operations, and make informed decisions.

Executive Summary

The oil and gas industry is witnessing a significant transformation due to the integration of big data analytics. The consumption market for big data in the sector is experiencing substantial growth, driven by the need for enhanced operational efficiency, cost reduction, risk management, and improved decision-making.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The consumption market for big data in the oil and gas sector is driven by a combination of technological advancements, industry trends, regulatory frameworks, and market forces. Companies in the sector are increasingly recognizing the potential of big data analytics to transform their operations and gain a competitive edge. However, challenges such as data security, integration complexity, and talent shortage need to be addressed to fully leverage the benefits of big data analytics.

Regional Analysis

The consumption market for big data in the oil and gas sector is witnessing significant growth across various regions. North America dominates the market due to the presence of major oil and gas companies, technological advancements, and early adoption of big data analytics. Europe and Asia Pacific are also experiencing substantial growth, driven by increasing energy demand, expanding exploration activities, and the need for operational efficiency.

Competitive Landscape

Leading Companies in the Big Data in Oil and Gas Sector Consumption Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

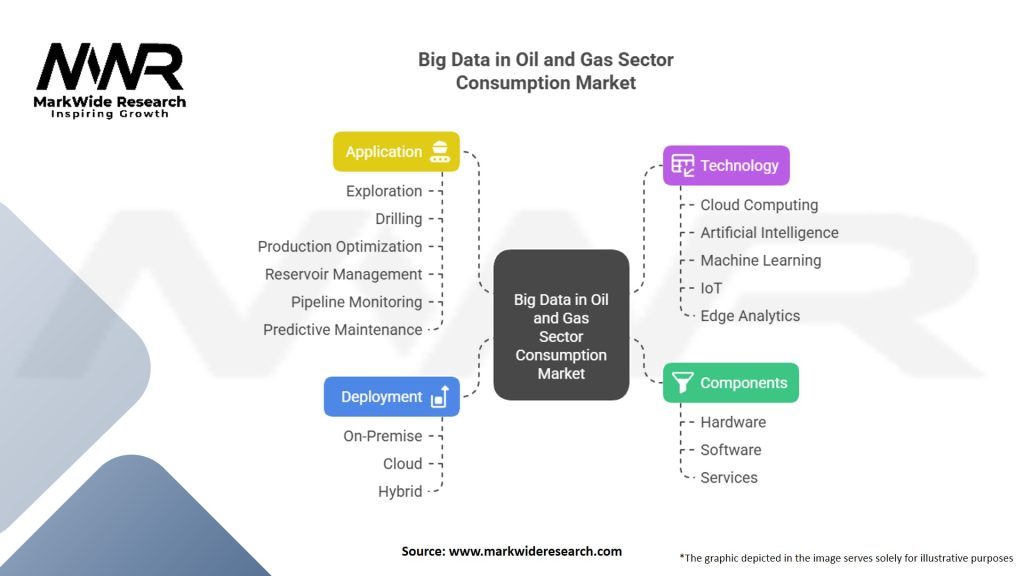

Segmentation

The market can be segmented based on the application of big data analytics in various aspects of the oil and gas sector, including exploration and production, refining and petrochemicals, supply chain management, asset management, and others. Each segment presents unique opportunities and challenges for leveraging big data analytics.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the oil and gas sector, leading to a decline in oil prices, reduced demand, and disrupted supply chains. However, it also highlighted the importance of digitalization and data-driven decision-making. The adoption of big data analytics accelerated during the pandemic as companies sought ways to optimize operations, manage risks, and improve resilience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The consumption market for big data in the oil and gas sector is expected to witness continued growth in the coming years. The industry will increasingly rely on data analytics to optimize operations, improve sustainability, manage risks, and drive innovation. Technological advancements such as AI, machine learning, and IoT integration will further enhance the sector’s ability to leverage big data for competitive advantage.

Conclusion

Big data analytics is reshaping the oil and gas sector, offering tremendous opportunities for operational optimization, cost reduction, risk management, and improved decision-making. The consumption market for big data in the sector is experiencing significant growth, driven by the need to address industry challenges and capitalize on emerging opportunities. To fully harness the potential of big data analytics, companies need to address data security concerns, overcome integration challenges, and invest in talent development. The future outlook for big data in the oil and gas sector is promising, with continued advancements in technology and an increasing focus on data-driven strategies.

Big Data in Oil and Gas Sector Consumption Market Segmentations

| Segment | Details |

|---|---|

| Component | Hardware, Software, Services |

| Technology | Cloud Computing, Artificial Intelligence, Machine Learning, IoT, Edge Analytics |

| Application | Exploration, Drilling, Production Optimization, Reservoir Management, Pipeline Monitoring, Predictive Maintenance |

| Deployment | On-Premise, Cloud, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Big Data in Oil and Gas Sector Consumption Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at