444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The big data in automotive market represents a transformative force reshaping the global automotive industry through advanced analytics, machine learning, and data-driven decision making. Automotive manufacturers are increasingly leveraging vast amounts of data generated from connected vehicles, manufacturing processes, and customer interactions to enhance operational efficiency, improve vehicle safety, and deliver personalized customer experiences. The market encompasses comprehensive data analytics solutions that enable predictive maintenance, autonomous driving capabilities, supply chain optimization, and enhanced customer relationship management.

Market dynamics indicate robust growth driven by the proliferation of connected vehicles, with over 78% of new vehicles expected to feature some form of connectivity by 2025. The integration of Internet of Things (IoT) sensors, telematics systems, and advanced driver assistance systems generates unprecedented volumes of data that require sophisticated analytics platforms for processing and interpretation. Automotive OEMs and suppliers are investing heavily in big data infrastructure to gain competitive advantages through improved product development cycles, enhanced manufacturing efficiency, and superior customer service delivery.

Technology adoption across the automotive sector demonstrates accelerating momentum, with artificial intelligence and machine learning algorithms becoming integral components of modern vehicle systems. The market spans multiple application areas including vehicle diagnostics, traffic management, insurance telematics, and autonomous vehicle development, creating diverse opportunities for data analytics providers and technology integrators.

The big data in automotive market refers to the comprehensive ecosystem of technologies, platforms, and services that collect, process, analyze, and derive actionable insights from the massive volumes of structured and unstructured data generated throughout the automotive value chain. This market encompasses data analytics solutions specifically designed for automotive applications, including vehicle telematics, manufacturing optimization, supply chain management, customer behavior analysis, and autonomous driving systems.

Big data applications in the automotive sector involve the integration of multiple data sources including vehicle sensors, GPS systems, mobile devices, social media platforms, and external databases to create holistic views of vehicle performance, driver behavior, and market trends. The market includes specialized software platforms, cloud-based analytics services, edge computing solutions, and consulting services that enable automotive companies to transform raw data into strategic business intelligence and operational improvements.

Market expansion in the big data automotive sector reflects the industry’s digital transformation journey, driven by increasing vehicle connectivity, regulatory requirements for safety and emissions monitoring, and growing consumer expectations for personalized mobility experiences. Key market participants include established technology giants, specialized automotive analytics providers, and emerging startups developing innovative data solutions for next-generation vehicles.

Growth trajectories demonstrate strong momentum across all major automotive segments, with commercial vehicle applications showing particularly robust adoption rates due to fleet management requirements and operational efficiency mandates. The market benefits from increasing investments in autonomous vehicle development, where big data analytics serves as a critical enabler for machine learning algorithms and decision-making systems.

Competitive dynamics reveal a diverse ecosystem of solution providers ranging from traditional automotive suppliers expanding into data services to cloud computing specialists developing automotive-specific analytics platforms. Partnership strategies between automotive OEMs and technology companies are becoming increasingly common as manufacturers seek to accelerate their digital transformation initiatives while maintaining focus on core vehicle development and manufacturing capabilities.

Strategic insights from comprehensive market analysis reveal several critical trends shaping the big data automotive landscape:

Primary growth drivers propelling the big data automotive market include the accelerating adoption of connected vehicle technologies and increasing consumer demand for intelligent transportation solutions. Vehicle electrification trends require sophisticated battery management systems and charging infrastructure optimization, creating substantial data analytics opportunities for monitoring performance, predicting maintenance needs, and optimizing energy consumption patterns.

Regulatory pressures for enhanced vehicle safety and environmental compliance drive significant demand for comprehensive data collection and analysis capabilities. Government mandates for electronic logging devices in commercial vehicles and emissions monitoring systems create mandatory data generation requirements that necessitate robust analytics platforms for compliance reporting and operational optimization.

Autonomous vehicle development represents a major market catalyst, with self-driving systems requiring massive amounts of real-time data processing for navigation, obstacle detection, and decision-making algorithms. The complexity of autonomous driving scenarios demands sophisticated machine learning models trained on diverse datasets encompassing various driving conditions, weather patterns, and traffic situations.

Consumer expectations for personalized mobility experiences drive automotive manufacturers to implement advanced analytics for understanding driver preferences, usage patterns, and service requirements. Digital natives increasingly expect their vehicles to provide connected services similar to smartphones, creating demand for data-driven features such as predictive navigation, personalized entertainment, and proactive maintenance notifications.

Significant challenges facing the big data automotive market include complex data privacy and security concerns that require comprehensive protection measures for sensitive vehicle and driver information. Cybersecurity threats pose substantial risks to connected vehicle systems, necessitating robust security frameworks and continuous monitoring capabilities that increase implementation costs and complexity.

Technical integration challenges arise from the need to harmonize diverse data sources, legacy systems, and emerging technologies within existing automotive architectures. Standardization issues across different vehicle manufacturers and technology providers create interoperability challenges that complicate data sharing and analytics implementation across the automotive ecosystem.

High implementation costs associated with comprehensive big data infrastructure development can be prohibitive for smaller automotive companies and suppliers. Skilled workforce shortages in data science and automotive technology integration limit the industry’s ability to fully capitalize on available data analytics opportunities, creating bottlenecks in project implementation and system optimization.

Regulatory uncertainties regarding data ownership, cross-border data transfer, and liability issues in autonomous vehicle applications create hesitation among automotive companies considering major big data investments. Compliance complexities vary significantly across different geographic markets, requiring flexible and adaptable analytics platforms that can accommodate diverse regulatory requirements.

Emerging opportunities in the big data automotive market include the development of advanced predictive analytics solutions for vehicle-as-a-service business models and shared mobility platforms. Subscription-based vehicle services require sophisticated data analytics for usage monitoring, pricing optimization, and customer retention strategies, creating new revenue streams for analytics providers.

Edge computing integration presents significant opportunities for real-time data processing capabilities that reduce latency and improve autonomous vehicle performance. 5G network deployment enables enhanced connectivity and data transmission capabilities, facilitating more sophisticated analytics applications and real-time decision-making systems in connected vehicles.

Artificial intelligence advancement creates opportunities for developing more sophisticated machine learning models that can process complex automotive data patterns and provide actionable insights for vehicle optimization, customer service enhancement, and operational efficiency improvements. Computer vision technologies combined with big data analytics enable advanced driver assistance systems and autonomous driving capabilities.

Sustainability initiatives drive demand for analytics solutions that optimize fuel efficiency, reduce emissions, and support electric vehicle adoption through intelligent charging management and battery performance optimization. Circular economy principles in automotive manufacturing create opportunities for data-driven recycling and remanufacturing processes that maximize resource utilization and minimize environmental impact.

Market dynamics in the big data automotive sector demonstrate complex interactions between technological advancement, regulatory evolution, and changing consumer preferences. Competitive pressures drive continuous innovation in analytics capabilities, with companies investing heavily in artificial intelligence and machine learning technologies to differentiate their offerings and capture market share.

Partnership ecosystems are becoming increasingly important as automotive companies collaborate with technology providers, telecommunications companies, and cloud service providers to develop comprehensive big data solutions. Strategic alliances enable faster time-to-market for new analytics capabilities while sharing development costs and risks across multiple stakeholders.

Data monetization strategies are evolving as automotive companies recognize the value of their data assets and explore new business models based on data sharing and analytics services. Platform approaches enable multiple stakeholders to access and contribute data while maintaining appropriate privacy and security controls, creating network effects that enhance the value of analytics insights.

Technology convergence between automotive systems and consumer electronics drives demand for integrated analytics platforms that can process data from multiple sources and provide unified insights for vehicle optimization and customer experience enhancement. Cross-industry collaboration with technology companies, telecommunications providers, and software developers accelerates innovation and market development.

Comprehensive research methodology employed for analyzing the big data automotive market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, technology providers, automotive manufacturers, and end-users to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure, competitive dynamics, and technological developments. Quantitative analysis utilizes statistical modeling techniques to project market growth trends and identify key performance indicators across different market segments and geographic regions.

Market validation processes include cross-referencing multiple data sources, conducting expert interviews, and performing sensitivity analysis to ensure research findings accurately reflect market realities. Continuous monitoring of market developments, technological advancements, and regulatory changes enables regular updates to market assessments and projections.

Data quality assurance measures include rigorous fact-checking procedures, peer review processes, and validation against established industry benchmarks to maintain high standards of research accuracy and reliability throughout the analysis process.

North American markets demonstrate strong leadership in big data automotive adoption, driven by advanced technology infrastructure, supportive regulatory frameworks, and significant investments in autonomous vehicle development. United States automotive manufacturers and technology companies lead global innovation in connected vehicle analytics, with approximately 42% market share in advanced automotive data solutions.

European markets show robust growth driven by stringent environmental regulations, advanced manufacturing capabilities, and strong emphasis on vehicle safety and efficiency optimization. Germany leads European adoption with comprehensive Industry 4.0 initiatives in automotive manufacturing, while Nordic countries demonstrate advanced implementation of electric vehicle analytics and charging infrastructure optimization.

Asia-Pacific regions exhibit the fastest growth rates, with China emerging as a major market for connected vehicle technologies and electric vehicle data analytics. Japanese automotive manufacturers leverage advanced manufacturing analytics and quality control systems, while South Korean companies focus on integrated mobility solutions and smart city applications.

Emerging markets in Latin America, Middle East, and Africa show increasing adoption of basic telematics and fleet management solutions, with growth potential driven by improving telecommunications infrastructure and increasing vehicle connectivity penetration rates.

Market leadership in the big data automotive sector includes a diverse mix of established technology companies, automotive suppliers, and specialized analytics providers. Key market participants demonstrate varying approaches to automotive data analytics, from comprehensive platform solutions to specialized niche applications.

Market segmentation analysis reveals diverse application areas and technology categories within the big data automotive market. By Application: The market encompasses vehicle telematics, manufacturing analytics, supply chain optimization, customer relationship management, autonomous driving systems, and predictive maintenance solutions, each requiring specialized data processing capabilities and analytics tools.

By Technology: Key technology segments include artificial intelligence and machine learning platforms, cloud-based analytics services, edge computing solutions, IoT data processing systems, and specialized automotive data visualization tools. By Vehicle Type: Segmentation covers passenger vehicles, commercial vehicles, electric vehicles, and autonomous vehicles, each generating distinct data patterns and analytics requirements.

By Data Source: Market segments include vehicle sensor data, telematics information, manufacturing systems data, customer interaction data, and external data sources such as weather, traffic, and geographic information systems. By End User: Primary segments encompass automotive OEMs, tier-1 suppliers, fleet operators, insurance companies, and mobility service providers.

By Deployment Model: The market includes cloud-based solutions, on-premises implementations, and hybrid deployment models that combine cloud and edge computing capabilities for optimal performance and data security requirements.

Vehicle Telematics represents the largest market category, encompassing comprehensive data collection and analysis systems for monitoring vehicle performance, driver behavior, and operational efficiency. Advanced telematics solutions integrate GPS tracking, vehicle diagnostics, and driver behavior monitoring to provide holistic insights for fleet management and individual vehicle optimization.

Manufacturing Analytics demonstrates strong growth driven by Industry 4.0 initiatives and smart factory implementations across automotive production facilities. Real-time monitoring systems enable predictive maintenance, quality control optimization, and production efficiency improvements through comprehensive data analysis of manufacturing processes and equipment performance.

Autonomous Vehicle Analytics emerges as a high-growth category requiring sophisticated machine learning algorithms and real-time data processing capabilities. Self-driving systems generate massive amounts of sensor data that require advanced analytics for navigation, obstacle detection, and decision-making processes in complex driving scenarios.

Customer Experience Analytics focuses on understanding consumer preferences, usage patterns, and service requirements to enhance vehicle features and improve customer satisfaction. Personalization engines utilize behavioral data to customize vehicle settings, recommend services, and optimize user interfaces for individual driver preferences.

Automotive manufacturers benefit from comprehensive big data analytics through improved product development cycles, enhanced quality control processes, and better understanding of customer preferences and usage patterns. Predictive analytics capabilities enable proactive maintenance scheduling, reducing warranty costs and improving customer satisfaction through minimized vehicle downtime and unexpected failures.

Fleet operators realize significant operational benefits including optimized route planning, fuel efficiency improvements, and enhanced driver safety through comprehensive monitoring and analytics systems. Cost reduction opportunities include predictive maintenance scheduling, insurance premium optimization, and improved asset utilization through data-driven decision making.

Technology providers gain access to new revenue streams and market opportunities through specialized automotive analytics solutions and platform services. Partnership opportunities with automotive manufacturers enable technology companies to develop industry-specific solutions while leveraging their core competencies in data processing and analytics.

Consumers benefit from enhanced vehicle safety, improved reliability, personalized features, and reduced ownership costs through data-driven vehicle optimization and predictive maintenance capabilities. Connected services provide convenience features such as remote diagnostics, predictive navigation, and personalized entertainment options that enhance the overall driving experience.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a dominant trend transforming automotive data analytics through advanced machine learning algorithms, natural language processing, and computer vision technologies. AI-powered systems enable more sophisticated pattern recognition, predictive analytics, and automated decision-making capabilities that enhance vehicle performance and customer experiences.

Edge computing adoption accelerates as automotive applications require real-time data processing capabilities for safety-critical systems and autonomous driving functions. Distributed computing architectures reduce latency and improve system reliability by processing data closer to the source, enabling faster response times for critical vehicle systems.

Data democratization trends enable broader access to automotive analytics capabilities across organizations, with self-service analytics platforms allowing non-technical users to generate insights and make data-driven decisions. Low-code and no-code solutions accelerate analytics implementation and reduce dependency on specialized technical resources.

Sustainability analytics gain prominence as automotive companies focus on environmental impact reduction and circular economy principles. Carbon footprint tracking, energy optimization, and sustainable manufacturing analytics become essential components of comprehensive automotive data strategies, with environmental metrics showing 65% increased importance in corporate decision-making processes.

Strategic partnerships between automotive manufacturers and technology companies accelerate big data analytics adoption and innovation. Collaborative initiatives focus on developing industry-specific analytics platforms, sharing best practices, and creating standardized approaches to automotive data management and analysis.

Investment activities in automotive analytics startups and technology companies demonstrate strong market confidence and drive innovation in specialized applications such as autonomous vehicle analytics, predictive maintenance, and customer experience optimization. Venture capital funding supports development of next-generation analytics platforms and emerging technologies.

Regulatory developments shape market evolution through new requirements for vehicle data collection, privacy protection, and safety monitoring. Government initiatives promoting connected vehicle infrastructure and smart transportation systems create additional demand for comprehensive analytics capabilities.

Technology advancements in quantum computing, advanced AI algorithms, and 5G communications enable new possibilities for automotive data processing and analytics applications. Research and development investments focus on breakthrough technologies that can process larger datasets and provide more sophisticated insights for automotive applications.

MarkWide Research analysis indicates that automotive companies should prioritize development of comprehensive data strategies that integrate multiple data sources and analytics capabilities to maximize competitive advantages. Strategic recommendations emphasize the importance of building scalable analytics platforms that can accommodate future growth and technological evolution while maintaining data security and privacy protection.

Investment priorities should focus on developing core analytics capabilities, building strategic partnerships with technology providers, and investing in workforce development to address skill shortages in automotive data science. Technology selection should emphasize platforms that offer flexibility, scalability, and integration capabilities with existing automotive systems and processes.

Market entry strategies for technology providers should focus on developing automotive-specific solutions that address unique industry requirements and regulatory compliance needs. Partnership approaches with established automotive companies can accelerate market penetration and provide access to valuable industry expertise and customer relationships.

Risk management strategies should address cybersecurity concerns, data privacy requirements, and regulatory compliance challenges through comprehensive security frameworks and continuous monitoring capabilities. Contingency planning should account for potential technology disruptions and market volatility that may impact long-term analytics investments and strategies.

Market projections indicate sustained growth in big data automotive applications driven by increasing vehicle connectivity, autonomous driving development, and expanding electric vehicle adoption. Technology evolution will enable more sophisticated analytics capabilities with improved real-time processing, enhanced AI algorithms, and better integration across automotive ecosystems.

Autonomous vehicle commercialization will create massive new data processing requirements and analytics opportunities, with self-driving systems expected to generate exponentially more data than current connected vehicles. Machine learning advancement will enable more sophisticated pattern recognition and decision-making capabilities for complex driving scenarios and vehicle optimization applications.

Industry consolidation trends may emerge as automotive companies and technology providers seek to build comprehensive analytics capabilities through acquisitions and strategic partnerships. Platform standardization efforts will likely accelerate to improve interoperability and reduce implementation complexity across the automotive ecosystem.

MWR projections suggest that the market will experience accelerated growth rates of 18-22% annually over the next five years, driven by expanding applications in autonomous vehicles, electric vehicle optimization, and advanced manufacturing analytics. Emerging applications in vehicle-as-a-service models and smart city integration will create additional growth opportunities for specialized analytics providers and platform developers.

Big data in automotive market represents a transformative force reshaping the global automotive industry through advanced analytics, artificial intelligence, and data-driven innovation. The market demonstrates robust growth potential driven by increasing vehicle connectivity, autonomous driving development, and expanding applications across manufacturing, customer experience, and operational optimization domains.

Strategic opportunities abound for automotive manufacturers, technology providers, and service companies that can effectively leverage comprehensive data analytics capabilities to enhance vehicle performance, improve customer experiences, and optimize operational efficiency. Successful market participants will be those that invest in scalable analytics platforms, develop strategic partnerships, and build specialized expertise in automotive data science applications.

Future success in the big data automotive market will depend on organizations’ ability to navigate complex technical integration challenges, address cybersecurity and privacy concerns, and adapt to rapidly evolving regulatory requirements while maintaining focus on delivering tangible business value through data-driven insights and optimization capabilities.

What is Big Data in Automotive?

Big Data in Automotive refers to the vast volumes of data generated from various sources within the automotive industry, including vehicle sensors, telematics, and consumer interactions. This data is analyzed to improve vehicle performance, enhance safety features, and optimize manufacturing processes.

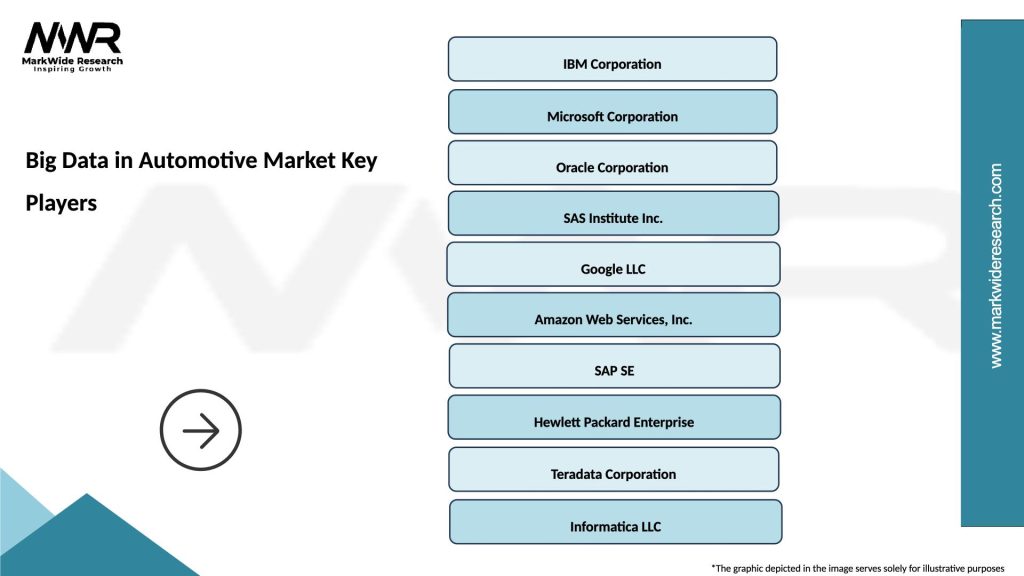

What are the key companies in the Big Data in Automotive Market?

Key companies in the Big Data in Automotive Market include IBM, Microsoft, and SAP, which provide analytics solutions and platforms for data management. Other notable players include Oracle and Google, among others.

What are the main drivers of growth in the Big Data in Automotive Market?

The main drivers of growth in the Big Data in Automotive Market include the increasing adoption of connected vehicles, the demand for enhanced customer experiences, and the need for predictive maintenance. Additionally, advancements in machine learning and AI are facilitating better data analysis.

What challenges does the Big Data in Automotive Market face?

Challenges in the Big Data in Automotive Market include data privacy concerns, the complexity of data integration from various sources, and the need for skilled professionals to analyze and interpret the data. These factors can hinder the effective utilization of big data.

What opportunities exist in the Big Data in Automotive Market?

Opportunities in the Big Data in Automotive Market include the potential for developing autonomous vehicles, enhancing supply chain efficiency, and creating personalized marketing strategies based on consumer data. The rise of electric vehicles also presents new data-driven insights.

What trends are shaping the Big Data in Automotive Market?

Trends shaping the Big Data in Automotive Market include the integration of IoT technologies, the use of real-time data analytics for decision-making, and the growing emphasis on sustainability through data-driven insights. Additionally, the shift towards mobility-as-a-service is influencing data strategies.

Big Data in Automotive Market

| Segmentation Details | Description |

|---|---|

| Product Type | Telematics, Infotainment Systems, Advanced Driver Assistance Systems, Fleet Management |

| Technology | Machine Learning, Cloud Computing, Edge Computing, Big Data Analytics |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Dealerships |

| Application | Predictive Maintenance, Vehicle Tracking, Driver Behavior Analysis, Smart Navigation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Big Data in Automotive Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at