444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The beverage non-dairy creamer market plays a crucial role in the food and beverage industry, offering a versatile alternative to traditional dairy creamers. Non-dairy creamers are widely used in coffee, tea, hot chocolate, and other beverages as a convenient, shelf-stable option. This market segment has witnessed significant growth driven by changing consumer preferences, dietary restrictions, and technological advancements in food processing.

Meaning

Beverage non-dairy creamers, often termed as coffee whitener or tea whitener, are dairy-free alternatives used to add creaminess and flavor to beverages. These products are typically made from plant-based ingredients such as coconut oil, soy, almond, or rice, blended with sweeteners and flavors. Non-dairy creamers cater to lactose-intolerant individuals and those opting for vegan or plant-based diets, offering a suitable substitute to dairy milk or cream.

Executive Summary

The beverage non-dairy creamer market has experienced rapid growth due to increasing consumer demand for plant-based and lactose-free alternatives in beverages. This market presents numerous opportunities for manufacturers and suppliers, driven by innovation in product formulations, expanding distribution channels, and rising health consciousness among consumers. Understanding key market insights and dynamics is crucial for stakeholders aiming to capitalize on these trends and maintain competitive advantage.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The beverage non-dairy creamer market operates within a dynamic framework influenced by shifting consumer preferences, regulatory landscapes, technological advancements, and competitive pressures. Adapting to these dynamics through innovation, strategic partnerships, and market expansion strategies is essential for sustained growth and competitiveness.

Regional Analysis

Competitive Landscape

Leading Companies in the Beverage Non-Dairy Creamer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

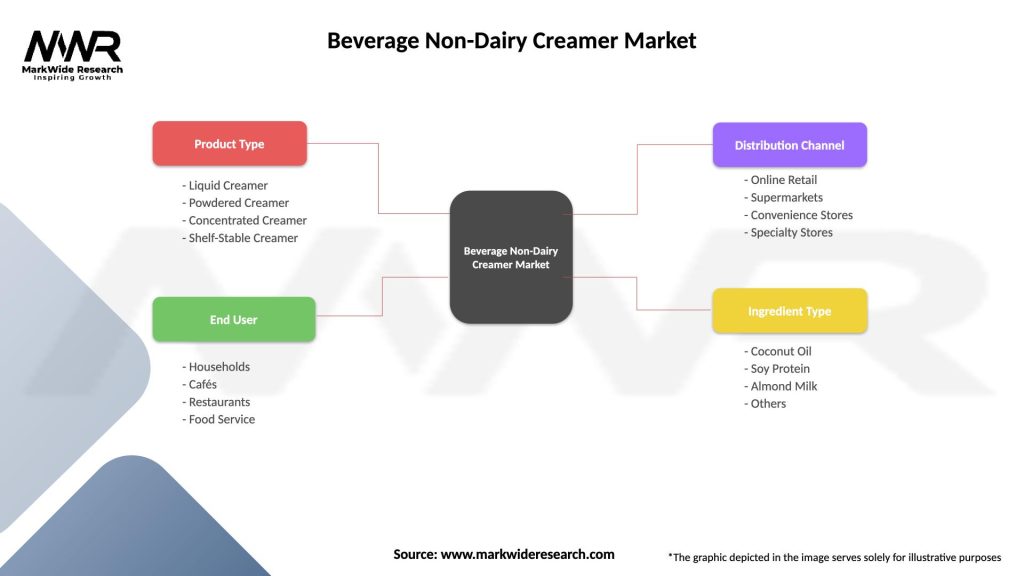

Segmentation

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic accelerated consumer demand for pantry staples, including non-dairy creamers, amid lockdowns and restricted mobility. While supply chain disruptions posed challenges, manufacturers adapted to shifting consumer behaviors and prioritized safety measures to ensure uninterrupted product availability.

Key Industry Developments

Analyst Suggestions

Future Outlook

The beverage non-dairy creamer market is poised for continued growth fueled by health and wellness trends, dietary shifts towards plant-based alternatives, and technological innovations in food processing. Key success factors include agility in adapting to consumer preferences, sustainability initiatives, and leveraging digital platforms for enhanced market reach and engagement.

Conclusion

The beverage non-dairy creamer market represents a dynamic segment within the global food and beverage industry, driven by innovation, consumer preferences, and sustainability imperatives. Stakeholders across the value chain are encouraged to capitalize on emerging opportunities, navigate market challenges, and align strategies with evolving trends to sustain growth and profitability. By fostering innovation, promoting sustainability, and meeting diverse consumer demands, industry players can secure a prominent position in this competitive landscape and contribute to shaping the future of beverage consumption worldwide.

What is Beverage Non-Dairy Creamer?

Beverage Non-Dairy Creamer refers to a plant-based alternative to traditional dairy creamers, often made from ingredients like coconut, almond, or soy. These creamers are used to enhance the flavor and texture of beverages such as coffee and tea.

What are the key companies in the Beverage Non-Dairy Creamer Market?

Key companies in the Beverage Non-Dairy Creamer Market include Nestlé, WhiteWave, and International Delight, among others. These companies are known for their diverse product offerings and innovations in non-dairy alternatives.

What are the growth factors driving the Beverage Non-Dairy Creamer Market?

The growth of the Beverage Non-Dairy Creamer Market is driven by increasing consumer demand for plant-based products, rising lactose intolerance awareness, and the trend towards healthier lifestyle choices. Additionally, the expansion of coffee culture globally contributes to market growth.

What challenges does the Beverage Non-Dairy Creamer Market face?

The Beverage Non-Dairy Creamer Market faces challenges such as competition from traditional dairy products, potential supply chain disruptions, and consumer skepticism regarding ingredient transparency. These factors can impact market penetration and growth.

What opportunities exist in the Beverage Non-Dairy Creamer Market?

Opportunities in the Beverage Non-Dairy Creamer Market include the development of new flavors and formulations, targeting health-conscious consumers, and expanding distribution channels. The rise of veganism and plant-based diets also presents significant growth potential.

What trends are shaping the Beverage Non-Dairy Creamer Market?

Trends shaping the Beverage Non-Dairy Creamer Market include the increasing popularity of organic and clean-label products, innovations in flavor profiles, and the rise of ready-to-drink coffee beverages. Additionally, sustainability practices in sourcing ingredients are becoming more prominent.

Beverage Non-Dairy Creamer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Creamer, Powdered Creamer, Concentrated Creamer, Shelf-Stable Creamer |

| End User | Households, Cafés, Restaurants, Food Service |

| Distribution Channel | Online Retail, Supermarkets, Convenience Stores, Specialty Stores |

| Ingredient Type | Coconut Oil, Soy Protein, Almond Milk, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Beverage Non-Dairy Creamer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at