444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Benelux container glass market represents a dynamic and evolving segment within the European packaging industry, encompassing Belgium, Netherlands, and Luxembourg. This market demonstrates remarkable resilience and growth potential, driven by increasing demand for sustainable packaging solutions across various industries including food and beverage, pharmaceuticals, and cosmetics. The region’s strategic location as a gateway to European markets, combined with strong manufacturing capabilities and environmental consciousness, positions the Benelux container glass market as a significant player in the global packaging landscape.

Market dynamics indicate substantial growth momentum, with the sector experiencing a 6.2% CAGR over recent years. This expansion reflects the region’s commitment to circular economy principles and the growing preference for recyclable packaging materials. The Netherlands leads regional consumption with approximately 45% market share, followed by Belgium at 38%, while Luxembourg contributes the remaining portion despite its smaller size.

Sustainability initiatives drive market transformation, with manufacturers investing heavily in energy-efficient production technologies and recycled content integration. The region’s advanced recycling infrastructure supports a 78% glass recycling rate, significantly above global averages. This environmental focus aligns with European Union regulations and consumer preferences for eco-friendly packaging solutions.

The Benelux container glass market refers to the comprehensive ecosystem of glass packaging production, distribution, and consumption across Belgium, Netherlands, and Luxembourg. This market encompasses various glass container types including bottles, jars, vials, and specialty packaging designed for diverse applications ranging from beverages and food products to pharmaceuticals and luxury goods.

Container glass manufacturing involves sophisticated processes including melting raw materials, forming containers through blow-and-blow or press-and-blow methods, annealing for strength enhancement, and quality control measures. The market includes both primary manufacturers who produce glass containers and secondary processors who provide decoration, labeling, and customization services.

Regional characteristics define this market through its emphasis on premium quality, innovative design capabilities, and strong environmental stewardship. The Benelux region’s container glass industry serves both domestic consumption and export markets, leveraging advanced logistics networks and proximity to major European population centers.

Strategic positioning of the Benelux container glass market reflects strong fundamentals and promising growth trajectories. The market benefits from robust demand across multiple end-use sectors, with the beverage industry accounting for approximately 52% of total consumption. Food packaging represents another significant segment, driven by premiumization trends and consumer preference for glass packaging’s perceived quality and safety benefits.

Technological advancement characterizes the regional industry, with manufacturers adopting Industry 4.0 principles including automated production lines, predictive maintenance systems, and quality monitoring technologies. These innovations enhance production efficiency while reducing environmental impact through optimized energy consumption and waste minimization.

Market consolidation trends show increasing collaboration between manufacturers and end-users, fostering innovation in container design and functionality. The region’s strong research and development capabilities support continuous product innovation, particularly in lightweight container designs and enhanced barrier properties for extended shelf life applications.

Export opportunities expand as Benelux manufacturers leverage their reputation for quality and sustainability to access growing international markets, particularly in emerging economies where glass packaging adoption continues to increase.

Market segmentation reveals diverse opportunities across multiple dimensions, with clear growth patterns emerging in specific categories:

Consumer preferences increasingly favor glass packaging due to its perceived premium quality, recyclability, and chemical inertness. Research indicates that 73% of consumers associate glass packaging with higher product quality compared to alternative materials.

Innovation trends focus on lightweighting technologies, which reduce material usage while maintaining structural integrity. Advanced forming techniques enable production of containers with 15-20% weight reduction compared to traditional designs, supporting sustainability goals while reducing transportation costs.

Environmental consciousness serves as the primary market driver, with increasing consumer and regulatory pressure for sustainable packaging solutions. The European Union’s circular economy action plan and single-use plastics directive create favorable conditions for glass packaging adoption. Glass containers offer infinite recyclability without quality degradation, aligning with regional sustainability objectives.

Premium positioning trends across food and beverage industries drive demand for glass packaging. Craft breweries, artisanal food producers, and premium spirits manufacturers prefer glass containers for their ability to preserve product integrity and enhance brand perception. This premiumization trend supports higher value segments within the container glass market.

Pharmaceutical industry growth creates specialized demand for high-quality glass containers. The region’s strong pharmaceutical manufacturing base, including both multinational corporations and specialized producers, requires containers meeting stringent regulatory standards for drug storage and delivery.

Technological advancement in manufacturing processes improves production efficiency and product quality. Advanced furnace technologies, automated handling systems, and quality control innovations reduce production costs while enhancing container performance characteristics.

Export market expansion provides growth opportunities as Benelux manufacturers leverage their quality reputation and strategic location to serve broader European and international markets.

Energy costs represent a significant challenge for container glass manufacturers, as glass production requires high-temperature furnaces operating continuously. Fluctuating energy prices impact production economics and competitiveness compared to alternative packaging materials.

Competition from alternatives poses ongoing challenges, particularly from lightweight plastic containers and aluminum packaging. These alternatives often offer cost advantages and reduced transportation expenses, creating pressure on glass container market share in price-sensitive applications.

Capital intensity of glass manufacturing operations creates barriers to entry and limits flexibility in production capacity adjustments. Furnace rebuilding cycles require substantial investments and extended downtime periods, affecting operational efficiency and market responsiveness.

Transportation costs impact market competitiveness due to glass containers’ weight and fragility. Higher logistics expenses compared to alternative packaging materials can limit market penetration in cost-sensitive applications and distant markets.

Regulatory compliance requirements, while supporting market growth through environmental regulations, also create operational complexities and compliance costs. Manufacturers must navigate evolving regulations regarding emissions, waste management, and product safety standards.

Circular economy initiatives create substantial opportunities for market expansion through increased recycled content utilization and closed-loop supply chains. The region’s advanced recycling infrastructure supports development of high-recycled-content containers, appealing to environmentally conscious consumers and brands.

Lightweighting innovations offer opportunities to address transportation cost concerns while maintaining glass packaging benefits. Advanced forming technologies and material science developments enable production of stronger, lighter containers that reduce logistics expenses and environmental impact.

Smart packaging integration presents emerging opportunities through incorporation of digital technologies into glass containers. Applications include temperature monitoring, authenticity verification, and consumer engagement features that add value beyond traditional packaging functions.

Emerging market expansion provides growth opportunities as developing economies increase glass packaging adoption. Benelux manufacturers can leverage their quality reputation and technological expertise to access these growing markets through strategic partnerships and export initiatives.

Specialty applications in pharmaceuticals, cosmetics, and premium food segments offer higher-value opportunities with less price sensitivity. These applications value glass packaging’s superior barrier properties, chemical inertness, and premium positioning capabilities.

Supply chain integration characterizes the evolving market structure, with manufacturers developing closer relationships with raw material suppliers and end-users. This integration improves efficiency, reduces costs, and enables better demand forecasting and capacity planning.

Technological convergence drives market evolution through adoption of digital technologies, automation, and advanced materials science. These developments enhance production efficiency, product quality, and customization capabilities while reducing environmental impact.

Competitive landscape shows increasing focus on differentiation through sustainability credentials, innovation capabilities, and service excellence. Manufacturers compete not only on price but also on environmental performance, design capabilities, and supply chain reliability.

Regulatory environment continues evolving toward greater environmental protection and circular economy principles. These changes create both opportunities for glass packaging growth and challenges requiring operational adaptations and compliance investments.

Consumer behavior shifts toward sustainability and premium quality support glass packaging adoption while creating pressure for continuous innovation in design, functionality, and environmental performance.

Comprehensive analysis of the Benelux container glass market employs multiple research methodologies to ensure accuracy and reliability. Primary research includes interviews with industry executives, manufacturers, suppliers, and end-users across the three countries to gather firsthand insights into market dynamics, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and regulatory documents. This approach provides historical context, market sizing information, and trend identification across different market segments and applications.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market trends and growth patterns. Data validation processes ensure accuracy and consistency across different information sources and analytical approaches.

Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis to understand market drivers, competitive dynamics, and future development scenarios. This methodology provides context and interpretation for quantitative findings.

Market segmentation analysis examines different product categories, end-use applications, and geographic regions to identify specific growth opportunities and market characteristics within the broader Benelux container glass market.

Netherlands market leads regional consumption with sophisticated demand patterns driven by strong food and beverage industries, advanced logistics infrastructure, and high environmental consciousness. The country’s strategic port locations support both domestic consumption and re-export activities, with Rotterdam serving as a major distribution hub for European markets.

Belgian market demonstrates strong performance across multiple segments, particularly in premium beer packaging and pharmaceutical applications. The country’s renowned brewing industry creates substantial demand for specialized glass containers, while its pharmaceutical manufacturing base requires high-quality medicinal packaging solutions.

Luxembourg market, despite its smaller size, shows unique characteristics with high per-capita consumption and focus on premium applications. The country’s financial sector and high disposable income levels support demand for luxury packaging in cosmetics and premium food products.

Cross-border integration characterizes the regional market, with manufacturers serving multiple countries and leveraging economies of scale. Transportation networks and regulatory harmonization facilitate efficient market operations across national boundaries.

Manufacturing concentration shows strategic positioning near major consumption centers and transportation hubs. Production facilities benefit from shared infrastructure, skilled workforce availability, and proximity to both raw material suppliers and end-user markets.

Market leadership reflects a combination of international corporations and regional specialists, each contributing unique strengths to the competitive environment:

Competitive strategies emphasize differentiation through sustainability credentials, innovation capabilities, and customer service excellence. Companies invest in advanced technologies, environmental performance improvements, and customization capabilities to maintain competitive advantages.

Market consolidation trends show strategic partnerships and acquisitions aimed at achieving scale economies and expanding market coverage. These developments enhance operational efficiency while providing broader service capabilities to customers.

Innovation focus drives competitive positioning through development of lightweight designs, enhanced barrier properties, and smart packaging features. Companies collaborate with customers and research institutions to develop next-generation container solutions.

By Product Type:

By End-Use Industry:

By Manufacturing Process:

Beverage containers dominate market volume with strong demand from alcoholic and non-alcoholic beverage producers. Wine bottles represent the largest single category, benefiting from the region’s wine consumption culture and import/export activities. Beer containers show steady demand from both large breweries and growing craft beer segment.

Food packaging applications demonstrate growth potential driven by artisanal food producers and premium positioning strategies. Specialty jars for preserves, sauces, and gourmet products benefit from consumer preference for glass packaging’s quality perception and recyclability.

Pharmaceutical packaging represents a high-value segment with stringent quality requirements and regulatory compliance needs. This category includes vials for injectable medications, bottles for oral medications, and specialized containers for biotechnology products.

Cosmetics packaging shows strong growth driven by premium brand positioning and aesthetic requirements. Glass containers provide luxury appeal and product protection for fragrances, skincare products, and color cosmetics.

Industrial applications serve specialized needs including laboratory glassware, chemical storage, and technical applications requiring glass’s chemical inertness and temperature resistance properties.

Manufacturers benefit from strong regional demand, advanced infrastructure, and skilled workforce availability. The region’s strategic location provides access to broader European markets while regulatory stability supports long-term investment planning and operational efficiency.

End-users gain from reliable supply chains, high-quality products, and innovation capabilities. Local manufacturing reduces transportation costs and delivery times while providing flexibility for customization and rapid response to market changes.

Consumers enjoy sustainable packaging options with superior product protection and premium positioning. Glass containers provide chemical inertness, recyclability, and aesthetic appeal that enhance product experience and environmental responsibility.

Environmental stakeholders benefit from the industry’s commitment to circular economy principles, high recycling rates, and continuous improvement in energy efficiency and emissions reduction.

Economic development receives support through manufacturing employment, export revenues, and supply chain integration that strengthens regional industrial competitiveness and innovation capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration drives fundamental market transformation through increased recycled content utilization, energy efficiency improvements, and circular economy implementation. Manufacturers achieve 85% recycled content in many product lines while reducing energy consumption through advanced furnace technologies.

Lightweighting innovation addresses transportation cost concerns while maintaining structural integrity and barrier properties. Advanced forming techniques enable weight reductions while improving container strength and durability.

Smart packaging development incorporates digital technologies including NFC chips, temperature indicators, and authenticity verification features. These innovations add value beyond traditional packaging functions while supporting brand engagement and supply chain transparency.

Customization capabilities expand through flexible manufacturing systems and digital design tools. Manufacturers offer shorter production runs and specialized designs to meet specific customer requirements and market niches.

Supply chain optimization focuses on reducing environmental impact and improving efficiency through local sourcing, transportation optimization, and waste minimization initiatives throughout the value chain.

Technology investments focus on Industry 4.0 implementation including automated production lines, predictive maintenance systems, and quality monitoring technologies. These developments improve efficiency while reducing environmental impact and operational costs.

Sustainability initiatives include major investments in renewable energy, recycling infrastructure expansion, and carbon footprint reduction programs. MarkWide Research analysis indicates that regional manufacturers have achieved 25% reduction in carbon emissions over the past five years.

Strategic partnerships between manufacturers and end-users foster innovation in container design and functionality. These collaborations accelerate development of specialized solutions for emerging applications and market requirements.

Capacity expansion projects focus on high-value segments including pharmaceutical packaging and specialty applications. Manufacturers invest in advanced production capabilities to serve growing demand in premium market segments.

Regulatory compliance initiatives address evolving environmental and safety requirements through operational improvements and technology upgrades. These investments ensure continued market access while supporting sustainability objectives.

Innovation investment should prioritize lightweighting technologies and smart packaging features to address market challenges and create competitive advantages. Manufacturers should collaborate with technology partners and research institutions to accelerate development timelines.

Sustainability leadership requires continued investment in recycled content utilization, energy efficiency, and circular economy implementation. Companies should set ambitious environmental targets and communicate progress transparently to stakeholders.

Market diversification into high-value segments including pharmaceuticals and specialty applications can improve profitability and reduce dependence on traditional markets. Strategic focus on these segments requires specialized capabilities and quality certifications.

Supply chain optimization should emphasize local sourcing, transportation efficiency, and waste reduction to improve competitiveness and environmental performance. Digital technologies can enhance visibility and optimization opportunities.

Customer collaboration through strategic partnerships and co-development initiatives can accelerate innovation while ensuring market relevance. Close relationships with end-users provide insights into emerging requirements and application opportunities.

Growth trajectory remains positive driven by sustainability trends, premium positioning, and innovation capabilities. MWR projections indicate continued expansion with particular strength in high-value applications and export markets.

Technology evolution will transform manufacturing processes through automation, digitalization, and advanced materials science. These developments will improve efficiency, quality, and customization capabilities while reducing environmental impact.

Market expansion opportunities exist in emerging applications including smart packaging, pharmaceutical innovations, and specialty industrial uses. These segments offer higher value and growth potential compared to traditional applications.

Sustainability requirements will continue driving market evolution through regulatory changes and consumer preferences. Companies investing in environmental performance will gain competitive advantages and market access opportunities.

Regional integration will deepen through supply chain optimization, regulatory harmonization, and market consolidation. This integration will improve efficiency while maintaining the region’s competitive position in global markets.

The Benelux container glass market demonstrates strong fundamentals and promising growth prospects driven by sustainability trends, premium positioning, and innovation capabilities. The region’s strategic advantages including location, infrastructure, and technical expertise position it well for continued market leadership and expansion opportunities.

Sustainability leadership provides the foundation for long-term growth as environmental consciousness drives demand for recyclable packaging solutions. The region’s advanced recycling infrastructure and commitment to circular economy principles create competitive advantages in global markets.

Innovation potential in lightweighting, smart packaging, and specialty applications offers pathways for market expansion and value creation. Manufacturers investing in these capabilities will capture emerging opportunities while addressing traditional market challenges.

Strategic positioning requires continued focus on quality, sustainability, and customer collaboration to maintain competitive advantages. The combination of environmental performance, technical excellence, and market responsiveness will determine success in this evolving market landscape.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

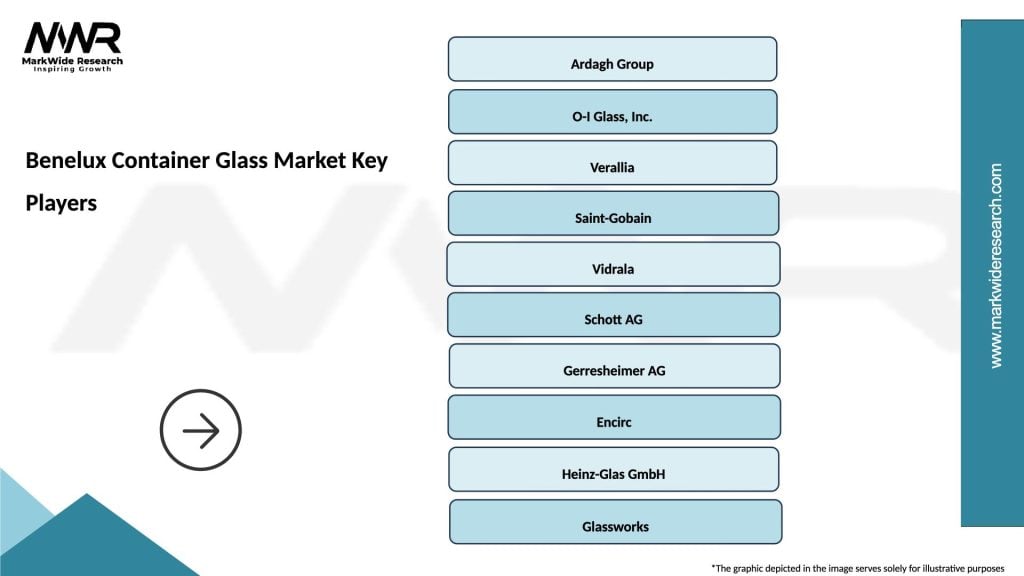

What are the key players in the Benelux Container Glass Market?

Key players in the Benelux Container Glass Market include Ardagh Group, O-I Glass, and Verallia, which are known for their innovative packaging solutions and extensive product ranges, among others.

What are the main drivers of the Benelux Container Glass Market?

The main drivers of the Benelux Container Glass Market include the increasing demand for sustainable packaging solutions, the growth of the beverage industry, and the rising consumer preference for glass over plastic due to health and environmental concerns.

What challenges does the Benelux Container Glass Market face?

Challenges in the Benelux Container Glass Market include the high production costs associated with glass manufacturing, competition from alternative packaging materials, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Benelux Container Glass Market?

Opportunities in the Benelux Container Glass Market include the expansion of e-commerce, which increases demand for safe and sustainable packaging, and the growing trend of premiumization in the food and beverage sector, which favors high-quality glass containers.

What trends are shaping the Benelux Container Glass Market?

Trends shaping the Benelux Container Glass Market include the rise of eco-friendly packaging solutions, advancements in glass recycling technologies, and the increasing use of smart packaging features to enhance consumer engagement.

Benelux Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Packaging Type | Rigid, Flexible, Bulk, Specialty |

| Grade | Recycled, High Clarity, Low Iron, Standard |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Benelux Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at