444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Belgium used car market represents a dynamic and rapidly evolving automotive sector that has experienced significant transformation in recent years. Market dynamics indicate robust growth driven by changing consumer preferences, economic considerations, and technological advancements in vehicle quality assessment. The Belgian automotive landscape demonstrates strong demand for pre-owned vehicles, with digital platforms revolutionizing how consumers discover, evaluate, and purchase used cars.

Consumer behavior in Belgium shows increasing sophistication in used car purchasing decisions, with buyers leveraging online resources and professional inspection services. The market benefits from strategic geographic positioning within Europe, facilitating cross-border trade and expanding inventory options for Belgian consumers. Growth projections suggest the market will continue expanding at a steady CAGR of 6.2% through the forecast period, driven by economic recovery and evolving mobility preferences.

Digital transformation has fundamentally altered the Belgium used car market, with online platforms capturing approximately 78% of initial vehicle searches. Traditional dealerships are adapting by integrating digital tools and enhancing customer experience through virtual showrooms and comprehensive vehicle history reporting. The market demonstrates resilience and adaptability, positioning Belgium as a significant player in the European used car ecosystem.

The Belgium used car market refers to the comprehensive ecosystem encompassing the sale, purchase, financing, and servicing of pre-owned vehicles within Belgian territory. This market includes various stakeholders such as independent dealers, franchised dealerships, private sellers, online platforms, and automotive service providers who facilitate the transfer of previously owned vehicles to new owners.

Market participants engage in activities ranging from vehicle acquisition and reconditioning to marketing, sales, and post-purchase services. The Belgium used car market operates through multiple channels including traditional brick-and-mortar dealerships, online marketplaces, auction houses, and direct consumer-to-consumer transactions. Regulatory frameworks govern vehicle inspections, documentation requirements, warranty provisions, and consumer protection measures.

Value proposition in the Belgium used car market centers on providing affordable mobility solutions while ensuring vehicle quality, reliability, and legal compliance. The market serves diverse consumer segments seeking cost-effective transportation alternatives to new vehicle purchases, supporting economic accessibility and sustainable automotive consumption patterns throughout Belgium.

Strategic analysis reveals the Belgium used car market as a robust and expanding sector characterized by digital innovation, consumer-centric services, and strong regulatory oversight. Market fundamentals demonstrate healthy demand dynamics supported by economic recovery, urbanization trends, and evolving consumer preferences toward flexible mobility solutions.

Key performance indicators highlight significant growth in online platform adoption, with digital channels accounting for 85% of vehicle research activities. The market benefits from Belgium’s strategic location, advanced logistics infrastructure, and sophisticated financial services ecosystem supporting used car transactions. Competitive landscape features established dealership networks alongside emerging digital-first platforms creating comprehensive market coverage.

Growth drivers include increasing consumer confidence in used vehicle quality, enhanced vehicle inspection technologies, and expanding financing options. The market demonstrates resilience through economic cycles while adapting to changing consumer expectations for transparency, convenience, and value. Future prospects indicate continued expansion supported by technological innovation and evolving mobility preferences across Belgian demographics.

Consumer preferences in the Belgium used car market reveal several critical trends shaping industry dynamics:

Market segmentation reveals distinct consumer groups with varying preferences, purchasing power, and decision-making criteria. Demographic analysis indicates strong participation across age groups, with millennials and Gen X representing the most active buyer segments in the Belgium used car market.

Economic factors serve as primary drivers propelling the Belgium used car market forward. Cost considerations motivate consumers to explore used vehicle options as alternatives to new car purchases, particularly given the significant depreciation advantages and lower insurance costs associated with pre-owned vehicles.

Digital transformation continues driving market expansion through enhanced accessibility and convenience. Online platforms provide comprehensive vehicle information, comparison tools, and streamlined purchasing processes that attract tech-savvy consumers. Mobile applications and digital marketplaces have democratized access to vehicle inventory, enabling consumers to explore options beyond their immediate geographic area.

Urbanization trends in Belgium create demand for flexible mobility solutions, with used cars offering affordable access to personal transportation. Environmental consciousness drives interest in newer used vehicles with improved fuel efficiency and lower emissions profiles. The market benefits from improved vehicle quality and longevity, making used cars increasingly attractive to quality-conscious consumers.

Financial services innovation supports market growth through accessible financing options, competitive interest rates, and flexible payment structures. Regulatory support through consumer protection measures and standardized inspection requirements builds confidence in used car transactions, encouraging market participation across diverse consumer segments.

Economic uncertainty poses challenges to the Belgium used car market, with fluctuating consumer confidence affecting discretionary spending on vehicle purchases. Supply chain disruptions impact vehicle availability and pricing stability, creating market volatility that affects both dealers and consumers.

Regulatory compliance requirements increase operational costs for market participants, particularly smaller dealers who must invest in inspection equipment, documentation systems, and staff training. Quality concerns regarding vehicle condition and history continue to influence consumer hesitation, despite improved inspection technologies and reporting systems.

Competition intensity from new vehicle incentives and promotional programs can divert consumer attention from used car options. Financing challenges for consumers with limited credit history or lower income levels restrict market accessibility, limiting potential customer base expansion.

Technology adoption barriers among traditional dealers slow market modernization and limit competitive positioning against digital-native platforms. Insurance costs and maintenance concerns for older vehicles create additional ownership considerations that may deter some potential buyers from entering the used car market.

Digital expansion presents significant opportunities for Belgium used car market participants to enhance customer engagement and operational efficiency. Artificial intelligence and machine learning technologies offer potential for improved vehicle valuation, predictive maintenance insights, and personalized customer recommendations.

Cross-border trade opportunities within the European Union enable Belgian dealers to access broader inventory sources and serve international customers. Subscription models and flexible ownership arrangements represent emerging opportunities to attract consumers seeking alternatives to traditional vehicle ownership.

Electric vehicle integration creates opportunities for specialized used EV markets, with growing consumer interest in sustainable transportation options. Data analytics capabilities enable more sophisticated market insights, pricing optimization, and customer relationship management for competitive advantage.

Partnership opportunities with financial institutions, insurance providers, and technology companies can create comprehensive service ecosystems that enhance customer value propositions. Export markets present growth opportunities for Belgian used car dealers to expand beyond domestic boundaries and capture international demand.

Supply and demand dynamics in the Belgium used car market reflect complex interactions between economic conditions, consumer preferences, and industry capabilities. Inventory management challenges require sophisticated forecasting and procurement strategies to maintain optimal stock levels across diverse vehicle categories.

Pricing mechanisms incorporate multiple factors including vehicle age, mileage, condition, brand reputation, and market demand patterns. Seasonal variations influence market activity, with spring and summer months typically showing increased transaction volumes and higher prices due to enhanced consumer mobility preferences.

Technology integration continues reshaping market dynamics through automated valuation systems, digital inspection tools, and enhanced customer communication platforms. Competitive pressures drive continuous innovation in service delivery, pricing strategies, and customer experience enhancement across market participants.

Regulatory evolution impacts market dynamics through changing inspection requirements, environmental standards, and consumer protection measures. According to MarkWide Research analysis, market dynamics indicate increasing consolidation among smaller dealers while digital platforms gain market share of approximately 42% in online vehicle transactions.

Comprehensive research methodology employed in analyzing the Belgium used car market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders, consumer surveys, and direct observation of market activities across various geographic regions within Belgium.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and academic publications relevant to automotive markets and consumer behavior. Quantitative analysis utilizes statistical modeling techniques to identify trends, correlations, and predictive indicators affecting market performance.

Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their preferences. Competitive analysis includes evaluation of market participants’ strategies, performance metrics, and positioning approaches to understand competitive dynamics.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Trend analysis incorporates historical data patterns and forward-looking indicators to develop reliable market projections and strategic insights for stakeholders.

Geographic distribution of the Belgium used car market reveals distinct regional characteristics influenced by population density, economic conditions, and transportation infrastructure. Brussels Capital Region demonstrates the highest market activity with approximately 35% of total transactions, driven by urban population density and higher disposable income levels.

Flanders region represents the largest market segment by volume, accounting for roughly 58% of used car sales due to its extensive population base and strong economic activity. Consumer preferences in Flanders show strong demand for practical vehicles suitable for both urban and rural environments.

Wallonia region contributes approximately 25% of market activity, with distinct preferences for fuel-efficient vehicles and competitive pricing. Cross-regional trade patterns indicate significant vehicle movement between regions, facilitated by Belgium’s compact geography and excellent transportation networks.

Border areas demonstrate unique market dynamics with increased cross-border shopping and arbitrage opportunities. Urban centers like Antwerp, Ghent, and Liège show higher adoption rates of digital platforms and premium vehicle segments, while rural areas maintain stronger relationships with traditional dealerships and local service providers.

Market competition in the Belgium used car sector features diverse participants ranging from large dealership groups to independent operators and digital platforms. Established players maintain competitive advantages through extensive inventory, financing partnerships, and comprehensive service offerings.

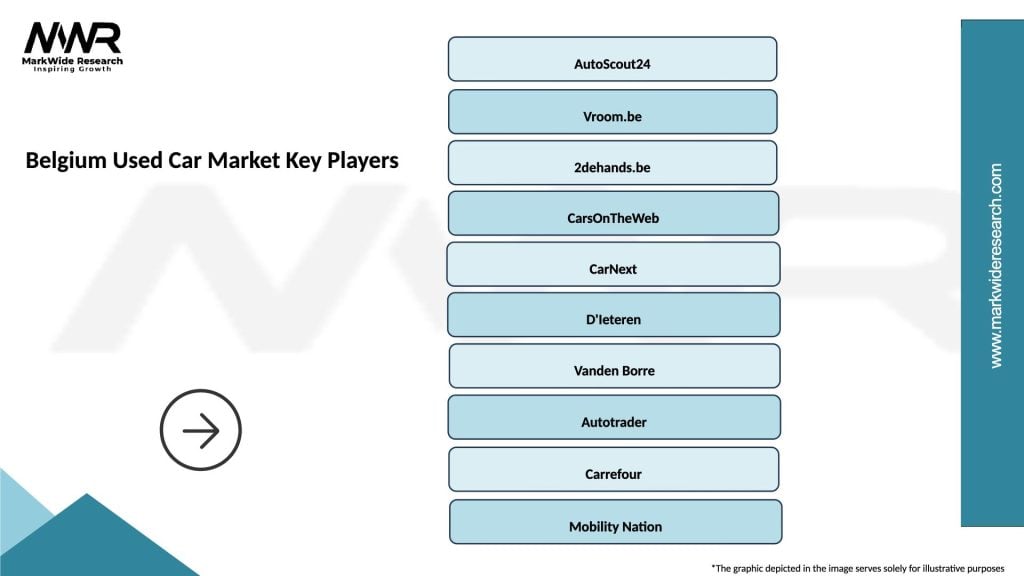

Key market participants include:

Competitive strategies emphasize customer experience enhancement, digital transformation, and value-added services. Market consolidation trends indicate increasing cooperation between traditional dealers and digital platforms to create comprehensive customer solutions.

Market segmentation in the Belgium used car market encompasses multiple dimensions reflecting diverse consumer needs and preferences. By Vehicle Type:

By Price Range:

By Age Group:

Compact cars dominate the Belgium used car market due to practical urban driving requirements and fuel efficiency considerations. Consumer preferences favor European brands with strong reliability records and readily available service networks throughout Belgium.

SUV segment demonstrates the strongest growth trajectory, with annual growth rates exceeding 12% driven by lifestyle preferences and perceived safety advantages. Premium SUVs show particular strength in urban markets where consumers value comfort and status symbolism.

Electric and hybrid vehicles represent an emerging category with increasing consumer interest and government incentive support. Market penetration remains limited but shows accelerating adoption rates among environmentally conscious consumers and urban commuters.

Commercial vehicles serve specialized business needs with distinct purchasing criteria emphasizing durability, payload capacity, and total cost of ownership. Delivery vehicles show increased demand driven by e-commerce growth and last-mile logistics requirements.

Luxury segment maintains stable demand among affluent consumers seeking premium features at reduced prices compared to new vehicle alternatives. Certified pre-owned programs from luxury manufacturers provide quality assurance and warranty coverage that appeals to discerning buyers.

Dealers and retailers benefit from expanding market opportunities through digital platform integration and enhanced customer reach. Operational efficiency improvements through technology adoption enable better inventory management, pricing optimization, and customer service delivery.

Consumers gain access to broader vehicle selection, transparent pricing information, and comprehensive vehicle history reporting. Financial benefits include lower purchase prices, reduced depreciation impact, and competitive financing options tailored to used car purchases.

Financial institutions benefit from expanding lending opportunities with competitive interest margins and diversified risk profiles. Insurance providers access growing customer bases while developing specialized products for used vehicle coverage.

Technology providers find opportunities in developing specialized solutions for vehicle inspection, valuation, and customer engagement. Service providers benefit from increased vehicle maintenance and repair demand as consumers invest in vehicle longevity and performance optimization.

Government stakeholders benefit from increased tax revenues, employment generation, and enhanced consumer mobility options supporting economic development. Environmental benefits include extended vehicle lifecycles and improved resource utilization efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first approach continues transforming the Belgium used car market with online platforms becoming primary research and discovery channels. Mobile optimization drives platform development as consumers increasingly use smartphones for vehicle shopping and comparison activities.

Transparency enhancement through comprehensive vehicle history reporting and professional inspection services builds consumer confidence. Artificial intelligence integration enables personalized recommendations, automated valuation, and predictive maintenance insights that enhance customer experience.

Subscription models emerge as alternative ownership structures appealing to consumers seeking flexibility and predictable costs. Contactless transactions gain popularity through digital documentation, virtual inspections, and home delivery services.

Sustainability focus drives interest in fuel-efficient and electric vehicles within the used car segment. Data analytics capabilities enable sophisticated market insights and personalized customer engagement strategies. MWR research indicates that digital platform adoption rates have increased by 28% annually among Belgian consumers.

Platform consolidation accelerates as major players acquire smaller competitors to expand market coverage and technological capabilities. Partnership agreements between traditional dealers and digital platforms create hybrid service models combining online convenience with physical inspection and delivery services.

Technology investments focus on artificial intelligence, blockchain verification systems, and augmented reality tools for virtual vehicle inspections. Financing innovation includes flexible payment structures, instant approval systems, and integrated insurance products.

Regulatory developments enhance consumer protection through standardized inspection protocols and mandatory vehicle history disclosure requirements. Cross-border initiatives facilitate international trade and expand inventory access for Belgian consumers and dealers.

Sustainability programs promote vehicle lifecycle extension and responsible disposal practices. Quality certification programs from industry associations provide standardized quality assurance frameworks that benefit both dealers and consumers in the Belgium used car market.

Digital transformation should remain a priority for all market participants, with investments in user-friendly platforms, mobile optimization, and data analytics capabilities. Customer experience enhancement through streamlined processes, transparent communication, and comprehensive support services will drive competitive differentiation.

Quality assurance programs should be expanded to include standardized inspection protocols, comprehensive warranty options, and professional reconditioning services. Partnership strategies between traditional dealers and technology providers can create synergistic advantages in market coverage and service delivery.

Market expansion opportunities should focus on cross-border trade within the EU and specialized segments like electric vehicles and commercial applications. Financial services integration can enhance customer value propositions while generating additional revenue streams.

Sustainability initiatives should be incorporated into business strategies to align with evolving consumer preferences and regulatory requirements. Data-driven decision making through advanced analytics can optimize inventory management, pricing strategies, and customer targeting for improved profitability and market share growth.

Growth projections for the Belgium used car market indicate continued expansion driven by digital transformation, evolving consumer preferences, and economic recovery. Market maturation will likely result in increased consolidation among smaller players while digital platforms strengthen their market positions.

Technology integration will accelerate with artificial intelligence, blockchain, and IoT applications becoming standard features in vehicle evaluation, transaction processing, and customer service delivery. Electric vehicle adoption within the used car segment is expected to grow significantly as EV prices decline and charging infrastructure expands.

Consumer expectations will continue evolving toward greater transparency, convenience, and personalized service experiences. Regulatory environment may introduce additional consumer protection measures and environmental standards that impact market operations and vehicle eligibility criteria.

Cross-border opportunities will expand as EU integration deepens and digital platforms facilitate international transactions. According to MarkWide Research projections, the Belgium used car market is positioned for sustained growth of 6.8% CAGR over the next five years, supported by technological innovation and changing mobility preferences across demographic segments.

Strategic assessment of the Belgium used car market reveals a dynamic and resilient sector positioned for continued growth and transformation. Digital innovation serves as the primary catalyst driving market evolution, with online platforms revolutionizing customer engagement and transaction processes throughout the automotive ecosystem.

Market fundamentals demonstrate strong underlying demand supported by economic recovery, urbanization trends, and evolving consumer preferences toward cost-effective mobility solutions. Competitive landscape continues evolving through technology adoption, service integration, and strategic partnerships that enhance customer value propositions.

Future prospects indicate sustained market expansion driven by digital transformation, regulatory support, and increasing consumer confidence in used vehicle quality and reliability. The Belgium used car market represents significant opportunities for stakeholders who embrace innovation, prioritize customer experience, and adapt to changing market dynamics in the evolving automotive landscape.

What is Belgium Used Car?

Belgium Used Car refers to pre-owned vehicles that are available for sale in Belgium. This market includes a variety of makes and models, catering to different consumer preferences and budgets.

What are the key players in the Belgium Used Car Market?

Key players in the Belgium Used Car Market include D’Ieteren, AutoScout24, and Vroom.be, which provide platforms for buying and selling used vehicles. These companies play a significant role in shaping market dynamics and consumer choices, among others.

What are the growth factors driving the Belgium Used Car Market?

The Belgium Used Car Market is driven by factors such as increasing consumer demand for affordable transportation, the rising popularity of online car sales platforms, and a growing awareness of the benefits of purchasing used vehicles over new ones.

What challenges does the Belgium Used Car Market face?

Challenges in the Belgium Used Car Market include fluctuating vehicle prices, the impact of economic conditions on consumer spending, and the need for stringent vehicle inspections to ensure quality and safety.

What opportunities exist in the Belgium Used Car Market?

Opportunities in the Belgium Used Car Market include the expansion of digital sales channels, increasing interest in electric and hybrid used vehicles, and potential partnerships between dealerships and online platforms to enhance customer experience.

What trends are shaping the Belgium Used Car Market?

Trends in the Belgium Used Car Market include a shift towards online purchasing, the growing importance of vehicle history reports, and an increasing focus on sustainability, with consumers showing interest in eco-friendly vehicle options.

Belgium Used Car Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, 1-3 Years, 4-6 Years, 7+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Belgium Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at