444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Belgium telecom market stands as one of Europe’s most advanced and competitive telecommunications landscapes, characterized by robust infrastructure development and high digital adoption rates. Belgium’s telecommunications sector has evolved significantly over the past decade, driven by increasing demand for high-speed internet connectivity, mobile services, and digital transformation initiatives across both consumer and enterprise segments.

Market dynamics in Belgium reflect a mature telecommunications environment with strong competition among major operators and emerging technology providers. The country’s strategic location in Europe, combined with its advanced digital infrastructure, positions Belgium as a critical hub for telecommunications services across the region. Growth patterns indicate sustained expansion at approximately 4.2% CAGR over the forecast period, supported by 5G network deployments and fiber-optic infrastructure investments.

Consumer behavior in Belgium demonstrates sophisticated preferences for integrated telecommunications solutions, with increasing adoption of bundled services combining mobile, broadband, and digital television offerings. The market exhibits strong penetration rates across all telecommunications segments, with mobile penetration exceeding 115% and broadband adoption reaching 87% of households nationwide.

Regulatory frameworks established by the Belgian Institute for Postal Services and Telecommunications (BIPT) continue to foster competitive market conditions while ensuring consumer protection and service quality standards. These regulatory measures have contributed to Belgium’s position among Europe’s leading telecommunications markets in terms of service quality and innovation adoption.

The Belgium telecom market refers to the comprehensive ecosystem of telecommunications services, infrastructure, and technologies operating within Belgium’s national boundaries. This market encompasses mobile communications, fixed-line telephony, broadband internet services, data transmission, and emerging digital communication technologies serving both residential and business customers.

Telecommunications services in Belgium include traditional voice communications, high-speed internet connectivity, mobile data services, enterprise networking solutions, and advanced digital services such as cloud communications and Internet of Things (IoT) connectivity. The market structure incorporates network operators, service providers, equipment manufacturers, and technology solution providers working collaboratively to deliver comprehensive telecommunications solutions.

Market participants range from established incumbent operators to innovative digital service providers, creating a diverse competitive landscape that drives continuous innovation and service improvement. The Belgium telecom market operates within European Union regulatory frameworks while maintaining specific national characteristics that reflect local consumer preferences and business requirements.

Belgium’s telecommunications market represents a highly developed and competitive sector characterized by advanced infrastructure, strong regulatory oversight, and sophisticated consumer demand patterns. The market demonstrates consistent growth momentum driven by digital transformation initiatives, 5G network deployments, and increasing enterprise demand for advanced connectivity solutions.

Key market drivers include accelerating digitalization across industries, remote work adoption trends, and growing demand for high-bandwidth applications. Enterprise segment growth accounts for approximately 38% of total market expansion, reflecting increased business investment in digital infrastructure and cloud-based communications solutions.

Competitive dynamics feature intense rivalry among major operators, with market leadership positions shifting based on service innovation, network quality, and customer experience delivery. The market structure supports healthy competition while maintaining service quality standards that position Belgium among Europe’s top-performing telecommunications markets.

Future prospects indicate continued market expansion supported by 5G technology adoption, fiber-optic network extensions, and emerging technologies such as edge computing and IoT connectivity solutions. Investment levels in network infrastructure remain robust, with operators committing significant resources to maintain technological leadership positions.

Strategic insights reveal several critical factors shaping Belgium’s telecommunications landscape and driving market evolution:

Digital transformation initiatives across Belgium’s economy serve as the primary catalyst for telecommunications market growth, with organizations investing heavily in advanced connectivity solutions to support modernization efforts. Enterprise digitalization drives demand for high-bandwidth internet services, cloud connectivity, and integrated communications platforms that enable remote work capabilities and digital collaboration tools.

5G network deployment represents a significant growth driver, enabling new service categories and applications that require ultra-low latency and high-speed connectivity. The rollout of 5G infrastructure creates opportunities for innovative services including augmented reality applications, autonomous vehicle communications, and industrial IoT implementations that drive revenue growth across multiple market segments.

Consumer lifestyle changes continue to fuel demand for enhanced telecommunications services, with streaming media consumption, online gaming, and remote work arrangements requiring robust broadband connectivity and reliable mobile services. Household broadband usage has increased by 45% over recent years, reflecting changing consumption patterns and digital service adoption.

Government digitalization programs contribute to market expansion through public sector investments in digital infrastructure and smart city initiatives. These programs create demand for advanced telecommunications solutions while demonstrating technology capabilities that encourage private sector adoption and investment in similar solutions.

European Union connectivity objectives drive infrastructure investment and service enhancement initiatives, with regulatory support for broadband expansion and 5G deployment creating favorable conditions for market growth and technology advancement across Belgium’s telecommunications sector.

Infrastructure investment requirements present significant challenges for telecommunications operators, with 5G network deployment and fiber-optic expansion requiring substantial capital commitments that may strain financial resources and impact profitability in the short term. Network modernization costs continue to pressure operator margins while competitive dynamics limit pricing flexibility.

Regulatory compliance complexities create operational challenges and additional costs for market participants, particularly regarding data protection requirements, network security standards, and consumer protection regulations. These compliance obligations require ongoing investment in systems and processes that may divert resources from growth initiatives and service innovation efforts.

Market saturation levels in core telecommunications services limit organic growth opportunities, with high penetration rates in mobile and broadband services requiring operators to focus on value-added services and customer retention strategies rather than subscriber acquisition. Competition intensity further pressures pricing strategies and profit margins across all service categories.

Technology transition challenges create operational complexities as operators manage legacy system maintenance while implementing new technologies and service platforms. The need to maintain service continuity during technology upgrades requires careful planning and additional resource allocation that may impact operational efficiency.

Cybersecurity threats require continuous investment in security infrastructure and monitoring capabilities, creating ongoing operational costs and potential service disruption risks that must be managed through comprehensive security strategies and incident response capabilities.

5G service innovation creates substantial opportunities for revenue diversification and market expansion, with new applications in industrial automation, smart city solutions, and enhanced mobile broadband services opening previously unavailable market segments. Enterprise 5G adoption is projected to grow at 28% annually, driven by manufacturing digitalization and logistics optimization requirements.

Internet of Things connectivity represents a significant growth opportunity as businesses and consumers increasingly adopt connected devices and smart systems. The expanding IoT ecosystem creates demand for specialized connectivity solutions, data management services, and analytics platforms that telecommunications operators are well-positioned to provide.

Edge computing services offer opportunities for operators to leverage network infrastructure investments while providing low-latency computing capabilities that support emerging applications such as autonomous vehicles, augmented reality, and real-time analytics. These services command premium pricing while utilizing existing network assets more effectively.

Digital services integration enables telecommunications operators to expand beyond traditional connectivity services into cloud computing, cybersecurity, and digital transformation consulting. MarkWide Research analysis indicates that integrated digital services represent the fastest-growing segment within Belgium’s telecommunications market.

Cross-border connectivity solutions leverage Belgium’s strategic European location to serve multinational enterprises and support regional digital infrastructure development. These opportunities include international private networks, cross-border data services, and regional telecommunications hub development that capitalize on Belgium’s connectivity advantages.

Competitive forces within Belgium’s telecommunications market create a dynamic environment where operators must continuously innovate and enhance service offerings to maintain market position. Price competition remains intense across all service categories, with operators leveraging service bundling, customer experience improvements, and technology differentiation to compete effectively.

Technology evolution drives rapid changes in service capabilities and customer expectations, requiring operators to invest continuously in network upgrades and new service development. The transition to 5G networks, fiber-optic infrastructure expansion, and cloud-based service platforms creates both opportunities and challenges for market participants.

Customer behavior shifts toward digital services and integrated solutions influence market dynamics, with consumers and businesses increasingly demanding seamless connectivity across multiple devices and locations. Service integration preferences have increased by 35% among enterprise customers, driving demand for unified communications and managed services.

Regulatory evolution continues to shape market structure and competitive dynamics, with policies promoting infrastructure sharing, spectrum allocation, and consumer protection influencing operator strategies and market development. These regulatory frameworks balance competition promotion with investment incentives to ensure continued market development.

Economic factors including business investment levels, consumer spending patterns, and government digitalization initiatives influence market demand and growth trajectories. Economic stability supports sustained investment in telecommunications infrastructure while economic uncertainties may impact discretionary spending on advanced services.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Belgium’s telecommunications market dynamics. Primary research activities include structured interviews with industry executives, telecommunications operators, enterprise customers, and regulatory officials to gather firsthand insights into market trends and competitive dynamics.

Secondary research components incorporate analysis of regulatory filings, financial reports, industry publications, and government statistics to validate primary research findings and provide comprehensive market context. Data triangulation techniques ensure research accuracy by comparing insights from multiple sources and methodologies.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators across different market segments. Market sizing methodologies employ bottom-up and top-down approaches to ensure comprehensive coverage of all market components and accurate representation of market dynamics.

Qualitative research methods include focus groups with telecommunications customers, expert interviews with technology providers, and case study analysis of successful service implementations. These approaches provide deeper insights into customer preferences, technology adoption patterns, and market development opportunities.

Continuous monitoring systems track market developments, regulatory changes, and competitive activities to ensure research findings remain current and relevant. This ongoing research approach enables identification of emerging trends and market shifts that may impact future market development.

Brussels Capital Region represents the most concentrated telecommunications market within Belgium, accounting for approximately 32% of total market activity due to high business density and advanced digital infrastructure requirements. The region’s status as a European political and business center drives demand for premium telecommunications services and international connectivity solutions.

Flanders region demonstrates strong market growth driven by industrial digitalization and logistics sector expansion, with particular strength in manufacturing connectivity solutions and supply chain digitalization services. The region’s economic diversity supports balanced demand across consumer and enterprise telecommunications segments.

Wallonia region shows increasing telecommunications adoption as economic development initiatives drive digital infrastructure investment and business modernization efforts. Rural connectivity improvements in Wallonia have increased broadband availability by 22% over recent years, supporting regional economic development objectives.

Urban market characteristics across all regions feature high service penetration rates, sophisticated customer requirements, and intense competition among service providers. Urban areas drive innovation adoption and premium service demand while supporting the business case for advanced network infrastructure investments.

Rural market development focuses on expanding broadband coverage and mobile network quality to support economic development and digital inclusion objectives. Government initiatives and EU funding programs support rural telecommunications infrastructure development while creating opportunities for service providers to expand market coverage.

Market leadership positions within Belgium’s telecommunications sector reflect a competitive environment featuring both established operators and innovative service providers. Major market participants include:

Competitive strategies emphasize service differentiation, network quality improvements, and customer experience enhancement as key differentiators in mature market conditions. Innovation investments focus on 5G service development, fiber-optic network expansion, and digital service integration to maintain competitive advantages.

Market consolidation trends reflect ongoing industry evolution as operators seek scale advantages and operational efficiencies through strategic partnerships and acquisition activities. These developments reshape competitive dynamics while maintaining market competition levels that benefit consumers and business customers.

Service-based segmentation reveals distinct market characteristics and growth patterns across different telecommunications service categories:

By Service Type:

By Customer Segment:

By Technology Platform:

Mobile services category demonstrates the strongest growth momentum within Belgium’s telecommunications market, driven by increasing data consumption, 5G network deployment, and expanding mobile application usage. Mobile data traffic continues growing at 18% annually, reflecting changing consumer behavior and business mobility requirements.

Fixed broadband services maintain stable market positions with growth opportunities in fiber-optic service upgrades and business connectivity solutions. Fiber adoption rates have reached 42% of broadband connections, supporting premium service delivery and competitive differentiation strategies among operators.

Enterprise telecommunications solutions represent the fastest-growing market category, with businesses investing in digital transformation initiatives that require advanced connectivity and communications capabilities. Cloud connectivity services and unified communications platforms drive significant revenue growth within this segment.

Digital television services face challenges from streaming service competition while creating opportunities through integrated content offerings and advanced viewing experiences. Operators increasingly focus on content partnerships and technology integration to maintain competitive positions in evolving entertainment markets.

Emerging service categories including IoT connectivity, edge computing, and cybersecurity services create new revenue opportunities while leveraging existing network infrastructure investments. These services command premium pricing and support operator diversification strategies beyond traditional telecommunications offerings.

Telecommunications operators benefit from Belgium’s advanced market environment through opportunities for premium service delivery, technology innovation, and customer relationship development. Network infrastructure investments generate long-term competitive advantages while supporting service differentiation and market leadership positions.

Enterprise customers gain access to world-class telecommunications infrastructure that supports digital transformation initiatives, operational efficiency improvements, and competitive advantage development. Advanced connectivity solutions enable businesses to implement innovative technologies and expand market reach through digital channels.

Consumer benefits include access to high-quality telecommunications services, competitive pricing through market competition, and continuous service innovation that enhances digital lifestyle capabilities. Service reliability and performance levels in Belgium rank among Europe’s highest, supporting consumer satisfaction and digital adoption.

Technology vendors find opportunities in Belgium’s advanced telecommunications market for equipment sales, service delivery, and innovation partnerships with operators. The market’s technology leadership creates demand for cutting-edge solutions and supports vendor growth strategies.

Government stakeholders benefit from advanced telecommunications infrastructure that supports economic development, digital inclusion objectives, and public service delivery improvements. Digital infrastructure capabilities enhance Belgium’s competitiveness and attractiveness for international business investment.

Strengths:

Weaknesses:

Opportunities:

Threats:

5G network acceleration represents the most significant trend shaping Belgium’s telecommunications landscape, with operators investing heavily in next-generation infrastructure to support advanced applications and maintain competitive positions. 5G coverage expansion continues rapidly, with nationwide coverage expected to reach 95% within the next two years.

Fiber-optic infrastructure expansion drives broadband service enhancement and supports growing bandwidth requirements across residential and business segments. Fiber deployment strategies focus on urban area completion while extending coverage to rural regions through government support programs and private investment initiatives.

Service convergence trends see operators increasingly offering integrated solutions that combine connectivity, cloud services, cybersecurity, and digital transformation consulting. MarkWide Research indicates that converged service offerings represent the primary growth strategy for major telecommunications operators in Belgium.

Sustainability initiatives gain prominence as operators implement energy-efficient technologies and carbon reduction programs to address environmental concerns and regulatory requirements. Green technology adoption includes renewable energy usage, network optimization, and equipment lifecycle management improvements.

Edge computing deployment emerges as operators leverage network infrastructure to provide low-latency computing capabilities that support emerging applications such as autonomous vehicles, industrial automation, and augmented reality services. These capabilities create new revenue opportunities while maximizing infrastructure utilization.

Major infrastructure investments continue across Belgium’s telecommunications sector as operators expand 5G networks and fiber-optic coverage to maintain competitive advantages and service quality leadership. Network modernization programs represent multi-year commitments that reshape service capabilities and market dynamics.

Strategic partnerships between telecommunications operators and technology companies accelerate innovation and service development, particularly in areas such as cloud computing, cybersecurity, and IoT connectivity. These collaborations enable operators to offer comprehensive digital solutions while leveraging specialized expertise.

Regulatory developments including spectrum allocation decisions, infrastructure sharing requirements, and consumer protection enhancements continue to influence market structure and competitive dynamics. Recent regulatory initiatives focus on promoting competition while ensuring continued investment in network infrastructure.

Merger and acquisition activities reshape market structure as operators seek scale advantages and operational efficiencies through consolidation. These transactions require regulatory approval and may impact competitive dynamics while creating opportunities for market optimization.

Technology innovation initiatives focus on emerging capabilities such as network slicing, artificial intelligence integration, and automated network management that enhance service delivery and operational efficiency. These innovations support service differentiation and cost optimization strategies.

Investment prioritization should focus on 5G network completion and fiber-optic infrastructure expansion to maintain competitive positions and support future service innovation. MWR analysis suggests that operators with comprehensive next-generation infrastructure will capture disproportionate market share growth over the forecast period.

Service diversification strategies should emphasize integrated digital solutions that combine connectivity with cloud services, cybersecurity, and business consulting capabilities. Enterprise market focus represents the highest growth opportunity, with businesses increasingly seeking comprehensive digital transformation partners rather than basic connectivity providers.

Customer experience enhancement requires continuous investment in service quality, support capabilities, and digital interaction platforms that meet evolving customer expectations. Retention strategies become increasingly important in mature market conditions where customer acquisition costs continue rising.

Partnership development with technology companies, content providers, and system integrators can accelerate service innovation while sharing development costs and risks. Ecosystem approaches enable operators to offer comprehensive solutions without developing all capabilities internally.

Operational efficiency improvements through automation, artificial intelligence, and network optimization can help manage cost pressures while maintaining service quality standards. Digital transformation of internal operations supports competitive positioning and profitability maintenance in challenging market conditions.

Market evolution over the next five years will be characterized by continued technology advancement, service integration, and competitive intensification as operators adapt to changing customer requirements and emerging technology capabilities. Growth projections indicate sustained expansion at approximately 4.8% CAGR driven by enterprise digitalization and 5G service adoption.

Technology transformation will accelerate as 5G networks reach maturity and enable new service categories including autonomous vehicle communications, industrial IoT applications, and immersive digital experiences. Edge computing integration will become standard across telecommunications networks, supporting low-latency applications and creating new revenue opportunities.

Service evolution will continue toward integrated digital solutions that combine connectivity, computing, and application services in comprehensive packages tailored to specific customer segments. Vertical market specialization will increase as operators develop industry-specific solutions for healthcare, manufacturing, logistics, and other sectors.

Competitive dynamics will intensify as traditional telecommunications boundaries blur and technology companies enter telecommunications markets with innovative service offerings. Market consolidation may continue as operators seek scale advantages and operational efficiencies through strategic combinations.

Regulatory evolution will balance competition promotion with investment incentives to ensure continued network development and service innovation. Sustainability requirements will increasingly influence network design and operations as environmental considerations become more prominent in regulatory frameworks and customer preferences.

Belgium’s telecommunications market represents a mature and sophisticated sector characterized by advanced infrastructure, intense competition, and continuous innovation that positions the country among Europe’s telecommunications leaders. Market dynamics reflect successful regulatory frameworks that promote competition while ensuring continued investment in network infrastructure and service development.

Growth opportunities remain substantial despite market maturity, with 5G service innovation, enterprise digitalization, and emerging technology adoption driving continued expansion and revenue diversification. Operator strategies increasingly focus on service integration and customer experience enhancement to maintain competitive positions in evolving market conditions.

Future success in Belgium’s telecommunications market will depend on continued investment in advanced infrastructure, service innovation capabilities, and customer relationship management that addresses evolving digital requirements across all market segments. Technology leadership and operational excellence remain critical success factors as market competition intensifies and customer expectations continue rising.

What is Telecom?

Telecom refers to the transmission of information over significant distances by electronic means. It encompasses various services such as mobile communication, internet services, and broadcasting, which are essential for personal and business connectivity.

What are the key players in the Belgium Telecom Market?

The Belgium Telecom Market features several key players, including Proximus, Orange Belgium, and Telenet. These companies provide a range of services, including mobile, broadband, and television, catering to both residential and business customers.

What are the growth factors driving the Belgium Telecom Market?

The Belgium Telecom Market is driven by factors such as increasing demand for high-speed internet, the proliferation of mobile devices, and the growth of digital services. Additionally, advancements in technology, such as 5G deployment, are enhancing service offerings.

What challenges does the Belgium Telecom Market face?

The Belgium Telecom Market faces challenges including intense competition among providers, regulatory pressures, and the need for continuous investment in infrastructure. These factors can impact profitability and service quality.

What opportunities exist in the Belgium Telecom Market?

Opportunities in the Belgium Telecom Market include the expansion of IoT services, the development of smart city initiatives, and the increasing adoption of cloud-based solutions. These trends present avenues for growth and innovation.

What trends are shaping the Belgium Telecom Market?

Trends in the Belgium Telecom Market include the shift towards bundled services, the rise of mobile payment solutions, and the growing importance of cybersecurity. These trends reflect changing consumer preferences and technological advancements.

Belgium Telecom Market

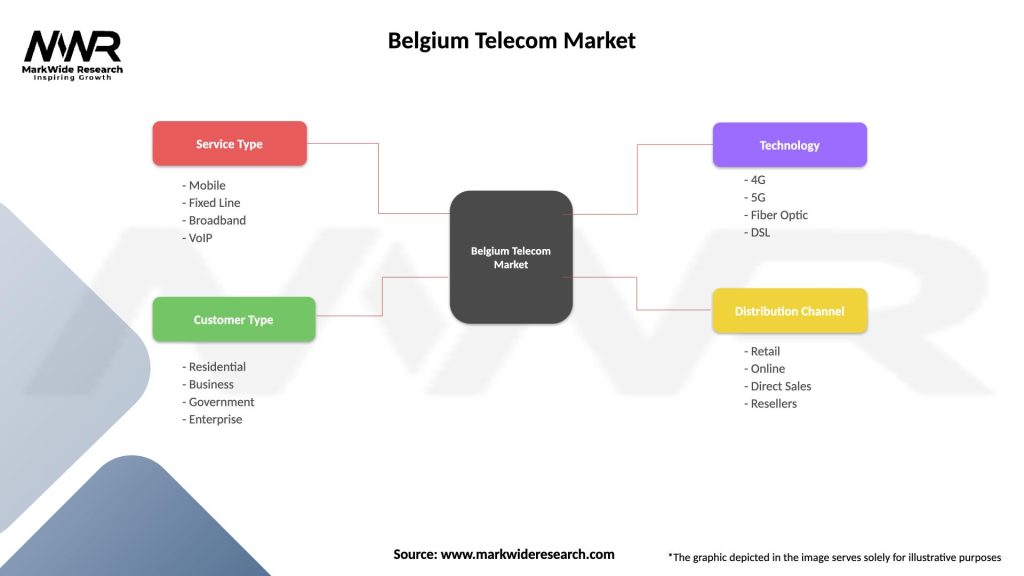

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile, Fixed Line, Broadband, VoIP |

| Customer Type | Residential, Business, Government, Enterprise |

| Technology | 4G, 5G, Fiber Optic, DSL |

| Distribution Channel | Retail, Online, Direct Sales, Resellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Belgium Telecom Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at