444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Belgium gift card and incentive card market represents a dynamic and rapidly evolving segment within the country’s retail and corporate ecosystem. This market encompasses both consumer-oriented gift cards used for retail purchases and corporate incentive cards designed to reward employees and customers. Belgium’s strategic position as a European business hub, combined with its sophisticated digital payment infrastructure, has created fertile ground for the expansion of gift card and incentive card solutions.

Market dynamics in Belgium reflect broader European trends toward digitalization and contactless payment solutions. The market has experienced substantial growth, with digital gift cards accounting for approximately 68% of total gift card transactions in recent years. This shift toward digital solutions has been accelerated by changing consumer preferences and the increasing adoption of mobile payment technologies across Belgian retail establishments.

Corporate adoption of incentive card programs has particularly strengthened, with businesses recognizing the value of these tools for employee engagement and customer retention. The market serves diverse sectors including retail, hospitality, e-commerce, and corporate services, with each segment contributing to the overall expansion of gift card and incentive card utilization throughout Belgium.

The Belgium gift card and incentive card market refers to the comprehensive ecosystem of prepaid payment instruments used for gifting purposes and corporate reward programs within Belgium’s commercial landscape. These cards function as stored-value payment methods that can be redeemed for goods and services at participating merchants or used within specific corporate incentive frameworks.

Gift cards in this context include both physical and digital prepaid cards that consumers purchase to give as gifts, allowing recipients to make purchases at designated retailers or across broader merchant networks. Incentive cards represent corporate-issued payment instruments used to reward employees, motivate sales teams, or provide customer loyalty benefits through structured reward programs.

The market encompasses various card types including closed-loop cards restricted to specific retailers, open-loop cards accepted across multiple merchant networks, and hybrid solutions that combine features of both formats. This comprehensive definition includes the technology infrastructure, merchant partnerships, and regulatory framework that support the issuance, distribution, and redemption of these payment instruments throughout Belgium.

Belgium’s gift card and incentive card market has demonstrated remarkable resilience and growth potential, establishing itself as a significant component of the country’s evolving payment landscape. The market benefits from Belgium’s advanced digital infrastructure, high smartphone penetration rates, and progressive regulatory environment that supports innovative payment solutions.

Key market drivers include the increasing digitalization of retail transactions, growing corporate focus on employee engagement, and rising consumer preference for flexible gifting options. The market has shown particular strength in the corporate segment, where incentive card adoption has increased by approximately 42% over the past three years, reflecting businesses’ recognition of these tools’ effectiveness in driving performance and loyalty.

Digital transformation continues to reshape market dynamics, with mobile-enabled gift cards and app-based redemption systems gaining significant traction among Belgian consumers. The integration of gift card solutions with e-commerce platforms and omnichannel retail strategies has further expanded market opportunities, creating new revenue streams for retailers and enhanced convenience for consumers.

Future prospects remain highly positive, supported by continued technological innovation, expanding merchant acceptance networks, and growing awareness of gift cards’ benefits among both consumers and businesses. The market is positioned for sustained growth as Belgium’s economy continues to digitize and businesses seek more effective ways to engage customers and employees.

Strategic analysis of Belgium’s gift card and incentive card market reveals several critical insights that define current market conditions and future opportunities:

Multiple factors contribute to the robust growth trajectory of Belgium’s gift card and incentive card market, creating a favorable environment for continued expansion and innovation.

Digital transformation serves as the primary catalyst, with Belgian consumers increasingly embracing digital payment solutions and mobile-first shopping experiences. The widespread adoption of smartphones and mobile payment apps has made digital gift cards more accessible and convenient, driving higher usage rates across demographic segments. E-commerce growth has particularly benefited the market, as online retailers integrate gift card options into their checkout processes and marketing strategies.

Corporate demand for effective employee engagement tools has significantly boosted the incentive card segment. Belgian businesses recognize that well-designed reward programs can improve employee satisfaction by approximately 35% while reducing turnover costs. This recognition has led to increased investment in comprehensive incentive card programs that offer flexibility and personalization options.

Consumer behavior shifts toward experiential gifting and personalized shopping experiences have created new opportunities for gift card providers. Modern consumers appreciate the flexibility that gift cards provide, allowing recipients to choose their preferred products or services while maintaining the thoughtful gesture of gift-giving.

Regulatory support from Belgian and European authorities has created a stable framework for gift card operations, encouraging innovation while protecting consumer interests. Clear guidelines regarding card expiration, fees, and redemption processes have built consumer confidence in gift card products.

Several challenges present obstacles to the unlimited growth of Belgium’s gift card and incentive card market, requiring strategic responses from industry participants.

Security concerns remain a significant restraint, as consumers and businesses worry about fraud, unauthorized use, and data breaches associated with digital payment instruments. High-profile security incidents in the broader payment industry have heightened awareness of these risks, potentially slowing adoption rates among security-conscious consumers and enterprises.

Regulatory complexity poses challenges for market participants, particularly smaller providers who must navigate evolving compliance requirements across multiple jurisdictions. The need to maintain compliance with European payment directives, anti-money laundering regulations, and consumer protection laws creates operational complexity and increases compliance costs.

Market fragmentation limits the effectiveness of gift card programs, as consumers often prefer solutions that work across multiple retailers and service providers. The proliferation of closed-loop cards tied to specific merchants can create confusion and reduce overall market appeal compared to more flexible payment alternatives.

Technology barriers affect some demographic segments, particularly older consumers who may be less comfortable with digital gift card solutions and mobile redemption processes. This digital divide limits market penetration and requires providers to maintain dual-channel strategies that support both digital and traditional card formats.

Economic sensitivity influences gift card purchasing patterns, as these products are often considered discretionary spending that may decline during economic uncertainty or periods of reduced consumer confidence.

Significant opportunities exist within Belgium’s gift card and incentive card market, driven by technological advancement, changing consumer preferences, and evolving business needs.

Artificial intelligence integration presents substantial opportunities for personalization and fraud prevention. AI-powered systems can analyze purchasing patterns to recommend relevant gift card options, detect suspicious transactions, and optimize incentive card program effectiveness. These capabilities can improve customer satisfaction rates by approximately 28% while reducing operational costs.

Blockchain technology offers potential for enhanced security, transparency, and interoperability in gift card systems. Smart contracts could automate complex incentive programs while providing immutable transaction records that build trust among all stakeholders.

Cross-border expansion opportunities exist as Belgian companies extend their operations throughout Europe. Gift card and incentive card programs that function seamlessly across multiple countries can provide competitive advantages for businesses operating in international markets.

Sustainability initiatives create opportunities for environmentally conscious gift card solutions. Digital-first approaches that minimize physical card production and packaging can appeal to environmentally aware consumers and businesses seeking to reduce their carbon footprint.

Integration with emerging technologies such as augmented reality, voice assistants, and Internet of Things devices can create innovative gift card experiences that differentiate providers in competitive markets.

Complex interactions between various market forces shape the evolution of Belgium’s gift card and incentive card landscape, creating both challenges and opportunities for industry participants.

Supply chain dynamics have evolved significantly, with traditional card manufacturing and distribution models giving way to digital-first approaches. This transformation has reduced time-to-market for new gift card products while enabling more flexible and responsive program management. Digital distribution channels now account for approximately 72% of gift card sales, reflecting the market’s rapid digitalization.

Competitive dynamics intensify as traditional payment processors, fintech startups, and retail technology providers compete for market share. This competition drives innovation in features, pricing, and service quality while creating more options for businesses and consumers seeking gift card solutions.

Partnership ecosystems have become increasingly important, with successful market participants building comprehensive networks of retailers, technology providers, and financial institutions. These partnerships enable broader acceptance networks and more sophisticated program capabilities that individual providers could not achieve independently.

Consumer expectations continue to evolve, demanding more personalized, secure, and convenient gift card experiences. Meeting these expectations requires ongoing investment in technology infrastructure and user experience design, creating both opportunities and challenges for market participants.

Comprehensive research methodology underpins the analysis of Belgium’s gift card and incentive card market, ensuring accurate and actionable insights for industry stakeholders.

Primary research components include structured interviews with key market participants, including gift card providers, major retailers, corporate buyers, and technology vendors. These interviews provide firsthand insights into market trends, challenges, and opportunities that may not be apparent from secondary data sources alone.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and trade publications to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Quantitative analysis involves statistical modeling of market trends, growth patterns, and adoption rates based on available transaction data and industry surveys. This analysis helps identify significant patterns and project future market developments with greater accuracy.

Qualitative assessment examines market sentiment, regulatory impacts, and technological influences that may affect future market evolution. This approach provides context for quantitative findings and helps identify emerging trends that may not yet be reflected in historical data.

Cross-validation techniques ensure research accuracy by comparing findings across multiple data sources and methodologies, identifying potential inconsistencies, and refining conclusions based on the most reliable information available.

Belgium’s regional characteristics significantly influence gift card and incentive card market dynamics, with distinct patterns emerging across different geographic and demographic segments.

Brussels Capital Region demonstrates the highest adoption rates for digital gift card solutions, reflecting the area’s concentration of international businesses, tech-savvy consumers, and advanced retail infrastructure. The region accounts for approximately 38% of total market activity despite representing a smaller portion of Belgium’s population, indicating higher per-capita usage rates and more sophisticated program implementations.

Flanders region shows strong growth in corporate incentive card programs, driven by the area’s manufacturing and logistics industries that increasingly use these tools for employee motivation and retention. The region’s business community has embraced incentive cards as part of comprehensive talent management strategies, contributing to steady market expansion.

Wallonia region exhibits growing interest in gift card solutions, particularly among small and medium-sized enterprises seeking cost-effective customer loyalty and employee reward programs. While adoption rates have historically lagged other regions, recent initiatives to promote digital payment solutions have accelerated market development.

Cross-regional trends include increasing standardization of gift card acceptance networks, growing integration with national retail chains, and expanding corporate program participation across all geographic areas. These trends suggest continued market convergence and reduced regional disparities in gift card availability and usage.

Belgium’s gift card and incentive card market features a diverse competitive landscape with both international players and local specialists competing for market share across different segments and customer categories.

Competitive strategies focus on technological innovation, partnership development, and service differentiation. Market leaders invest heavily in mobile-first solutions, advanced analytics, and integrated program management capabilities to maintain competitive advantages.

Market consolidation trends suggest potential for strategic acquisitions and partnerships as companies seek to expand their capabilities and market reach through complementary business combinations.

Market segmentation reveals distinct categories within Belgium’s gift card and incentive card market, each with unique characteristics, growth patterns, and customer requirements.

By Card Type:

By Application:

By Distribution Channel:

Detailed analysis of market categories reveals specific trends, opportunities, and challenges within each segment of Belgium’s gift card and incentive card market.

Consumer Gift Card Category demonstrates strong seasonal patterns with peak sales during holiday periods accounting for approximately 45% of annual volume. This category benefits from growing consumer acceptance of digital gifting options and increasing integration with social media platforms for gift sharing and personalization. Mobile-first approaches have proven particularly effective, with app-based gift card purchases showing higher engagement rates and repeat usage patterns.

Corporate Incentive Category shows consistent year-round growth driven by businesses’ recognition of these tools’ effectiveness in employee engagement and retention strategies. Companies report improved employee satisfaction scores of approximately 31% when implementing comprehensive incentive card programs. This category benefits from increasing integration with human resources management systems and performance tracking platforms.

Customer Loyalty Category exhibits strong growth potential as retailers seek more effective alternatives to traditional point-based loyalty programs. Gift card-based loyalty solutions offer greater flexibility and perceived value, leading to higher program participation rates and increased customer lifetime value.

Promotional Category serves as an entry point for many businesses exploring gift card solutions, often leading to expansion into more comprehensive programs as companies recognize the marketing and customer engagement benefits these tools provide.

Multiple stakeholders derive significant value from Belgium’s gift card and incentive card market, creating a robust ecosystem that supports continued growth and innovation.

For Retailers:

For Corporations:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Several significant trends are reshaping Belgium’s gift card and incentive card market, influencing both current operations and future strategic directions.

Mobile-First Design has become the dominant trend, with providers prioritizing smartphone-optimized experiences and app-based functionality. This trend reflects consumer preferences for convenient, instant access to gift card services and has led to mobile transaction growth of approximately 56% year-over-year. Mobile-first approaches enable features like real-time balance checking, location-based merchant discovery, and social sharing capabilities.

Personalization and Customization increasingly differentiate successful gift card programs from basic offerings. Advanced personalization includes customized card designs, personalized messaging, and AI-driven product recommendations based on recipient preferences and purchase history. These features enhance the emotional value of gift-giving while improving redemption rates and customer satisfaction.

Integration with Loyalty Programs creates more comprehensive customer engagement strategies that combine gift card functionality with traditional loyalty benefits. This integration allows businesses to offer more flexible reward options while gathering valuable customer data for improved targeting and personalization.

Sustainability Initiatives drive adoption of digital-first gift card solutions that minimize environmental impact through reduced physical card production and packaging. Companies implementing sustainable gift card programs report improved brand perception and increased appeal among environmentally conscious consumers.

Real-Time Analytics enable more sophisticated program management and optimization, allowing businesses to track usage patterns, identify trends, and adjust strategies based on actual performance data rather than assumptions.

Recent developments within Belgium’s gift card and incentive card market demonstrate the dynamic nature of this sector and highlight emerging opportunities for growth and innovation.

Technology Partnerships have accelerated, with traditional retailers partnering with fintech companies to develop more sophisticated gift card platforms. These partnerships combine retail expertise with technological innovation to create more compelling customer experiences and operational efficiencies.

Regulatory Enhancements have strengthened consumer protection while maintaining market flexibility. Recent updates to payment regulations have clarified gift card expiration policies, fee structures, and redemption rights, building consumer confidence while providing clear operational guidelines for providers.

Cross-Border Integration initiatives have expanded, with Belgian companies developing gift card programs that function across multiple European markets. These developments reflect the growing importance of international business operations and the need for consistent customer experiences across geographic boundaries.

AI Implementation has progressed significantly, with leading providers deploying machine learning algorithms for fraud detection, personalization, and program optimization. Early results indicate fraud reduction rates of approximately 34% and improved customer engagement metrics.

Blockchain Pilots have emerged as companies explore distributed ledger technology for enhanced security, transparency, and interoperability in gift card systems. While still in early stages, these initiatives show promise for addressing some of the market’s persistent challenges around security and cross-platform compatibility.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing persistent challenges in Belgium’s gift card and incentive card market.

Invest in Digital Infrastructure: Companies should prioritize mobile-first platforms and cloud-based systems that can scale efficiently and support advanced features like real-time analytics, personalization, and integration with other business systems. MarkWide Research analysis indicates that companies with superior digital platforms achieve customer retention rates approximately 23% higher than competitors with legacy systems.

Develop Partnership Ecosystems: Building comprehensive networks of retailers, technology providers, and financial institutions creates competitive advantages that individual companies cannot achieve independently. Strategic partnerships enable broader acceptance networks, enhanced functionality, and more attractive value propositions for both business and consumer customers.

Focus on Security and Compliance: Ongoing investment in security measures and regulatory compliance is essential for maintaining customer trust and avoiding operational disruptions. Companies should implement multi-layered security approaches that include advanced fraud detection, data encryption, and regular security audits.

Embrace Sustainability: Environmental consciousness among consumers and businesses creates opportunities for companies that prioritize sustainable practices in their gift card operations. Digital-first approaches, recyclable materials, and carbon-neutral operations can provide competitive differentiation while supporting corporate social responsibility objectives.

Leverage Data Analytics: Advanced analytics capabilities enable more effective program management, better customer targeting, and improved operational efficiency. Companies should invest in data collection, analysis, and application capabilities that support evidence-based decision making and continuous program optimization.

Belgium’s gift card and incentive card market is positioned for continued expansion and evolution, driven by technological advancement, changing consumer preferences, and evolving business needs.

Growth projections remain highly positive, with the market expected to maintain robust expansion rates supported by increasing digital adoption, corporate program growth, and expanding merchant acceptance networks. MWR forecasts suggest the market will experience compound annual growth rates of approximately 8.2% over the next five years, reflecting strong underlying demand and favorable market conditions.

Technology evolution will continue to drive market transformation, with artificial intelligence, blockchain, and Internet of Things technologies creating new possibilities for gift card functionality and user experiences. These technologies promise to address current market limitations while enabling innovative features that enhance value for all stakeholders.

Market consolidation may accelerate as companies seek to achieve scale economies and comprehensive service capabilities through strategic acquisitions and partnerships. This consolidation could lead to more standardized platforms and broader acceptance networks that benefit consumers and businesses alike.

Regulatory development will likely focus on balancing innovation encouragement with consumer protection, potentially leading to more harmonized standards across European markets. These developments could facilitate cross-border program expansion and reduce compliance complexity for market participants.

Integration opportunities with emerging payment technologies, loyalty programs, and business management systems will create more comprehensive solutions that address broader customer needs beyond traditional gift card functionality.

Belgium’s gift card and incentive card market represents a dynamic and rapidly evolving sector with substantial growth potential and significant opportunities for innovation. The market benefits from strong foundational elements including advanced digital infrastructure, supportive regulatory frameworks, and high levels of consumer and business adoption.

Key success factors for market participants include embracing digital transformation, building comprehensive partnership networks, maintaining focus on security and compliance, and leveraging data analytics for continuous improvement. Companies that excel in these areas are well-positioned to capture market share and drive future growth.

Market challenges around security, fragmentation, and regulatory complexity require ongoing attention and strategic responses. However, these challenges also create opportunities for companies that can develop superior solutions and differentiate themselves through innovation and service excellence.

Future prospects remain highly favorable, supported by continued technological advancement, growing market awareness, and expanding use cases across consumer and business segments. The market’s evolution toward more integrated, personalized, and sustainable solutions aligns with broader trends in digital commerce and customer engagement.

Strategic positioning for long-term success requires balancing innovation with operational excellence, customer focus with business efficiency, and growth ambitions with risk management. Companies that achieve this balance while maintaining adaptability to changing market conditions will be best positioned to capitalize on the substantial opportunities within Belgium’s gift card and incentive card market.

What is Gift Card & Incentive Card?

Gift Card & Incentive Card refers to prepaid cards that can be used as a form of payment or as incentives for employees and customers. These cards are popular in various sectors, including retail, hospitality, and corporate rewards.

What are the key players in the Belgium Gift Card & Incentive Card Market?

Key players in the Belgium Gift Card & Incentive Card Market include companies like Edenred, Sodexo, and Givex, which provide a range of gift card solutions and incentive programs. These companies focus on enhancing customer engagement and employee motivation, among others.

What are the growth factors driving the Belgium Gift Card & Incentive Card Market?

The growth of the Belgium Gift Card & Incentive Card Market is driven by increasing consumer demand for flexible payment options and the rising popularity of digital gift cards. Additionally, businesses are leveraging these cards for employee rewards and customer loyalty programs.

What challenges does the Belgium Gift Card & Incentive Card Market face?

Challenges in the Belgium Gift Card & Incentive Card Market include regulatory compliance issues and the risk of fraud associated with card usage. Furthermore, competition from alternative payment methods can also pose a challenge to market growth.

What opportunities exist in the Belgium Gift Card & Incentive Card Market?

Opportunities in the Belgium Gift Card & Incentive Card Market include the expansion of e-commerce and the increasing adoption of mobile wallets. Companies can also explore partnerships with retailers to enhance their offerings and reach a broader audience.

What trends are shaping the Belgium Gift Card & Incentive Card Market?

Trends in the Belgium Gift Card & Incentive Card Market include the shift towards digital and contactless solutions, as well as personalized gift card offerings. Additionally, there is a growing emphasis on sustainability, with companies looking to offer eco-friendly card options.

Belgium Gift Card & Incentive Card Market

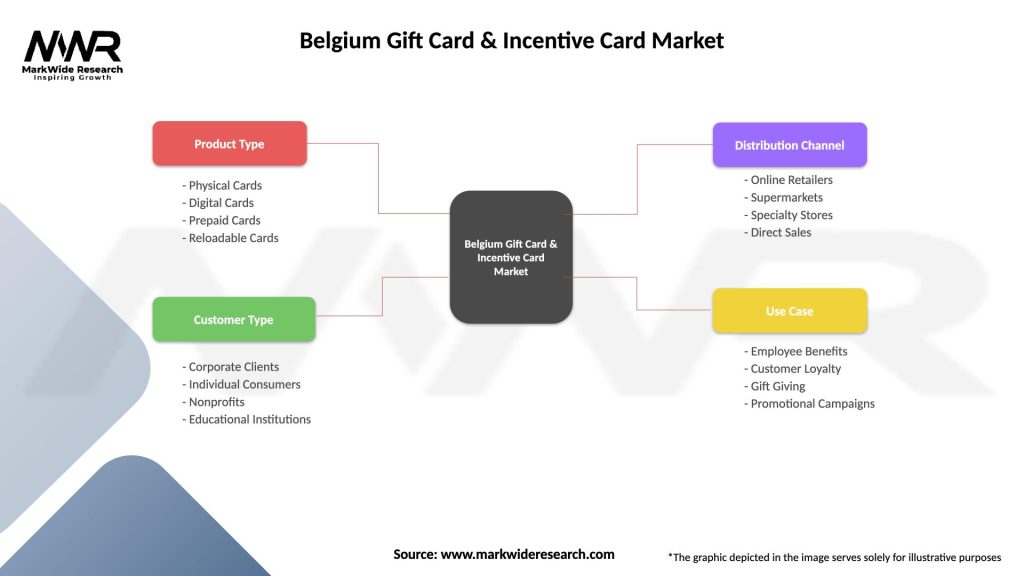

| Segmentation Details | Description |

|---|---|

| Product Type | Physical Cards, Digital Cards, Prepaid Cards, Reloadable Cards |

| Customer Type | Corporate Clients, Individual Consumers, Nonprofits, Educational Institutions |

| Distribution Channel | Online Retailers, Supermarkets, Specialty Stores, Direct Sales |

| Use Case | Employee Benefits, Customer Loyalty, Gift Giving, Promotional Campaigns |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Belgium Gift Card & Incentive Card Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at