444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Belgium data center power market represents a critical infrastructure segment experiencing unprecedented growth driven by digital transformation initiatives and increasing cloud adoption across enterprises. Belgium’s strategic location in Europe, combined with its robust telecommunications infrastructure and favorable regulatory environment, positions the country as a key hub for data center operations requiring reliable and efficient power solutions.

Market dynamics indicate that Belgium’s data center power sector is witnessing significant expansion, with growth rates reaching 8.2% CAGR over recent years. The increasing demand for uninterruptible power supply systems, backup generators, and energy-efficient cooling solutions reflects the critical nature of power infrastructure in modern data center operations. European data sovereignty requirements and GDPR compliance mandates are further accelerating investments in local data center facilities.

Power reliability remains paramount in Belgium’s data center ecosystem, where even brief outages can result in substantial operational disruptions. The market encompasses various power components including UPS systems, diesel generators, power distribution units, and advanced monitoring systems. Sustainability initiatives are increasingly influencing purchasing decisions, with operators seeking solutions that reduce carbon footprint while maintaining operational excellence.

Regional concentration shows that approximately 65% of data center power infrastructure is located in the Brussels-Capital Region and Flanders, reflecting proximity to major business centers and international connectivity hubs. The market benefits from Belgium’s stable political environment, skilled workforce, and commitment to renewable energy integration in critical infrastructure applications.

The Belgium data center power market refers to the comprehensive ecosystem of electrical infrastructure, backup power systems, and energy management solutions specifically designed to support data center operations throughout Belgium. This market encompasses all power-related components essential for maintaining continuous, reliable electricity supply to computing equipment, cooling systems, and facility operations within data centers.

Core components include uninterruptible power supply systems, emergency backup generators, power distribution units, electrical switchgear, and sophisticated monitoring systems that ensure seamless power delivery. The market also covers power management software, energy storage solutions, and renewable energy integration systems that help data centers optimize their electrical consumption while maintaining operational resilience.

Market scope extends beyond traditional hardware to include installation services, maintenance contracts, and consulting services for power infrastructure optimization. Energy efficiency considerations play an increasingly important role, with solutions designed to minimize power usage effectiveness ratios while maximizing computational capacity and operational reliability.

Belgium’s data center power market demonstrates robust growth momentum driven by accelerating digitalization trends and increasing enterprise cloud adoption. The market benefits from Belgium’s strategic position as a European gateway, attracting international hyperscale operators and colocation providers seeking reliable power infrastructure solutions.

Key growth drivers include the expansion of cloud services, edge computing deployments, and regulatory requirements for data localization. Power efficiency improvements of up to 25% annually are being achieved through advanced UPS technologies and intelligent power management systems. The market shows strong demand for modular power solutions that can scale with growing computational requirements.

Competitive landscape features both international power system manufacturers and local system integrators providing specialized solutions for Belgium’s unique regulatory and operational environment. Sustainability mandates are reshaping procurement decisions, with renewable energy integration becoming a critical differentiator for power infrastructure providers.

Market outlook remains positive, supported by continued digital transformation initiatives across industries and Belgium’s commitment to becoming a leading European digital hub. Investment flows into data center infrastructure continue to accelerate, creating sustained demand for advanced power solutions and energy management technologies.

Strategic positioning analysis reveals several critical insights shaping Belgium’s data center power market landscape:

Digital transformation acceleration serves as the primary catalyst driving Belgium’s data center power market expansion. Organizations across industries are migrating critical workloads to cloud platforms, creating unprecedented demand for reliable data center infrastructure and associated power systems.

Cloud adoption trends continue to reshape enterprise IT strategies, with Belgian companies increasingly relying on local data centers for compliance and performance reasons. This shift necessitates substantial investments in power infrastructure capable of supporting high-density computing environments while maintaining operational continuity.

Regulatory requirements including GDPR compliance and data sovereignty mandates compel organizations to utilize European-based data centers, driving demand for local infrastructure investments. Financial services and healthcare sectors particularly require robust power systems to ensure uninterrupted access to critical applications and data.

Edge computing proliferation creates new requirements for distributed power infrastructure as organizations deploy computing resources closer to end users. This trend drives demand for smaller, efficient power systems that can operate reliably in diverse environments while maintaining centralized monitoring and management capabilities.

Sustainability initiatives increasingly influence infrastructure decisions, with organizations seeking power solutions that reduce environmental impact while maintaining operational excellence. Energy efficiency mandates and carbon reduction targets drive adoption of advanced power management technologies and renewable energy integration solutions.

High capital investment requirements present significant barriers for organizations considering data center power infrastructure upgrades or new deployments. The substantial upfront costs associated with enterprise-grade UPS systems, backup generators, and supporting infrastructure can delay or limit market expansion, particularly for smaller operators.

Technical complexity in power system design and integration creates challenges for organizations lacking specialized expertise. Power infrastructure planning requires careful consideration of load requirements, redundancy needs, and future scalability, often necessitating expensive consulting services and extended implementation timelines.

Regulatory compliance costs associated with environmental standards and safety requirements add complexity to power system deployments. Permitting processes for backup generators and electrical installations can create delays and additional expenses, particularly in urban areas with strict environmental regulations.

Skills shortage in specialized power systems engineering and maintenance creates operational challenges for data center operators. The limited availability of qualified technicians capable of managing complex power infrastructure can result in higher operational costs and potential reliability risks.

Grid integration challenges may arise when connecting large-scale data center power systems to Belgium’s electrical grid, particularly in areas with limited transmission capacity. Utility coordination requirements and potential grid upgrade costs can complicate project development and increase overall investment requirements.

Renewable energy integration presents substantial opportunities for power system providers to develop innovative solutions combining traditional backup power with solar and wind generation. Belgium’s commitment to renewable energy creates favorable conditions for hybrid power systems that reduce operational costs while meeting sustainability objectives.

Edge computing expansion creates new market segments requiring specialized power solutions for distributed data center deployments. Micro data centers and edge computing nodes require compact, efficient power systems that can operate autonomously while providing remote monitoring and management capabilities.

Energy storage advancement opens opportunities for battery-based solutions that can provide both backup power and grid services. Advanced battery technologies enable data centers to participate in demand response programs while maintaining operational resilience, creating additional revenue streams for operators.

Artificial intelligence integration in power management systems offers opportunities to optimize energy consumption and predict maintenance requirements. AI-powered monitoring can improve system reliability while reducing operational costs through predictive maintenance and automated optimization.

Government incentives for digital infrastructure development and renewable energy adoption create favorable conditions for market expansion. Tax incentives and grants for sustainable data center development can accelerate adoption of advanced power technologies and infrastructure investments.

Supply chain evolution in Belgium’s data center power market reflects changing technology preferences and operational requirements. Traditional lead-acid battery systems are increasingly being replaced by lithium-ion alternatives that offer superior performance characteristics and reduced maintenance requirements, fundamentally altering supplier relationships and procurement strategies.

Competitive intensity continues to increase as international power system manufacturers establish local presence to serve Belgium’s growing data center market. Local system integrators are responding by developing specialized expertise in Belgian regulatory requirements and forming strategic partnerships with global technology providers.

Technology convergence between power systems and IT infrastructure creates new opportunities for integrated solutions that optimize both computational and electrical efficiency. Software-defined power management enables dynamic load balancing and automated failover capabilities that improve overall system reliability.

Customer expectations are evolving toward comprehensive service offerings that include installation, maintenance, and performance optimization. Service-based models are gaining traction as operators seek to reduce capital expenditure while ensuring reliable power infrastructure operation.

Market consolidation trends show larger players acquiring specialized power system providers to offer complete data center infrastructure solutions. This consolidation creates opportunities for niche providers to focus on specific technology segments or specialized applications within the broader market.

Comprehensive market analysis for Belgium’s data center power market employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes structured interviews with data center operators, power system manufacturers, and industry consultants to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, regulatory filings, and technical publications to understand market structure and competitive dynamics. MarkWide Research utilizes proprietary databases and industry connections to validate market information and identify emerging trends affecting the Belgium data center power sector.

Quantitative analysis incorporates statistical modeling and trend analysis to project market growth patterns and identify key performance indicators. Market sizing methodologies combine bottom-up analysis of individual market segments with top-down validation using industry benchmarks and comparative analysis.

Qualitative assessment includes expert interviews and focus group discussions to understand market dynamics and strategic considerations influencing purchasing decisions. Technology evaluation examines emerging power system technologies and their potential impact on market development and competitive positioning.

Data validation processes ensure research accuracy through multiple source verification and cross-referencing of market information. Continuous monitoring of market developments enables real-time updates to research findings and maintains relevance of analytical insights.

Brussels-Capital Region dominates Belgium’s data center power market, accounting for approximately 45% of total infrastructure investments. The region’s concentration of international businesses, government institutions, and financial services creates substantial demand for reliable data center power solutions. Proximity to European institutions and major telecommunications hubs makes Brussels particularly attractive for hyperscale operators requiring robust power infrastructure.

Flanders region represents the second-largest market segment, capturing roughly 35% market share through its strategic position near major European markets and excellent transportation connectivity. Antwerp and Ghent serve as key data center locations, benefiting from industrial power infrastructure and favorable utility relationships that support large-scale data center deployments.

Wallonia region shows emerging growth potential with approximately 20% market share, driven by competitive real estate costs and available industrial sites suitable for data center development. Government incentives for digital infrastructure development in Wallonia create opportunities for power system providers to establish regional presence and serve growing demand.

Cross-border connectivity influences regional power infrastructure requirements, with data centers near French, German, and Dutch borders requiring specialized power solutions to support international network connectivity. Redundant power feeds from multiple utility sources become critical for facilities serving multinational enterprises and cloud service providers.

Urban versus rural deployment patterns show distinct power infrastructure requirements, with urban locations requiring compact, efficient systems while rural sites can accommodate larger backup generator installations and renewable energy integration projects.

Market leadership in Belgium’s data center power sector is characterized by a mix of international technology providers and specialized local integrators. The competitive environment reflects the diverse requirements of data center operators ranging from hyperscale cloud providers to enterprise colocation facilities.

Competitive differentiation increasingly focuses on energy efficiency, service capabilities, and integrated solution offerings that address complete data center power requirements. Local partnerships between international manufacturers and Belgian system integrators create competitive advantages through specialized market knowledge and regulatory expertise.

Technology segmentation reveals distinct market categories based on power system types and applications within Belgium’s data center infrastructure:

By Power System Type:

By Data Center Type:

By Power Capacity:

UPS Systems Category demonstrates the strongest growth trajectory within Belgium’s data center power market, driven by increasing power quality requirements and advances in battery technology. Lithium-ion UPS systems are capturing market share from traditional lead-acid solutions due to superior energy density, longer lifespan, and reduced maintenance requirements.

Backup Generator Category remains essential for extended outage protection, with natural gas generators gaining preference over diesel systems in urban locations due to environmental considerations. Hybrid power systems combining generators with renewable energy sources are emerging as preferred solutions for sustainability-focused operators.

Power Distribution Category shows increasing sophistication with intelligent PDUs providing detailed monitoring and remote management capabilities. Smart power strips and rack-level power management systems enable granular control over individual equipment power consumption and automated load balancing.

Energy Storage Category represents an emerging segment with significant growth potential as battery costs decline and grid services become more valuable. Grid-scale storage systems integrated with data center power infrastructure can provide both backup power and revenue-generating grid services.

Monitoring and Management Category encompasses software and hardware solutions providing real-time visibility into power system performance and predictive maintenance capabilities. AI-powered analytics enable optimization of power consumption and early detection of potential system issues.

Data Center Operators benefit from advanced power infrastructure through improved operational reliability, reduced energy costs, and enhanced ability to meet customer service level agreements. Modular power solutions enable rapid scaling of capacity to match growing demand while maintaining operational efficiency and minimizing capital investment risks.

Enterprise Customers gain access to reliable, high-performance computing infrastructure supported by robust power systems that ensure business continuity and data protection. Power redundancy and backup systems provide peace of mind for mission-critical applications and regulatory compliance requirements.

Technology Providers can capitalize on growing market demand through innovative product development and strategic partnerships with local system integrators. Service-based revenue models create opportunities for recurring income streams through maintenance contracts and performance optimization services.

Government and Regulatory Bodies benefit from increased digital infrastructure capacity that supports economic development and attracts international investment. Energy-efficient data centers contribute to national sustainability goals while providing essential digital services for citizens and businesses.

Utility Companies gain stable, predictable load customers while potentially participating in demand response programs and grid stabilization services. Smart grid integration with data center power systems can improve overall electrical system efficiency and reliability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend reshaping Belgium’s data center power market, with operators increasingly prioritizing renewable energy sources and energy-efficient technologies. Carbon neutrality commitments from major cloud providers drive demand for clean power solutions and innovative energy management systems.

Edge computing proliferation creates new requirements for distributed power infrastructure as organizations deploy computing resources closer to end users. Micro data centers and edge nodes require compact, reliable power systems that can operate autonomously while providing centralized monitoring and management capabilities.

Artificial intelligence adoption in power management enables predictive maintenance, automated optimization, and intelligent load balancing. Machine learning algorithms analyze power consumption patterns to identify efficiency opportunities and predict potential system failures before they impact operations.

Modular infrastructure deployment gains traction as operators seek flexible, scalable solutions that can adapt to changing requirements. Prefabricated power modules enable rapid deployment and standardized configurations that reduce installation time and improve reliability.

Grid integration advancement allows data centers to participate in demand response programs and provide grid stabilization services. Bidirectional power flow capabilities enable data centers to sell excess capacity back to the grid during peak demand periods, creating additional revenue streams.

Technology advancement in lithium-ion battery systems continues to reshape the UPS market segment, with manufacturers introducing solutions offering 50% longer lifespan and significantly reduced maintenance requirements compared to traditional lead-acid alternatives. These developments enable data center operators to reduce total cost of ownership while improving system reliability.

Strategic partnerships between international power system manufacturers and Belgian system integrators are expanding local capabilities and service offerings. MWR analysis indicates these collaborations are essential for addressing the unique regulatory and operational requirements of Belgium’s data center market.

Renewable energy integration projects are demonstrating the feasibility of combining traditional backup power systems with solar and wind generation. Hybrid power installations at major data center facilities showcase the potential for reducing operational costs while meeting sustainability objectives.

Regulatory developments including updated building codes and environmental standards are influencing power system design and installation requirements. Energy efficiency mandates drive adoption of advanced monitoring and management systems that optimize power consumption across data center operations.

Investment announcements from major cloud service providers and colocation operators signal continued growth in Belgium’s data center sector. These investments create sustained demand for advanced power infrastructure and drive innovation in system design and integration capabilities.

Market participants should prioritize development of integrated power solutions that combine traditional backup systems with renewable energy sources and advanced monitoring capabilities. Sustainability credentials are becoming essential differentiators in competitive bidding processes for major data center projects.

Technology providers should invest in local service capabilities and technical expertise to address Belgium’s specific regulatory requirements and customer preferences. Partnership strategies with established Belgian system integrators can accelerate market entry and improve competitive positioning.

Data center operators should evaluate power infrastructure investments through a total cost of ownership lens that includes energy efficiency, maintenance requirements, and potential revenue from grid services. Modular approaches to power system deployment can provide flexibility to adapt to changing requirements and technology evolution.

Financial institutions and investors should consider the long-term growth potential of Belgium’s data center power market driven by digital transformation and regulatory requirements for data localization. ESG considerations increasingly influence investment decisions and operational strategies.

Government agencies should continue supporting digital infrastructure development through favorable policies and incentives while ensuring environmental standards keep pace with industry growth. Grid modernization investments can enhance Belgium’s attractiveness for large-scale data center deployments.

Long-term growth prospects for Belgium’s data center power market remain highly positive, supported by accelerating digital transformation trends and the country’s strategic position in European data infrastructure. MarkWide Research projects sustained expansion driven by cloud adoption, edge computing requirements, and regulatory mandates for data sovereignty.

Technology evolution will continue reshaping market dynamics, with advanced battery systems, AI-powered management, and renewable energy integration becoming standard features rather than premium options. Power system efficiency improvements of 30-40% are anticipated over the next five years through technological advancement and operational optimization.

Market consolidation trends are expected to continue as larger players acquire specialized providers to offer comprehensive data center infrastructure solutions. Service-based models will gain prominence as operators seek to reduce capital expenditure while ensuring reliable power infrastructure operation.

Regulatory influence will intensify with stricter environmental standards and energy efficiency requirements driving innovation in power system design and operation. Carbon neutrality mandates will accelerate adoption of renewable energy integration and advanced energy management technologies.

Investment flows into Belgium’s data center sector are projected to maintain strong momentum, with international hyperscale operators and regional colocation providers continuing to expand their presence. This sustained investment creates long-term demand for advanced power infrastructure and related services.

Belgium’s data center power market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by digital transformation, regulatory requirements, and the country’s strategic advantages as a European data hub. The market demonstrates strong fundamentals with diverse growth drivers ranging from cloud adoption to edge computing expansion and sustainability mandates.

Technological advancement continues to reshape market dynamics, with innovations in battery systems, power management, and renewable energy integration creating new opportunities for market participants. The shift toward more efficient, sustainable power solutions aligns with broader industry trends and regulatory requirements, positioning Belgium as an attractive location for data center investments.

Competitive landscape evolution reflects the market’s maturation, with successful players combining technological expertise, local market knowledge, and comprehensive service capabilities. The importance of sustainability credentials and energy efficiency in customer decision-making processes will continue to influence competitive positioning and product development strategies.

Future success in Belgium’s data center power market will depend on the ability to deliver integrated solutions that address reliability, efficiency, and sustainability requirements while providing the flexibility to adapt to rapidly evolving technology and regulatory landscapes. Organizations that can effectively combine innovative technology with local expertise and comprehensive service offerings are best positioned to capitalize on the market’s growth potential and establish long-term competitive advantages in this critical infrastructure sector.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, including servers, storage, and networking equipment. It encompasses various aspects such as power distribution, backup systems, and energy efficiency measures.

What are the key players in the Belgium Data Center Power Market?

Key players in the Belgium Data Center Power Market include companies like Engie, Schneider Electric, and RTE, which provide power solutions and infrastructure for data centers. These companies focus on energy efficiency and reliable power supply, among others.

What are the growth factors driving the Belgium Data Center Power Market?

The Belgium Data Center Power Market is driven by the increasing demand for cloud computing services, the rise of big data analytics, and the need for enhanced data security. Additionally, the push for energy-efficient solutions is also contributing to market growth.

What challenges does the Belgium Data Center Power Market face?

Challenges in the Belgium Data Center Power Market include the high costs associated with energy consumption, regulatory compliance regarding energy efficiency, and the need for continuous upgrades to infrastructure. These factors can hinder the growth of data center operations.

What opportunities exist in the Belgium Data Center Power Market?

Opportunities in the Belgium Data Center Power Market include the development of renewable energy sources, advancements in energy storage technologies, and the increasing adoption of green data center practices. These trends can enhance sustainability and reduce operational costs.

What trends are shaping the Belgium Data Center Power Market?

Trends shaping the Belgium Data Center Power Market include the integration of artificial intelligence for power management, the shift towards modular data center designs, and the growing emphasis on sustainability initiatives. These trends are influencing how data centers operate and manage their energy consumption.

Belgium Data Center Power Market

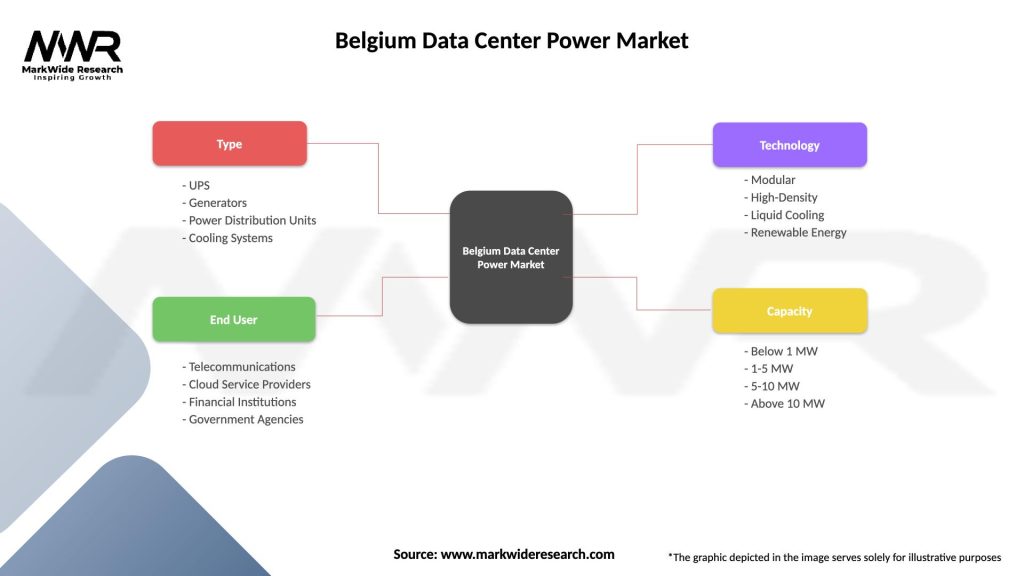

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Power Distribution Units, Cooling Systems |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | Modular, High-Density, Liquid Cooling, Renewable Energy |

| Capacity | Below 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Belgium Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at