444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The banknote sorter market is a crucial component of the currency handling industry, providing efficient and accurate solutions for the sorting, counting, and authentication of banknotes. Banknote sorters are sophisticated machines equipped with advanced technologies such as image recognition, magnetic ink detection, and ultraviolet (UV) scanning to ensure the integrity and security of currency processing operations. With the increasing circulation of banknotes worldwide and the need for secure and efficient cash management solutions, the demand for banknote sorters is expected to grow significantly in the coming years.

Meaning

Banknote sorters are specialized machines designed to automate the process of sorting, counting, and authenticating banknotes. These machines use various sensors, cameras, and algorithms to identify and categorize banknotes based on factors such as denomination, serial number, and authenticity. Banknote sorters play a crucial role in cash-intensive industries such as banking, retail, gaming, and transportation, where accurate and efficient currency handling is essential for operational efficiency, fraud prevention, and customer satisfaction.

Executive Summary

The banknote sorter market has witnessed steady growth driven by factors such as the increasing adoption of cash management solutions, rising concerns about counterfeit currency, and technological advancements in banknote sorting technology. Market players are focusing on innovation, product differentiation, and strategic partnerships to gain a competitive edge and expand their market presence. However, challenges such as regulatory compliance, currency diversity, and budget constraints pose hurdles for market growth. Navigating these challenges while capitalizing on market opportunities is crucial for sustained success in the banknote sorter market.

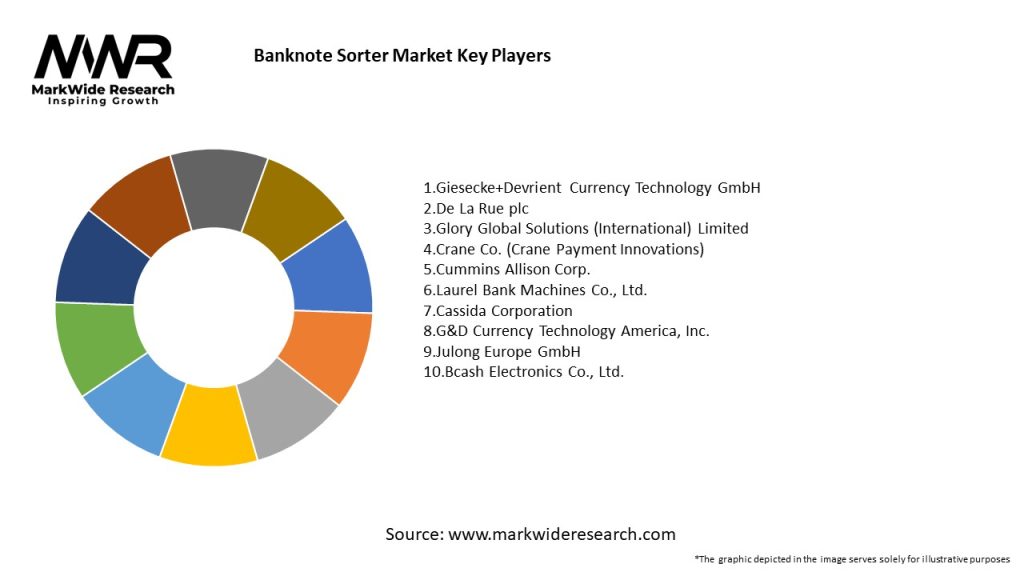

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The banknote sorter market operates within a dynamic ecosystem influenced by factors such as technological innovation, regulatory compliance, market demand, and competitive forces. Market participants must navigate these dynamics effectively, adapting strategies, product offerings, and business models to meet evolving customer needs and preferences while addressing regulatory requirements and market challenges.

Regional Analysis

The adoption of banknote sorting solutions varies by region, influenced by factors such as currency diversity, regulatory requirements, economic conditions, and technological infrastructure. Tailoring solutions and strategies to specific regional characteristics and market dynamics can enhance market relevance and competitiveness for banknote sorter vendors.

Competitive Landscape

Leading Companies in the Banknote Sorter Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The banknote sorter market can be segmented based on factors such as sorting capacity, counterfeit detection capabilities, currency compatibility, and end-user industries. Segmentation allows banknote sorter vendors to target specific market segments, customize solutions, and tailor marketing strategies to meet diverse customer needs and preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of banknote sorting solutions, driven by factors such as the need for contactless currency handling, enhanced security, and regulatory compliance in cash-intensive environments. Market players have responded by innovating, adapting solutions, and leveraging technology to meet changing customer needs and preferences amidst the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The banknote sorter market is poised for continued growth and innovation, driven by factors such as technological advancements, regulatory compliance, market demand, and competitive forces. Market participants must adapt to changing market dynamics, leverage technology-driven solutions, and embrace collaboration to capitalize on market opportunities and achieve sustained growth and success in the dynamic and rapidly evolving currency handling market.

Conclusion

In conclusion, the banknote sorter market represents a critical segment within the currency handling industry, providing businesses and financial institutions with efficient, accurate, and secure solutions for sorting, counting, and authenticating banknotes. Despite challenges such as high initial investment, currency diversity, and regulatory compliance, banknote sorter vendors have opportunities to drive market growth and innovation through technology adoption, partnerships, and customer education. By investing in innovation, ensuring regulatory compliance, and fostering collaboration, industry participants can navigate market dynamics effectively and position themselves for sustained growth and success in meeting the evolving needs of customers and stakeholders in the currency handling market.

What is Banknote Sorter?

A banknote sorter is a machine designed to sort and organize banknotes based on various criteria such as denomination, orientation, and quality. These devices are widely used in banks, casinos, and retail environments to streamline cash handling processes.

What are the key players in the Banknote Sorter Market?

Key players in the Banknote Sorter Market include companies like Giesecke+Devrient, Glory Global Solutions, and De La Rue, which provide advanced sorting technologies and solutions for cash management, among others.

What are the main drivers of growth in the Banknote Sorter Market?

The growth of the Banknote Sorter Market is driven by increasing cash transactions, the need for efficient cash handling in retail and banking sectors, and advancements in sorting technology that enhance accuracy and speed.

What challenges does the Banknote Sorter Market face?

Challenges in the Banknote Sorter Market include the high initial investment costs for advanced sorting machines and the need for regular maintenance and updates to keep up with evolving currency designs and security features.

What opportunities exist in the Banknote Sorter Market?

Opportunities in the Banknote Sorter Market include the growing adoption of automation in cash handling processes and the expansion of cashless payment systems, which may lead to innovations in sorting technology to accommodate new currency formats.

What trends are shaping the Banknote Sorter Market?

Trends in the Banknote Sorter Market include the integration of artificial intelligence for improved sorting accuracy, the development of compact and portable sorting machines, and a focus on sustainability through energy-efficient designs.

Banknote Sorter Market

| Segmentation Details | Description |

|---|---|

| Product Type | High-Speed Sorters, Compact Sorters, Fitness Sorters, Mixed Denomination Sorters |

| Technology | Optical Recognition, Magnetic Detection, Infrared Scanning, RFID Technology |

| End User | Banks, Retailers, Casinos, ATMs |

| Application | Cash Handling, Currency Processing, Fraud Detection, Inventory Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Banknote Sorter Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at