444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The banking industry relies heavily on secure and confidential data transfer and storage. With the rise in cyber threats and hacking attempts, encryption software has become an integral part of banking operations. Banking encryption software provides robust security measures to protect sensitive financial information from unauthorized access and ensures the confidentiality and integrity of data. This software encrypts data using complex algorithms, making it virtually impossible for hackers to decipher the information. As a result, the banking encryption software market has witnessed significant growth in recent years.

Meaning

Banking encryption software refers to the technology and tools used to encrypt and decrypt sensitive data within the banking industry. It ensures that information shared between banks, customers, and other stakeholders remains secure and confidential. Encryption software uses advanced algorithms to convert data into an unreadable format, making it unintelligible to unauthorized individuals. This technology plays a crucial role in safeguarding financial transactions, protecting customer data, and preventing cyber threats.

Executive Summary

The banking encryption software market is experiencing substantial growth due to the increasing need for data security and confidentiality in the banking sector. As financial institutions continue to face sophisticated cyber attacks, the demand for robust encryption solutions has soared. The market offers a wide range of encryption software solutions tailored to meet the specific requirements of banks and financial institutions. These solutions provide end-to-end encryption, secure key management, and multi-factor authentication to ensure the highest level of data protection.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The banking encryption software market is driven by the need for data security and compliance with regulatory requirements. The increasing frequency and sophistication of cyber attacks have prompted banks to invest in encryption software to protect their sensitive data from unauthorized access. Additionally, the growing adoption of digital banking services and the rising awareness of data security among customers have fueled the demand for encryption solutions.

On the other hand, the high cost of implementation, complexity of integration, resistance to change, and the shortage of skilled professionals pose challenges to market growth. However, emerging markets, collaborations, technological advancements, and increased investment in cybersecurity provide opportunities for encryption software vendors to expand their market share and cater to the evolving needs of the banking industry.

Regional Analysis

The banking encryption software market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America currently holds a significant market share due to the presence of major banking institutions and stringent data protection regulations. Europe follows closely, driven by regulatory compliance requirements and the increasing adoption of encryption software by banks.

The Asia Pacific region is expected to witness substantial growth in the banking encryption software market due to the rapid digitalization of banking services in countries like China and India. The increasing number of cyber threats and the need for data protection are pushing banks in the region to adopt encryption software solutions. Latin America and the Middle East and Africa are also expected to contribute to market growth as the banking sectors in these regions continue to modernize and prioritize data security.

Competitive Landscape

Leading Companies in the Banking Encryption Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

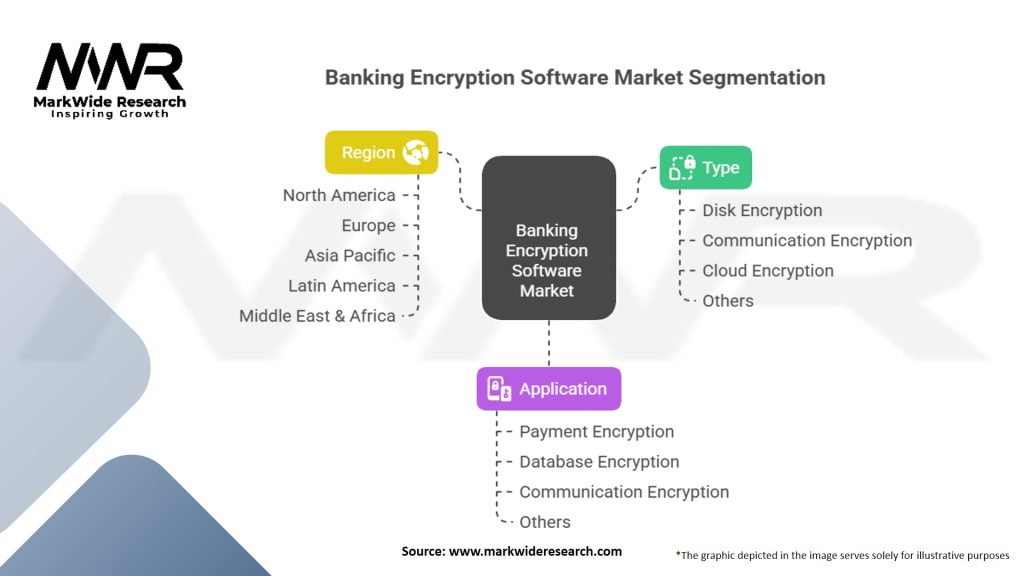

The banking encryption software market can be segmented based on deployment mode, organization size, and application.

Based on deployment mode, the market can be categorized into:

Based on organization size, the market can be categorized into:

Based on application, the market can be categorized into:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the banking encryption software market. The sudden shift to remote work and increased reliance on digital banking services created new challenges for data security. Banks faced an increased risk of cyber attacks, phishing attempts, and data breaches.

In response to the pandemic, banks accelerated their digital transformation efforts and adopted encryption software solutions to strengthen their security measures. The demand for encryption software surged as financial institutions sought to protect customer data and ensure secure remote access to banking systems.

The pandemic also highlighted the importance of regulatory compliance and data protection. Governments and regulatory bodies emphasized the need for secure data transmission and storage, leading banks to invest in encryption software to comply with these requirements.

Overall, the COVID-19 pandemic acted as a catalyst for the adoption of encryption software in the banking industry, driving market growth and reinforcing the importance of data security in a rapidly evolving digital landscape.

Key Industry Developments

The banking encryption software market has seen several notable developments as technology evolves and new security challenges emerge:

Analyst Suggestions

Future Outlook

The future outlook for the banking encryption software market is promising. The increasing frequency and sophistication of cyber attacks, coupled with stringent data protection regulations, will continue to drive the demand for robust encryption solutions within the banking industry.

As digital banking services expand and become more prevalent, the need for encryption software to protect sensitive data transmitted over networks and stored in databases will increase. Additionally, emerging markets, technological advancements, and the growing investment in cybersecurity infrastructure present significant growth opportunities for encryption software vendors.

To capitalize on these opportunities, vendors must focus on continuous innovation, develop scalable and customizable solutions, and forge strategic partnerships with banks and financial institutions. By addressing the challenges related to implementation costs, integration complexity, and skill shortages, encryption software vendors can secure a strong market position and meet the evolving needs of the banking industry.

Conclusion

The banking encryption software market is witnessing substantial growth driven by the increasing need for data security, compliance with regulatory requirements, and the growing awareness of data protection among banks and customers. Encryption software provides robust security measures to protect sensitive banking data and ensure secure data transmission and storage.

While challenges such as implementation costs and integration complexity exist, emerging markets, technological advancements, and increased investment in cybersecurity offer growth opportunities. Continuous innovation, strategic partnerships, and compliance with data protection regulations will be crucial for encryption software vendors to succeed in the banking encryption software market.

Overall, encryption software plays a vital role in safeguarding the banking industry’s sensitive data, maintaining customer trust, and mitigating cyber risks. The market’s future outlook is promising, with increasing demand expected as banks prioritize data security and compliance with regulatory standards in an ever-evolving digital landscape.

What is Banking Encryption Software?

Banking Encryption Software refers to tools and technologies designed to secure sensitive financial data through encryption methods. This software is essential for protecting customer information, transaction details, and other confidential data in the banking sector.

What are the key players in the Banking Encryption Software Market?

Key players in the Banking Encryption Software Market include Symantec, McAfee, Thales, and IBM, among others. These companies provide various encryption solutions tailored for financial institutions to enhance data security.

What are the main drivers of growth in the Banking Encryption Software Market?

The main drivers of growth in the Banking Encryption Software Market include the increasing frequency of cyberattacks, the rising demand for secure online banking services, and stringent regulatory requirements for data protection.

What challenges does the Banking Encryption Software Market face?

Challenges in the Banking Encryption Software Market include the complexity of implementation, the need for continuous updates to counter evolving threats, and the potential for performance impacts on banking systems.

What opportunities exist in the Banking Encryption Software Market?

Opportunities in the Banking Encryption Software Market include the growing adoption of cloud-based solutions, advancements in encryption technologies, and the increasing focus on data privacy regulations across various regions.

What trends are shaping the Banking Encryption Software Market?

Trends shaping the Banking Encryption Software Market include the integration of artificial intelligence for threat detection, the rise of end-to-end encryption solutions, and the shift towards zero-trust security models in financial institutions.

Banking Encryption Software Market

| Segmentation | Details |

|---|---|

| Type | Disk Encryption, Communication Encryption, Cloud Encryption, Others |

| Application | Payment Encryption, Database Encryption, Communication Encryption, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Banking Encryption Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at