444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bangladesh lithium ion battery industry represents one of the most rapidly expanding sectors within the country’s manufacturing landscape, driven by increasing demand for renewable energy storage solutions and portable electronic devices. Market dynamics indicate substantial growth potential as Bangladesh positions itself as a key player in South Asia’s energy storage revolution. The industry has experienced remarkable transformation over the past five years, with local manufacturing capabilities expanding at an impressive 12.5% CAGR while import dependency gradually decreases.

Industrial development in Bangladesh’s lithium ion battery sector reflects the government’s strategic focus on sustainable energy solutions and technology advancement. The market encompasses various applications including electric vehicles, consumer electronics, grid-scale energy storage, and backup power systems. Manufacturing facilities have emerged across key industrial zones, particularly in Chittagong, Dhaka, and Sylhet regions, establishing Bangladesh as an emerging hub for battery production in the region.

Investment patterns show increasing confidence from both domestic and international stakeholders, with technology transfer agreements facilitating knowledge exchange and capacity building. The industry benefits from Bangladesh’s strategic geographic location, providing access to both raw material suppliers and major consumer markets across Asia. Production capacity has expanded significantly, with local manufacturers achieving 65% capacity utilization rates while maintaining competitive pricing structures.

The Bangladesh lithium ion battery industry market refers to the comprehensive ecosystem encompassing manufacturing, distribution, and application of lithium-based energy storage solutions within Bangladesh’s industrial framework. This market includes domestic production facilities, import operations, technology development initiatives, and end-user applications across various sectors including automotive, telecommunications, renewable energy, and consumer electronics.

Market scope extends beyond traditional battery manufacturing to include research and development activities, recycling operations, and supporting infrastructure development. The industry represents Bangladesh’s commitment to sustainable energy solutions while addressing growing domestic demand for reliable energy storage systems. Value chain integration encompasses raw material procurement, cell manufacturing, battery pack assembly, and distribution networks serving both local and regional markets.

Strategic positioning of Bangladesh’s lithium ion battery industry demonstrates remarkable progress toward establishing the country as a regional manufacturing hub. The sector has achieved significant milestones including technology partnerships with leading international companies, establishment of modern manufacturing facilities, and development of skilled workforce capabilities. Growth trajectory remains robust with domestic demand increasing at 18.3% annually driven by expanding telecommunications infrastructure and growing adoption of renewable energy systems.

Market fundamentals reflect strong underlying demand across multiple application segments, with particular strength in backup power solutions for telecommunications and emerging opportunities in electric vehicle applications. The industry benefits from government support through favorable policies, tax incentives, and infrastructure development programs. Competitive landscape includes both established local manufacturers and international companies establishing operations through joint ventures and technology transfer agreements.

Investment climate remains favorable with continued capital inflows supporting capacity expansion and technology upgrades. The sector demonstrates resilience through diversified supply chains and strategic partnerships ensuring sustainable growth. Future prospects indicate accelerating development with projected capacity expansion and increasing export potential to neighboring markets.

Market intelligence reveals several critical insights shaping Bangladesh’s lithium ion battery industry development:

Primary growth drivers propelling Bangladesh’s lithium ion battery industry include accelerating digitalization across sectors requiring reliable backup power solutions. The telecommunications sector represents the largest demand segment, with mobile network operators investing heavily in energy storage infrastructure to ensure service continuity. Rural electrification programs have created substantial demand for off-grid energy storage solutions, particularly in remote areas where traditional grid connectivity remains challenging.

Renewable energy adoption serves as another significant driver, with solar power installations requiring efficient energy storage systems for optimal utilization. Government initiatives promoting clean energy solutions have accelerated demand for lithium ion batteries in both residential and commercial applications. Electric vehicle momentum is building gradually, with early adopters and pilot programs creating initial demand for automotive-grade battery systems.

Industrial automation trends across manufacturing sectors have increased demand for uninterruptible power supply systems utilizing lithium ion technology. The growing emphasis on energy efficiency and reduced operational costs drives adoption of advanced battery solutions. Export opportunities in neighboring markets provide additional growth impetus, with Bangladesh’s competitive manufacturing costs attracting international buyers seeking reliable suppliers.

Operational challenges facing Bangladesh’s lithium ion battery industry include limited access to high-quality raw materials, particularly lithium compounds and specialized chemicals required for advanced battery chemistries. Supply chain vulnerabilities remain a concern, with most critical materials imported from distant suppliers, creating potential disruptions and cost volatility.

Technical expertise limitations in advanced battery technologies pose development constraints, requiring continued investment in training and technology transfer programs. Quality control capabilities need enhancement to meet international standards consistently, particularly for export markets demanding stringent specifications. Infrastructure limitations including reliable power supply and transportation networks affect manufacturing efficiency and cost competitiveness.

Financial constraints impact smaller manufacturers’ ability to invest in advanced equipment and technology upgrades. Limited access to long-term financing options restricts capacity expansion plans and research and development activities. Regulatory framework development lags behind industry growth, creating uncertainty around environmental standards and safety requirements for battery manufacturing and disposal.

Emerging opportunities in Bangladesh’s lithium ion battery market include expanding electric vehicle adoption driven by government incentives and environmental awareness. The transportation sector transformation presents substantial long-term growth potential as infrastructure development supports electric mobility solutions. Grid modernization initiatives create demand for large-scale energy storage systems supporting renewable energy integration and grid stability.

Export market development offers significant expansion opportunities, with regional demand for cost-effective battery solutions growing rapidly. Strategic partnerships with international companies can facilitate technology transfer and market access while leveraging Bangladesh’s manufacturing cost advantages. Recycling industry development presents opportunities for sustainable business models and resource recovery from end-of-life batteries.

Research and development initiatives supported by academic institutions and government programs can drive innovation in battery chemistry and manufacturing processes. Value-added services including battery management systems and monitoring solutions create additional revenue opportunities. Vertical integration possibilities exist for companies seeking to control supply chains and improve profit margins through backward integration into raw material processing.

Industry dynamics in Bangladesh’s lithium ion battery market reflect complex interactions between supply and demand factors, technological advancement, and policy influences. Competitive pressures drive continuous improvement in manufacturing efficiency and product quality while maintaining cost competitiveness. Market consolidation trends show larger players acquiring smaller manufacturers to achieve economies of scale and expand market presence.

Technology evolution influences market dynamics through introduction of new battery chemistries and manufacturing processes improving performance and reducing costs. Customer preferences shift toward higher energy density and longer-lasting solutions, driving innovation requirements. Price dynamics reflect global commodity price fluctuations and local manufacturing cost structures, with efficiency improvements helping maintain competitive positioning.

Regulatory environment evolution affects market dynamics through environmental standards, safety requirements, and trade policies impacting both domestic operations and export opportunities. MarkWide Research analysis indicates that market dynamics favor companies with strong technology partnerships and diversified customer bases, enabling better risk management and sustainable growth.

Comprehensive research approach employed for analyzing Bangladesh’s lithium ion battery industry combines primary and secondary research methodologies ensuring accurate market assessment. Primary research includes extensive interviews with industry executives, government officials, technology experts, and end-users across various application segments. Field visits to manufacturing facilities provide insights into operational capabilities and production processes.

Secondary research encompasses analysis of government publications, industry reports, trade statistics, and academic research papers relevant to battery technology and market development. Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification of findings. Quantitative analysis includes statistical modeling and trend analysis using historical data and forward-looking projections.

Market segmentation analysis employs detailed categorization by application, technology type, and end-user segments enabling comprehensive understanding of market structure. Competitive analysis includes company profiling, market share assessment, and strategic positioning evaluation. Research methodology ensures objective analysis while maintaining confidentiality of proprietary information shared by industry participants.

Geographic distribution of Bangladesh’s lithium ion battery industry shows concentration in key industrial regions with distinct characteristics and advantages. Chittagong region leads in manufacturing capacity with 45% market share, benefiting from port access for raw material imports and finished product exports. The region hosts several major manufacturing facilities and supporting infrastructure including specialized industrial zones.

Dhaka metropolitan area represents 30% market share with focus on research and development activities, corporate headquarters, and high-tech manufacturing operations. The region benefits from skilled workforce availability and proximity to major customers including telecommunications companies and government institutions. Technology parks in Dhaka facilitate innovation and startup development in battery-related technologies.

Sylhet region accounts for 15% market share with emerging manufacturing capabilities and strategic location for serving northeastern markets. The remaining 10% market share is distributed across other regions including Rajshahi and Khulna, where smaller-scale operations and specialized applications drive local demand. Regional development patterns reflect infrastructure availability, logistics connectivity, and local market demand characteristics.

Market competition in Bangladesh’s lithium ion battery industry features diverse players ranging from established local manufacturers to international companies with joint venture operations. Leading companies have achieved market position through strategic investments, technology partnerships, and customer relationship development.

Competitive strategies include technology differentiation, cost leadership, and market segmentation approaches. Companies invest in research and development, quality improvement, and capacity expansion to maintain competitive advantages. Strategic partnerships with international technology providers enable access to advanced manufacturing processes and global market opportunities.

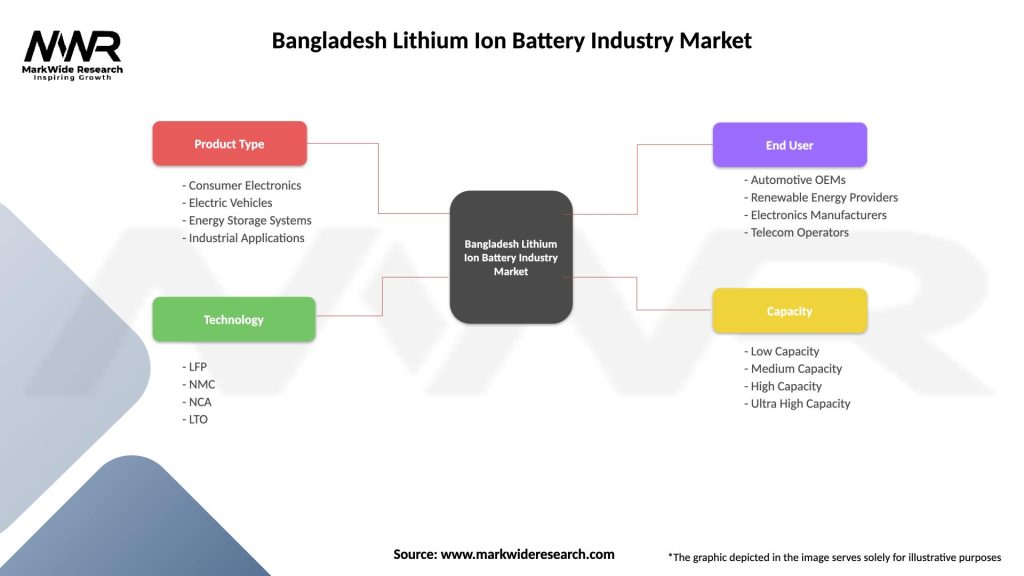

Market segmentation analysis reveals distinct categories within Bangladesh’s lithium ion battery industry based on application, technology, and end-user requirements:

By Application:

By Technology Type:

Telecommunications segment dominates Bangladesh’s lithium ion battery market with robust demand driven by network expansion and modernization initiatives. Mobile operators prioritize reliable backup power solutions ensuring service continuity during grid outages. This segment shows steady growth with 8.5% annual expansion as 5G network deployment creates additional energy storage requirements.

Consumer electronics category demonstrates strong growth potential as smartphone penetration increases and electronic device adoption accelerates across urban and rural areas. Local assembly operations for mobile devices create demand for battery components and replacement markets. Quality requirements in this segment drive technology advancement and manufacturing process improvements.

Automotive applications represent the fastest-growing segment despite small current market size, with electric vehicle adoption beginning to gain momentum. Government incentives and environmental awareness drive early adoption while infrastructure development supports market expansion. This segment requires advanced battery technologies and stringent quality standards creating opportunities for technology-focused manufacturers.

Industrial applications provide stable demand base with requirements for reliable power backup systems across manufacturing facilities, hospitals, and commercial buildings. Energy efficiency focus drives replacement of traditional lead-acid systems with lithium ion alternatives offering superior performance and lifecycle benefits.

Manufacturing companies benefit from expanding market opportunities across multiple application segments while leveraging Bangladesh’s competitive manufacturing costs and strategic location. Technology partnerships enable access to advanced battery technologies and global market opportunities through established distribution networks. Local manufacturers gain from government support policies and infrastructure development initiatives.

End-users benefit from improved product availability, competitive pricing, and local technical support services. Telecommunications operators achieve operational cost reductions through efficient energy storage solutions while improving service reliability. Industrial customers benefit from reduced maintenance requirements and improved system performance compared to traditional battery technologies.

Government stakeholders benefit from industrial development, employment generation, and reduced import dependency for critical energy storage components. Export earnings potential contributes to foreign exchange generation while technology transfer enhances local capabilities. Environmental benefits include reduced carbon footprint through efficient energy storage supporting renewable energy adoption.

Investors benefit from attractive returns in growing market with strong fundamentals and government support. Supply chain partners including raw material suppliers, equipment manufacturers, and logistics providers benefit from expanding business opportunities. Research institutions benefit from industry collaboration and funding for battery technology development programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology advancement trends in Bangladesh’s lithium ion battery industry focus on improving energy density, reducing costs, and enhancing safety features. Manufacturing automation adoption increases production efficiency while maintaining consistent quality standards. Companies invest in advanced testing equipment and quality control systems meeting international certification requirements.

Sustainability initiatives gain prominence with companies developing recycling capabilities and environmentally responsible manufacturing processes. Circular economy approaches include battery lifecycle management and resource recovery programs. MWR analysis indicates growing emphasis on sustainable practices driven by both regulatory requirements and customer preferences.

Digital transformation trends include implementation of Industry 4.0 technologies in manufacturing operations, predictive maintenance systems, and supply chain optimization tools. Smart battery technologies incorporating monitoring and management systems create value-added product offerings. Market consolidation trends show larger companies acquiring smaller players to achieve scale advantages and technology integration.

Customer preference trends favor higher performance batteries with longer lifecycle and faster charging capabilities. Customization demand increases as applications require specialized battery solutions optimized for specific operating conditions and performance requirements.

Recent developments in Bangladesh’s lithium ion battery industry include establishment of new manufacturing facilities by both local and international companies. Technology transfer agreements have facilitated knowledge sharing and capability development while enabling access to advanced manufacturing processes. Several companies have achieved international quality certifications enabling export market participation.

Government initiatives include policy reforms supporting foreign investment and technology transfer in the battery sector. Infrastructure development projects improve industrial zone facilities and logistics connectivity supporting manufacturing operations. Educational programs develop skilled workforce capabilities required for advanced battery manufacturing and research activities.

Partnership developments include joint ventures between local companies and international battery manufacturers establishing production capabilities and market access. Research collaborations between industry and academic institutions advance battery technology development and innovation. Investment announcements indicate continued confidence in market growth potential and expansion opportunities.

Market expansion activities include companies diversifying into new application segments and geographic markets. Product development initiatives focus on customized solutions meeting specific customer requirements and performance specifications. Export market development efforts target regional customers seeking reliable and cost-effective battery suppliers.

Strategic recommendations for Bangladesh’s lithium ion battery industry participants include prioritizing technology partnerships and capability development to remain competitive in evolving markets. Investment focus should emphasize automation, quality control, and research and development activities supporting long-term growth objectives. Companies should diversify customer bases and application segments reducing dependence on single markets or technologies.

Supply chain optimization requires developing multiple supplier relationships and exploring backward integration opportunities for critical materials. Quality improvement initiatives should target international certification standards enabling export market access and premium pricing opportunities. Workforce development programs should address technical skill requirements for advanced manufacturing operations.

Market positioning strategies should leverage Bangladesh’s cost advantages while building capabilities in higher value-added products and services. Sustainability initiatives should include environmental compliance and recycling capabilities meeting evolving regulatory requirements. Companies should monitor technology trends and invest in innovation capabilities maintaining competitive relevance.

Government collaboration opportunities should be pursued for policy advocacy, infrastructure development, and research funding support. Export market development requires understanding regional customer requirements and establishing distribution partnerships. Risk management strategies should address supply chain vulnerabilities and market volatility factors.

Long-term prospects for Bangladesh’s lithium ion battery industry remain highly positive with continued growth expected across multiple application segments. Market expansion will be driven by increasing domestic demand, export opportunities, and technology advancement initiatives. The industry is projected to achieve 15.2% CAGR over the next five years as manufacturing capabilities expand and market applications diversify.

Technology evolution will continue driving performance improvements and cost reductions while enabling new application opportunities. Electric vehicle adoption acceleration will create substantial long-term demand for automotive-grade battery systems. Grid modernization and renewable energy integration will drive demand for large-scale energy storage solutions.

Manufacturing capacity expansion will continue with both domestic and international companies investing in production facilities and technology upgrades. MarkWide Research projections indicate significant export potential as regional markets seek reliable and cost-effective battery suppliers. Quality improvement and certification achievements will enable access to premium market segments.

Industry maturation will bring consolidation opportunities and vertical integration possibilities for well-positioned companies. Innovation capabilities will become increasingly important for maintaining competitive advantages in evolving markets. Sustainability requirements will drive development of recycling capabilities and environmentally responsible manufacturing processes.

Bangladesh’s lithium ion battery industry represents a dynamic and rapidly evolving sector with substantial growth potential driven by expanding domestic demand and emerging export opportunities. The industry has demonstrated remarkable progress in establishing manufacturing capabilities, developing technical expertise, and building strategic partnerships with international technology providers. Market fundamentals remain strong with diversified demand across telecommunications, consumer electronics, automotive, and industrial applications.

Strategic positioning advantages include competitive manufacturing costs, favorable government policies, and strategic geographic location enabling access to regional markets. While challenges exist in technology development, raw material access, and infrastructure limitations, the industry continues advancing through targeted investments and international collaboration. Future growth prospects appear robust with projected expansion in manufacturing capacity, technology capabilities, and market applications.

Success factors for industry participants include maintaining technology partnerships, investing in quality improvement, diversifying market presence, and developing sustainable business practices. The industry’s contribution to Bangladesh’s industrial development, employment generation, and export earnings positions it as a strategic sector deserving continued support and investment. Long-term outlook indicates Bangladesh’s emergence as a significant player in the regional lithium ion battery market with expanding influence in global supply chains.

What is Lithium Ion Battery?

Lithium Ion Battery refers to a type of rechargeable battery that uses lithium ions as a key component of its electrochemistry. These batteries are widely used in consumer electronics, electric vehicles, and renewable energy storage due to their high energy density and efficiency.

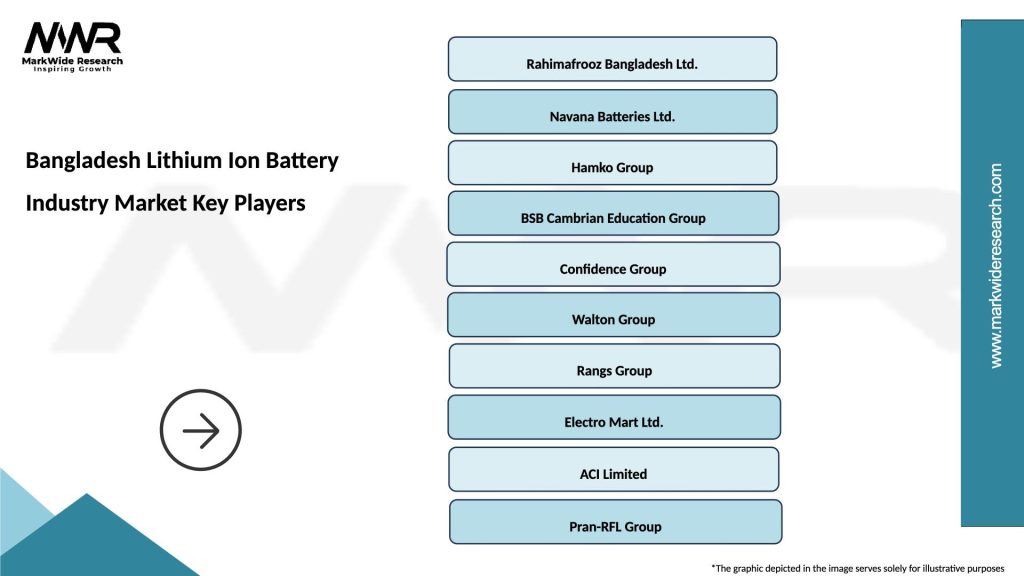

What are the key players in the Bangladesh Lithium Ion Battery Industry Market?

Key players in the Bangladesh Lithium Ion Battery Industry Market include companies like Rahimafrooz Batteries, Energypac Power Generation Ltd., and Aftab Batteries, among others. These companies are involved in manufacturing and supplying lithium-ion batteries for various applications.

What are the growth factors driving the Bangladesh Lithium Ion Battery Industry Market?

The growth of the Bangladesh Lithium Ion Battery Industry Market is driven by the increasing demand for electric vehicles, the expansion of renewable energy projects, and the rising adoption of portable electronic devices. These factors contribute to a growing need for efficient energy storage solutions.

What challenges does the Bangladesh Lithium Ion Battery Industry Market face?

The Bangladesh Lithium Ion Battery Industry Market faces challenges such as high production costs, limited raw material availability, and environmental concerns related to battery disposal. These issues can hinder market growth and sustainability efforts.

What opportunities exist in the Bangladesh Lithium Ion Battery Industry Market?

Opportunities in the Bangladesh Lithium Ion Battery Industry Market include advancements in battery technology, government incentives for electric vehicle adoption, and potential collaborations with international firms. These factors can enhance market growth and innovation.

What trends are shaping the Bangladesh Lithium Ion Battery Industry Market?

Trends shaping the Bangladesh Lithium Ion Battery Industry Market include the development of solid-state batteries, increased focus on recycling and sustainability, and the integration of smart technologies in battery management systems. These trends are expected to influence future market dynamics.

Bangladesh Lithium Ion Battery Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Consumer Electronics, Electric Vehicles, Energy Storage Systems, Industrial Applications |

| Technology | LFP, NMC, NCA, LTO |

| End User | Automotive OEMs, Renewable Energy Providers, Electronics Manufacturers, Telecom Operators |

| Capacity | Low Capacity, Medium Capacity, High Capacity, Ultra High Capacity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bangladesh Lithium Ion Battery Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at