444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bangladesh car insurance market represents a rapidly evolving sector within the country’s financial services landscape, driven by increasing vehicle ownership, regulatory reforms, and growing consumer awareness about insurance protection. Market dynamics indicate substantial growth potential as Bangladesh experiences economic development and urbanization trends that directly impact automotive insurance demand.

Insurance penetration in Bangladesh’s automotive sector has shown remarkable improvement, with adoption rates increasing by approximately 12.5% annually over recent years. The market encompasses various insurance products including comprehensive coverage, third-party liability, and specialized commercial vehicle insurance solutions tailored to meet diverse customer requirements across urban and rural markets.

Regulatory frameworks established by the Insurance Development and Regulatory Authority (IDRA) have created a more structured environment for car insurance operations, encouraging both local and international insurers to expand their presence in Bangladesh. Digital transformation initiatives have particularly accelerated market accessibility, with online policy purchases growing by 35% year-over-year, reflecting changing consumer preferences and technological adoption patterns.

Economic growth and rising disposable incomes have contributed to increased vehicle purchases, subsequently driving demand for comprehensive insurance coverage. The market serves a diverse customer base ranging from individual car owners to commercial fleet operators, each requiring specialized insurance solutions that address specific risk profiles and coverage needs.

The Bangladesh car insurance market refers to the comprehensive ecosystem of insurance products, services, and regulatory frameworks designed to provide financial protection for vehicle owners against various risks including accidents, theft, natural disasters, and third-party liabilities. This market encompasses both mandatory and voluntary insurance coverage options that serve individual consumers, commercial enterprises, and institutional fleet operators across Bangladesh’s diverse geographical and economic landscape.

Insurance coverage within this market includes multiple product categories such as comprehensive policies that protect against damage, theft, and liability claims, third-party insurance that meets legal requirements, and specialized commercial vehicle insurance designed for business operations. Market participants include domestic insurance companies, international insurers, insurance brokers, agents, and digital platforms that facilitate policy distribution and customer service delivery.

Regulatory oversight ensures market stability and consumer protection through standardized policy terms, pricing guidelines, and claims settlement procedures. The market operates within Bangladesh’s broader financial services sector, contributing to economic development through risk mitigation, capital formation, and employment generation across urban and rural communities.

Bangladesh’s car insurance market demonstrates robust growth momentum driven by expanding vehicle ownership, regulatory modernization, and increasing consumer awareness about insurance benefits. Market expansion reflects broader economic development trends, with insurance adoption rates accelerating as more citizens recognize the financial protection value offered by comprehensive coverage options.

Key growth drivers include government initiatives promoting insurance awareness, rising middle-class purchasing power, and technological innovations that simplify policy acquisition and claims processing. Digital channels have emerged as significant distribution platforms, with online insurance sales representing approximately 28% of total policy acquisitions, indicating substantial digital transformation within the sector.

Competitive dynamics feature both established local insurers and emerging market entrants leveraging technology-driven approaches to capture market share. Product innovation focuses on customized coverage options, flexible premium payment structures, and enhanced customer service delivery through mobile applications and digital platforms.

Market challenges include limited insurance awareness in rural areas, price sensitivity among consumers, and the need for improved claims settlement efficiency. However, strategic opportunities exist in expanding coverage to underserved segments, developing innovative insurance products, and leveraging partnerships with automotive dealers and financial institutions to enhance market penetration.

Market intelligence reveals several critical insights that shape Bangladesh’s car insurance landscape and influence strategic decision-making for industry participants:

Economic prosperity serves as a fundamental driver for Bangladesh’s car insurance market expansion, with rising disposable incomes enabling more citizens to purchase vehicles and subsequently seek insurance protection. GDP growth has directly correlated with increased automotive sales, creating a larger addressable market for insurance providers seeking to expand their customer base.

Regulatory mandates requiring third-party liability insurance for all vehicles have established a baseline market demand that ensures consistent policy sales. Government initiatives promoting financial inclusion and insurance awareness have further accelerated market adoption, particularly in previously underserved rural and semi-urban areas where insurance penetration was historically low.

Urbanization trends contribute significantly to market growth as more people migrate to cities where vehicle ownership becomes necessary for daily transportation needs. Infrastructure development including improved road networks and transportation systems has increased vehicle usage, consequently raising awareness about accident risks and insurance necessity.

Technological advancement has revolutionized insurance accessibility through mobile applications, online platforms, and digital payment systems that simplify policy purchase and management processes. Consumer education campaigns by insurance companies and regulatory authorities have enhanced understanding of insurance benefits, leading to increased voluntary coverage adoption beyond mandatory requirements.

Partnership strategies between insurance companies and automotive dealers have created convenient insurance acquisition opportunities at the point of vehicle purchase, significantly improving market penetration rates and customer convenience.

Price sensitivity among consumers represents a significant market restraint, as many potential customers prioritize cost considerations over comprehensive coverage benefits. Economic constraints particularly affect lower-income segments who may opt for minimum required coverage rather than comprehensive protection, limiting premium growth potential for insurance providers.

Limited insurance literacy in rural areas creates barriers to market expansion, as many potential customers lack understanding of insurance concepts, benefits, and claims procedures. Cultural factors and traditional risk management approaches sometimes conflict with modern insurance practices, requiring extensive education and awareness campaigns to overcome resistance.

Fraudulent claims and documentation challenges pose operational difficulties for insurance companies, leading to increased costs and longer settlement times that can negatively impact customer satisfaction and market reputation. Regulatory complexities and bureaucratic processes sometimes create delays in policy approvals and claims settlements, discouraging potential customers from pursuing insurance coverage.

Infrastructure limitations in remote areas make it difficult for insurance companies to establish service networks and provide adequate customer support, restricting market reach and growth opportunities. Competition from informal risk-sharing arrangements and traditional community-based support systems sometimes reduces demand for formal insurance products.

Economic volatility and currency fluctuations can impact premium affordability and claims settlement values, creating uncertainty for both insurers and policyholders in long-term planning and coverage decisions.

Digital transformation presents substantial opportunities for insurance companies to reach underserved markets through mobile technology and online platforms, particularly as smartphone penetration continues expanding across Bangladesh. Fintech partnerships can enable innovative payment solutions and micro-insurance products that make coverage more accessible to price-sensitive customer segments.

Rural market expansion offers significant growth potential as agricultural mechanization and rural economic development increase vehicle ownership in previously untapped areas. Customized products designed specifically for rural customers, including seasonal payment options and agriculture-linked coverage, can unlock substantial market opportunities.

Commercial fleet insurance represents a high-value opportunity as Bangladesh’s logistics and e-commerce sectors continue expanding rapidly. Corporate partnerships with ride-sharing platforms, delivery services, and transportation companies can create large-scale policy acquisition opportunities with predictable revenue streams.

Product innovation including usage-based insurance, telematics-enabled policies, and integrated automotive services can differentiate market offerings and attract tech-savvy consumers seeking modern insurance solutions. Cross-selling opportunities with other financial products such as vehicle loans and life insurance can enhance customer lifetime value and market penetration.

Regulatory support for insurance sector development creates favorable conditions for market expansion and innovation, encouraging both domestic and international investment in Bangladesh’s insurance industry.

Supply-side dynamics in Bangladesh’s car insurance market reflect increasing competition among domestic and international insurers seeking to capture market share through competitive pricing, enhanced service delivery, and innovative product offerings. Market consolidation trends indicate potential merger and acquisition activities as companies seek economies of scale and expanded distribution networks.

Demand-side factors demonstrate growing consumer sophistication and expectations for digital services, transparent pricing, and efficient claims processing. Customer behavior patterns show increasing preference for comprehensive coverage options and value-added services that extend beyond basic insurance protection.

Technological disruption continues reshaping market dynamics through artificial intelligence applications in underwriting, automated claims processing, and predictive analytics for risk assessment. Data analytics capabilities enable more precise pricing models and personalized insurance products that better match individual customer risk profiles and preferences.

Regulatory evolution influences market dynamics through updated guidelines for digital insurance sales, consumer protection measures, and standardized policy terms that enhance market transparency and customer confidence. Economic factors including inflation, interest rates, and currency stability impact both premium pricing strategies and claims settlement values.

Competitive pressure drives continuous innovation in customer service delivery, product development, and operational efficiency improvements that benefit consumers through better coverage options and competitive pricing structures.

Comprehensive research approach employed for analyzing Bangladesh’s car insurance market incorporates multiple data collection methodologies including primary research through industry interviews, consumer surveys, and stakeholder consultations with insurance companies, regulatory authorities, and market participants.

Secondary research encompasses analysis of regulatory filings, industry reports, financial statements, and market intelligence from authoritative sources including the Insurance Development and Regulatory Authority (IDRA), Bangladesh Bank, and relevant government agencies. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification.

Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation factors that influence insurance demand and market dynamics. Qualitative insights derive from in-depth interviews with industry experts, consumer focus groups, and observational research of market behaviors and preferences.

Market segmentation analysis examines customer demographics, geographic distribution, product preferences, and purchasing behaviors to identify distinct market segments and growth opportunities. Competitive intelligence gathering includes analysis of competitor strategies, market positioning, pricing models, and service delivery approaches.

Forecasting methodologies combine historical data analysis with forward-looking indicators including economic projections, demographic trends, and regulatory developments to project future market scenarios and growth trajectories.

Dhaka Division dominates Bangladesh’s car insurance market, accounting for approximately 45% of total policy volume due to high vehicle concentration, strong economic activity, and advanced insurance infrastructure. Metropolitan areas within Dhaka Division demonstrate the highest insurance penetration rates and premium values, reflecting urban consumers’ greater awareness and financial capacity for comprehensive coverage.

Chittagong Division represents the second-largest regional market, contributing 28% of national insurance premiums driven by commercial port activities, industrial development, and significant commercial vehicle operations. Business insurance dominates this region’s market composition, with logistics companies and industrial enterprises requiring extensive fleet coverage.

Sylhet Division shows emerging market potential with 12% market share and rapid growth rates driven by remittance-fueled economic development and increasing vehicle ownership among returning expatriate workers. Consumer preferences in this region favor comprehensive coverage options, reflecting higher disposable incomes and risk awareness.

Rajshahi and Rangpur Divisions collectively represent 15% of the market with significant growth opportunities in agricultural mechanization insurance and rural transportation coverage. Market penetration remains lower in these regions but shows steady improvement through targeted awareness campaigns and mobile insurance services.

Barisal and Khulna Divisions account for the remaining market share, with unique requirements for weather-related coverage due to coastal geography and seasonal flooding risks that influence insurance product design and pricing strategies.

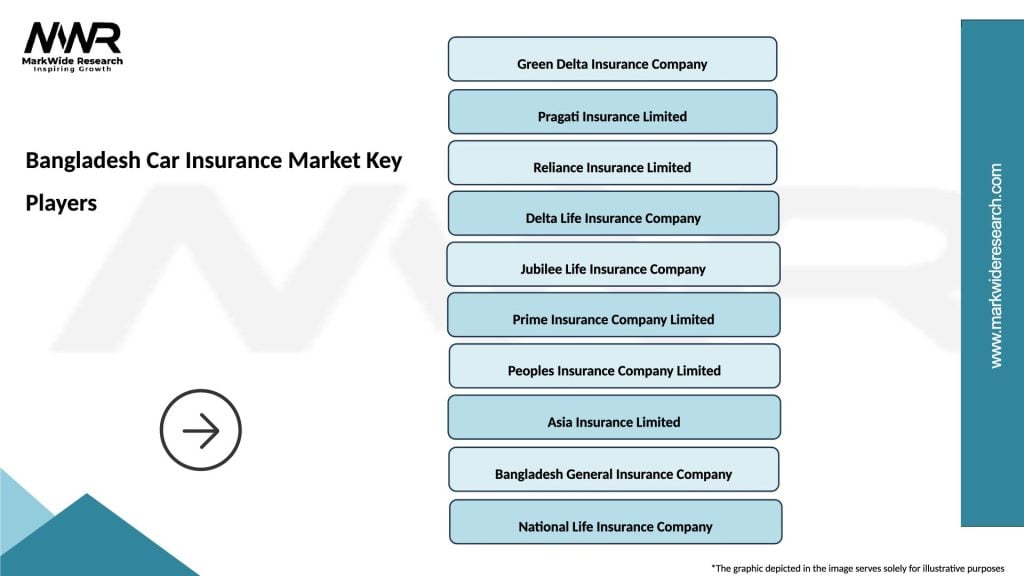

Market leadership in Bangladesh’s car insurance sector features a mix of established domestic insurers and emerging technology-driven companies competing through differentiated service offerings and competitive pricing strategies:

Competitive strategies include digital platform development, strategic partnerships with automotive dealers, and specialized product offerings for different customer segments. Market differentiation occurs through claims settlement efficiency, customer service quality, and innovative coverage options that address specific local market needs.

Product-based segmentation reveals distinct market categories that serve different customer needs and risk profiles within Bangladesh’s car insurance market:

By Coverage Type:

By Customer Type:

By Vehicle Category:

Comprehensive insurance demonstrates strongest growth momentum as consumers increasingly recognize the value of complete protection beyond mandatory requirements. Premium trends indicate willingness to pay higher costs for enhanced coverage, particularly among middle and upper-income segments who prioritize financial security and convenience.

Commercial vehicle insurance exhibits the highest premium values per policy due to increased risk exposure and coverage complexity required for business operations. Fleet management services integrated with insurance coverage create additional value propositions that differentiate providers in competitive commercial markets.

Third-party liability insurance remains the largest segment by policy count but generates lower premium revenues, creating opportunities for insurers to develop upgrade strategies that encourage customers to purchase comprehensive coverage. Regulatory compliance ensures consistent demand for this category while market education efforts focus on demonstrating additional coverage benefits.

Motorcycle insurance represents an emerging high-growth category as two-wheeler ownership expands rapidly across urban and rural areas. Product innovation in this segment includes affordable micro-insurance options and usage-based pricing models that appeal to cost-conscious consumers.

Digital insurance products across all categories show superior growth rates compared to traditional distribution channels, indicating fundamental shifts in consumer purchasing preferences and service delivery expectations that influence future market development strategies.

Insurance companies benefit from expanding market opportunities, diversified revenue streams, and enhanced customer relationships through comprehensive service offerings that extend beyond basic coverage to include value-added services and digital convenience features.

Consumers gain financial protection against vehicle-related risks, peace of mind through comprehensive coverage options, and improved access to insurance services through digital platforms and simplified purchasing processes that reduce traditional barriers to coverage acquisition.

Automotive dealers enhance customer satisfaction and sales conversion rates by offering integrated insurance solutions at the point of vehicle purchase, creating additional revenue opportunities through commission arrangements and strengthened customer relationships.

Government entities achieve improved road safety outcomes, enhanced regulatory compliance, and economic development benefits through increased insurance penetration that reduces financial burdens on public resources and promotes responsible vehicle ownership.

Financial institutions expand cross-selling opportunities, reduce lending risks through required insurance coverage, and strengthen customer relationships through integrated financial service offerings that combine vehicle financing with comprehensive insurance protection.

Technology providers access growing market opportunities for digital platform development, data analytics services, and innovative insurance technology solutions that support industry modernization and operational efficiency improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the most significant trend reshaping Bangladesh’s car insurance market, with companies investing heavily in mobile applications, online platforms, and automated service delivery systems that enhance customer convenience and operational efficiency.

Personalization trends drive development of customized insurance products that address specific customer needs, risk profiles, and preferences through data analytics and artificial intelligence applications that enable more precise underwriting and pricing strategies.

Sustainability focus influences insurance product development with eco-friendly vehicle coverage options, carbon offset programs, and green insurance initiatives that appeal to environmentally conscious consumers and support national sustainability goals.

Partnership strategies between insurance companies and technology firms, automotive manufacturers, and financial institutions create integrated service ecosystems that provide comprehensive solutions beyond traditional insurance coverage.

Regulatory modernization continues evolving toward digital-first approaches, streamlined approval processes, and enhanced consumer protection measures that support market growth while ensuring industry stability and customer confidence.

Customer experience enhancement through omnichannel service delivery, real-time claims processing, and proactive customer communication systems that leverage technology to exceed traditional service expectations and build stronger customer relationships.

Regulatory reforms by the Insurance Development and Regulatory Authority (IDRA) have introduced streamlined licensing procedures for digital insurance platforms, enabling faster market entry for innovative service providers and enhanced competition that benefits consumers through improved service options.

Technology partnerships between traditional insurers and fintech companies have accelerated digital transformation initiatives, resulting in mobile-first insurance applications that simplify policy management and claims processing for tech-savvy consumers across urban and rural markets.

Market consolidation activities include strategic mergers and acquisitions that strengthen market positions, expand distribution networks, and enhance operational capabilities for participating companies seeking to achieve economies of scale in competitive market conditions.

Product innovation initiatives have introduced usage-based insurance options, micro-insurance products for low-income segments, and integrated automotive services that combine insurance coverage with vehicle maintenance and roadside assistance programs.

International expansion by global insurance companies into Bangladesh’s market brings advanced technology platforms, international best practices, and increased competition that drives overall industry improvement and customer service enhancement.

Government initiatives promoting insurance awareness through public education campaigns and financial inclusion programs have significantly increased market awareness and acceptance, particularly in previously underserved rural and semi-urban areas.

MarkWide Research analysis indicates that insurance companies should prioritize digital platform development and mobile-first service delivery to capture growing segments of tech-savvy consumers who prefer convenient, self-service insurance management capabilities.

Market expansion strategies should focus on rural and semi-urban areas where insurance penetration remains low but economic development and vehicle ownership are increasing rapidly, creating substantial untapped market opportunities for companies with appropriate distribution strategies.

Product diversification recommendations include developing specialized insurance solutions for emerging vehicle categories such as electric vehicles, ride-sharing platforms, and commercial delivery services that require customized coverage options and risk assessment approaches.

Partnership development with automotive dealers, financial institutions, and technology providers can create integrated customer acquisition channels that streamline insurance purchasing processes and enhance customer convenience through coordinated service delivery.

Customer education initiatives should emphasize the value proposition of comprehensive coverage beyond mandatory requirements, helping consumers understand insurance benefits and encouraging voluntary upgrades from basic to comprehensive protection options.

Operational efficiency improvements through automation, artificial intelligence, and data analytics can reduce costs, accelerate claims processing, and enhance customer satisfaction while maintaining competitive pricing structures in price-sensitive market segments.

Market projections indicate sustained growth momentum for Bangladesh’s car insurance sector, driven by continued economic development, increasing vehicle ownership, and expanding insurance awareness across demographic segments. Growth trajectories suggest annual expansion rates of 15-18% over the next five years, outpacing general economic growth indicators.

Digital transformation will fundamentally reshape market dynamics, with online insurance sales projected to represent 60% of total policy acquisitions by 2028 as consumers increasingly prefer digital convenience and self-service capabilities over traditional agent-based purchasing processes.

Rural market development presents the greatest expansion opportunity, with insurance penetration in rural areas expected to increase from current levels to 40% by 2027 through targeted product development, mobile service delivery, and strategic partnerships with rural financial institutions.

Product innovation will focus on usage-based insurance, telematics-enabled policies, and integrated automotive services that provide comprehensive vehicle ownership support beyond traditional insurance coverage, creating new revenue streams and enhanced customer value propositions.

Regulatory evolution toward digital-first approaches and streamlined processes will continue supporting market growth while ensuring consumer protection and industry stability through modernized oversight frameworks that balance innovation with prudential requirements.

MWR forecasts indicate that Bangladesh’s car insurance market will achieve significantly higher penetration rates and premium growth as economic development, urbanization, and digital adoption trends converge to create favorable conditions for sustained industry expansion and modernization.

Bangladesh’s car insurance market stands at a pivotal transformation point, characterized by robust growth potential, technological innovation, and expanding consumer awareness that collectively create favorable conditions for sustained industry development. Market fundamentals including economic growth, increasing vehicle ownership, and regulatory support provide strong foundations for continued expansion across diverse customer segments and geographic regions.

Strategic opportunities in digital transformation, rural market expansion, and product innovation offer pathways for insurance companies to achieve sustainable competitive advantages while serving previously underserved market segments. Industry evolution toward customer-centric service delivery, technological integration, and comprehensive coverage options reflects broader trends in consumer expectations and market sophistication.

Future success in Bangladesh’s car insurance market will depend on companies’ abilities to balance innovation with affordability, expand market reach while maintaining service quality, and leverage technology to enhance operational efficiency and customer satisfaction. The market’s trajectory toward increased penetration, digital adoption, and comprehensive coverage adoption positions Bangladesh’s car insurance sector for significant growth and modernization in the coming years.

What is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions, theft, and other incidents involving vehicles. It typically covers liability, collision, and comprehensive damages.

What are the key players in the Bangladesh Car Insurance Market?

Key players in the Bangladesh Car Insurance Market include Sadharan Bima Corporation, Green Delta Insurance Company, and Reliance Insurance Limited, among others. These companies offer a range of car insurance products tailored to the needs of consumers.

What are the growth factors driving the Bangladesh Car Insurance Market?

The growth of the Bangladesh Car Insurance Market is driven by increasing vehicle ownership, rising awareness of insurance benefits, and the expansion of the automotive sector. Additionally, government regulations promoting insurance coverage contribute to market growth.

What challenges does the Bangladesh Car Insurance Market face?

The Bangladesh Car Insurance Market faces challenges such as low penetration rates, lack of consumer awareness, and regulatory hurdles. These factors can hinder the growth and adoption of car insurance products among potential customers.

What opportunities exist in the Bangladesh Car Insurance Market?

Opportunities in the Bangladesh Car Insurance Market include the introduction of innovative insurance products, the use of technology for better customer service, and the potential for partnerships with automotive companies. These factors can enhance market reach and customer engagement.

What trends are shaping the Bangladesh Car Insurance Market?

Trends in the Bangladesh Car Insurance Market include the increasing use of digital platforms for policy purchase and claims processing, the rise of usage-based insurance models, and a growing focus on customer-centric services. These trends are transforming how consumers interact with insurance providers.

Bangladesh Car Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Comprehensive, Third-Party Liability, Fire & Theft, Personal Accident |

| Customer Type | Individual, Corporate, Fleet, Government |

| Distribution Channel | Online, Agents, Brokers, Direct Sales |

| Coverage Type | Full Coverage, Limited Coverage, Third-Party Only, Add-ons |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bangladesh Car Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at