444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The baked foods and cereals market represents a fundamental pillar of the global food industry, encompassing a diverse range of products from traditional bread and pastries to innovative breakfast cereals and healthy grain-based snacks. This expansive market continues to evolve rapidly, driven by changing consumer preferences, health consciousness, and technological advancements in food processing and manufacturing.

Market dynamics indicate robust growth patterns across multiple segments, with the industry experiencing a 6.2% CAGR in recent years. The sector benefits from consistent demand patterns, as baked goods and cereals constitute staple food items across virtually all demographics and geographic regions. Consumer behavior has shifted significantly toward premium, organic, and functional food products, creating new opportunities for manufacturers to innovate and differentiate their offerings.

Regional variations in consumption patterns reflect cultural preferences and economic development levels, with developed markets showing increasing demand for artisanal and health-focused products, while emerging markets demonstrate strong growth in basic staple categories. The integration of advanced manufacturing technologies and supply chain optimization has enabled producers to meet diverse consumer needs while maintaining cost efficiency and product quality standards.

The baked foods and cereals market refers to the comprehensive industry segment encompassing all commercially produced grain-based food products that undergo baking, processing, or manufacturing processes to create ready-to-eat or ready-to-prepare consumer goods, including bread, pastries, breakfast cereals, crackers, and related bakery items.

Product categories within this market span from traditional baked goods like bread, cakes, and cookies to modern breakfast cereals, granola bars, and specialty grain-based snacks. The market includes both fresh baked products with shorter shelf lives and packaged goods designed for extended storage and distribution. Manufacturing processes range from artisanal small-batch production to large-scale industrial operations utilizing automated systems and advanced preservation techniques.

Market participants include multinational food corporations, regional bakery chains, specialty manufacturers, and local artisanal producers, each serving different consumer segments and distribution channels. The industry encompasses both retail consumer products sold through grocery stores and food service applications for restaurants, cafeterias, and institutional buyers.

Market performance in the baked foods and cereals sector demonstrates consistent resilience and growth, supported by fundamental consumer demand patterns and continuous product innovation. The industry has successfully adapted to evolving health trends, incorporating functional ingredients, reducing artificial additives, and developing products that meet specific dietary requirements including gluten-free, organic, and high-protein formulations.

Key growth drivers include urbanization trends that increase demand for convenient breakfast options, rising health consciousness leading to premium product adoption, and expanding distribution networks in emerging markets. The sector benefits from a 78% household penetration rate for breakfast cereals in developed markets, indicating strong market maturity and consistent consumption patterns.

Technological advancement has revolutionized production capabilities, enabling manufacturers to achieve greater efficiency, consistency, and product variety. Supply chain optimization and improved packaging technologies have extended product shelf life and reduced waste, contributing to overall market sustainability and profitability.

Future prospects remain positive, with industry analysts projecting continued expansion driven by population growth, increasing disposable income in emerging markets, and ongoing product innovation focused on health, convenience, and sustainability attributes that resonate with modern consumers.

Consumer preferences have undergone significant transformation, with health-conscious buyers increasingly seeking products with clean labels, minimal processing, and enhanced nutritional profiles. This shift has prompted manufacturers to reformulate existing products and develop new offerings that align with contemporary wellness trends.

Market segmentation reveals distinct growth patterns across different product categories, with breakfast cereals showing particular strength in developed markets while traditional baked goods maintain steady demand across all regions. Innovation cycles have accelerated, with companies launching new products more frequently to capture evolving consumer interests and maintain competitive positioning.

Demographic trends serve as primary catalysts for market expansion, with urbanization creating increased demand for convenient breakfast and snacking options. Busy lifestyles in metropolitan areas drive consumption of ready-to-eat cereals and portable baked goods that fit modern time constraints and mobility requirements.

Health consciousness represents a fundamental driver reshaping product development priorities. Consumers increasingly seek functional benefits from their food choices, leading to demand for products fortified with vitamins, minerals, probiotics, and other beneficial ingredients. This trend has resulted in a 42% increase in sales of health-focused cereal varieties over recent years.

Economic development in emerging markets creates expanding middle-class populations with increased purchasing power and exposure to Western dietary patterns. Rising disposable income enables consumers to explore premium product categories and experiment with new flavors and formats previously considered luxury items.

Technological advancement in food processing enables manufacturers to create products with improved nutritional profiles, extended shelf life, and enhanced sensory characteristics. Innovation capabilities allow companies to respond quickly to market trends and develop products that meet specific consumer needs and preferences.

Distribution expansion through modern retail channels and e-commerce platforms increases product accessibility and market reach. Supply chain improvements enable efficient delivery of fresh and packaged products to diverse geographic markets, supporting overall industry growth and market penetration.

Health concerns regarding processed foods create challenges for traditional product categories, with consumers increasingly scrutinizing ingredient lists and nutritional content. Negative perceptions about artificial additives, high sugar content, and refined grains have prompted some consumers to reduce consumption of conventional baked goods and cereals.

Raw material volatility affects production costs and profit margins, with grain prices subject to weather conditions, geopolitical factors, and global supply chain disruptions. Commodity price fluctuations create planning challenges for manufacturers and can impact product pricing strategies and market positioning.

Regulatory pressures regarding labeling requirements, nutritional standards, and food safety protocols increase compliance costs and operational complexity. Government initiatives targeting sugar reduction and improved nutritional quality require significant reformulation efforts and potential impacts on taste and consumer acceptance.

Competition intensity from alternative breakfast options and snacking categories creates market share pressure. Private label products offer consumers lower-cost alternatives, while artisanal producers compete on quality and uniqueness, creating challenges for mainstream manufacturers to maintain differentiation and pricing power.

Changing dietary patterns including intermittent fasting, low-carb diets, and meal replacement trends can reduce overall category consumption. Lifestyle modifications that emphasize fresh, unprocessed foods may limit growth potential for packaged baked goods and processed cereals.

Product innovation presents substantial opportunities for market expansion through development of functional foods that address specific health needs and dietary preferences. Personalized nutrition trends create potential for customized products targeting individual consumer requirements and lifestyle choices.

Emerging markets offer significant growth potential as economic development increases consumer purchasing power and exposure to diverse food categories. Market penetration in developing regions remains relatively low, providing opportunities for established brands to expand their geographic footprint and build consumer loyalty.

E-commerce expansion enables direct-to-consumer sales channels and subscription-based models that can improve profit margins and customer relationships. Digital marketing capabilities allow targeted promotion of specialty products and niche categories that may not receive adequate shelf space in traditional retail environments.

Sustainability initiatives create opportunities for differentiation through eco-friendly packaging, sustainable sourcing practices, and carbon-neutral production processes. Environmental consciousness among consumers provides competitive advantages for companies that demonstrate genuine commitment to sustainability goals.

Partnership opportunities with health and wellness brands, fitness companies, and nutritional supplement manufacturers can create co-branded products and cross-promotional marketing initiatives. Strategic alliances enable access to new consumer segments and distribution channels while sharing development costs and market risks.

Supply chain evolution continues to reshape industry operations, with manufacturers investing in automation, quality control systems, and logistics optimization to improve efficiency and reduce costs. Vertical integration strategies enable better control over ingredient sourcing, production processes, and distribution networks.

Consumer engagement has become increasingly important, with successful brands developing strong social media presence and community-building initiatives. Brand loyalty in the cereals segment shows a 68% retention rate among satisfied customers, highlighting the importance of consistent quality and effective marketing communications.

Seasonal demand patterns influence production planning and inventory management, with certain products experiencing peak sales during specific periods. Holiday baking seasons create opportunities for specialty products and limited-edition offerings that can command premium pricing and generate incremental revenue.

Competitive dynamics involve continuous product launches, promotional activities, and market share battles across different segments. Innovation speed has become a critical success factor, with companies needing to rapidly develop and launch new products to maintain relevance and competitive positioning.

Regulatory environment continues to evolve, with increasing focus on nutritional labeling, health claims substantiation, and food safety standards. Compliance requirements create both challenges and opportunities for companies that can effectively navigate regulatory complexity and use compliance as a competitive advantage.

Data collection for comprehensive market analysis involves multiple research approaches including primary surveys, secondary data analysis, and industry expert interviews. Quantitative research methods provide statistical insights into market size, growth rates, and consumer behavior patterns across different demographic segments and geographic regions.

Primary research encompasses consumer surveys, retailer interviews, and manufacturer consultations to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies include online questionnaires, focus groups, and in-depth interviews with key industry stakeholders to ensure comprehensive perspective coverage.

Secondary research utilizes industry reports, government statistics, trade association data, and company financial statements to validate primary findings and provide historical context. Data triangulation ensures accuracy and reliability by cross-referencing information from multiple independent sources.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. Analytical frameworks consider multiple variables including economic indicators, demographic trends, and competitive dynamics to create robust market assessments.

Quality assurance processes include data validation, peer review, and expert verification to ensure research findings meet professional standards and provide actionable insights for industry participants and stakeholders.

North America represents a mature market with high consumption rates and strong brand loyalty, accounting for approximately 35% of global market share. The region demonstrates particular strength in breakfast cereals and premium baked goods, with consumers showing willingness to pay higher prices for organic and health-focused products.

European markets exhibit diverse consumption patterns reflecting cultural preferences and regulatory environments. Western Europe shows strong demand for artisanal and organic products, while Eastern European markets demonstrate rapid growth in packaged goods adoption as economic development continues.

Asia-Pacific region presents the highest growth potential, with emerging economies experiencing rapid urbanization and rising disposable income. Market penetration remains relatively low in many countries, providing substantial expansion opportunities for international brands and local manufacturers.

Latin America shows steady growth driven by population expansion and increasing consumer exposure to international food trends. Regional preferences for traditional baked goods create opportunities for products that blend local flavors with modern convenience and nutritional benefits.

Middle East and Africa represent emerging markets with significant long-term potential as economic development and urbanization trends continue. Cultural considerations and religious dietary requirements create opportunities for specialized product development and targeted marketing approaches.

Market leadership is distributed among several multinational corporations that have established strong brand recognition and extensive distribution networks. Competitive positioning varies by product category and geographic region, with different companies holding dominant positions in specific market segments.

Competitive strategies focus on product innovation, brand building, distribution expansion, and operational efficiency improvements. Market consolidation continues through mergers and acquisitions as companies seek to achieve scale advantages and expand geographic reach.

Private label competition has intensified, with retailers developing high-quality store brands that compete directly with national brands on price and quality. Brand differentiation becomes increasingly important as companies work to maintain premium positioning and consumer loyalty.

Product segmentation reveals distinct market dynamics across different categories, with breakfast cereals, bread products, and cookies representing the largest segments by consumption volume. Premium categories including organic, gluten-free, and functional products show the highest growth rates and profit margins.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Breakfast cereals continue to dominate market share with consistent demand patterns and strong brand loyalty. Innovation focus centers on protein enrichment, sugar reduction, and functional ingredient addition to meet evolving health consciousness among consumers.

Bread products show regional variation in preferences, with artisanal and specialty breads gaining market share in developed countries while basic bread categories maintain strength in emerging markets. Gluten-free alternatives represent a rapidly growing subsegment with 23% annual growth in recent years.

Cookie and biscuit categories benefit from premiumization trends, with consumers willing to pay higher prices for organic, artisanal, and unique flavor profiles. Portion control packaging and healthier formulations address consumer concerns about indulgent snacking.

Cracker segments show strong performance in healthy snacking applications, with whole grain and seed-based varieties experiencing robust growth. Functional crackers with added protein, fiber, and other beneficial ingredients appeal to health-conscious consumers.

Cake and pastry markets demonstrate seasonal demand patterns with opportunities for limited-edition and holiday-themed products. Individual serving formats and premium ingredients drive category innovation and margin improvement.

Manufacturers benefit from consistent consumer demand, established distribution channels, and opportunities for product differentiation through innovation and premium positioning. Operational efficiency improvements through automation and supply chain optimization contribute to improved profitability and competitive positioning.

Retailers gain from high inventory turnover, strong consumer traffic generation, and opportunities for private label development. Category management expertise in baked goods and cereals provides competitive advantages and improved supplier relationships.

Consumers enjoy expanded product choices, improved nutritional options, and convenient consumption formats that fit modern lifestyles. Value propositions include time savings, nutritional benefits, and taste satisfaction across diverse price points and quality levels.

Suppliers of ingredients and packaging materials benefit from stable demand patterns and opportunities for innovation partnerships. Sustainable sourcing initiatives create additional value propositions and competitive differentiation opportunities.

Investors find attractive opportunities in a stable industry with consistent cash flows, growth potential in emerging markets, and innovation-driven margin expansion possibilities. Market resilience during economic downturns provides defensive investment characteristics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues to reshape product development priorities, with consumers demanding transparency in ingredient lists and manufacturing processes. Artificial ingredient reduction has become a standard practice across most product categories, driving reformulation efforts and supply chain modifications.

Functional food integration represents a major trend, with manufacturers incorporating probiotics, plant proteins, vitamins, and minerals into traditional products. Nutritional enhancement strategies focus on addressing specific health concerns while maintaining taste and texture characteristics that consumers expect.

Sustainable packaging initiatives gain momentum as environmental consciousness influences purchasing decisions. Recyclable materials and reduced packaging waste become competitive differentiators, particularly among younger consumer demographics who prioritize environmental responsibility.

Personalization trends drive development of products targeting specific dietary needs, lifestyle preferences, and health goals. Customized nutrition approaches include products for athletes, seniors, children, and individuals with specific dietary restrictions or health conditions.

Digital engagement strategies become increasingly important for brand building and consumer relationship management. Social media marketing and influencer partnerships help companies reach target audiences and build community around their products and brand values.

Acquisition activity continues to reshape the competitive landscape, with major companies pursuing strategic purchases to expand product portfolios, enter new markets, or acquire innovative capabilities. Market consolidation enables companies to achieve greater scale and operational efficiency while expanding their geographic reach.

Manufacturing technology advances include automation improvements, quality control enhancements, and sustainability initiatives that reduce environmental impact. Production efficiency gains enable companies to maintain competitive pricing while improving product consistency and safety standards.

Product launches accelerate across all categories, with companies introducing new flavors, formats, and nutritional profiles to capture evolving consumer interests. Innovation cycles have shortened, requiring faster development processes and more agile market response capabilities.

Partnership agreements between manufacturers and technology companies enable development of smart packaging, supply chain optimization, and consumer engagement solutions. Collaborative innovation approaches help companies access new capabilities and share development risks and costs.

Sustainability commitments include carbon neutrality goals, sustainable sourcing initiatives, and waste reduction programs that address environmental concerns and regulatory requirements. Corporate responsibility programs become increasingly important for brand reputation and consumer loyalty.

MarkWide Research recommends that industry participants focus on health and wellness positioning while maintaining taste and convenience attributes that drive consumer preference. Innovation investment should prioritize functional ingredients and clean label formulations that address contemporary health concerns.

Market expansion strategies should emphasize emerging market penetration while developing products that accommodate local taste preferences and cultural requirements. Distribution partnerships with local retailers and e-commerce platforms can accelerate market entry and reduce operational complexity.

Sustainability initiatives should be integrated throughout the value chain, from ingredient sourcing to packaging and distribution. Environmental responsibility becomes a competitive necessity rather than optional differentiation as consumer awareness and regulatory requirements continue to evolve.

Digital transformation investments should focus on consumer engagement, supply chain optimization, and data analytics capabilities that enable better decision-making and market responsiveness. Technology adoption can provide competitive advantages in efficiency, quality, and customer relationship management.

Portfolio optimization should balance traditional products that provide stable cash flows with innovative offerings that capture growth opportunities and premium pricing. Brand management strategies should emphasize authenticity, quality, and health benefits while maintaining emotional connections with consumers.

Market growth prospects remain positive, supported by population expansion, urbanization trends, and rising disposable income in emerging markets. Demand patterns will continue evolving toward healthier, more convenient, and environmentally sustainable products that align with contemporary lifestyle preferences.

Innovation acceleration will drive category expansion through functional foods, personalized nutrition, and novel ingredients that address specific health and wellness needs. Technology integration will enable more efficient production, better quality control, and enhanced consumer engagement capabilities.

Geographic expansion opportunities will focus on emerging markets where consumption rates remain below developed market levels. Market penetration strategies will need to accommodate local preferences while introducing international quality standards and innovation capabilities.

Sustainability requirements will become increasingly important for market access and consumer acceptance. Environmental performance will influence purchasing decisions and regulatory compliance, requiring significant investments in sustainable practices throughout the value chain.

MWR analysis projects continued market evolution toward premium, health-focused, and environmentally responsible products that command higher margins and stronger consumer loyalty. Industry transformation will reward companies that successfully balance innovation, sustainability, and operational efficiency while maintaining strong brand relationships with consumers.

The baked foods and cereals market demonstrates remarkable resilience and adaptability, successfully navigating changing consumer preferences, health trends, and economic conditions while maintaining its position as a fundamental component of global food consumption. Industry evolution continues toward healthier, more sustainable, and convenient products that meet contemporary lifestyle demands.

Growth opportunities remain substantial, particularly in emerging markets and premium product categories that address specific consumer needs and preferences. Innovation capabilities and brand strength will determine competitive success as companies work to differentiate their offerings and build lasting consumer relationships.

Future success will require balanced strategies that combine operational excellence, product innovation, sustainability commitment, and consumer engagement to create value for all stakeholders while addressing evolving market dynamics and regulatory requirements in this essential food industry sector.

What is Baked Foods and Cereals?

Baked Foods and Cereals refer to a variety of products that are prepared through baking or processing grains. This includes items such as bread, pastries, breakfast cereals, and snacks made from wheat, oats, and other grains.

What are the key players in the Baked Foods and Cereals Market?

Key players in the Baked Foods and Cereals Market include companies like General Mills, Kellogg’s, and Mondelez International, which are known for their extensive range of baked goods and cereal products, among others.

What are the main drivers of growth in the Baked Foods and Cereals Market?

The growth of the Baked Foods and Cereals Market is driven by increasing consumer demand for convenient and ready-to-eat food options, the rising popularity of healthy snacks, and innovations in product formulations that cater to dietary preferences.

What challenges does the Baked Foods and Cereals Market face?

Challenges in the Baked Foods and Cereals Market include rising raw material costs, health concerns related to processed foods, and intense competition among brands that can affect pricing strategies.

What opportunities exist in the Baked Foods and Cereals Market?

Opportunities in the Baked Foods and Cereals Market include the growing trend towards gluten-free and organic products, as well as the potential for expansion into emerging markets where demand for baked goods is increasing.

What trends are shaping the Baked Foods and Cereals Market?

Trends in the Baked Foods and Cereals Market include the rise of plant-based ingredients, the incorporation of superfoods into cereals, and a focus on sustainable packaging solutions to meet consumer preferences.

Baked Foods and Cereals Market

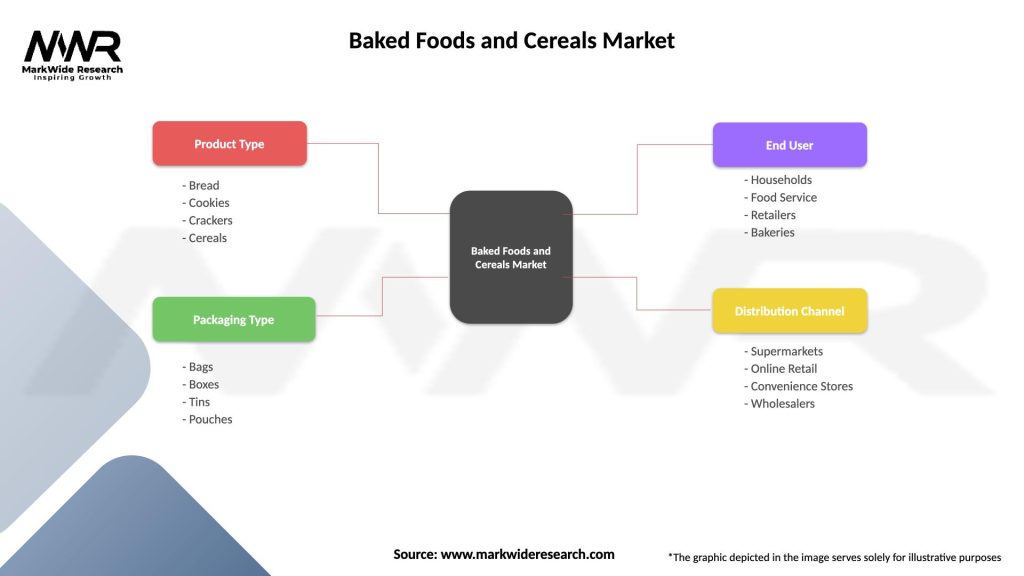

| Segmentation Details | Description |

|---|---|

| Product Type | Bread, Cookies, Crackers, Cereals |

| Packaging Type | Bags, Boxes, Tins, Pouches |

| End User | Households, Food Service, Retailers, Bakeries |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Baked Foods and Cereals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at