444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bahrain poultry meat market represents a vital component of the kingdom’s food security infrastructure, serving as a cornerstone of protein consumption for the local population. Market dynamics indicate robust growth potential driven by increasing consumer demand, population expansion, and evolving dietary preferences. The sector has experienced significant transformation over recent years, with domestic production capacity expanding alongside strategic import partnerships to ensure consistent supply chains.

Consumer preferences in Bahrain have shifted toward higher-quality poultry products, driving market segmentation across premium, standard, and value categories. The market demonstrates resilient growth patterns with approximately 6.2% annual expansion in consumption volumes, reflecting the protein’s position as a dietary staple. Government initiatives supporting food security and local production capabilities have created favorable conditions for both domestic producers and international suppliers.

Supply chain infrastructure has evolved to accommodate growing demand, with modern processing facilities, cold storage networks, and distribution systems enhancing market efficiency. The integration of advanced technologies in poultry farming and processing has improved product quality while reducing operational costs, contributing to market competitiveness and consumer satisfaction.

The Bahrain poultry meat market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of chicken, turkey, duck, and other poultry products within the Kingdom of Bahrain. This market includes both domestic production facilities and imported products that meet local demand across retail, foodservice, and institutional segments.

Market scope extends beyond raw meat products to include processed items such as marinated cuts, ready-to-cook products, and value-added preparations that cater to diverse consumer preferences. The sector operates within a regulatory framework designed to ensure food safety, quality standards, and sustainable production practices while supporting economic growth and employment generation.

Industry participants range from large-scale commercial producers and processors to smaller local farms, importers, distributors, and retailers who collectively serve the kingdom’s poultry meat requirements. The market’s definition encompasses both fresh and frozen products, organic and conventional options, and various packaging formats designed to meet specific consumer and commercial needs.

Strategic positioning of Bahrain’s poultry meat market reflects the kingdom’s commitment to food security while leveraging regional trade relationships and domestic production capabilities. The sector demonstrates consistent growth momentum supported by favorable demographics, rising disposable incomes, and increasing awareness of protein nutrition benefits among consumers.

Market performance indicators reveal strong fundamentals with domestic consumption growth of approximately 4.8% annually, driven by population expansion and changing dietary patterns. The integration of modern farming techniques and processing technologies has enhanced productivity while maintaining quality standards that meet both local preferences and international requirements.

Competitive landscape features a balanced mix of domestic producers and international suppliers, creating a dynamic environment that benefits consumers through product variety, competitive pricing, and consistent availability. Government support for agricultural development and food security initiatives has strengthened the sector’s foundation while encouraging sustainable growth practices.

Future prospects remain positive with anticipated market expansion driven by tourism growth, expatriate population increases, and evolving consumer preferences toward convenient, high-quality poultry products. The sector’s strategic importance to Bahrain’s food security objectives ensures continued policy support and investment in infrastructure development.

Consumer behavior analysis reveals significant preferences for fresh poultry products, with approximately 72% of consumers prioritizing freshness over price considerations. This trend has driven retailers and suppliers to invest in cold chain infrastructure and rapid distribution systems to maintain product quality from farm to table.

Market segmentation demonstrates clear preferences across different consumer categories, with expatriate communities showing distinct purchasing patterns compared to local consumers. Price sensitivity varies significantly across segments, with premium products gaining traction among higher-income demographics while value options remain important for price-conscious consumers.

Population growth serves as a fundamental driver for Bahrain’s poultry meat market, with steady demographic expansion creating consistent demand increases. The kingdom’s strategic location as a regional hub attracts expatriate workers and tourists, further amplifying consumption requirements across diverse cultural preferences and dietary habits.

Economic prosperity and rising disposable incomes enable consumers to prioritize protein quality and variety in their dietary choices. Urbanization trends have shifted consumption patterns toward convenient, ready-to-prepare products that align with busy lifestyles while maintaining nutritional value and taste preferences.

Health awareness campaigns promoting lean protein consumption have positioned poultry meat as a preferred option compared to red meat alternatives. Government initiatives supporting food security and local production have created favorable conditions for market expansion while ensuring supply chain resilience.

Technological advancement in farming, processing, and distribution has improved product quality while reducing costs, making poultry meat more accessible to broader consumer segments. Retail modernization through supermarket expansion and improved cold storage facilities has enhanced product availability and consumer convenience.

Import dependency creates vulnerability to international price fluctuations and supply chain disruptions, potentially affecting market stability and consumer prices. Limited land availability for large-scale domestic production constrains the kingdom’s ability to achieve complete self-sufficiency in poultry meat production.

Regulatory compliance requirements for food safety and quality standards can increase operational costs for producers and importers, potentially impacting product pricing and market accessibility. Climate challenges in the region affect farming conditions and may require additional investments in controlled environment systems.

Competition from alternative proteins including seafood, lamb, and plant-based options may limit market share expansion in certain consumer segments. Economic volatility can affect consumer purchasing power and shift demand toward lower-priced protein alternatives during challenging periods.

Infrastructure limitations in cold storage and distribution networks may constrain market growth in certain areas while increasing operational costs for market participants. Skilled labor shortage in specialized farming and processing operations can limit production efficiency and expansion capabilities.

Export potential to neighboring GCC countries presents significant growth opportunities for Bahraini poultry producers who can leverage the kingdom’s strategic location and quality standards. Value-added product development including marinated, seasoned, and ready-to-cook options can capture higher margins while meeting evolving consumer preferences.

Organic and free-range poultry segments offer premium positioning opportunities as health-conscious consumers seek higher-quality protein sources. E-commerce expansion creates new distribution channels that can reach consumers directly while providing convenience and competitive pricing.

Tourism sector growth generates additional demand from hotels, restaurants, and catering services, creating opportunities for specialized products and service offerings. Technology integration in farming and processing can improve efficiency, reduce costs, and enhance product quality to compete more effectively.

Partnership opportunities with international producers and technology providers can enhance local capabilities while ensuring consistent supply and quality standards. Government support programs for agricultural development may provide funding and incentives for market expansion and modernization initiatives.

Supply and demand equilibrium in Bahrain’s poultry meat market reflects the interplay between domestic production capabilities and import requirements to meet growing consumption needs. Seasonal variations influence both production cycles and consumer demand patterns, with religious holidays and cultural events creating periodic demand spikes.

Price dynamics are influenced by international commodity markets, currency fluctuations, and local supply conditions, requiring market participants to maintain flexible pricing strategies. Quality competition has intensified as consumers become more discerning, driving improvements in production standards and product differentiation.

Distribution channel evolution shows increasing importance of modern retail formats while traditional markets maintain relevance for specific consumer segments. Regulatory environment continues to evolve with enhanced food safety requirements and sustainability standards affecting operational practices across the value chain.

Technology adoption is accelerating across farming, processing, and retail operations, improving efficiency while enabling better traceability and quality control. Consumer education about nutrition and food safety is raising awareness and influencing purchasing decisions toward higher-quality products and trusted brands.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Bahrain’s poultry meat market dynamics. Primary research includes structured interviews with industry stakeholders, consumer surveys, and direct observations of market conditions across different regions and retail channels.

Secondary research incorporates analysis of government statistics, trade data, industry reports, and regulatory documents to establish market baselines and trends. Quantitative analysis utilizes statistical modeling to project market growth, demand patterns, and competitive positioning across different market segments.

Qualitative assessment through expert interviews and focus group discussions provides deeper insights into consumer preferences, industry challenges, and emerging opportunities. Market validation processes ensure data accuracy through cross-referencing multiple sources and stakeholder verification.

Analytical framework combines traditional market research techniques with modern data analytics to provide comprehensive understanding of market dynamics, competitive landscape, and future growth potential. Continuous monitoring of market indicators ensures research findings remain current and relevant for strategic decision-making.

Geographic distribution across Bahrain reveals distinct consumption patterns with urban areas, particularly Manama and surrounding regions, accounting for approximately 68% of total market demand. Northern governorates demonstrate higher per-capita consumption rates due to concentrated expatriate populations and higher income levels.

Central regions show balanced consumption patterns with strong preference for traditional cuts and preparations, while southern areas exhibit growing demand for convenient, processed products. Retail infrastructure varies significantly across regions, with modern supermarkets concentrated in urban centers and traditional markets serving rural communities.

Distribution networks have adapted to regional preferences and infrastructure capabilities, with specialized cold chain logistics ensuring product quality across all areas. Cultural influences affect product preferences in different regions, with certain areas showing stronger demand for specific cuts and preparation styles.

Economic factors including income levels and employment patterns influence consumption patterns across regions, creating opportunities for targeted marketing and product positioning strategies. Infrastructure development continues to improve market access and distribution efficiency across all governorates.

Market leadership is distributed among several key players who have established strong positions through quality products, reliable supply chains, and effective distribution networks. Domestic producers compete alongside international suppliers, creating a dynamic environment that benefits consumers through variety and competitive pricing.

Competitive strategies focus on product quality, supply chain reliability, and customer service excellence. Innovation initiatives include new product development, packaging improvements, and technology adoption to enhance operational efficiency and market positioning.

Market consolidation trends show potential for strategic partnerships and acquisitions as companies seek to strengthen their competitive positions and expand market reach. Brand differentiation becomes increasingly important as consumers develop stronger preferences for trusted suppliers and quality products.

Product segmentation reveals distinct categories based on processing levels, with fresh whole chickens representing the largest segment, followed by cut portions and processed products. Premium segments including organic and free-range options show rapid growth at approximately 12% annually, reflecting evolving consumer preferences.

By Product Type:

By Distribution Channel:

Consumer segmentation identifies distinct groups with varying preferences, purchasing behaviors, and price sensitivities, enabling targeted marketing and product development strategies.

Fresh chicken category maintains market dominance with consumers preferring locally sourced products when available, supplemented by high-quality imports during supply gaps. Whole chicken sales remain strong due to cultural preferences and perceived value, while cut portions gain popularity among busy consumers seeking convenience.

Frozen segment serves specific needs including bulk purchasing, extended storage, and price-conscious consumers who prioritize value over freshness. Quality improvements in freezing and packaging technologies have enhanced consumer acceptance of frozen products across various market segments.

Processed products represent the fastest-growing category with innovation driving expansion through new flavors, marinades, and preparation styles that cater to diverse cultural preferences. Ready-to-cook options appeal to time-constrained consumers while maintaining quality and nutritional value.

Premium categories including organic and free-range products attract health-conscious consumers willing to pay higher prices for perceived quality benefits. Specialty items such as heritage breeds and unique preparations create niche opportunities for differentiated positioning and higher margins.

Producers benefit from growing market demand, government support for agricultural development, and opportunities to expand operations through modern farming techniques and technology adoption. Economies of scale enable cost reductions while quality improvements enhance market positioning and consumer loyalty.

Retailers gain from strong consumer demand, product variety opportunities, and the ability to differentiate through quality, service, and pricing strategies. Modern retail formats can leverage cold chain capabilities to offer superior products while building customer relationships through consistent availability and quality.

Consumers enjoy improved product quality, greater variety, competitive pricing, and enhanced food safety standards resulting from industry development and regulatory oversight. Convenience options save time while maintaining nutritional value and taste preferences across diverse cultural backgrounds.

Government achieves food security objectives, economic development through job creation, and tax revenue generation from a thriving industry. Strategic partnerships with international suppliers ensure supply security while domestic production reduces import dependency and supports local economic development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness trends drive consumer preferences toward lean protein sources, with poultry meat positioned favorably compared to red meat alternatives. Organic and natural products gain traction among health-conscious consumers willing to pay premium prices for perceived quality benefits.

Convenience orientation shapes product development with increasing demand for ready-to-cook, marinated, and portion-controlled products that save preparation time. E-commerce adoption accelerates, particularly following global events that emphasized home delivery and contactless shopping preferences.

Sustainability awareness influences consumer choices and industry practices, with companies adopting environmentally responsible farming and packaging methods. Traceability demands increase as consumers seek transparency about product origins, farming practices, and supply chain integrity.

Cultural fusion creates opportunities for innovative products that blend traditional flavors with modern convenience, appealing to diverse expatriate communities and adventurous local consumers. Premium positioning becomes more important as consumers associate higher prices with better quality and safety standards.

Technology investments in automated processing, cold storage, and distribution systems have improved efficiency while maintaining quality standards across the supply chain. Regulatory enhancements strengthen food safety requirements and quality control measures, building consumer confidence and industry credibility.

Strategic partnerships between local distributors and international suppliers ensure consistent product availability while diversifying supply sources for enhanced security. Retail expansion through new supermarket openings and format innovations improves market access and consumer convenience.

Product innovation focuses on convenience, health benefits, and cultural preferences, with companies launching new marinades, cuts, and preparation styles. Infrastructure development includes expanded cold storage facilities and improved transportation networks supporting market growth.

Sustainability initiatives encompass packaging improvements, waste reduction programs, and environmentally responsible farming practices that appeal to conscious consumers. Digital transformation enables better inventory management, customer engagement, and operational efficiency across industry participants.

Market participants should focus on quality differentiation and brand building to capture premium segments while maintaining competitive positioning in value categories. Investment priorities should emphasize cold chain infrastructure, technology adoption, and supply chain resilience to ensure consistent product availability and quality.

MarkWide Research analysis indicates that companies should diversify supply sources and develop strategic partnerships to mitigate risks associated with import dependency. Product development efforts should concentrate on convenience, health benefits, and cultural preferences to capture evolving consumer demands.

Retail strategies should leverage both traditional and modern channels while investing in e-commerce capabilities to reach diverse consumer segments effectively. Sustainability initiatives will become increasingly important for brand positioning and regulatory compliance as environmental awareness grows.

Government collaboration on food security initiatives and agricultural development programs can provide competitive advantages while supporting industry growth objectives. Export exploration to regional markets offers growth opportunities for companies with quality products and efficient operations.

Growth projections for Bahrain’s poultry meat market remain positive with anticipated expansion driven by demographic trends, economic development, and evolving consumer preferences. Market maturation will likely lead to increased competition and quality differentiation as the foundation for sustainable competitive advantage.

Technology integration will accelerate across all market segments, improving efficiency, quality control, and consumer engagement while reducing operational costs. Sustainability requirements will become more stringent, driving innovation in farming practices, packaging, and supply chain management.

Consumer sophistication will continue increasing, creating opportunities for premium products, specialized offerings, and enhanced service levels. Regional integration may provide export opportunities for efficient producers who can meet quality standards and competitive pricing requirements.

MWR projections suggest that successful companies will be those that balance quality, convenience, and value while maintaining supply chain resilience and adapting to changing consumer preferences. Market consolidation may occur as companies seek scale advantages and operational efficiencies in an increasingly competitive environment.

Bahrain’s poultry meat market demonstrates strong fundamentals with consistent growth driven by favorable demographics, rising incomes, and evolving consumer preferences toward quality protein sources. The sector’s strategic importance to food security ensures continued government support while creating opportunities for both domestic and international market participants.

Market dynamics reflect a maturing industry with increasing emphasis on quality, convenience, and sustainability as key differentiating factors. Competitive positioning will increasingly depend on supply chain efficiency, product innovation, and brand building as consumers become more discerning in their purchasing decisions.

Future success in this market will require balanced strategies that address quality expectations, price sensitivity, and convenience demands while maintaining operational efficiency and regulatory compliance. The Bahrain poultry meat market presents significant opportunities for companies that can adapt to changing consumer needs while building resilient, sustainable business models that support long-term growth and profitability.

What is Poultry Meat?

Poultry meat refers to the flesh of domesticated birds, primarily chickens, turkeys, ducks, and geese, raised for human consumption. In Bahrain, poultry meat is a significant source of protein and is widely consumed across various culinary traditions.

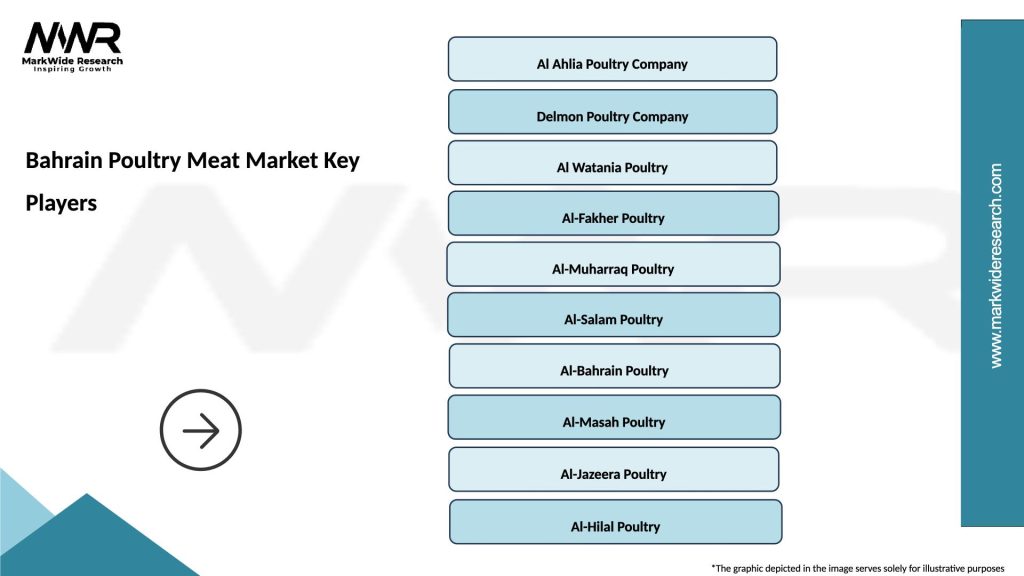

What are the key players in the Bahrain Poultry Meat Market?

Key players in the Bahrain Poultry Meat Market include Al-Ahlia Poultry Company, Bahrain Poultry Company, and Al-Muharraq Poultry, among others. These companies are involved in various aspects of poultry production, processing, and distribution.

What are the growth factors driving the Bahrain Poultry Meat Market?

The Bahrain Poultry Meat Market is driven by increasing consumer demand for protein-rich foods, a growing population, and the rising trend of convenience foods. Additionally, health awareness and the preference for fresh poultry products contribute to market growth.

What challenges does the Bahrain Poultry Meat Market face?

The Bahrain Poultry Meat Market faces challenges such as fluctuating feed prices, disease outbreaks among poultry, and competition from imported meat products. These factors can impact production costs and market stability.

What opportunities exist in the Bahrain Poultry Meat Market?

Opportunities in the Bahrain Poultry Meat Market include the potential for expanding organic poultry production, increasing exports to neighboring regions, and the development of value-added poultry products. These trends can enhance market competitiveness.

What trends are shaping the Bahrain Poultry Meat Market?

Trends in the Bahrain Poultry Meat Market include a shift towards sustainable farming practices, the rise of plant-based alternatives, and innovations in poultry processing technologies. These trends reflect changing consumer preferences and environmental considerations.

Bahrain Poultry Meat Market

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Chicken, Chicken Breast, Chicken Thighs, Chicken Wings |

| Distribution Channel | Supermarkets, Online Retail, Wholesalers, Local Markets |

| End User | Households, Restaurants, Food Service, Catering |

| Packaging Type | Vacuum Sealed, Tray Pack, Bulk Packaging, Frozen |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bahrain Poultry Meat Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at