444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bahrain cybersecurity market represents a rapidly evolving landscape driven by the kingdom’s ambitious digital transformation initiatives and growing recognition of cyber threats. As Bahrain positions itself as a regional fintech hub and smart city pioneer, the demand for comprehensive cybersecurity solutions has intensified significantly. The market encompasses various security domains including network security, endpoint protection, cloud security, and identity management systems.

Digital infrastructure expansion across Bahrain’s banking, telecommunications, and government sectors has created substantial opportunities for cybersecurity vendors and service providers. The kingdom’s strategic location as a financial center in the Gulf region, combined with increasing cyber attack sophistication, has elevated cybersecurity from a compliance requirement to a business-critical investment priority.

Market growth is particularly robust in sectors such as banking and financial services, which account for approximately 35% of cybersecurity investments in the kingdom. Government initiatives supporting digital economy development have further accelerated adoption rates, with the public sector representing another significant portion of market demand. The integration of artificial intelligence and machine learning technologies into cybersecurity solutions is reshaping the competitive landscape and driving innovation across the market.

The Bahrain cybersecurity market refers to the comprehensive ecosystem of security technologies, services, and solutions designed to protect digital assets, infrastructure, and data within the Kingdom of Bahrain. This market encompasses threat detection and prevention systems, security consulting services, compliance management tools, and incident response capabilities tailored to meet the specific regulatory and operational requirements of Bahraini organizations.

Cybersecurity solutions in Bahrain address multiple threat vectors including malware, ransomware, phishing attacks, and advanced persistent threats targeting critical infrastructure and sensitive data. The market includes both traditional security measures and next-generation technologies such as zero-trust architecture, behavioral analytics, and automated threat response systems.

Market participants range from global cybersecurity vendors establishing regional presence to local system integrators and managed security service providers. The ecosystem also includes government agencies, regulatory bodies, and industry associations working collaboratively to enhance the kingdom’s overall cybersecurity posture and resilience against evolving digital threats.

Bahrain’s cybersecurity market is experiencing unprecedented growth momentum, driven by accelerating digital transformation across key economic sectors and heightened awareness of cyber risks. The kingdom’s strategic focus on becoming a regional technology and financial hub has created substantial demand for advanced security solutions and services.

Key market drivers include stringent regulatory requirements from the Central Bank of Bahrain, increasing sophistication of cyber threats, and growing adoption of cloud computing and Internet of Things technologies. The financial services sector leads market adoption, followed by government agencies and telecommunications providers seeking to enhance their security infrastructure.

Technology trends shaping the market include the integration of artificial intelligence for threat detection, adoption of zero-trust security models, and increasing demand for managed security services. Organizations are prioritizing comprehensive security strategies that address both traditional IT environments and emerging digital platforms.

Competitive dynamics feature a mix of international cybersecurity leaders and regional specialists, with growing emphasis on local partnerships and knowledge transfer. The market is characterized by increasing consolidation as organizations seek integrated security platforms rather than point solutions, driving demand for comprehensive cybersecurity ecosystems.

Strategic market insights reveal several critical trends shaping Bahrain’s cybersecurity landscape and driving investment decisions across various sectors:

Market maturity indicators suggest that Bahrain is transitioning from reactive security approaches to proactive, intelligence-driven cybersecurity strategies. This evolution is supported by increasing collaboration between public and private sectors in threat intelligence sharing and incident response coordination.

Digital transformation initiatives across Bahrain’s economy serve as the primary catalyst for cybersecurity market expansion. The kingdom’s commitment to becoming a regional technology hub has accelerated digitization across government services, financial institutions, and private enterprises, creating substantial security requirements.

Regulatory mandates from the Central Bank of Bahrain and other regulatory authorities have established comprehensive cybersecurity frameworks requiring financial institutions and critical infrastructure operators to implement robust security measures. These regulations drive consistent investment in security technologies and services, with compliance requirements growing approximately 25% annually in complexity and scope.

Threat landscape evolution continues to drive market demand as cybercriminals increasingly target the Gulf region’s financial and energy sectors. The sophistication of attacks, including state-sponsored threats and advanced persistent threats, necessitates continuous investment in next-generation security technologies and threat intelligence capabilities.

Cloud adoption acceleration has created new security requirements as organizations migrate critical workloads to cloud platforms. This transition demands specialized cloud security solutions, identity and access management systems, and hybrid security architectures that can protect both on-premises and cloud-based assets effectively.

Smart city development initiatives are generating substantial cybersecurity requirements as Bahrain implements IoT infrastructure, connected transportation systems, and digital government services. These projects require comprehensive security frameworks addressing device security, data protection, and network segmentation across interconnected urban systems.

Cybersecurity skills shortage represents a significant constraint on market growth, with demand for qualified security professionals exceeding supply by approximately 40% across the kingdom. This talent gap limits organizations’ ability to implement and manage advanced security solutions effectively, potentially slowing adoption rates for sophisticated technologies.

Budget constraints among small and medium enterprises limit their ability to invest in comprehensive cybersecurity solutions. Many organizations struggle to balance security investment requirements with operational costs, leading to delayed implementations or adoption of less comprehensive security measures that may not adequately address evolving threats.

Technology complexity poses challenges for organizations lacking internal cybersecurity expertise. The rapid evolution of security technologies and the complexity of integrating multiple security solutions can overwhelm organizations without dedicated security teams, creating implementation barriers and reducing solution effectiveness.

Legacy system integration difficulties constrain security modernization efforts across various sectors. Many organizations operate aging IT infrastructure that cannot easily accommodate modern security solutions, requiring costly upgrades or complex integration projects that may delay security improvements.

Vendor fragmentation in the cybersecurity market creates challenges for organizations seeking comprehensive security coverage. The proliferation of specialized security vendors and point solutions can complicate procurement decisions and increase management overhead, potentially deterring some organizations from implementing optimal security architectures.

Managed security services present substantial growth opportunities as organizations increasingly prefer outsourced security operations to address skills shortages and reduce operational complexity. The managed services segment is experiencing growth rates of approximately 30% annually as organizations recognize the value of 24/7 security monitoring and expert threat response capabilities.

Artificial intelligence integration offers significant opportunities for security vendors to differentiate their solutions and improve threat detection capabilities. AI-powered security solutions can address the skills shortage by automating routine security tasks and providing intelligent threat analysis that enhances human security analysts’ effectiveness.

Industry-specific solutions represent growing opportunities as sectors such as healthcare, education, and manufacturing increase their digital adoption. These industries require specialized security solutions addressing unique regulatory requirements and operational challenges, creating niche markets for targeted cybersecurity offerings.

Regional expansion opportunities exist for successful cybersecurity providers in Bahrain to leverage their local expertise and regulatory knowledge to serve other Gulf Cooperation Council markets. Bahrain’s position as a regional financial center provides strategic advantages for cybersecurity companies seeking broader regional presence.

Public-private partnerships in cybersecurity create opportunities for collaborative threat intelligence sharing, joint incident response capabilities, and coordinated security infrastructure development. These partnerships can enhance overall national cybersecurity resilience while creating new business models for security service providers.

Supply-demand dynamics in Bahrain’s cybersecurity market reflect strong demand growth outpacing supply capabilities, particularly in specialized areas such as cloud security and industrial control system protection. This imbalance is driving price premiums for advanced security solutions and creating opportunities for new market entrants with innovative offerings.

Technology evolution cycles are accelerating, with security solutions requiring more frequent updates and replacements to address emerging threats. Organizations are shifting from traditional three-to-five-year technology refresh cycles to continuous security improvement models that emphasize agility and adaptability over long-term stability.

Competitive intensity is increasing as global cybersecurity vendors establish regional presence while local providers enhance their capabilities through partnerships and acquisitions. This competition is driving innovation and improving solution quality while potentially pressuring profit margins across the market.

Customer sophistication is growing rapidly as organizations develop internal cybersecurity expertise and become more discerning in their technology selection processes. This trend is pushing vendors to provide more comprehensive solutions and higher levels of service support to meet evolving customer expectations.

Regulatory evolution continues to shape market dynamics as authorities update cybersecurity requirements to address new threats and technologies. These regulatory changes create both compliance-driven demand and potential disruption as organizations must adapt their security strategies to meet evolving requirements.

Primary research methodology employed comprehensive stakeholder interviews with cybersecurity vendors, system integrators, end-user organizations, and regulatory authorities across Bahrain. These interviews provided insights into market trends, technology adoption patterns, and future investment priorities driving the cybersecurity market.

Secondary research analysis incorporated government publications, industry reports, regulatory guidelines, and vendor documentation to establish market context and validate primary research findings. This analysis included examination of cybersecurity incident reports, regulatory compliance requirements, and technology adoption statistics across key sectors.

Market sizing methodology utilized bottom-up analysis based on sector-specific cybersecurity spending patterns, vendor revenue data, and project pipeline analysis. The research team analyzed spending patterns across government, financial services, telecommunications, and private sector organizations to develop comprehensive market understanding.

Trend analysis incorporated longitudinal data analysis to identify emerging patterns in threat evolution, technology adoption, and market structure changes. This analysis included examination of cybersecurity incident trends, regulatory development patterns, and technology investment cycles affecting market dynamics.

Validation processes included cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and analyzing market data consistency across different research methodologies. MarkWide Research analysts employed rigorous quality assurance processes to ensure research accuracy and reliability.

Manama metropolitan area dominates cybersecurity market activity, accounting for approximately 60% of total market demand due to its concentration of financial institutions, government agencies, and multinational corporations. The capital region’s advanced digital infrastructure and regulatory requirements drive sophisticated security solution adoption across multiple sectors.

Northern Governorate represents a growing market segment driven by industrial and manufacturing facilities implementing Industry 4.0 technologies. This region’s cybersecurity requirements focus on operational technology protection, industrial control system security, and supply chain risk management solutions.

Southern and Central regions show increasing cybersecurity adoption as digital government services expand and small-to-medium enterprises enhance their digital capabilities. These areas present opportunities for cost-effective security solutions and managed services targeting organizations with limited internal security resources.

Cross-regional connectivity requirements drive demand for comprehensive network security solutions that can protect distributed operations and remote access capabilities. Organizations operating across multiple governorates require integrated security architectures that provide consistent protection regardless of location.

Regional specialization is emerging as different areas develop distinct cybersecurity requirements based on their economic focus. Financial districts emphasize regulatory compliance and fraud prevention, while industrial areas prioritize operational technology security and business continuity solutions.

Market leadership is distributed among several categories of cybersecurity providers, each serving different market segments and customer requirements:

Regional system integrators play crucial roles in solution deployment and ongoing support, with companies such as Gulf Business Machines and Injazat providing localized expertise and customer support. These partners often combine multiple vendor solutions to create comprehensive security architectures tailored to local requirements.

Competitive differentiation increasingly focuses on solution integration capabilities, local support quality, and ability to address specific regulatory requirements. Vendors are investing in regional partnerships and local talent development to enhance their competitive positioning in the market.

By Solution Type:

By Service Type:

By Deployment Model:

By Organization Size:

Network Security Solutions represent the largest market segment, driven by fundamental requirements to protect organizational perimeters and internal network infrastructure. This category includes next-generation firewalls, intrusion prevention systems, and network access control solutions that form the foundation of most cybersecurity architectures.

Cloud Security Platforms are experiencing the fastest growth rates, with adoption increasing approximately 45% annually as organizations accelerate cloud migration initiatives. This category encompasses cloud access security brokers, cloud workload protection platforms, and cloud infrastructure security solutions addressing unique cloud environment challenges.

Managed Security Services show strong growth momentum as organizations seek to address cybersecurity skills shortages and reduce operational complexity. This category includes security operations center services, threat hunting, incident response, and compliance management services delivered by specialized providers.

Identity and Access Management solutions are gaining prominence as organizations implement zero-trust security models and address remote work security challenges. This category includes multi-factor authentication, privileged access management, and identity governance solutions critical for modern security architectures.

Security Analytics and Intelligence platforms are becoming essential components of comprehensive security strategies, providing threat visibility and automated response capabilities. This category includes SIEM platforms, threat intelligence services, and security orchestration tools that enhance security team effectiveness and response capabilities.

Financial Institutions benefit from enhanced regulatory compliance capabilities, fraud prevention systems, and customer data protection measures that support their role as regional financial centers. Cybersecurity investments enable banks and financial services companies to maintain customer trust while expanding digital service offerings.

Government Agencies gain improved citizen data protection, critical infrastructure security, and digital service delivery capabilities through comprehensive cybersecurity implementations. These benefits support national digital transformation initiatives while maintaining public trust in government digital services.

Private Enterprises achieve business continuity protection, intellectual property security, and competitive advantage through robust cybersecurity measures. Security investments enable organizations to pursue digital transformation initiatives with confidence while protecting valuable business assets and customer information.

Cybersecurity Vendors access growing market opportunities, establish regional presence, and develop local partnerships that support long-term business growth. The expanding market provides opportunities for both established vendors and innovative startups to capture market share through specialized solutions.

System Integrators benefit from increasing demand for complex security implementations, ongoing support services, and multi-vendor solution integration projects. These opportunities support business growth while enabling development of specialized cybersecurity expertise and service capabilities.

Technology Professionals gain access to expanding career opportunities, specialized training programs, and competitive compensation packages in the growing cybersecurity field. The market expansion creates demand for various skill levels from entry-level analysts to senior security architects and consultants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Zero Trust Architecture Adoption is accelerating across Bahraini organizations as traditional perimeter-based security models prove inadequate for modern threat landscapes. This trend involves implementing comprehensive identity verification, device authentication, and continuous monitoring across all network access points, fundamentally changing how organizations approach cybersecurity.

AI-Powered Security Solutions are becoming mainstream as organizations seek to address cybersecurity skills shortages and improve threat detection capabilities. Machine learning algorithms are being integrated into security platforms to provide automated threat analysis, behavioral anomaly detection, and intelligent incident response capabilities.

Cloud-First Security Strategies are emerging as organizations prioritize cloud-native security solutions over traditional on-premises alternatives. This trend reflects the broader shift toward cloud computing and the need for security architectures that can protect distributed, cloud-based business operations effectively.

Managed Security Services Growth continues as organizations increasingly prefer outsourced security operations to dedicated internal teams. This trend is particularly strong among small and medium enterprises seeking enterprise-grade security capabilities without the associated staffing and infrastructure costs.

Regulatory Compliance Automation is gaining traction as organizations seek to streamline compliance processes and reduce manual oversight requirements. Automated compliance monitoring and reporting tools are becoming essential components of comprehensive cybersecurity strategies.

Industry-Specific Security Solutions are developing as sectors such as healthcare, education, and manufacturing implement digital transformation initiatives requiring specialized security approaches. These solutions address unique regulatory requirements and operational challenges specific to individual industries.

Central Bank of Bahrain has implemented enhanced cybersecurity regulations requiring financial institutions to adopt comprehensive security frameworks and incident reporting procedures. These regulations have driven significant investment in security technologies and professional services across the financial sector.

National Cybersecurity Strategy initiatives have established frameworks for public-private cybersecurity cooperation, threat intelligence sharing, and coordinated incident response capabilities. These developments are enhancing overall national cybersecurity resilience while creating new business opportunities for security service providers.

Smart City Projects across Bahrain are incorporating comprehensive cybersecurity requirements from the design phase, creating substantial opportunities for IoT security, network segmentation, and integrated security management solutions. These projects represent significant long-term market opportunities for cybersecurity vendors.

Financial Technology Innovation initiatives are driving demand for specialized security solutions addressing digital payment systems, blockchain applications, and mobile banking platforms. These developments require innovative security approaches that balance user experience with robust protection capabilities.

International Partnership Agreements with cybersecurity organizations and government agencies are facilitating knowledge transfer, threat intelligence sharing, and collaborative security research initiatives. These partnerships are enhancing local cybersecurity capabilities while attracting international investment in the sector.

Cybersecurity Education Programs launched by universities and professional organizations are beginning to address local skills shortages while creating pathways for career development in cybersecurity fields. These initiatives support long-term market sustainability and growth potential.

Investment Prioritization should focus on comprehensive security platforms rather than point solutions, as organizations increasingly prefer integrated security architectures that reduce complexity and improve operational efficiency. MarkWide Research analysis indicates that organizations achieving the best security outcomes typically implement platform-based approaches rather than multiple disparate solutions.

Skills Development Initiatives represent critical success factors for market participants, with organizations needing to invest in training programs, certification support, and knowledge transfer initiatives. The cybersecurity skills shortage constrains market growth and solution effectiveness, making talent development a strategic priority.

Regional Market Expansion opportunities should be evaluated carefully, as successful implementation in Bahrain can provide valuable experience and references for broader Gulf Cooperation Council market penetration. Organizations should consider Bahrain as a strategic entry point for regional cybersecurity market development.

Regulatory Compliance Capabilities must be integrated into all cybersecurity solutions and services, as compliance requirements continue to evolve and become more stringent across sectors. Organizations that can demonstrate comprehensive compliance support will maintain competitive advantages in the market.

Technology Innovation Focus should emphasize artificial intelligence integration, cloud-native architectures, and automated security operations to address market demands for more effective and efficient security solutions. Innovation in these areas will differentiate successful vendors from competitors.

Partnership Strategy Development is essential for international vendors seeking to establish sustainable market presence, as local partnerships provide cultural understanding, regulatory expertise, and customer relationship advantages that are difficult to replicate independently.

Market expansion is projected to continue at robust rates driven by ongoing digital transformation initiatives, evolving regulatory requirements, and increasing cyber threat sophistication. The cybersecurity market is expected to maintain growth rates of approximately 12-15% annually over the next five years, supported by consistent investment across both public and private sectors.

Technology evolution will increasingly focus on artificial intelligence integration, automated threat response capabilities, and cloud-native security architectures. Organizations will prioritize solutions that can adapt to changing threat landscapes while reducing dependence on scarce cybersecurity expertise through intelligent automation and orchestration capabilities.

Regulatory development will continue to drive market demand as authorities implement more comprehensive cybersecurity requirements across additional sectors beyond financial services. Healthcare, education, and critical infrastructure sectors are expected to face enhanced cybersecurity mandates that will create new market opportunities.

Skills development programs are expected to begin addressing talent shortages within the next three to five years, as educational institutions and professional organizations expand cybersecurity curriculum and certification programs. This development will support more sophisticated security implementations and potentially moderate service pricing pressures.

Regional integration opportunities will expand as Bahrain’s cybersecurity market matures and successful vendors leverage local expertise to serve broader Gulf markets. The kingdom’s position as a regional financial center provides strategic advantages for cybersecurity companies seeking regional expansion opportunities.

Innovation acceleration will be driven by increasing collaboration between international technology vendors, local system integrators, and end-user organizations. These partnerships will foster development of specialized solutions addressing unique regional requirements while maintaining alignment with global cybersecurity best practices and standards.

Bahrain’s cybersecurity market represents a dynamic and rapidly evolving ecosystem driven by digital transformation initiatives, regulatory requirements, and growing threat awareness across key economic sectors. The market demonstrates strong growth potential supported by government initiatives, private sector investment, and increasing recognition of cybersecurity as a business-critical capability rather than merely a compliance requirement.

Market opportunities are substantial across multiple segments, with particular strength in managed security services, cloud security solutions, and industry-specific offerings tailored to financial services and government requirements. The kingdom’s strategic position as a regional financial hub creates additional opportunities for cybersecurity vendors seeking to establish broader Gulf market presence.

Success factors for market participants include comprehensive solution portfolios, strong local partnerships, regulatory compliance expertise, and investment in talent development initiatives. Organizations that can address the cybersecurity skills shortage while delivering integrated security platforms will be best positioned to capture market opportunities and achieve sustainable growth in this expanding market environment.

What is Bahrain Cybersecurity?

Bahrain Cybersecurity refers to the practices, technologies, and processes designed to protect networks, devices, and data from unauthorized access or attacks within Bahrain. It encompasses various aspects such as threat detection, risk management, and compliance with local regulations.

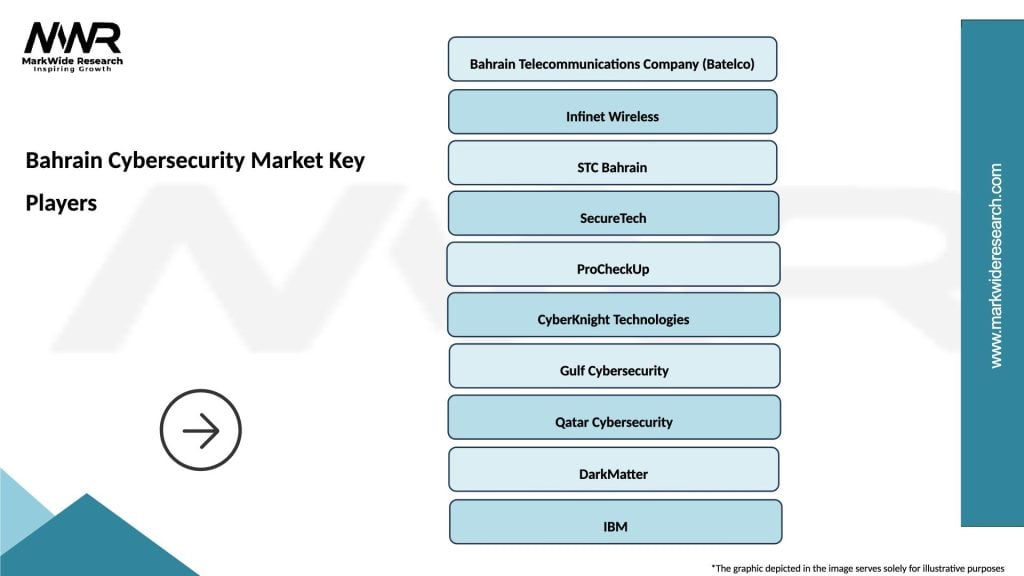

What are the key players in the Bahrain Cybersecurity Market?

Key players in the Bahrain Cybersecurity Market include companies like Batelco, Zain Bahrain, and STC Bahrain, which provide a range of cybersecurity solutions and services. These companies focus on protecting critical infrastructure and enhancing digital security for businesses and consumers, among others.

What are the main drivers of growth in the Bahrain Cybersecurity Market?

The main drivers of growth in the Bahrain Cybersecurity Market include the increasing frequency of cyberattacks, the rising adoption of digital technologies, and the growing awareness of data protection regulations. Additionally, the expansion of e-commerce and online services has heightened the need for robust cybersecurity measures.

What challenges does the Bahrain Cybersecurity Market face?

The Bahrain Cybersecurity Market faces challenges such as a shortage of skilled cybersecurity professionals, the rapid evolution of cyber threats, and the need for continuous investment in advanced security technologies. These factors can hinder the effectiveness of cybersecurity strategies and implementations.

What opportunities exist in the Bahrain Cybersecurity Market?

Opportunities in the Bahrain Cybersecurity Market include the potential for growth in managed security services, the development of innovative cybersecurity solutions, and increased collaboration between public and private sectors. As businesses seek to enhance their security posture, demand for specialized services is expected to rise.

What trends are shaping the Bahrain Cybersecurity Market?

Trends shaping the Bahrain Cybersecurity Market include the increasing use of artificial intelligence for threat detection, the rise of cloud security solutions, and a focus on regulatory compliance. Additionally, there is a growing emphasis on cybersecurity awareness training for employees to mitigate human-related risks.

Bahrain Cybersecurity Market

| Segmentation Details | Description |

|---|---|

| Solution | Endpoint Security, Network Security, Cloud Security, Application Security |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Government, BFSI, Healthcare, Telecommunications |

| Service Type | Consulting, Implementation, Managed Security Services, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bahrain Cybersecurity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at