444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bahrain bakeries industry market represents a dynamic and rapidly evolving sector within the Kingdom’s food and beverage landscape. This thriving market encompasses traditional Arabic bakeries, modern commercial bread production facilities, and artisanal specialty bakeries that serve both local consumers and the growing expatriate population. Market dynamics indicate robust growth driven by population expansion, urbanization trends, and evolving consumer preferences toward premium baked goods.

Traditional bakeries continue to dominate the market landscape, offering authentic Arabic bread varieties including khubz, manakish, and specialty flatbreads that remain staples in Bahraini households. The industry has witnessed significant modernization with automated production systems and quality control measures enhancing operational efficiency by approximately 35% over recent years. Commercial bakeries have expanded their product portfolios to include international bread varieties, pastries, and confectionery items catering to diverse demographic segments.

Consumer spending patterns reflect increasing demand for premium bakery products, with specialty items experiencing growth rates of 12.5% annually. The market benefits from Bahrain’s strategic location as a regional hub, facilitating ingredient imports and enabling bakeries to maintain consistent product quality. Health-conscious trends have influenced product development, with whole grain and organic options gaining market traction among urban consumers.

The Bahrain bakeries industry market refers to the comprehensive ecosystem of bread and baked goods production, distribution, and retail operations within the Kingdom of Bahrain. This market encompasses traditional neighborhood bakeries, large-scale commercial production facilities, specialty artisanal bakeries, and retail outlets that collectively serve the nation’s diverse consumer base with fresh baked products ranging from traditional Arabic breads to international pastries and confectionery items.

Market participants include family-owned traditional bakeries that have operated for generations, modern commercial enterprises utilizing advanced baking technologies, and specialty establishments focusing on premium or niche products. The industry serves multiple distribution channels including direct retail sales, wholesale supply to restaurants and hotels, and institutional catering for schools, hospitals, and corporate facilities.

Product categories span traditional Arabic breads, international bread varieties, pastries, cakes, cookies, and seasonal specialty items. The market operates within a regulatory framework ensuring food safety standards while preserving traditional baking methods that define Bahraini culinary heritage.

Strategic analysis reveals the Bahrain bakeries industry as a resilient and expanding market characterized by strong domestic demand and increasing export potential to neighboring Gulf states. The sector demonstrates remarkable adaptability, successfully integrating traditional baking practices with modern production technologies to meet evolving consumer expectations.

Key performance indicators highlight sustained growth momentum with traditional bread categories maintaining 68% market share while premium and specialty segments expand rapidly. The industry benefits from favorable demographic trends including population growth and rising disposable incomes that support increased consumption of bakery products across all segments.

Competitive landscape features a balanced mix of established traditional bakeries and emerging modern enterprises, creating healthy market competition that drives innovation and quality improvements. Investment in production capacity and technology upgrades has enhanced operational efficiency while maintaining product authenticity that consumers value.

Future prospects indicate continued expansion opportunities driven by tourism growth, expatriate population increases, and regional export potential. The market’s strategic positioning within the Gulf Cooperation Council region provides additional growth avenues for established Bahraini bakery brands.

Consumer behavior analysis reveals distinct purchasing patterns that shape market dynamics and influence product development strategies across the Bahrain bakeries industry:

Market segmentation demonstrates clear differentiation between traditional neighborhood bakeries serving local communities and commercial operations targeting broader distribution networks. This diversity creates multiple growth pathways while preserving the industry’s cultural significance within Bahraini society.

Population growth dynamics serve as the primary catalyst for sustained expansion within the Bahrain bakeries industry market. The Kingdom’s growing population, including both nationals and expatriate residents, creates consistent demand for bakery products across all demographic segments. Urbanization trends concentrate consumer populations in areas well-served by commercial bakeries, facilitating market penetration and distribution efficiency.

Cultural preservation initiatives support traditional bakery operations while encouraging innovation in product offerings. Government policies promoting local food production and cultural heritage preservation create favorable operating conditions for established bakeries. Tourism sector growth introduces international visitors to authentic Bahraini baked goods, expanding market reach beyond domestic consumers.

Economic diversification efforts position the food and beverage sector, including bakeries, as important contributors to non-oil economic activity. Rising disposable incomes enable consumers to explore premium bakery options while maintaining loyalty to traditional products. Regional trade relationships facilitate ingredient sourcing and create export opportunities for successful Bahraini bakery brands.

Technology adoption enhances production capabilities while reducing operational costs, enabling bakeries to maintain competitive pricing while improving product quality. Modern equipment installations have increased production efficiency by approximately 28% across commercial operations, supporting market expansion initiatives.

Raw material cost volatility presents ongoing challenges for Bahrain bakeries industry participants, particularly regarding wheat flour and other essential ingredients subject to international commodity price fluctuations. Import dependency for key ingredients exposes operators to supply chain disruptions and currency exchange rate impacts that affect profit margins and pricing strategies.

Skilled labor availability constraints limit expansion capabilities for traditional bakeries requiring experienced bakers familiar with authentic preparation methods. The specialized knowledge required for traditional Arabic bread production creates workforce development challenges that impact operational scalability. Training program limitations restrict the pipeline of qualified baking professionals entering the industry.

Regulatory compliance costs associated with food safety standards and licensing requirements create operational burdens, particularly for smaller traditional bakeries with limited administrative resources. Equipment modernization expenses represent significant capital investments that may strain financial resources for family-owned operations seeking to upgrade production capabilities.

Competition intensity from large-scale commercial operations and imported baked goods creates pricing pressures that challenge traditional bakeries’ profitability. Consumer preference shifts toward convenience foods and alternative breakfast options may impact long-term demand for traditional bakery products among younger demographic segments.

Export market development represents substantial growth potential for established Bahraini bakeries seeking to expand beyond domestic boundaries. Regional demand for authentic Arabic baked goods creates opportunities to serve expatriate communities and food service establishments throughout the Gulf Cooperation Council region. Brand recognition for quality Bahraini products supports premium positioning in international markets.

Product diversification initiatives enable bakeries to capture emerging consumer segments interested in health-conscious options, gluten-free alternatives, and fusion products combining traditional and international flavors. Specialty catering services for corporate events, weddings, and cultural celebrations provide higher-margin revenue streams that complement retail operations.

Technology integration opportunities include e-commerce platforms, mobile ordering applications, and delivery services that enhance customer convenience while expanding market reach. Digital marketing strategies enable smaller bakeries to compete effectively with larger operations by building direct customer relationships and brand loyalty.

Tourism sector partnerships create opportunities to showcase authentic Bahraini baking traditions to international visitors while generating additional revenue streams. Hotel and restaurant supply contracts provide stable wholesale revenue that supports business growth and operational planning. MarkWide Research analysis indicates that tourism-related bakery sales could increase by 18% with strategic partnership development.

Supply chain integration within the Bahrain bakeries industry demonstrates increasing sophistication as operators optimize ingredient sourcing, production scheduling, and distribution networks. Vertical integration strategies enable larger bakeries to control quality and costs while smaller operations benefit from collaborative purchasing arrangements that improve negotiating power with suppliers.

Consumer engagement patterns reflect strong loyalty to neighborhood bakeries combined with willingness to explore premium options for special occasions. This dual preference structure creates market stability while encouraging innovation and quality improvements across all operational scales. Seasonal demand variations require flexible production capabilities and inventory management strategies.

Competitive dynamics foster continuous improvement in product quality, customer service, and operational efficiency. Traditional bakeries leverage authenticity and community relationships while modern operations emphasize consistency and convenience. Market consolidation trends may emerge as successful operators acquire smaller competitors or expand through franchise arrangements.

Regulatory environment evolution supports industry growth through streamlined licensing processes and food safety standards that enhance consumer confidence. Government initiatives promoting local food production create favorable conditions for domestic bakery expansion while maintaining quality standards that support export potential.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Bahrain bakeries industry market. Primary research activities included structured interviews with bakery owners, managers, and key industry stakeholders to gather firsthand operational insights and market perspectives.

Secondary research components encompassed analysis of government statistics, industry reports, trade publications, and regulatory documentation to establish market context and validate primary findings. Consumer survey data provided insights into purchasing behaviors, preferences, and satisfaction levels across different demographic segments and geographic regions.

Market observation studies involved systematic monitoring of bakery operations, customer traffic patterns, and competitive activities to understand real-world market dynamics. Financial analysis of publicly available information and industry benchmarks supported market sizing and growth projections.

Expert consultation with industry professionals, food service specialists, and cultural experts ensured comprehensive understanding of traditional practices and modern market trends. Data validation processes included cross-referencing multiple sources and conducting follow-up interviews to confirm key findings and market insights.

Manama metropolitan area dominates the Bahrain bakeries industry market, accounting for approximately 45% of total market activity due to high population density and diverse consumer demographics. The capital region supports both traditional neighborhood bakeries and modern commercial operations serving residential communities, business districts, and tourist areas.

Northern governorate regions demonstrate strong market presence with established bakeries serving local communities and industrial areas. These regions benefit from proximity to port facilities that facilitate ingredient imports while maintaining lower operational costs compared to central urban areas. Traditional bakery concentration remains high in these areas, preserving authentic baking practices.

Southern regions show emerging market potential as residential development and infrastructure improvements attract new residents and businesses. Market penetration rates in these areas indicate growth opportunities for both traditional and modern bakery concepts. Regional preferences lean toward traditional products with growing interest in premium options.

Industrial area developments create demand for wholesale bakery services and employee catering options. These zones represent 22% of commercial bakery sales through institutional contracts and food service partnerships. Strategic location advantages near transportation hubs support distribution efficiency and export activities.

Market leadership within the Bahrain bakeries industry reflects a diverse competitive environment featuring established traditional operators alongside modern commercial enterprises. The competitive landscape demonstrates healthy market dynamics that encourage innovation while preserving cultural authenticity.

Competitive advantages vary across market segments with traditional bakeries emphasizing authenticity and community connections while modern operations focus on convenience, consistency, and product innovation. Market share distribution remains relatively fragmented, preventing any single operator from achieving dominant market control.

Strategic partnerships between bakeries and suppliers, distributors, or complementary businesses create competitive advantages through improved efficiency and market access. Brand development initiatives help distinguish operators in increasingly competitive markets while building customer loyalty and premium positioning opportunities.

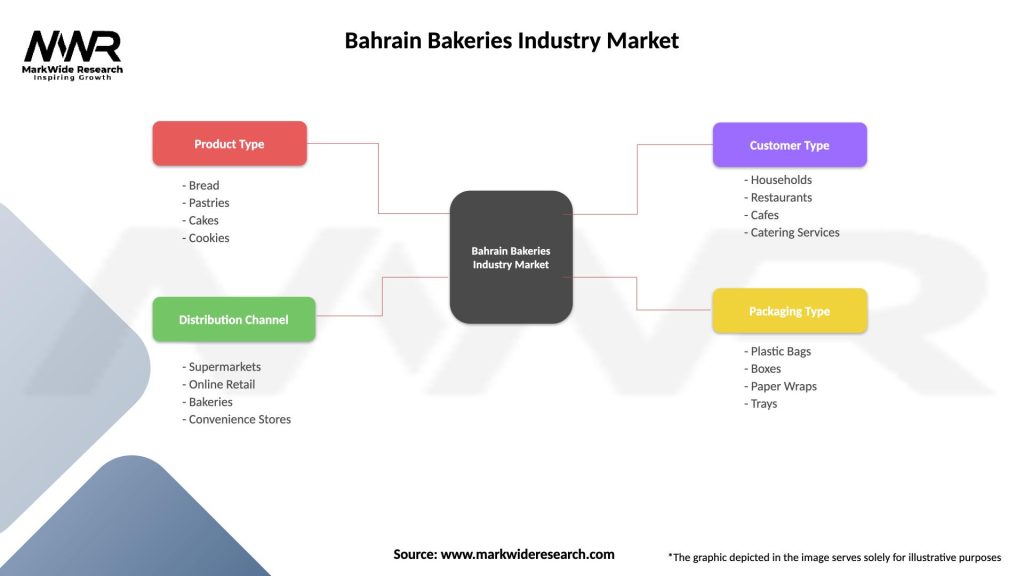

Product-based segmentation reveals distinct market categories within the Bahrain bakeries industry, each serving specific consumer needs and preferences:

By Product Type:

By Distribution Channel:

By Consumer Segment:

Traditional Arabic bread category maintains market leadership through consistent daily demand and cultural importance within Bahraini households. This segment benefits from established consumer loyalty and resistance to substitution, providing stable revenue foundations for participating bakeries. Quality consistency and authentic preparation methods serve as key differentiation factors among competitors.

Premium and specialty segments demonstrate accelerating growth as affluent consumers seek unique products and artisanal quality. These categories command higher profit margins while requiring specialized skills and premium ingredients. Market expansion in this segment reflects evolving consumer sophistication and willingness to pay premium prices for exceptional products.

Health-conscious product categories emerge as significant growth opportunities driven by increasing wellness awareness and dietary considerations. Whole grain options, reduced-sugar alternatives, and organic ingredients attract health-focused consumers willing to pay premium prices. Product innovation in this category requires balancing health benefits with traditional taste preferences.

Convenience-oriented products including pre-packaged items and ready-to-eat options serve busy consumers seeking quality bakery products with extended shelf life. This category supports distribution through supermarkets and convenience stores while maintaining product quality and brand recognition. Packaging innovation plays crucial roles in product differentiation and market success.

Bakery operators benefit from stable domestic demand, cultural product significance, and growing export opportunities that support sustainable business growth. Traditional establishments leverage community relationships and authentic products while modern operations capitalize on efficiency and scalability advantages.

Consumers enjoy access to fresh, high-quality baked goods that preserve cultural traditions while embracing innovation and variety. Product diversity ensures options for different dietary requirements, preferences, and budget considerations across all demographic segments.

Suppliers and distributors participate in a growing market that requires consistent ingredient supply, packaging materials, and logistics services. Partnership opportunities with successful bakeries provide stable revenue streams and potential for collaborative growth initiatives.

Government stakeholders benefit from job creation, tax revenue generation, and cultural preservation through a thriving domestic bakeries industry. Economic diversification objectives receive support through non-oil sector development and potential export revenue generation.

Tourism industry gains authentic cultural experiences and local products that enhance visitor satisfaction while supporting destination marketing efforts. Culinary tourism opportunities showcase Bahraini baking traditions and create memorable experiences for international guests.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness integration represents the most significant trend reshaping the Bahrain bakeries industry market. Consumers increasingly seek products with whole grains, reduced sugar content, and organic ingredients while maintaining traditional flavors and textures. Product reformulation efforts balance health benefits with authentic taste profiles that satisfy cultural preferences.

Technology adoption acceleration transforms traditional bakery operations through automated mixing systems, precision baking equipment, and digital ordering platforms. Operational efficiency improvements enable smaller bakeries to compete effectively while maintaining product quality and customer service standards. Point-of-sale systems and inventory management software enhance business operations.

Premium positioning strategies emerge as successful differentiation approaches, with artisanal bakeries emphasizing handcrafted products, premium ingredients, and unique flavor combinations. Brand development initiatives help establish market recognition and justify higher pricing for specialty products targeting affluent consumer segments.

Sustainability initiatives gain importance as environmentally conscious consumers prefer bakeries implementing eco-friendly practices. Waste reduction programs, sustainable packaging options, and local ingredient sourcing create competitive advantages while supporting corporate social responsibility objectives. MWR data suggests that sustainability-focused bakeries experience 15% higher customer retention rates compared to conventional operations.

Modernization investments across the Bahrain bakeries industry demonstrate commitment to maintaining competitiveness while preserving traditional product quality. Several established bakeries have upgraded production equipment, implemented quality control systems, and expanded product lines to serve evolving consumer preferences.

Strategic partnerships between local bakeries and international suppliers enhance ingredient quality and consistency while reducing procurement costs. Collaborative arrangements with hotels, restaurants, and catering companies create stable wholesale revenue streams that support business growth and operational planning.

Digital transformation initiatives include e-commerce platform development, mobile ordering applications, and social media marketing strategies that expand customer reach and engagement. Online presence becomes increasingly important for attracting younger consumers and competing with modern retail alternatives.

Export market exploration activities involve product certification, packaging adaptation, and distribution network development to serve regional markets. Brand recognition efforts support premium positioning in international markets while showcasing authentic Bahraini baking traditions and quality standards.

Workforce development programs address skill shortages through apprenticeship initiatives, training partnerships with educational institutions, and knowledge transfer programs that preserve traditional baking techniques while incorporating modern practices.

Strategic recommendations for Bahrain bakeries industry participants focus on balancing tradition preservation with market evolution requirements. Product portfolio diversification should maintain core traditional offerings while selectively adding premium and health-conscious options that serve emerging consumer segments without diluting brand authenticity.

Technology integration should prioritize customer-facing improvements including online ordering, delivery services, and digital payment options that enhance convenience without compromising product quality. Operational technology investments should focus on efficiency improvements and quality consistency rather than complete automation that might affect product authenticity.

Market expansion strategies should explore regional export opportunities while strengthening domestic market positions. Partnership development with tourism operators, hotels, and cultural organizations can create new revenue streams while showcasing Bahraini baking traditions to broader audiences.

Brand development initiatives should emphasize heritage, quality, and community connections while building recognition beyond immediate neighborhoods. Marketing strategies should leverage social media and digital platforms to reach younger consumers while maintaining traditional customer relationships.

Financial management should focus on cost control, inventory optimization, and revenue diversification to maintain profitability amid competitive pressures and cost volatility. Investment priorities should balance immediate operational needs with long-term growth capabilities.

Growth projections for the Bahrain bakeries industry market indicate sustained expansion driven by demographic trends, economic development, and evolving consumer preferences. Market maturation will likely favor operators who successfully balance traditional authenticity with modern convenience and quality standards.

Consolidation trends may emerge as successful operators expand through acquisitions or franchise arrangements, creating larger entities capable of competing with international chains while preserving local character. Operational scale advantages will become increasingly important for maintaining competitive pricing and market access.

Export market development represents significant long-term opportunity as regional demand for authentic Arabic baked goods continues growing. Brand recognition and quality certification will become crucial factors for success in international markets. MarkWide Research projections suggest export activities could represent 25% of industry revenue within the next decade.

Innovation requirements will focus on health-conscious product development, sustainable practices, and technology integration that enhances customer experience while maintaining product authenticity. Consumer education about traditional baking methods and cultural significance will support premium positioning strategies.

Regulatory evolution will likely emphasize food safety standards, nutritional labeling, and environmental sustainability requirements that may favor larger, well-resourced operations while creating compliance challenges for smaller traditional bakeries.

The Bahrain bakeries industry market demonstrates remarkable resilience and adaptability, successfully preserving cultural traditions while embracing modern market requirements. Strategic positioning at the intersection of heritage and innovation creates sustainable competitive advantages that support long-term growth and market leadership.

Market fundamentals remain strong with consistent domestic demand, growing export opportunities, and favorable demographic trends supporting continued expansion. The industry’s ability to serve diverse consumer segments while maintaining authentic product quality positions it well for future challenges and opportunities.

Success factors for industry participants include maintaining product authenticity, embracing selective technology adoption, developing strong brand recognition, and building strategic partnerships that enhance market access and operational efficiency. Balanced approaches that honor traditional practices while meeting modern consumer expectations will determine long-term market success.

The Bahrain bakeries industry market represents a vital component of the Kingdom’s food sector and cultural heritage, providing employment opportunities, preserving traditions, and contributing to economic diversification objectives while serving the daily needs of residents and visitors alike.

What is Bahrain Bakeries?

Bahrain Bakeries refers to the sector involved in the production and sale of various baked goods, including bread, pastries, and cakes, catering to both local and international markets.

What are the key players in the Bahrain Bakeries Industry Market?

Key players in the Bahrain Bakeries Industry Market include Bahrain Flour Mills, Al Aali Bakery, and La Fontaine Bakery, among others.

What are the growth factors driving the Bahrain Bakeries Industry Market?

The growth of the Bahrain Bakeries Industry Market is driven by increasing consumer demand for convenience foods, a rise in the popularity of artisanal baked goods, and the expansion of retail outlets offering fresh bakery products.

What challenges does the Bahrain Bakeries Industry Market face?

The Bahrain Bakeries Industry Market faces challenges such as rising raw material costs, competition from imported baked goods, and changing consumer preferences towards healthier options.

What opportunities exist in the Bahrain Bakeries Industry Market?

Opportunities in the Bahrain Bakeries Industry Market include the potential for product innovation, such as gluten-free and organic options, and the expansion of online sales channels to reach a broader customer base.

What trends are shaping the Bahrain Bakeries Industry Market?

Trends shaping the Bahrain Bakeries Industry Market include the growing demand for artisanal and specialty breads, increased focus on sustainability in packaging, and the incorporation of local flavors and ingredients into baked products.

Bahrain Bakeries Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bread, Pastries, Cakes, Cookies |

| Distribution Channel | Supermarkets, Online Retail, Bakeries, Convenience Stores |

| Customer Type | Households, Restaurants, Cafes, Catering Services |

| Packaging Type | Plastic Bags, Boxes, Paper Wraps, Trays |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bahrain Bakeries Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at