444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Backup-as-a-Service (BaaS) market represents a rapidly evolving segment within the cloud computing ecosystem, driven by increasing data volumes and stringent regulatory compliance requirements. Organizations across various industries are embracing BaaS solutions to ensure data protection, business continuity, and disaster recovery capabilities without the complexity of managing on-premises backup infrastructure.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 15.2% as businesses prioritize data security and operational resilience. The shift toward hybrid cloud environments and the increasing adoption of remote work models have accelerated demand for scalable, cost-effective backup solutions that can protect distributed data assets.

Enterprise adoption of BaaS solutions has reached 68% penetration among large organizations, while small and medium-sized businesses are increasingly recognizing the value proposition of outsourced backup services. The market encompasses various deployment models, including public cloud, private cloud, and hybrid configurations, each addressing specific organizational requirements for data protection and compliance.

Technological advancements in areas such as artificial intelligence, machine learning, and automated data management are reshaping the BaaS landscape, enabling more intelligent backup strategies and improved recovery time objectives. These innovations are particularly relevant as organizations generate 2.5 quintillion bytes of data daily, necessitating sophisticated backup and recovery mechanisms.

The Backup-as-a-Service (BaaS) market refers to the comprehensive ecosystem of cloud-based data protection services that enable organizations to securely store, manage, and recover their critical business data through third-party service providers. This market encompasses the technologies, platforms, and services that facilitate automated backup processes, data replication, and disaster recovery capabilities delivered through cloud infrastructure.

BaaS solutions eliminate the need for organizations to maintain complex on-premises backup hardware and software, instead providing scalable, subscription-based services that can adapt to changing data volumes and business requirements. The service model typically includes data encryption, automated scheduling, version control, and rapid recovery options to ensure business continuity in the event of data loss or system failures.

Key characteristics of the BaaS market include multi-tenant architectures that enable cost-effective service delivery, integration capabilities with existing IT infrastructure, and compliance features that address regulatory requirements across various industries. The market also encompasses specialized solutions for different data types, including structured databases, unstructured files, and application-specific backups.

Market transformation within the Backup-as-a-Service sector reflects the broader digital transformation initiatives undertaken by organizations worldwide. The convergence of increasing data volumes, evolving threat landscapes, and regulatory compliance requirements has created a compelling value proposition for cloud-based backup solutions that offer enhanced security, scalability, and cost-effectiveness.

Growth drivers include the rising frequency of cyberattacks, with ransomware incidents increasing by 41% annually, prompting organizations to invest in robust backup and recovery capabilities. Additionally, the proliferation of Internet of Things (IoT) devices and edge computing deployments has expanded the data protection perimeter, requiring more sophisticated backup strategies that can accommodate distributed data sources.

Service provider landscape features established cloud infrastructure companies, specialized backup vendors, and managed service providers competing to deliver comprehensive BaaS solutions. The market is characterized by continuous innovation in areas such as deduplication technologies, compression algorithms, and intelligent data tiering to optimize storage costs and improve backup performance.

Regional adoption patterns vary significantly, with North American organizations leading in BaaS implementation due to mature cloud infrastructure and stringent data protection regulations. European markets are experiencing accelerated growth driven by GDPR compliance requirements, while Asia-Pacific regions present substantial opportunities due to rapid digitalization and increasing awareness of data protection importance.

Strategic insights reveal several critical factors shaping the BaaS market evolution and competitive dynamics:

Primary growth catalysts propelling the BaaS market include several interconnected factors that address fundamental business challenges and technological evolution:

Data proliferation represents the most significant driver, as organizations across industries experience exponential growth in data volumes requiring protection. The shift toward digital business models has made data a critical asset, with 87% of executives considering data protection essential for business continuity and competitive advantage.

Cybersecurity threats continue to evolve in sophistication and frequency, with ransomware attacks targeting backup systems to maximize impact on victim organizations. This threat landscape has elevated the importance of immutable backup solutions and air-gapped storage capabilities that can withstand advanced persistent threats and ensure data recovery even after successful attacks.

Regulatory compliance requirements across industries mandate specific data protection and retention standards, creating legal imperatives for robust backup solutions. Regulations such as GDPR, HIPAA, and SOX require organizations to demonstrate data protection capabilities and maintain audit trails, driving adoption of compliant BaaS platforms.

Cloud migration initiatives are accelerating as organizations modernize their IT infrastructure and adopt cloud-first strategies. This transition creates opportunities for BaaS providers to offer integrated solutions that protect both on-premises and cloud-based workloads through unified platforms.

Cost optimization pressures encourage organizations to evaluate alternatives to traditional backup infrastructure that requires significant capital investment and ongoing maintenance. BaaS solutions offer predictable operational costs and eliminate the need for specialized backup hardware and software management.

Implementation challenges within the BaaS market include several factors that may limit adoption rates and market expansion in certain segments:

Data sovereignty concerns remain significant barriers for organizations operating in regulated industries or regions with strict data localization requirements. Many enterprises express hesitation about storing sensitive data in third-party cloud environments, particularly when regulatory frameworks mandate specific geographic data residency.

Network bandwidth limitations can impact BaaS deployment effectiveness, especially for organizations with large data volumes or limited internet connectivity. Initial backup operations and disaster recovery scenarios may require substantial bandwidth, potentially affecting business operations and increasing telecommunications costs.

Integration complexity presents challenges when organizations attempt to incorporate BaaS solutions with existing IT infrastructure and legacy systems. Compatibility issues, API limitations, and custom application requirements may necessitate significant technical resources and extended implementation timelines.

Vendor lock-in risks concern organizations that worry about proprietary backup formats and limited data portability between service providers. These concerns may slow adoption rates among enterprises that prioritize flexibility and vendor independence in their technology decisions.

Performance variability in cloud-based backup and recovery operations can impact user experience and business operations. Factors such as network latency, shared infrastructure resources, and geographic distance between data sources and backup repositories may affect backup and recovery performance consistency.

Emerging opportunities within the BaaS market present significant potential for service providers and technology vendors to expand their offerings and capture new customer segments:

Small and medium-sized businesses represent a substantial untapped market segment, with only 32% currently utilizing professional backup services. These organizations often lack the technical expertise and resources to implement comprehensive backup solutions, creating opportunities for simplified, cost-effective BaaS offerings tailored to SMB requirements.

Vertical-specific solutions offer opportunities to address unique industry requirements and compliance standards. Healthcare, financial services, and government sectors have specialized data protection needs that generic BaaS solutions may not fully address, creating demand for industry-tailored offerings.

Edge computing expansion creates new requirements for distributed backup solutions that can protect data generated at remote locations while maintaining centralized management and reporting capabilities. This trend opens opportunities for BaaS providers to develop edge-optimized solutions.

Artificial intelligence integration presents opportunities to enhance BaaS capabilities through intelligent data classification, predictive analytics for backup optimization, and automated threat detection. AI-powered features can differentiate service offerings and improve operational efficiency.

Disaster Recovery as a Service (DRaaS) integration allows BaaS providers to expand their value proposition by offering comprehensive business continuity solutions that combine backup and recovery capabilities with failover infrastructure and testing services.

Competitive dynamics within the BaaS market reflect the interplay between established cloud infrastructure providers, specialized backup vendors, and emerging technology companies seeking to capture market share through innovation and differentiation.

Technology evolution continues to reshape market dynamics, with advances in data deduplication, compression algorithms, and intelligent data tiering enabling more efficient backup operations and reduced storage costs. These technological improvements allow service providers to offer more competitive pricing while maintaining profitability.

Customer expectations are evolving toward more comprehensive solutions that integrate backup, disaster recovery, and business continuity capabilities. Organizations increasingly prefer single-vendor solutions that can address multiple data protection requirements rather than managing separate point solutions from different providers.

Pricing pressures intensify as the market matures and competition increases among service providers. Organizations are becoming more sophisticated in their procurement processes, demanding transparent pricing models and demonstrable return on investment from BaaS implementations.

Partnership ecosystems are becoming increasingly important as BaaS providers collaborate with system integrators, managed service providers, and technology vendors to expand their market reach and enhance solution capabilities. These partnerships enable more comprehensive go-to-market strategies and improved customer support.

Comprehensive analysis of the BaaS market employs multiple research methodologies to ensure accuracy and reliability of findings. The research approach combines quantitative data collection with qualitative insights from industry experts and market participants.

Primary research includes structured interviews with key stakeholders across the BaaS ecosystem, including service providers, technology vendors, system integrators, and end-user organizations. These interviews provide insights into market trends, competitive dynamics, and customer requirements that may not be apparent through secondary research alone.

Secondary research encompasses analysis of publicly available information, including company financial reports, industry publications, regulatory filings, and technology research papers. This information provides context for market sizing, competitive positioning, and technology trend analysis.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth rates and segment evolution. These models incorporate multiple variables, including economic indicators, technology adoption rates, and regulatory changes that may impact market development.

Data validation processes ensure research findings accuracy through triangulation of multiple data sources and expert review. MarkWide Research employs rigorous quality control procedures to verify data consistency and eliminate potential biases in the analysis process.

North American markets maintain leadership in BaaS adoption, accounting for approximately 42% of global market share due to mature cloud infrastructure, stringent regulatory requirements, and high technology adoption rates among enterprises. The region benefits from established service provider ecosystems and sophisticated customer requirements that drive innovation.

European markets demonstrate strong growth momentum, particularly following GDPR implementation, which has heightened awareness of data protection requirements. The region’s focus on data sovereignty and privacy regulations creates demand for compliant BaaS solutions that can address specific European requirements.

Asia-Pacific regions present the highest growth potential, with CAGR projections of 18.7% driven by rapid digitalization, increasing cloud adoption, and growing awareness of data protection importance. Countries such as China, India, and Japan are experiencing significant demand for BaaS solutions as organizations modernize their IT infrastructure.

Latin American markets show emerging opportunities as organizations in the region begin to prioritize data protection and business continuity. Economic development and increasing internet penetration are creating favorable conditions for BaaS adoption, particularly among growing businesses.

Middle East and Africa represent developing markets with substantial long-term potential as digital transformation initiatives accelerate across various industries. Government investments in technology infrastructure and increasing cybersecurity awareness are driving initial BaaS adoption in these regions.

Market leadership within the BaaS sector is distributed among several categories of providers, each bringing distinct capabilities and competitive advantages:

Competitive differentiation occurs through various factors including pricing models, technology capabilities, industry specialization, and geographic coverage. Service providers are increasingly focusing on vertical-specific solutions and advanced features such as AI-powered data management and integrated cybersecurity capabilities.

Market segmentation within the BaaS sector occurs across multiple dimensions, reflecting diverse customer requirements and use cases:

By Deployment Model:

By Organization Size:

By Industry Vertical:

Enterprise segment demonstrates the highest revenue contribution, with large organizations requiring comprehensive backup solutions that can protect diverse data types across multiple locations. These customers typically demand advanced features such as granular recovery options, compliance reporting, and integration capabilities with existing IT infrastructure.

Small business segment shows the fastest growth rate, with adoption increasing by 23% annually as simplified BaaS solutions become more accessible and affordable. These customers prioritize ease of use, automated operations, and predictable pricing models that align with limited IT budgets and technical resources.

Healthcare vertical requires specialized solutions that address HIPAA compliance requirements and protect sensitive patient information. The segment demands features such as encryption at rest and in transit, audit logging, and business associate agreements that ensure regulatory compliance.

Financial services emphasize security and regulatory compliance, requiring BaaS solutions that can demonstrate adherence to banking regulations and provide advanced threat protection capabilities. These customers often require immutable backup storage and rapid recovery options to minimize operational disruption.

Government sector presents unique requirements including security clearance levels, data sovereignty mandates, and specific compliance frameworks. BaaS providers serving this segment must demonstrate adherence to government security standards and provide specialized deployment options.

Service providers benefit from recurring revenue models and scalable business opportunities that can grow with customer data volumes and requirements. The BaaS model enables providers to leverage shared infrastructure investments across multiple customers while offering differentiated services that command premium pricing.

End-user organizations realize significant advantages including reduced capital expenditure requirements, improved data protection capabilities, and enhanced business continuity. BaaS solutions eliminate the complexity of managing backup infrastructure while providing access to enterprise-grade capabilities that may be cost-prohibitive for internal implementation.

Technology vendors find opportunities to expand their market reach through partnerships with BaaS providers and integration of their solutions into comprehensive backup platforms. These relationships enable vendors to access larger customer bases and benefit from the growing demand for cloud-based data protection.

System integrators can enhance their service portfolios by incorporating BaaS solutions into broader digital transformation initiatives. These professionals help customers navigate the complexity of backup solution selection and implementation while providing ongoing support and optimization services.

Managed service providers leverage BaaS capabilities to offer comprehensive IT services that include data protection as a core component. This integration enables MSPs to provide more complete solutions while generating additional revenue streams from backup and recovery services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming BaaS capabilities through intelligent data classification, automated backup optimization, and predictive analytics that can identify potential data protection issues before they impact operations. AI-powered solutions are becoming standard features rather than premium add-ons.

Immutable backup storage has emerged as a critical requirement following the increase in ransomware attacks targeting backup systems. Organizations are demanding write-once, read-many (WORM) capabilities that prevent unauthorized modification or deletion of backup data.

Multi-cloud strategies are driving demand for BaaS solutions that can operate across different cloud platforms and provide unified management of backup operations. Customers want to avoid vendor lock-in while optimizing performance and costs across multiple cloud environments.

Edge computing integration requires BaaS providers to develop solutions that can protect data generated at distributed edge locations while maintaining centralized management and reporting capabilities. This trend is particularly relevant for IoT deployments and remote office scenarios.

Compliance automation features are becoming essential as organizations struggle to keep pace with evolving regulatory requirements. BaaS solutions increasingly include automated compliance reporting and policy enforcement capabilities that reduce manual oversight requirements.

Strategic acquisitions continue to reshape the competitive landscape as larger technology companies acquire specialized backup vendors to enhance their cloud service portfolios. These consolidation activities are creating more comprehensive platforms that combine backup, disaster recovery, and cybersecurity capabilities.

Partnership announcements between BaaS providers and system integrators are expanding market reach and improving customer support capabilities. These relationships enable service providers to leverage partner expertise in specific industries or geographic regions.

Technology innovations in areas such as quantum-safe encryption and blockchain-based data integrity verification are being incorporated into next-generation BaaS solutions. These advances address emerging security requirements and provide enhanced data protection capabilities.

Regulatory compliance enhancements reflect the evolving data protection landscape, with BaaS providers investing in capabilities that address new regulations such as the California Consumer Privacy Act and similar state-level privacy laws.

Industry certifications and security validations are becoming increasingly important as organizations demand proof of service provider compliance with industry standards such as SOC 2, ISO 27001, and FedRAMP authorization for government customers.

Market positioning recommendations for BaaS providers emphasize the importance of developing vertical-specific solutions that address unique industry requirements and compliance standards. MarkWide Research analysis indicates that specialized offerings command premium pricing and demonstrate higher customer retention rates.

Technology investment priorities should focus on artificial intelligence capabilities, advanced security features, and multi-cloud integration to remain competitive in the evolving market landscape. Organizations that fail to invest in these areas risk losing market share to more innovative competitors.

Customer acquisition strategies should emphasize the small and medium business segment, which represents significant untapped potential with growth rates exceeding 20% annually. Simplified solutions and competitive pricing models are essential for success in this segment.

Partnership development with system integrators and managed service providers can accelerate market penetration and improve customer support capabilities. These relationships are particularly important for reaching customers in specific industries or geographic regions.

Compliance capabilities must remain a top priority as regulatory requirements continue to evolve and become more stringent. BaaS providers should invest in automated compliance features and industry-specific certifications to address customer requirements.

Market evolution over the next five years will be characterized by continued consolidation among service providers, increased integration of artificial intelligence capabilities, and expansion into new vertical markets. The sector is expected to maintain strong growth momentum with projected CAGR of 16.8% through 2029.

Technology advancement will focus on improving backup efficiency, reducing recovery time objectives, and enhancing security capabilities to address evolving threat landscapes. Quantum computing applications may begin to influence backup and recovery technologies, particularly in areas such as encryption and data compression.

Customer expectations will continue to evolve toward more comprehensive solutions that integrate backup, disaster recovery, and cybersecurity capabilities. Organizations will increasingly demand single-vendor solutions that can address multiple data protection requirements through unified platforms.

Regulatory landscape changes will likely drive additional compliance requirements and potentially create new market opportunities for specialized BaaS solutions. Data sovereignty regulations may become more prevalent, requiring service providers to offer localized deployment options.

Competitive dynamics will intensify as the market matures, with differentiation occurring through technology innovation, industry specialization, and customer service excellence. Smaller providers may need to focus on niche markets or consider strategic partnerships to remain competitive against larger technology companies.

The Backup-as-a-Service market represents a dynamic and rapidly evolving sector within the broader cloud computing ecosystem, driven by fundamental changes in how organizations generate, store, and protect their critical data assets. The convergence of increasing data volumes, sophisticated cyber threats, and stringent regulatory requirements has created a compelling value proposition for cloud-based backup solutions that offer enhanced security, scalability, and cost-effectiveness compared to traditional on-premises alternatives.

Market growth prospects remain robust across all segments, with particular opportunities in the small and medium business sector, vertical-specific solutions, and emerging technologies such as edge computing and artificial intelligence integration. The sector’s evolution toward more comprehensive platforms that combine backup, disaster recovery, and cybersecurity capabilities reflects customer demand for simplified vendor relationships and integrated data protection strategies.

Success factors for market participants include continuous technology innovation, strategic partnership development, and deep understanding of industry-specific requirements and compliance standards. Organizations that can effectively address the diverse needs of different customer segments while maintaining competitive pricing and superior service quality will be best positioned to capture market share in this expanding sector. The Backup-as-a-Service market continues to demonstrate its critical importance in enabling digital transformation initiatives and ensuring business continuity in an increasingly data-dependent global economy.

What is Backup-as-a-Service (BaaS)?

Backup-as-a-Service (BaaS) refers to a cloud-based service model that allows businesses to back up their data and applications to a remote server. This service is designed to provide data protection, disaster recovery, and easy access to backups without the need for on-premises infrastructure.

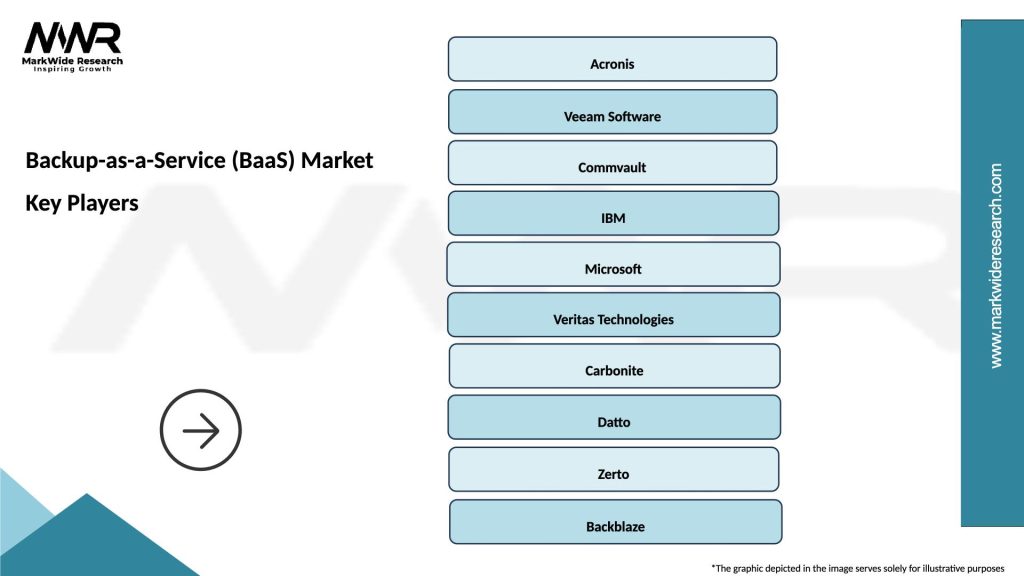

Who are the key players in the Backup-as-a-Service (BaaS) Market?

Key players in the Backup-as-a-Service (BaaS) Market include companies like Veeam Software, Acronis, and Commvault, which offer various solutions for data backup and recovery. These companies focus on providing scalable and secure backup solutions for businesses of all sizes, among others.

What are the main drivers of growth in the Backup-as-a-Service (BaaS) Market?

The main drivers of growth in the Backup-as-a-Service (BaaS) Market include the increasing volume of data generated by businesses, the need for efficient disaster recovery solutions, and the rising adoption of cloud technologies. Additionally, regulatory compliance requirements are pushing organizations to seek reliable backup solutions.

What challenges does the Backup-as-a-Service (BaaS) Market face?

The Backup-as-a-Service (BaaS) Market faces challenges such as data security concerns, potential downtime during backup processes, and the complexity of managing multi-cloud environments. These factors can hinder the adoption of BaaS solutions among some organizations.

What opportunities exist in the Backup-as-a-Service (BaaS) Market?

Opportunities in the Backup-as-a-Service (BaaS) Market include the growing demand for hybrid cloud solutions, advancements in data encryption technologies, and the increasing focus on data compliance and governance. These trends are likely to drive innovation and expansion in the BaaS sector.

What trends are shaping the Backup-as-a-Service (BaaS) Market?

Trends shaping the Backup-as-a-Service (BaaS) Market include the rise of automated backup solutions, integration with artificial intelligence for predictive analytics, and the shift towards subscription-based pricing models. These trends are enhancing the efficiency and accessibility of backup services.

Backup-as-a-Service (BaaS) Market

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Service Type | Data Backup, Disaster Recovery, Archiving, Data Migration |

| End User | SMEs, Large Enterprises, Government Agencies, Educational Institutions |

| Solution | Managed Services, Software Solutions, On-Premises Solutions, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Backup-as-a-Service (BaaS) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at