444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aviation industry is constantly evolving, and with the advent of advanced technologies, it has witnessed significant transformations. One such technology that has gained prominence in recent years is aviation telematics. Aviation telematics refers to the integration of telecommunications and informatics in aviation systems to enable the transfer of real-time data between aircraft, ground stations, and other relevant stakeholders. This technology has revolutionized the way aviation operations are managed and has paved the way for improved safety, efficiency, and cost-effectiveness.

Meaning

Aviation telematics can be defined as the use of advanced telecommunications and informatics to collect, analyze, and transmit data between aircraft and ground-based systems. It involves the integration of various sensors, communication devices, and data processing algorithms to enable the seamless exchange of information. This technology allows aircraft operators, maintenance personnel, and other stakeholders to monitor and manage critical parameters such as engine performance, fuel consumption, weather conditions, and flight operations in real-time. By bridging the gap between aircraft and ground operations, aviation telematics plays a vital role in enhancing safety, optimizing maintenance activities, and improving overall operational efficiency.

Executive Summary

The aviation telematics market is experiencing significant growth, driven by the increasing demand for real-time data analytics, the growing emphasis on operational efficiency, and the rising adoption of connected aircraft solutions. This comprehensive market analysis provides key insights into the industry, including market drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, key trends, and the impact of COVID-19. The report aims to assist industry participants and stakeholders in understanding the market dynamics, making informed decisions, and capitalizing on the emerging opportunities in the aviation telematics sector.

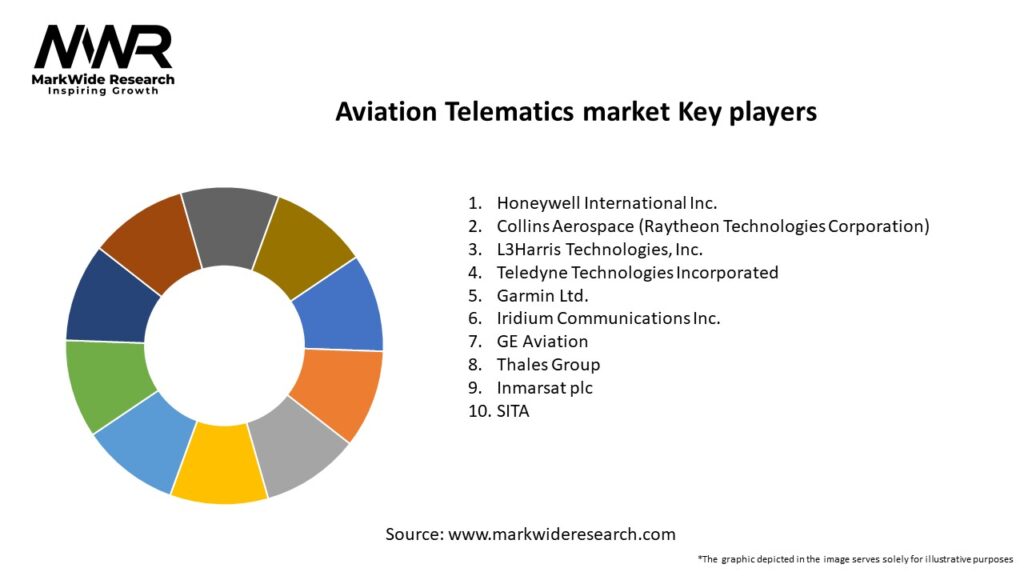

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Predictive Maintenance Impact: Airlines report up to 15% reduction in unscheduled AOG (Aircraft on Ground) events after integrating telematics-driven health-monitoring programs.

Fuel Efficiency Gains: Real-time fuel-flow analytics combined with flight-optimization guidance deliver average fuel burn reductions of 3–5%.

Data Volumes: A single narrow-body aircraft can generate 5–10 GB of telematics data per flight, necessitating scalable cloud infrastructures and compression algorithms.

Regulatory Alignment: EASA’s Digital Sequence Intervention (DSI) and FAA’s Aviation Safety Information Analysis and Sharing (ASIAS) initiatives endorse telemetry data sharing for safety improvements.

Retrofit vs. OEM Fit: Retrofit telematics installations comprise over 60% of new telemetry contracts, as operators extend the life of existing fleets with cost-effective aftermarket kits.

Market Drivers

Operational Cost Pressure: With fuel accounting for up to 30% of airline operating expenses, real-time performance monitoring and flight-path optimization are critical.

Regulatory Requirements: Stricter CO₂ and NOₓ emissions regulations drive the need for detailed engine-performance data to demonstrate compliance and optimize eco-operational procedures.

Fleet Ageing: Aging commercial and corporate fleets benefit from continuous structural health monitoring to safely maximize time-on-wing and defer CapEx.

Safety Enhancement: Early detection of sensor anomalies and pilot-behavior deviations improves operational safety and reduces incident investigations.

Digital Transformation: Airlines and MROs invest in digital ecosystems—integrating telematics with maintenance-planning systems and digital twins—to realize end-to-end performance visibility.

Market Restraints

High Implementation Costs: Initial expenditure for hardware, connectivity subscriptions, and integration with existing IT/OSS/BSS systems can be significant.

Data Management Complexity: Processing, storing, and securing large volumes of sensitive telemetry data demands robust IT infrastructure and compliance with data-privacy regulations.

Interoperability Challenges: Diverse fleet types and OEM-specific data formats hinder seamless integration and cross-fleet analytics standardization.

Cybersecurity Risks: Increasing connectivity introduces potential attack vectors; stringent cybersecurity measures are essential to protect aircraft systems and passenger data.

Organizational Change: Effective telematics adoption requires process reengineering, staff training, and alignment across flight ops, engineering, and IT departments.

Market Opportunities

Advanced Analytics & AI: Leveraging machine-learning for anomaly detection, engine-remaining-useful-life prediction, and automated maintenance recommendations unlocks greater ROI.

Vertical Expansion: Extending telematics beyond engines to cabin systems, environmental controls, and APU monitoring offers comprehensive aircraft health profiles.

Service Bundling: Packaging hardware, connectivity, cloud analytics, and maintenance-decision support into turnkey subscriptions simplifies procurement and budgeting for carriers.

Emerging Segments: Unmanned Aerial Vehicles (UAVs), urban air mobility (eVTOL), and helicopter EMS fleets seek lightweight telematics for regulatory compliance and remote-operation safety.

Digital Twins: Creating full-aircraft digital twins—fed by continuous telemetry—enables scenario simulations, lifecycle-cost analysis, and virtual certification workflows.

Market Dynamics

Partnership Ecosystems: Alliances among OEMs, telematics providers, cloud platforms (AWS, Azure), and MROs facilitate integrated solutions and global service coverage.

Edge Computing Adoption: On-board pre-processing and compression reduce bandwidth consumption and latency, enabling faster in-flight anomaly alerts.

Open-Data Initiatives: Industry bodies (IATA, ATA) are establishing data standards (e.g., ARINC 633, AIDX) to promote cross-operator benchmarking and collective safety analysis.

Performance-Based Contracts: Maintenance and service agreements increasingly tie payments to Key Performance Indicators (KPIs) such as dispatch reliability and maintenance turnaround time.

Connectivity Evolution: Next-generation satellite constellations (LEO broadband) and 5G-enabled airport networks promise higher-throughput, lower-latency telemetry channels.

Regional Analysis

North America: Leading market share due to large commercial and business-jet fleets, advanced digital-transformation budgets, and home to major system integrators.

Europe: Strong airline consolidation and Pan-European data-sharing initiatives propelling telematics adoption for both safety and sustainability targets.

Asia-Pacific: Fastest growth driven by aggressive fleet expansion in China, India, and Southeast Asia; demand for retrofit solutions on cost-sensitive carriers.

Middle East & Africa: Gulf carriers invest heavily in premium telematics packages for flagship fleets; African operators explore telematics to reduce maintenance-in-Africa costs.

Latin America: Emerging demand from low-cost carriers and business-jet operators seeking to improve dispatch reliability amid challenging maintenance infrastructure.

Competitive Landscape

Leading Companies in the Aviation Telematics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Aviation Telematics market can be segmented based on:

Platform Type: Fixed-Wing Aircraft, Rotorcraft, Business Jets, UAVs/eVTOL.

Service Type: Health & Usage Monitoring (HUMS), Predictive Maintenance Analytics, Flight Tracking & Dispatch, Fuel Management, Compliance & Reporting.

Connectivity: Satellite (Iridium, Inmarsat), Air-to-Ground (VHF Data Link, ATG 4G/5G), Hybrid.

Deployment Model: Onboard Edge Processing, Cloud-Only, Hybrid Edge-Cloud Architectures.

End User: Commercial Airlines, MRO Providers, Business Aviation Operators, Military & Government, UAV Services.

Category-wise Insights

HUMS & Predictive Maintenance: Early adoption in rotorcraft and business jets; advanced analytics identify bearing faults, gear-mesh anomalies, and oil-contamination events.

Flight Tracking & Dispatch: Real-time position and performance data feed into dispatch-center dashboards, optimizing turnaround times and crew scheduling.

Fuel Management: Telematics-driven fuel-flow monitoring integrates with flight-planning systems to recommend speed and altitude adjustments, achieving up to 3% fuel savings.

Compliance Reporting: Automated generation of ADR (Air Data Recorder) and FOQA (Flight Operational Quality Assurance) reports simplifies regulatory submissions and safety audits.

UAV/eVTOL Telematics: Lightweight, low-power telemetry units integrate with UTM networks, supporting beyond-visual-line-of-sight (BVLOS) operations and urban air mobility trials.

Key Benefits for Industry Participants and Stakeholders

Reduced Downtime: Predictive maintenance averts unscheduled AOG events, improving dispatch reliability and increasing aircraft availability by up to 5%.

Cost Savings: Optimized maintenance scheduling and fuel-efficiency measures can save operators millions annually in direct operating costs.

Enhanced Safety: Continuous health monitoring and rapid anomaly detection enable proactive interventions, reducing risk of in-flight failures.

Regulatory Compliance: Automated data collection and reporting streamline compliance with global standards such as ICAO IDRP (International Data-Link Recordings Protocol).

Data-Driven Decision Making: Consolidated telematics dashboards facilitate cross-functional collaboration—maintenance, flight operations, safety—driving operational excellence.

SWOT Analysis

Strengths:

Mature sensor and connectivity technologies providing high data integrity and coverage.

Strong ROI demonstrated via maintenance savings, fuel reduction, and safety enhancements.

Weaknesses:

High integration complexity for retrofit installations on legacy fleets.

Large volumes of raw data require robust data-engineering and analytics capabilities.

Opportunities:

Expansion into emerging UAV/eVTOL markets with tailored, lightweight telematics modules.

Growth of digital twin and edge-AI capabilities enhancing onboard decision support.

Threats:

Fragmentation of data standards hindering cross-platform interoperability.

Cybersecurity threats requiring continuous investment in secure data-transmission architectures.

Market Key Trends

Edge-AI Processing: Onboard analytics reduce bandwidth needs by transmitting only actionable events rather than raw data streams.

Digital Twin Integration: Live telematics feeds support virtual aircraft models, enabling scenario simulations and “what-if” maintenance planning.

Open Data Architectures: Initiatives such as the Future Airborne Capability Environment (FACE) promote standardized telematics interfaces for third-party app development.

Blockchain for Data Integrity: Immutable ledgers are being explored to guarantee the provenance and authenticity of flight and maintenance records.

Green Telematics: Environmental-impact modules track emissions and optimize descent profiles to minimize noise and CO₂ footprint near urban airports.

Covid-19 Impact

The pandemic temporarily reduced flight volumes, impacting telematics-based service revenues tied to flight hours and data usage. However, as operators focused on cost recovery and safety, investment in predictive maintenance and remote health monitoring accelerated. Telematics providers adapted by offering flexible subscription models and providing remote-support tools to minimize on-site engagements.

Key Industry Developments

Rolls-Royce & AWS Collaboration: Developing edge-analytics packages for engine-health monitoring via AWS IoT services, reducing data latency.

Airbus Skywise Expansion: Integration of Skywise’s open data-platform capabilities with third-party telematics feeds for holistic fleet analytics.

GE Digital’s Digital Twin Launch: Introduced digital-twin solutions for select CFM56 and GE90 engines, leveraging live streaming from onboard sensors.

Analyst Suggestions

Adopt Open Standards: Embrace ADS-B, ARINC 690, and Future Airborne Capability Environment (FACE) to ensure interoperability and foster ecosystem growth.

Invest in Cybersecurity: Implement zero-trust architectures, end-to-end encryption, and continuous-monitoring platforms to safeguard telematics networks.

Expand Edge Capabilities: Prioritize development of AI-enabled edge modules to deliver real-time insights with minimal bandwidth dependency.

Tailor to UAV/eVTOL: Create lightweight, modular telematics solutions optimized for urban air mobility and drone operations, capitalizing on nascent markets.

Future Outlook

The Aviation Telematics market will continue its strong trajectory as global fleets modernize and regulatory frameworks tighten around safety and sustainability. Advances in AI, edge computing, and open data architectures will drive the next wave of innovation, reducing data-processing burdens and enabling more autonomous decision support. Emerging segments—such as eVTOL air taxis and commercial drones—offer fresh opportunities for specialized telematics offerings. Providers who deliver secure, interoperable, and extensible platforms will secure leadership in this dynamic, high-value arena.

Conclusion

Aviation telematics stands at the forefront of the industry’s digital transformation, unlocking unprecedented levels of visibility, efficiency, and safety. By harnessing real-time data streams, predictive analytics, and integrated workflows, stakeholders—from airlines and MROs to OEMs and regulators—can collaboratively optimize asset performance and advance the future of connected flight. Strategic focus on open standards, cybersecurity, and edge-AI will be essential to capitalize on the full potential of aviation telematics in the years ahead.

What is Aviation Telematics?

Aviation Telematics refers to the integration of telecommunications and monitoring systems in the aviation industry, enabling real-time data collection and analysis for aircraft performance, maintenance, and operational efficiency.

What are the key players in the Aviation Telematics market?

Key players in the Aviation Telematics market include companies like Honeywell, Boeing, and Airbus, which provide advanced telematics solutions for aircraft monitoring and management, among others.

What are the main drivers of growth in the Aviation Telematics market?

The growth of the Aviation Telematics market is driven by increasing demand for operational efficiency, advancements in satellite communication technologies, and the need for enhanced safety and compliance in aviation operations.

What challenges does the Aviation Telematics market face?

Challenges in the Aviation Telematics market include high implementation costs, data security concerns, and the complexity of integrating new technologies with existing aviation systems.

What opportunities exist in the Aviation Telematics market?

Opportunities in the Aviation Telematics market include the development of predictive maintenance solutions, the expansion of data analytics capabilities, and the increasing adoption of unmanned aerial vehicles (UAVs) for various applications.

What trends are shaping the Aviation Telematics market?

Trends in the Aviation Telematics market include the rise of Internet of Things (IoT) applications, the use of big data analytics for flight optimization, and the growing focus on sustainability and fuel efficiency in aviation operations.

Aviation Telematics market

| Segmentation Details | Description |

|---|---|

| Technology | GPS, RFID, IoT, Satellite Communication |

| End User | Commercial Airlines, Cargo Operators, Private Aviation, Government Agencies |

| Application | Fleet Management, Flight Tracking, Maintenance Monitoring, Safety Management |

| Service Type | Data Analytics, Real-time Monitoring, Predictive Maintenance, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aviation Telematics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at