444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The offshore oil and gas industry plays a crucial role in meeting the global energy demand. It involves the exploration, production, and transportation of oil and gas resources from offshore locations. In order to ensure the smooth operations of offshore facilities, regular inspection, repair, and maintenance (IRM) activities are essential. Autonomous Underwater Vehicles (AUVs) have emerged as a valuable tool in the offshore oil and gas IRM market. These unmanned underwater robots are designed to perform a wide range of tasks, including subsea inspections, pipeline surveys, and structural integrity assessments.

Meaning

An Autonomous Underwater Vehicle (AUV) is a self-propelled underwater robot equipped with various sensors, cameras, and navigational systems. It operates autonomously, without the need for human intervention, and can perform complex tasks in challenging underwater environments. AUVs are specifically designed to gather data, capture images, and conduct inspections of underwater structures, pipelines, and equipment in the offshore oil and gas industry.

Executive Summary

The offshore oil and gas IRM market has witnessed significant growth in recent years, driven by the increasing demand for energy resources and the need for efficient maintenance of offshore facilities. AUVs have revolutionized the way IRM activities are conducted, offering advantages such as improved safety, reduced costs, and enhanced data collection capabilities. This report provides a comprehensive analysis of the AUV market for offshore oil and gas IRM, highlighting key market insights, drivers, restraints, opportunities, and trends. It also includes a regional analysis, competitive landscape, segmentation, and SWOT analysis, along with suggestions for industry participants and a future outlook for the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

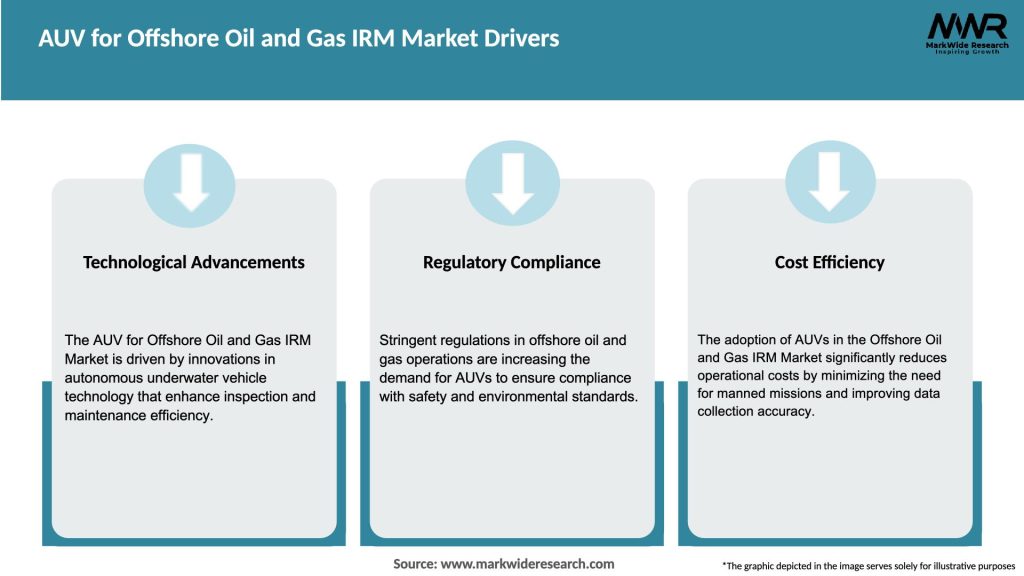

The offshore oil and gas IRM market is driven by a combination of factors, including industry trends, technological advancements, and regulatory requirements. The demand for AUVs in the market is influenced by the need for efficient and cost-effective solutions for subsea inspection, repair, and maintenance activities. The market dynamics are also shaped by the competitive landscape, with key players constantly striving to develop innovative AUVs with improved capabilities and features. The market is expected to witness further growth in the coming years, driven by the expansion of offshore activities and the increasing focus on asset integrity and safety.

Regional Analysis

The offshore oil and gas IRM market can be segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America currently holds a significant share in the market, driven by the presence of a large number of offshore installations in the Gulf of Mexico. Europe is also a prominent market, with countries like Norway, the UK, and the Netherlands leading in offshore oil and gas activities. The Asia Pacific region is witnessing rapid growth in the market, fueled by increasing exploration and production activities in countries like China, Australia, and Malaysia. Latin America and the Middle East and Africa are also emerging as lucrative markets for AUVs in offshore IRM.

Competitive Landscape

Leading companies in the AUV for Offshore Oil and Gas IRM market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

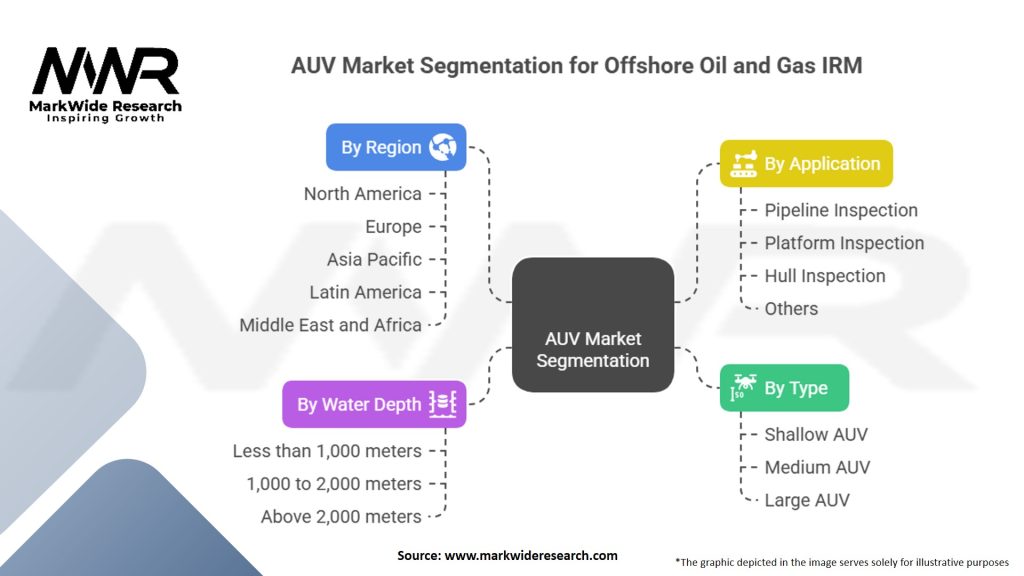

Segmentation

The offshore oil and gas IRM market can be segmented based on the type of AUV, application, and end-user.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The offshore oil and gas IRM market, like many other industries, has been affected by the COVID-19 pandemic. The pandemic led to a significant decline in global oil demand and a decrease in oil prices, which impacted offshore activities and investments. Many oil and gas companies reduced their operational and capital expenditures, affecting the demand for AUVs in the market. However, as the industry recovers from the pandemic and oil prices stabilize, the demand for AUVs for offshore IRM is expected to rebound. AUVs can play a crucial role in ensuring the efficiency and safety of operations, especially in the post-pandemic era where there is a greater focus on optimizing costs and reducing human intervention.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the AUV market in the offshore oil and gas IRM sector is promising. The increasing demand for energy resources, coupled with the need for efficient maintenance and inspection of offshore installations, will drive the adoption of AUVs. Technological advancements, such as the integration of AI, ML, and advanced sensors, will further enhance the capabilities of AUVs, making them more reliable, efficient, and cost-effective. The market is expected to witness significant growth, with opportunities for both AUV manufacturers and service providers specializing in offshore IRM. However, challenges such as high costs and regulatory constraints need to be addressed for the market to reach its full potential.

Conclusion

The AUV market for offshore oil and gas IRM is poised for significant growth, driven by the increasing need for efficient maintenance and inspection of offshore installations. AUVs offer numerous benefits, including improved safety, cost-efficiency, and enhanced data collection capabilities. Technological advancements and collaborations between AUV manufacturers and oil and gas companies are shaping the market, with a focus on AI integration, multi-sensor capabilities, and environmental monitoring. While challenges exist, such as high costs and regulatory compliance, the future outlook for the market is positive. AUVs will continue to play a vital role in ensuring the integrity and safety of offshore oil and gas operations, driving the growth of the market in the coming years.

What is AUV for Offshore Oil and Gas IRM?

AUV for Offshore Oil and Gas IRM refers to Autonomous Underwater Vehicles used in Inspection, Repair, and Maintenance operations in the offshore oil and gas sector. These vehicles enhance operational efficiency and safety by performing underwater tasks such as inspections and data collection.

What are the key companies in the AUV for Offshore Oil and Gas IRM Market?

Key companies in the AUV for Offshore Oil and Gas IRM Market include Oceaneering International, Kongsberg Gruppen, and TechnipFMC, among others.

What are the growth factors driving the AUV for Offshore Oil and Gas IRM Market?

The growth of the AUV for Offshore Oil and Gas IRM Market is driven by the increasing demand for efficient underwater inspections, the need for cost-effective maintenance solutions, and advancements in AUV technology that enhance operational capabilities.

What challenges does the AUV for Offshore Oil and Gas IRM Market face?

Challenges in the AUV for Offshore Oil and Gas IRM Market include high initial investment costs, technical limitations in harsh underwater environments, and regulatory compliance issues that can affect deployment.

What opportunities exist in the AUV for Offshore Oil and Gas IRM Market?

Opportunities in the AUV for Offshore Oil and Gas IRM Market include the expansion of offshore exploration activities, the integration of AI and machine learning for improved data analysis, and the growing focus on sustainable practices in the oil and gas industry.

What trends are shaping the AUV for Offshore Oil and Gas IRM Market?

Trends in the AUV for Offshore Oil and Gas IRM Market include the increasing use of hybrid AUVs, advancements in sensor technology for better data collection, and a shift towards automation in underwater operations.

AUV for Offshore Oil and Gas IRM Market:

| Segmentation Details | Description |

|---|---|

| By Type | Shallow AUV, Medium AUV, Large AUV |

| By Water Depth | Less than 1,000 meters, 1,000 to 2,000 meters, Above 2,000 meters |

| By Application | Pipeline Inspection, Platform Inspection, Hull Inspection, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the AUV for Offshore Oil and Gas IRM market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at