444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Autonomous Aircraft Air Data Inertial Reference Unit (ADIRU) market is witnessing significant growth due to the increasing demand for advanced navigation systems in the aviation industry. ADIRU systems play a crucial role in providing accurate and reliable flight data, making them essential for autonomous aircraft operations. This comprehensive market analysis aims to provide valuable insights into the ADIRU market, including its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and a conclusion.

Meaning

The Autonomous Aircraft Air Data Inertial Reference Unit (ADIRU) is an essential component of autonomous aircraft. It integrates various sensors to collect and process critical flight data, including aircraft position, altitude, airspeed, attitude, and heading. The ADIRU system provides precise information for navigation, flight control, and aircraft systems management, ensuring safe and efficient autonomous flight operations.

Executive Summary

The ADIRU market is experiencing substantial growth due to the rising demand for autonomous aircraft and the need for accurate navigation systems. With advancements in sensor technology and increasing investments in the aviation industry, the ADIRU market is poised for significant expansion. This report provides a comprehensive analysis of the market, including key market insights, drivers, restraints, opportunities, and competitive landscape.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Miniaturization Trend: MEMS-based IMUs and compact air data modules are reducing ADIRU size, weight, and power (SWaP) by up to 50%, critical for small UAVs and eVTOL aircraft.

Sensor Fusion Algorithms: Advanced Kalman filtering and AI-enhanced error-correction routines are improving accuracy to <0.1° attitude error and position drift <0.5 nm/hr, meeting autonomy requirements.

Certifiable Platforms: Modular ADIRUs with built-in redundancy are achieving DO-178C software and DO-254 hardware certification, easing integration into manned and unmanned systems.

Defense vs. Commercial Split: Defense procurement accounts for over 60% of current ADIRU revenues, but commercial UAV and UAM programs are growing at faster rates (CAGR >12%).

Aftermarket & Upgrades: Legacy aircraft retrofits and mid-life upgrades of manned platforms to autonomous capabilities represent a burgeoning aftermarket segment.

Market Drivers

Autonomous Capability Demand: Beyond-visual-line-of-sight (BVLOS) drone operations and UAM traffic management necessitate highly reliable, self-contained navigation systems.

Defense Modernization: Military modernization programs across the U.S., Europe, and Asia emphasize unmanned systems equipped with advanced inertial navigation for contested environments.

Urban Air Mobility Growth: Investments by OEMs like Airbus, Boeing, and numerous startups in eVTOL air taxis propel demand for aviation-grade ADIRUs capable of redundancy and fail-safe operation.

Degraded GPS Resilience: Rising concerns over GPS jamming and spoofing drive adoption of inertial-centric navigation units that maintain accuracy in harsh electromagnetic environments.

Regulatory Advances: Frameworks by FAA, EASA, and CAAC for certified autonomous operations and BVLOS approvals are creating a clear pathway for ADIRU integration.

Market Restraints

Certification Complexity: Achieving aviation-grade safety certifications (DAL A/E) incurs lengthy and costly processes, slowing time-to-market for new ADIRU variants.

High Entry Barriers: R&D investment in precision sensors and ruggedized packaging restricts new entrants and consolidates market share among established avionics firms.

Cost Sensitivity in Commercial UAVs: Price pressures in the consumer and small-UAV segments limit the penetration of high-end, fully redundant ADIRU systems.

Maintenance & Calibration Needs: Despite increased reliability, ADIRUs still require periodic calibration and health monitoring, adding lifecycle costs for operators.

Cybersecurity Concerns: Integration of ADIRUs into complex avionics networks raises risks of cyber-attacks, necessitating additional security measures.

Market Opportunities

Software-Defined ADIRUs: Updatable firmware platforms enable new features—such as real-time anomaly detection—without hardware changes, opening subscription and upgrade revenue streams.

Hybrid Sensor Architectures: Combining MEMS with FOGs and quantum sensors can unlock unprecedented stability and long-duration navigation accuracy.

Unmanned Logistics: Growth in autonomous cargo drones for e-commerce and medical supply delivery in remote regions presents large-scale opportunity.

Civil Helicopters & Air Ambulances: Integration of ADIRUs into rotorcraft enhances safety in instrument flight rules (IFR) operations and emergency medical services.

Aftermarket Retrofits: Converting existing manned fleets to autonomous or optionally piloted configurations requires ADIRU installations, fueling aftermarket growth.

Market Dynamics

Strategic Collaborations: Joint development agreements between sensor OEMs (e.g., Honeywell, Collins Aerospace) and UAV startups accelerate tailored ADIRU solutions.

Consolidation Trends: Mergers and acquisitions among mid-tier avionics vendors strengthen portfolio breadth, from sensor hardware to integrated flight management systems.

Open Architecture Movements: Adoption of standards like FACE™ (Future Airborne Capability Environment) enables interoperable ADIRU software modules, reducing integration time.

Digital Twin Testing: Virtual prototyping of ADIRU performance in simulated flight scenarios reduces ground test cycles and improves reliability before deployment.

Lifecycle Sustainment: Predictive maintenance platforms using onboard health data extend time between calibrations and reduce unscheduled groundings.

Regional Analysis

North America: Largest market share, propelled by U.S. DoD UAV programs, NASA autonomy research, and FAA’s permissive BVLOS sandbox initiatives.

Europe: Strong adoption in defense (e.g., Eurodrone) and growing UAM pilots in the U.K., Germany, and France; EASA certification frameworks support growth.

Asia Pacific: Fastest-growing region, led by China’s military UAV expansion and CAAC’s progressive autonomous flight trials; major investments in manufacturing capacity.

Latin America: Emerging UAV applications in agriculture and mining; government tenders for border surveillance drive ADIRU demand.

Middle East & Africa: Defense modernization and infrastructure surveillance projects spur growth, though regulatory maturity varies widely across countries.

Competitive Landscape

Leading companies in the Autonomous Aircraft Air Data Inertial Reference Unit market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

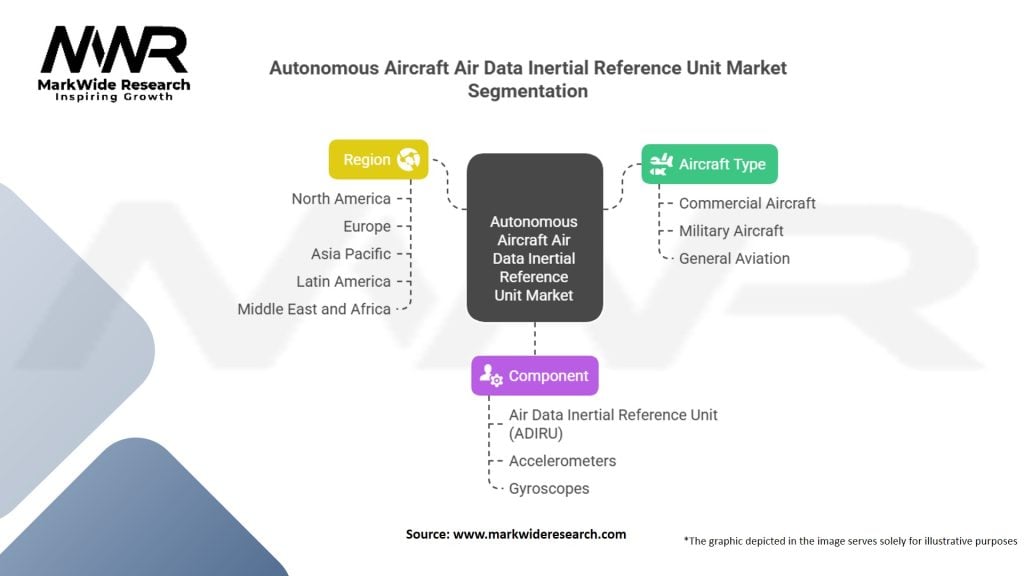

Segmentation

The ADIRU market can be segmented based on component, aircraft type, and end-use industry. By component, the market includes inertial sensors, air data sensors, and digital processing units. Based on aircraft type, the market segments comprise commercial aircraft, military aircraft, and unmanned aerial vehicles (UAVs). Regarding end-use industry, the market covers transportation, defense and security, and others.

Category-wise Insights

MEMS-Based ADIRUs: Offer lowest SWaP and cost; well-suited for small drones but require advanced filtering to counter drift.

FOG-Based ADIRUs: Deliver higher accuracy and long-term stability; favored in tactical UAVs and commercial eVTOLs despite higher cost.

Hybrid IMUs: Combine MEMS and FOG elements to balance cost-effectiveness and performance, emerging as a mainstream solution for mid-sized platforms.

RLG and Ring-Resonator IMUs: Provide the highest precision for strategic reconnaissance and test-flight applications; niche due to complexity and cost.

Key Benefits for Industry Participants and Stakeholders

Enhanced Autonomous Safety: Precise, redundant navigation reduces collision risk and supports regulatory certification for autonomous operations.

Reduced GPS Dependence: Robust inertial back-up ensures continued operation during GPS outages or denial, crucial for military and urban environments.

Improved Mission Efficiency: High-integrity air data and inertial measurements optimize flight paths, fuel consumption, and payload delivery accuracy.

Lower Lifecycle Costs: Software-updatable ADIRUs and predictive maintenance analytics extend service intervals and minimize downtime.

Scalable Integration: Modular form factors and open-architecture interfaces simplify integration across diverse airborne platforms.

SWOT Analysis

Strengths

Critical enabler of flight autonomy and navigation resilience.

Mature technology roadmap with clear certification pathways.

Weaknesses

High certification and development costs limit rapid innovation cycles.

Sensor drift challenges in MEMS require ongoing algorithmic compensation.

Opportunities

Expansion into civil UAM and urban logistics drone markets.

Integration with AI-based navigation and obstacle-avoidance systems.

Threats

Competition from satellite-based augmentation systems and alternative navigation technologies (e.g., vision-based).

Regulatory fragmentation across regions slowing global deployment.

Market Key Trends

AI-Enhanced Calibration: Machine-learning models predict and correct sensor biases in real time, improving long-term navigation accuracy.

Edge-Computing ADIRUs: Embedding analytics directly within the unit reduces latency and bandwidth needs for autonomous flight control.

Modular Open Systems: Adoption of FACE™ and OMS (Open Mission Standard) architectures accelerates multi-supplier integration and upgrades.

Digital Twin Validation: Virtual replicas of ADIRUs in simulation environments speed software verification and hardware-in-the-loop testing.

Sustainable Manufacturing: Use of lead-free soldering, RoHS-compliant components, and eco-friendly packaging aligns with ESG goals.

Covid-19 Impact

The pandemic induced supply-chain disruptions for semiconductor components and assembly, delaying some ADIRU deliveries. However, remote-sensing UAV applications for medical supply delivery and infrastructure inspection surged, underscoring the strategic importance of autonomous platforms. Manufacturers accelerated automation in production and embraced digital support tools—such as remote firmware updates and virtual commissioning—to sustain operations.

Key Industry Developments

Partnership Announcements: Collaborations between aerospace OEMs and sensor specialists to co-develop next-generation ADIRUs for electric and hybrid aircraft.

New Product Launches: Introduction of miniaturized, dual-redundant MEMS/FOG ADIRUs targeting micro-UAV and eVTOL applications.

Facility Expansions: Investments in clean-room assembly lines and MEMS fabrication capacity to meet scaling demands.

Certification Milestones: Achieving DO-254 DAL A approvals for new IMU hardware and DO-178C for onboard fusion algorithms.

Analyst Suggestions

Pursue Certification Early: Engage regulators during development to streamline DO-254/DO-178C qualification and reduce rework.

Invest in Hybrid Architectures: Leverage combined MEMS/FOG solutions to optimize SWaP and performance for emerging UAM platforms.

Strengthen Aftermarket Support: Offer predictive maintenance services and on-aircraft health monitoring to build recurring revenue streams.

Expand Regional Footprint: Establish local calibration and repair centers in Asia Pacific and Middle East to meet fast-growing regional demand.

Future Outlook

The Autonomous Aircraft ADIRU market is poised for strong, sustained growth as autonomous flight transitions from niche defense programs to widespread commercial and civil applications. Advances in sensor technologies, AI-driven fusion, and cloud-native design flows will further reduce costs and expand capabilities. As UAM, drone logistics, and optionally piloted aircraft emerge, the demand for robust, certifiable ADIRUs will intensify. Stakeholders who align product roadmaps with evolving regulatory frameworks and invest in modular, software-defined architectures will lead the next generation of aerial autonomy.

Conclusion

Air Data Inertial Reference Units are at the core of autonomous aircraft navigation, providing the precise, resilient data streams needed for safe, reliable flight operations. The confluence of shrinking SWaP budgets, stringent safety certifications, and rapid growth in autonomous platforms is reshaping the ADIRU market into a dynamic, innovation-driven sector. Through continued collaboration between avionics suppliers, aircraft OEMs, and regulatory bodies—combined with advances in sensor fusion, AI, and digital validation—ADIRUs will enable the full realization of autonomous aviation’s promise, from urban air taxis to long-endurance cargo drones.

What is Autonomous Aircraft Air Data Inertial Reference Unit?

An Autonomous Aircraft Air Data Inertial Reference Unit is a critical component in aviation that provides accurate data on an aircraft’s position, velocity, and orientation. It integrates air data measurements with inertial navigation to enhance flight safety and performance.

What are the key players in the Autonomous Aircraft Air Data Inertial Reference Unit Market?

Key players in the Autonomous Aircraft Air Data Inertial Reference Unit Market include Honeywell International Inc., Northrop Grumman Corporation, and Thales Group, among others.

What are the growth factors driving the Autonomous Aircraft Air Data Inertial Reference Unit Market?

The growth of the Autonomous Aircraft Air Data Inertial Reference Unit Market is driven by the increasing demand for advanced navigation systems in unmanned aerial vehicles, the rise in air traffic, and the need for enhanced safety features in aviation.

What challenges does the Autonomous Aircraft Air Data Inertial Reference Unit Market face?

Challenges in the Autonomous Aircraft Air Data Inertial Reference Unit Market include high development costs, regulatory hurdles for certification, and the need for continuous technological advancements to meet evolving industry standards.

What opportunities exist in the Autonomous Aircraft Air Data Inertial Reference Unit Market?

Opportunities in the Autonomous Aircraft Air Data Inertial Reference Unit Market include the growing adoption of autonomous systems in commercial aviation, advancements in sensor technology, and the potential for integration with artificial intelligence for improved navigation.

What trends are shaping the Autonomous Aircraft Air Data Inertial Reference Unit Market?

Trends in the Autonomous Aircraft Air Data Inertial Reference Unit Market include the increasing use of miniaturized sensors, the shift towards fully autonomous flight systems, and the integration of data analytics for enhanced operational efficiency.

Autonomous Aircraft Air Data Inertial Reference Unit Market:

| Segmentation Details | Description |

|---|---|

| By Aircraft Type | Commercial Aircraft, Military Aircraft, General Aviation |

| By Component | Air Data Inertial Reference Unit (ADIRU), Accelerometers, Gyroscopes |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Autonomous Aircraft Air Data Inertial Reference Unit market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at