444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The automotive turbocharger market has witnessed significant growth in recent years, driven by the increasing demand for fuel-efficient vehicles and the need for enhanced engine performance. Turbochargers are a critical component of modern automotive engines, designed to boost power and improve fuel efficiency by compressing the incoming air. This market analysis delves into the key insights, market drivers, restraints, opportunities, and dynamics shaping the automotive turbocharger industry.

Meaning

An automotive turbocharger is a device that utilizes exhaust gas to drive a turbine, which in turn compresses the incoming air before it enters the combustion chamber. This compressed air enables the engine to burn more fuel efficiently, resulting in improved power output without sacrificing fuel economy. Turbochargers are widely used in both gasoline and diesel engines, across various vehicle types, including passenger cars, commercial vehicles, and even off-road and heavy-duty vehicles.

Executive Summary

The automotive turbocharger market has experienced steady growth in recent years, with a compound annual growth rate (CAGR) of XX% between the forecast period of 20XX and 20XX. The market is primarily driven by factors such as increasing government regulations for emission control, advancements in engine technology, and the growing trend of downsized engines to improve fuel efficiency. Additionally, the emergence of electric turbochargers and the shift towards electric vehicles are expected to present new growth opportunities for the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Growing Turbocharger Penetration: Turbochargers are now standard on over 85% of new diesel vehicles and 50% of gasoline vehicles globally.

Emergence of E‐Turbo Technology: Electrically assisted turbochargers eliminate traditional lag, improve low‐end torque, and integrate seamlessly with hybrid systems.

Regional Variations: Europe leads adoption due to diesel popularity and stringent CO₂ targets; Asia-Pacific shows the fastest growth driven by India and China; North America adoption accelerates on gasoline downsizing.

Aftermarket and Retrofitting: Rising interest in performance upgrades fuels aftermarket turbocharger sales, particularly in light commercial vehicles and enthusiast segments.

Supply Chain Localization: OEMs are increasingly sourcing turbocharger components locally to reduce lead times and meet “just‐in‐time” production targets.

Market Drivers

Emissions Regulations: Stricter global CO₂ and NOₓ limits force OEMs to adopt smaller, turbocharged engines to comply without sacrificing performance.

Fuel Efficiency Mandates: Corporate Average Fuel Economy (CAFE) standards and consumer fuel cost concerns drive engine downsizing and turbocharging solutions.

Consumer Demand for Performance: Drivers seek responsive acceleration and higher torque, which turbochargers deliver across RPM ranges.

Growth of Light Commercial Vehicles: Rising e-commerce and logistics activity boost demand for turbocharged vans and trucks for better fuel economy and payload capacity.

Technological Innovation: Advances in materials (e.g., high‐temperature ceramics), aerodynamics, and electric assist enhance turbocharger efficiency and durability.

Market Restraints

Cost Pressure: High development and manufacturing costs of advanced turbochargers challenge pricing, especially in cost‐sensitive markets.

Complexity and Reliability: Sophisticated systems (VGT, e‐turbos) require precise controls and robust materials, raising warranty and maintenance concerns.

Shift to Electrification: Growing EV penetration may reduce internal combustion engine (ICE) turbocharger demand in long term.

Aftertreatment Integration: Turbocharger performance is interlinked with exhaust aftertreatment systems (SCR, DPF), complicating development and increasing packaging constraints.

Consumer Education: Awareness of benefits versus maintenance considerations is still growing, limiting aftermarket and retrofit adoption in some regions.

Market Opportunities

Hybridization Synergy: Integration of e‐turbochargers with 48V mild‐hybrid systems enhances peak efficiency, opening new applications in passenger cars.

Emerging Market Penetration: Lower turbocharger adoption in India, Southeast Asia, and Latin America presents growth potential as regulations tighten and consumer awareness rises.

Lightweight and Compact Designs: Demand for smaller, lighter turbochargers for urban microcars and micro‐SUVs can unlock new niche segments.

Advanced Manufacturing: Additive manufacturing (AM) of turbocharger components can reduce costs and lead times, enabling rapid prototyping and customization.

Aftermarket Services: Expansion of performance and retrofit programs for existing ICE vehicles, especially where full EV transition is slower, can sustain aftermarket growth.

Market Dynamics

Supply Side: Major OEMs and tier‐1 suppliers are investing in multi‐location manufacturing to mitigate supply chain risks and meet regional content requirements. Innovations in casting and machining reduce production costs.

Demand Side: Automotive OEMs, fleet operators, and aftermarket distributors are increasingly specifying turbochargers for new ICE and hybrid platforms to meet performance and efficiency targets.

Economic Factors: Oil price volatility and rising fuel costs make turbocharged, fuel‐efficient vehicles more attractive. Economic growth in emerging markets correlates with increased vehicle sales and turbocharger adoption.

Regional Analysis

Europe: Leads with over 75% turbo penetration in passenger cars; strong R&D ecosystem and stringent EU emissions policies drive premium and sub‐compact segments alike.

North America: Gasoline engine downsizing accelerated in 2018–2023; by 2030, over 60% of cars will be turbocharged. Key OEMs (GM, FCA, Ford) have broad turbo portfolios.

Asia-Pacific: Fastest‐growing region; China’s dual credit policy fosters gasoline turbo uptake; India’s BS‐VI norms (2020) mandate ultra‐low emissions, boosting diesel and gasoline turbo vehicles.

Latin America: Lower penetration (~20%) but rising due to CAFE‐like national policies and consumer shift to modern, efficient cars.

Middle East & Africa: Penetration still nascent (<15%); premium segment in GCC shows growth; broader uptake delayed by infrastructure and cost concerns.

Competitive Landscape

Leading companies in the Automotive Turbocharger Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

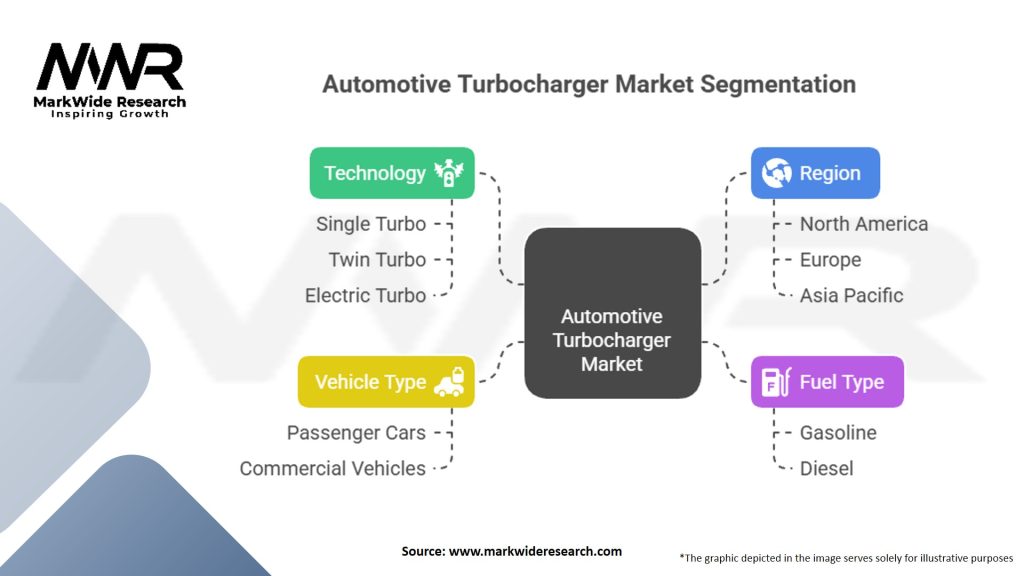

Segmentation

The automotive turbocharger market can be segmented based on various parameters, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The automotive industry, including the turbocharger market, experienced a significant impact due to the COVID-19 pandemic. The pandemic led to disruptions in global supply chains, temporary production shutdowns, and a decline in vehicle sales. However, the market has shown resilience, with recovery witnessed in the post-pandemic period as economies reopen and consumer demand gradually recovers.

Key Industry Developments

Garrett Motion’s E‐Turbine Launch: Integration in multiple OEM 48V hybrid powertrains in 2023.

BorgWarner‐Hella JV: Strategic alliance to co‐develop next‐gen turbochargers combining electronics and sensor tech.

Cummins Holset Expansion: New facility in India (2024) focusing on light truck turbos for domestic OEMs.

Additive Manufacturing Pilots: Garrett and IHI testing 3D‐printed turbo housings for rapid prototyping and lightweighting.

Aftermarket Digital Platforms: BorgWarner’s online turbo rebuild service and Garrett’s remote performance tuning dashboard.

Analyst Suggestions

Future Outlook

The automotive turbocharger market is expected to witness steady growth in the coming years, driven by factors such as stricter emission regulations, the shift towards downsized engines, and the increasing demand for fuel-efficient vehicles. The market will also be influenced by technological advancements, such as electric turbochargers and hybrid turbocharging systems. As the industry continues to evolve, collaboration between automakers and turbocharger manufacturers will play a crucial role in developing innovative solutions that meet the demands of the future automotive landscape.

Conclusion

The automotive turbocharger market is experiencing significant growth, driven by the need for improved engine performance and fuel efficiency. Turbochargers enable automakers to achieve these goals by compressing the incoming air, resulting in increased power output and better combustion efficiency. Despite challenges such as turbo lag and higher costs, turbocharging technology continues to evolve, with electric turbochargers and hybrid systems paving the way for further advancements. The future of the automotive turbocharger market looks promising, with opportunities arising from emerging markets, electrification, and the pursuit of sustainable transportation solutions.

What is Automotive Turbocharger?

An automotive turbocharger is a device that increases the efficiency and power output of an internal combustion engine by forcing extra air into the combustion chamber. This process enhances engine performance and fuel efficiency, making it a popular choice in modern vehicles.

What are the key players in the Automotive Turbocharger Market?

Key players in the Automotive Turbocharger Market include Garrett Motion, BorgWarner, Honeywell, and IHI Corporation. These companies are known for their innovative technologies and extensive product offerings in turbocharging solutions, among others.

What are the main drivers of the Automotive Turbocharger Market?

The main drivers of the Automotive Turbocharger Market include the increasing demand for fuel-efficient vehicles, stringent emission regulations, and the growing popularity of turbocharged engines in both passenger and commercial vehicles. These factors contribute to the market’s expansion.

What challenges does the Automotive Turbocharger Market face?

The Automotive Turbocharger Market faces challenges such as high manufacturing costs and the complexity of turbocharger systems. Additionally, the shift towards electric vehicles may impact the demand for traditional turbocharging solutions.

What opportunities exist in the Automotive Turbocharger Market?

Opportunities in the Automotive Turbocharger Market include advancements in turbocharger technology, such as variable geometry turbochargers and electric turbochargers. These innovations can enhance performance and efficiency, catering to the evolving automotive landscape.

What trends are shaping the Automotive Turbocharger Market?

Trends shaping the Automotive Turbocharger Market include the increasing integration of turbochargers in smaller engines to improve performance and fuel economy. Additionally, the rise of hybrid and electric vehicles is prompting manufacturers to explore new turbocharging technologies.

Automotive Turbocharger Market

| Segmentation | Details |

|---|---|

| Technology | Single Turbo, Twin Turbo, Electric Turbo |

| Fuel Type | Gasoline, Diesel |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Region | North America, Europe, Asia Pacific, etc. |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Automotive Turbocharger Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at