444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The automotive tube hydroformed parts market is a rapidly growing segment within the automotive industry. Tube hydroforming is a manufacturing process that involves shaping metal tubes into complex geometries using high-pressure fluid. This technique offers several advantages over traditional metal forming methods, such as improved strength-to-weight ratio, reduced material waste, and enhanced design flexibility. As a result, tube hydroformed parts have gained significant traction in the automotive sector, especially in the production of lightweight vehicles.

Meaning

Tube hydroforming refers to the process of shaping metal tubes by applying internal fluid pressure. It involves placing a tube into a die and closing it with a punch. High-pressure fluid is then introduced into the tube, causing it to expand and take the shape of the die. This process enables the creation of complex, seamless, and lightweight components that offer superior structural integrity and performance compared to conventionally manufactured parts.

Executive Summary

The automotive tube hydroformed parts market has witnessed substantial growth in recent years, driven by the increasing demand for lightweight and fuel-efficient vehicles. The market is characterized by technological advancements, expanding applications, and a competitive landscape. Key market players are focusing on product innovation, strategic partnerships, and mergers and acquisitions to gain a competitive edge in the market.

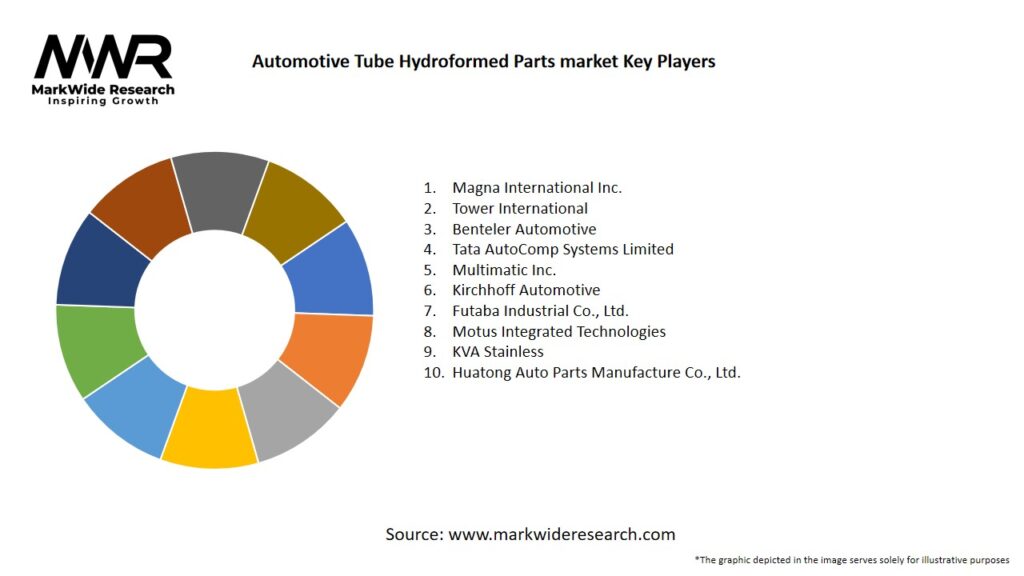

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Lightweighting Imperative: Hydroformed parts deliver 15–30% weight savings compared to traditional welded assemblies, directly contributing to improved fuel economy and EV range extension.

Structural Performance: Complex geometries—such as tapered sections and integrated mounting brackets—achieved in a single hydroformed part improve load distribution and crash energy absorption.

Cost Optimization: Reducing part counts and welding operations lowers assembly time, labor costs, and quality inspection requirements.

Material Diversification: Advances in aluminum and tailored steel grades enable hydroforming of lighter, corrosion-resistant components for both ICE and EV platforms.

Geographic Expansion: New hydroforming plants in Asia Pacific and Eastern Europe support regional content localization for global automakers.

Market Drivers

Stringent Emissions Standards: Global CO₂ regulations (e.g., EU Euro 7, China 6) incentivize vehicle lightweighting strategies, elevating adoption of hydroformed components.

EV Proliferation: Battery electric vehicles require stiff, crashworthy frames to house heavy battery packs, driving demand for integrated hydroformed subframes and rails.

Safety Regulations: Enhanced frontal, side-impact, and rollover protection standards promote use of high-strength hydroformed parts in occupant safety structures.

Manufacturing Efficiency: OEMs seek to streamline production with fewer body-in-white (BIW) components, reducing cycle times and assembly complexity.

Supply Chain Localization: Automotive platforms with global footprints encourage local sourcing of hydroformed parts to mitigate logistics costs and tariffs.

Market Restraints

High Capital Expenditure: Hydroforming presses, high-pressure pumps, and custom die sets require significant upfront investment, limiting smaller suppliers.

Material Limitations: Some high-strength steels and advanced aluminum alloys pose formability challenges, requiring specialized lubrication and process controls.

Process Complexity: Achieving tight tolerances and defect-free parts demands rigorous simulation, monitoring, and skilled operators.

Tooling Costs: Custom die fabrication and maintenance represent ongoing expenses, especially for low-volume or rapidly changing vehicle platforms.

Market Volatility: Automotive production fluctuations—due to economic cycles or semiconductor shortages—can impact hydroforming plant utilization.

Market Opportunities

Advanced Materials: Development of magnesium and composite‐reinforced tubes for ultra-lightweight structures opens new application areas.

Hybrid Forming: Combining hydroforming with stamping or roll forming enables creation of multi‐material, functionally graded parts.

Industry 4.0 Integration: Smart sensors, real-time pressure monitoring, and predictive maintenance enhance process reliability and reduce scrap rates.

Aftermarket Growth: Customized hydroformed parts for performance and replacement markets present niche revenue streams.

Global Footprint Expansion: Establishing greenfield hydroforming facilities in Latin America and Africa to serve emerging automotive clusters.

Market Dynamics

Collaborative R&D: OEMs partnering with university research centers and toolmakers to optimize process parameters and explore new tube geometries.

M&A Activity: Consolidation among tier-1 hydroforming specialists to expand global capabilities and technological portfolios.

Standardization Efforts: Development of industry‐wide quality and safety standards for hydroformed parts to facilitate cross‐supplier interchangeability.

Digital Twin Adoption: Virtual simulations of hydroforming processes reduce trial‐and‐error, accelerating die design and ramp‐up timelines.

Sustainability Initiatives: Lifecycle assessments and energy‐efficient press technologies support OEMs’ carbon reduction commitments.

Regional Analysis

Asia Pacific: Leading region with highest hydroforming equipment installations, driven by China’s mature automotive industry and rising EV output in South Korea and Japan.

North America: Strong presence of domestic automakers and tier-1 suppliers; growth hinges on reshoring initiatives and EV platform investments.

Europe: Early adopter of aluminum hydroforming and multi‐material BIWs; stringent safety regulations and luxury vehicle production drive premium applications.

Latin America: Emerging hydroforming capacity in Brazil and Mexico, supporting localized content for global OEMs and reducing import dependence.

Middle East & Africa: Nascent market with limited hydroforming infrastructure; opportunities exist in regional assembly plants and defense vehicle programs.

Competitive Landscape

Leading companies in the Automotive Tube Hydroformed Parts market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

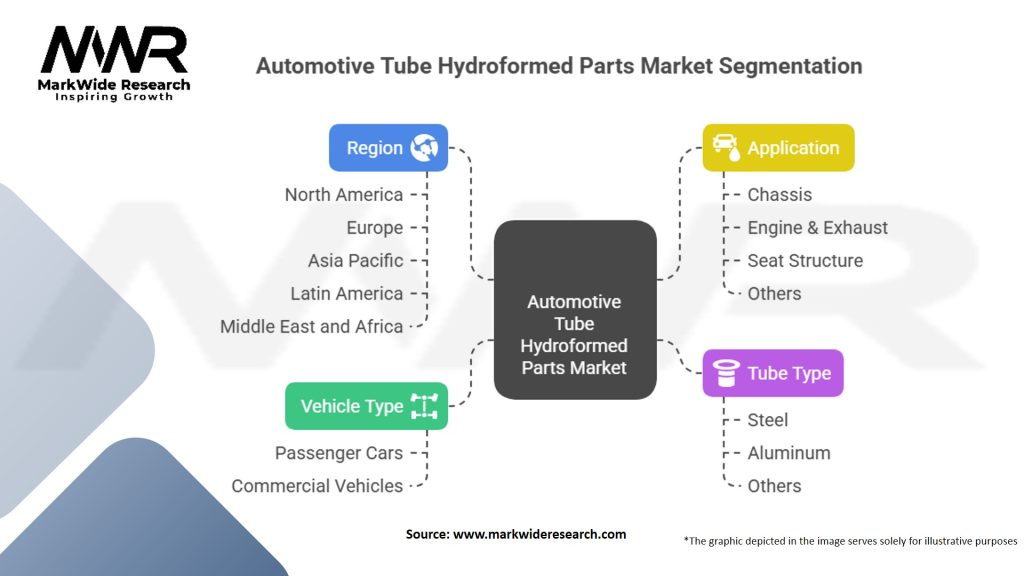

Segmentation

The automotive tube hydroformed parts market can be segmented based on product type, application, and vehicle type.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the global automotive industry, including the tube hydroformed parts market. The pandemic resulted in supply chain disruptions, production halts, and reduced consumer demand. However, the market has shown resilience, with recovery expected as economies reopen, and the automotive sector rebounds.

The pandemic has also highlighted the importance of lightweighting and fuel efficiency, driving the demand for tube hydroformed parts in the post-pandemic era. The industry is expected to witness increased investments in research and development, technological advancements, and sustainability initiatives.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the automotive tube hydroformed parts market is promising. The market is expected to witness significant growth due to increasing demand for lightweight vehicles, technological advancements, expanding applications, and stringent environmental regulations. Continued research and development, focus on sustainability, and strategic collaborations are likely to shape the market’s future landscape.

Conclusion

The automotive tube hydroformed parts market is experiencing robust growth, driven by the demand for lightweight and fuel-efficient vehicles. Technological advancements, expanding applications, and stringent environmental regulations are further fueling market growth. Industry participants need to focus on innovation, sustainability, and strategic collaborations to stay competitive in this evolving landscape. With promising opportunities in the electric vehicle market and emerging economies, the future looks bright for the automotive tube hydroformed parts market.

What is Automotive Tube Hydroformed Parts?

Automotive tube hydroformed parts are components created through a manufacturing process that uses high-pressure fluid to shape metal tubes into complex geometries. This technique is commonly used in the automotive industry for producing lightweight and strong parts, such as chassis components and structural elements.

What are the key players in the Automotive Tube Hydroformed Parts Market?

Key players in the Automotive Tube Hydroformed Parts Market include companies like Magna International, Benteler International, and Aisin Seiki, which specialize in manufacturing advanced automotive components. These companies focus on innovation and efficiency in production processes, among others.

What are the growth factors driving the Automotive Tube Hydroformed Parts Market?

The growth of the Automotive Tube Hydroformed Parts Market is driven by the increasing demand for lightweight materials to improve fuel efficiency and reduce emissions in vehicles. Additionally, advancements in hydroforming technology and the rising trend of electric vehicles are contributing to market expansion.

What challenges does the Automotive Tube Hydroformed Parts Market face?

The Automotive Tube Hydroformed Parts Market faces challenges such as high initial setup costs and the complexity of the hydroforming process. Additionally, fluctuations in raw material prices can impact production costs and profitability.

What opportunities exist in the Automotive Tube Hydroformed Parts Market?

Opportunities in the Automotive Tube Hydroformed Parts Market include the growing adoption of electric and hybrid vehicles, which require innovative lightweight components. Furthermore, the increasing focus on sustainability and recycling in automotive manufacturing presents new avenues for growth.

What trends are shaping the Automotive Tube Hydroformed Parts Market?

Trends in the Automotive Tube Hydroformed Parts Market include the integration of advanced materials such as high-strength steel and aluminum, which enhance performance and reduce weight. Additionally, the shift towards automation and smart manufacturing processes is transforming production efficiency.

Automotive Tube Hydroformed Parts Market:

| Segmentation Details | Description |

|---|---|

| By Vehicle Type | Passenger Cars, Commercial Vehicles |

| By Tube Type | Steel, Aluminum, Others |

| By Application | Chassis, Engine & Exhaust, Seat Structure, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Automotive Tube Hydroformed Parts market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at