444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Automotive Power Module Packaging Market refers to the segment of the automotive industry that deals with the packaging and integration of power modules used in vehicles. Power modules are electronic devices that control and manage the flow of power in automotive systems. These modules are crucial for the functioning of various electrical and electronic components in vehicles, such as powertrain systems, infotainment systems, and advanced driver-assistance systems (ADAS).

Meaning

Automotive power module packaging involves the design, development, and production of packages that house power modules. These packages are designed to provide protection, thermal management, and electrical connectivity to the power modules. The packaging solutions ensure the efficient and reliable operation of the power modules under challenging automotive conditions, including high temperatures, vibrations, and electrical noise.

Executive Summary

The Automotive Power Module Packaging Market has witnessed significant growth in recent years, driven by the increasing demand for electric and hybrid vehicles, as well as the growing adoption of advanced electronic systems in automobiles. Power module packaging plays a crucial role in improving the performance, efficiency, and reliability of these vehicles by providing robust protection and effective thermal management for power modules.

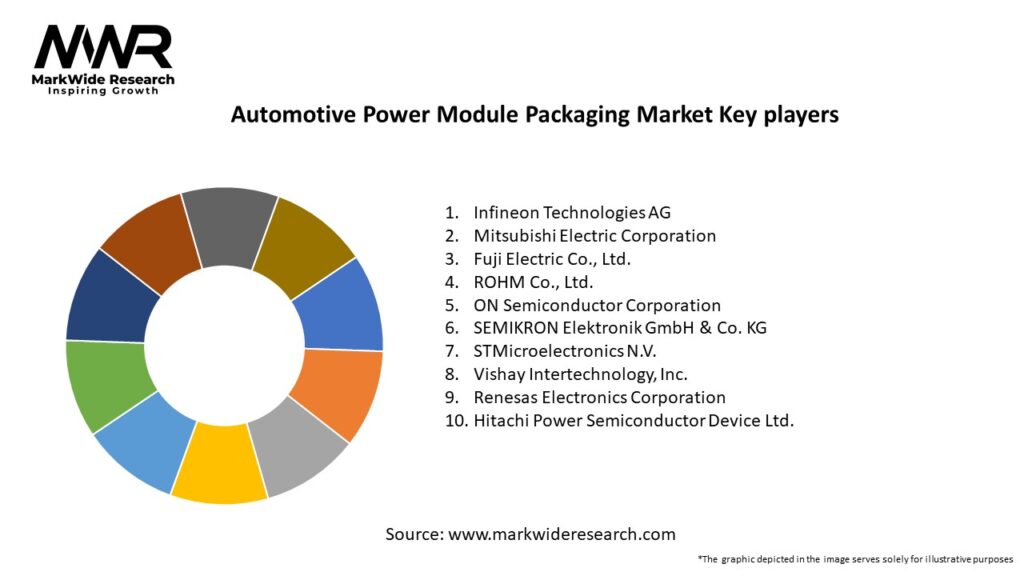

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The automotive power module packaging market is driven by various dynamics, including technological advancements, regulatory requirements, and market demand. The market is highly competitive, with several key players offering a wide range of packaging solutions to automotive manufacturers. Innovation, cost-effectiveness, and customization are key factors for success in the market.

Regional Analysis

The automotive power module packaging market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific dominates the market, driven by the presence of key automotive manufacturing countries like China, Japan, and South Korea. The region’s rapid industrialization, increasing vehicle production, and government initiatives to promote electric vehicles contribute to its market leadership.

Europe is also a significant market for automotive power module packaging, owing to the region’s strong automotive industry and stringent emission regulations. North America and Latin America exhibit steady growth, driven by the rising adoption of electric vehicles and advancements in automotive electronics. The Middle East and Africa region are expected to witness moderate growth, influenced by the development of electric vehicle infrastructure and government initiatives to reduce carbon emissions.

Competitive Landscape

Leading Companies in the Automotive Power Module Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The automotive power module packaging market can be segmented based on packaging technology, material type, vehicle type, and application.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

The SWOT analysis provides an overview of the strengths, weaknesses, opportunities, and threats in the automotive power module packaging market.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the automotive industry, including the automotive power module packaging market. The pandemic led to disruptions in the global supply chain, production shutdowns, and a decline in vehicle sales. Automotive manufacturers faced challenges in the procurement of power module packaging solutions, resulting in temporary slowdowns in the market.

However, the pandemic also accelerated certain trends, such as the demand for electric vehicles and advanced electronics in automobiles. The shift towards electric and hybrid vehicles gained momentum as governments and consumers emphasized sustainability and reduced carbon emissions. This, in turn, drove the demand for power module packaging solutions.

The pandemic highlighted the importance of resilient and robust supply chains, leading to increased investments in local manufacturing and supplier diversification. Automotive manufacturers and power module packaging suppliers focused on streamlining operations, ensuring employee safety, and adopting digital technologies for remote collaboration and customer engagement.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the automotive power module packaging market is optimistic, driven by the increasing adoption of electric and hybrid vehicles, advancements in power electronics, and the growing integration of advanced electronic systems in automobiles. The market is expected to witness continued technological advancements, focusing on thermal management, miniaturization, and reliability.

The shift towards wide bandgap semiconductors, such as SiC and GaN, will drive the demand for power module packaging solutions compatible with these materials. The market will also witness increased collaboration and partnerships among industry players to deliver comprehensive and integrated packaging solutions.

As the automotive industry recovers from the impact of the COVID-19 pandemic, the demand for power module packaging solutions is expected to rebound. Governments worldwide continue to support electric vehicle adoption through incentives and regulations, providing a favorable market environment for power module packaging.

Conclusion

The Automotive Power Module Packaging Market is witnessing significant growth due to the increasing demand for electric and hybrid vehicles, the integration of advanced electronic systems, and the emphasis on thermal management. Despite challenges such as high costs and lack of standardization, the market offers numerous opportunities, including the integration of power electronics in autonomous vehicles, adoption of wide bandgap semiconductors, and the growing market for electric two-wheelers.

The market’s future outlook is positive, with continuous technological advancements, collaborations, and investments in research and development. Power module packaging solutions will continue to play a crucial role in improving the performance, reliability, and safety of vehicles. As the automotive industry transitions towards sustainability and electrification, power module packaging will remain a vital component, enabling efficient power management and contributing to a greener future.

What is Automotive Power Module Packaging?

Automotive Power Module Packaging refers to the methods and materials used to encase power modules in vehicles, ensuring protection, thermal management, and electrical performance. This packaging is crucial for the reliability and efficiency of automotive power electronics.

What are the key players in the Automotive Power Module Packaging Market?

Key players in the Automotive Power Module Packaging Market include Infineon Technologies, Texas Instruments, and ON Semiconductor, among others. These companies are known for their innovative packaging solutions that enhance the performance of automotive power modules.

What are the growth factors driving the Automotive Power Module Packaging Market?

The growth of the Automotive Power Module Packaging Market is driven by the increasing demand for electric vehicles, advancements in power electronics, and the need for improved thermal management solutions. These factors contribute to the development of more efficient and compact power modules.

What challenges does the Automotive Power Module Packaging Market face?

The Automotive Power Module Packaging Market faces challenges such as the high cost of advanced materials and the complexity of integrating multiple functionalities into compact designs. Additionally, ensuring reliability under harsh automotive conditions remains a significant challenge.

What opportunities exist in the Automotive Power Module Packaging Market?

Opportunities in the Automotive Power Module Packaging Market include the growing trend of electrification in vehicles and the increasing adoption of advanced driver-assistance systems (ADAS). These trends create a demand for innovative packaging solutions that can support higher power densities.

What trends are shaping the Automotive Power Module Packaging Market?

Trends shaping the Automotive Power Module Packaging Market include the shift towards miniaturization of components, the use of advanced materials for better thermal management, and the integration of smart technologies for enhanced performance. These trends are essential for meeting the evolving needs of the automotive industry.

Automotive Power Module Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Power Modules, Power Distributors, Power Converters, Power Regulators |

| Technology | Silicon, Gallium Nitride, Silicon Carbide, Hybrid |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Application | Electric Vehicles, Hybrid Vehicles, Commercial Vehicles, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Power Module Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at