Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Demand for glass-fiber reinforced polypropylene (GFPP) is surging, owing to its favorable cost-performance balance for interior and exterior trims.

-

Carbon-fiber composites are gaining share in high-performance and EV segments, despite higher material costs, due to superior stiffness-to-weight ratios.

-

Bio-based and recycled composites are emerging as sustainable alternatives, addressing end-of-life disposal concerns and regulatory pressures.

-

Advances in processing technologies—such as in-line continuous fiber placement and reactive injection molding—are reducing cycle times and expanding composite use in mass-production vehicles.

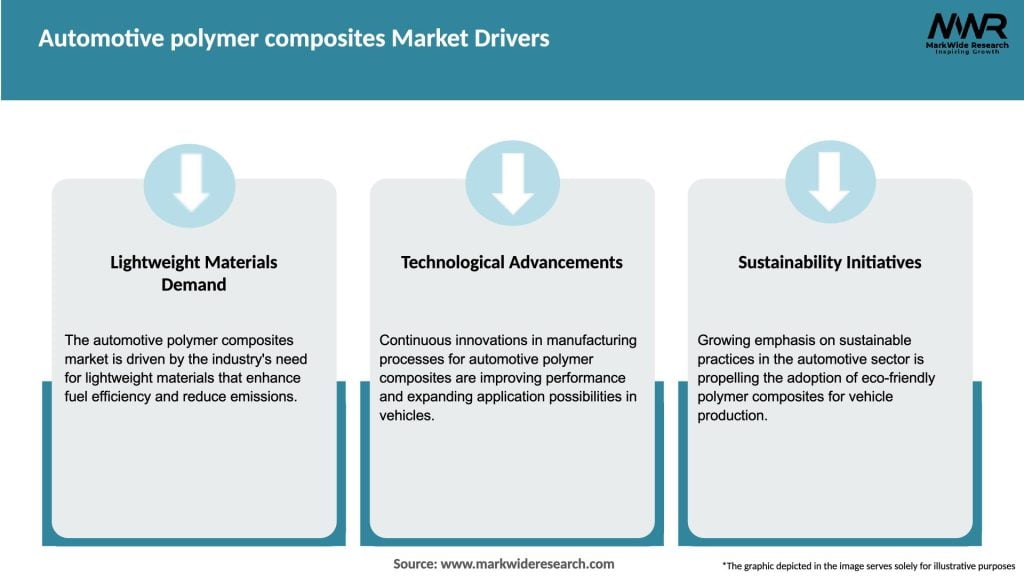

Market Drivers

Several factors are driving growth in the Automotive Polymer Composites market:

-

Lightweighting Initiatives: Automakers aim to reduce vehicle weight to improve fuel economy and extend EV range, making composites a strategic material choice.

-

Regulatory Compliance: Stricter emission and safety standards worldwide are compelling OEMs to adopt advanced materials to meet crashworthiness and environmental targets.

-

EV Proliferation: The shift to electric powertrains emphasizes lightweight structures and integration of composite battery enclosures to maintain performance and safety.

-

Design Flexibility: Composites allow complex geometries, integrated functions (e.g., wiring channels), and aesthetic finishes, enabling innovative vehicle designs.

-

Sustainability Trends: Growing focus on bio-based resins, recycled fibers, and closed-loop manufacturing processes is expanding the use of green composites in automotive applications.

Market Restraints

Despite strong momentum, the market faces several challenges:

-

High Material Costs: Carbon fiber and advanced resin systems remain pricier than conventional metals and standard polymers, limiting adoption in cost-sensitive segments.

-

Processing Complexity: Specialized equipment and longer cycle times for composite fabrication can impede integration into high-volume production lines.

-

Repair and Recycling Issues: Composite components require specialized repair techniques, and end-of-life recovery and recycling infrastructures are still emerging.

-

Performance Variability: Achieving consistent mechanical properties requires stringent process controls and quality assurance, which can be resource-intensive.

-

Supply Chain Constraints: Availability of high-quality reinforcement fibers and sustainable resin feedstocks can fluctuate, affecting production continuity and costs.

Market Opportunities

The Automotive Polymer Composites market offers numerous avenues for innovation and expansion:

-

Advanced Hybrid Composites: Combining carbon and glass fibers with novel resin matrices to optimize performance-to-cost ratios for mainstream vehicles.

-

Smart Composites: Embedding sensors or conductive fibers within composites for structural health monitoring, enabling predictive maintenance and enhanced safety.

-

Bio-Resin Development: R&D into plant-based and bio-derived polymers (e.g., polylactic acid, bio-polyamides) presents sustainable material options.

-

Automated Manufacturing: Adoption of Industry 4.0 practices—such as robotics and digital twins—in composite production to shorten cycle times and improve yield.

-

Aftermarket and Retrofitting: Growing aftermarket demand for composite performance upgrades (e.g., weight-saving body kits) and retrofitting of legacy fleets with lightweight components.

Market Dynamics

The Automotive Polymer Composites market is shaped by the following dynamics:

-

Collaborative Innovation: OEMs, tier-1 suppliers, and material providers are co-developing tailored composite solutions to meet specific vehicle requirements, shortening development cycles.

-

Regulatory Momentum: Government incentives for lightweight and electric vehicles—as well as CO₂ emission taxes—are accelerating composite adoption.

-

Cost Reduction Trends: Economies of scale, process automation, and material innovations (e.g., low-cost carbon fibers) are gradually narrowing the cost gap with traditional materials.

-

Circular Economy Focus: Extended producer responsibility and end-of-life vehicle directives are driving investments in recyclable composites and closed-loop manufacturing systems.

-

Consumer Perception: Growing consumer awareness of vehicle sustainability and performance is bolstering demand for lightweight, fuel-efficient, and eco-friendly materials.

Regional Analysis

Adoption and growth of automotive polymer composites vary by region:

-

Asia Pacific: The largest market, led by China, Japan, and South Korea, driven by high vehicle production volumes, strong EV adoption, and government support for lightweight technologies.

-

North America: Significant demand fueled by stringent CAFE standards and rapid EV rollouts; major OEMs and suppliers invest heavily in domestic composite manufacturing capabilities.

-

Europe: Robust growth backed by Euro 7 emission targets, EU-backed research initiatives (e.g., Horizon Europe), and a mature automotive supplier ecosystem focused on lightweighting.

-

Latin America: Emerging market with gradual adoption in premium and EV segments; localized production constraints and cost sensitivity moderate growth.

-

Middle East & Africa: Nascent market, with some uptake in luxury and performance vehicle segments; infrastructure development and diversification of automotive industries will drive future opportunities.

Competitive Landscape

Leading Companies in the Automotive Polymer Composites Market:

- Toray Industries, Inc.

- SGL Carbon SE

- Owens Corning

- Teijin Limited

- Hexcel Corporation

- Mitsubishi Chemical Holdings Corporation

- Gurit Holding AG

- Solvay SA

- Hanwha Advanced Materials Corporation

- Plasan Carbon Composites

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

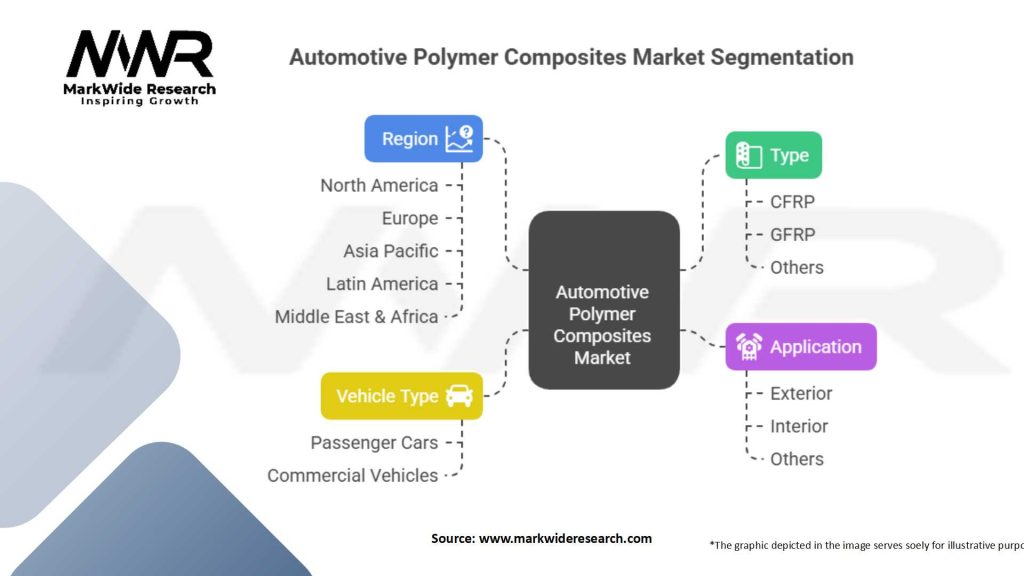

Segmentation

The Automotive Polymer Composites market can be segmented based on:

-

Reinforcement Type: Glass Fiber Reinforced Polymers (GFRP), Carbon Fiber Reinforced Polymers (CFRP), Natural Fiber Composites, Hybrid Fiber Composites

-

Polymer Matrix: Thermoset (Epoxy, Polyester), Thermoplastic (Polypropylene, Polyamide, Polycarbonate)

-

Application: Exterior Body Panels, Interior Components, Structural Reinforcements, Under-the-Hood Parts, Battery Enclosures

-

Vehicle Type: Passenger Cars, Commercial Vehicles, Electric Vehicles, Luxury & Sports Vehicles

Category-wise Insights

-

GFRP: Widely used in cost-sensitive applications such as bumpers, door panels, and interior trims due to its favorable cost-to-performance ratio and ease of processing.

-

CFRP: Preferred in high-end and EV applications where maximum weight savings and structural stiffness are critical, despite higher material costs.

-

Natural Fiber Composites: Emerging in interior trims and non-structural parts, combining eco-friendliness with adequate performance for secondary components.

-

Thermoplastic Composites: Growing adoption due to recyclability and faster cycle times, supporting mass production and closed-loop material strategies.

Key Benefits for Industry Participants and Stakeholders

-

Fuel Efficiency: Reduced vehicle weight directly translates into lower fuel consumption and extended EV range, aligning with regulatory and consumer demands.

-

Design Freedom: Complex shapes, integrated functionalities, and aesthetic finishes are achievable, enhancing vehicle styling and part consolidation.

-

Corrosion Resistance: Polymer composites offer superior durability in harsh environments, reducing maintenance costs and improving lifecycle performance.

-

Safety Enhancement: Tailored composite reinforcements can improve crash energy absorption and occupant protection in critical zones.

-

Sustainability: Use of bio-based resins and recycled fibers contributes to lower carbon footprints and supports circular economy initiatives.

SWOT Analysis

Strengths

-

Exceptional strength-to-weight ratios for improved vehicle performance

-

Corrosion resistance and durability in diverse environments

-

Versatile processing methods enabling part consolidation

Weaknesses

-

Elevated material and processing costs compared to conventional metals

-

Limited large-scale recycling infrastructure for composite waste

-

Need for specialized skills and equipment for fabrication and repair

Opportunities

-

Rising demand from EV manufacturers for lightweight battery housing and chassis components

-

Integration of smart features (embedded sensors) for condition monitoring

-

Expansion of bio-based and recycled composites under sustainability mandates

Threats

-

Volatility in raw material prices (fibers and specialty resins)

-

Competition from alternative lightweight materials (aluminum alloys, high-strength steels)

-

Regulatory shifts impacting composite manufacturing and recycling requirements

Market Key Trends

-

Low-Cost Carbon Fibers: Efforts to develop more affordable carbon fibers are making CFRP viable for mainstream automotive applications beyond luxury segments.

-

Automated Fiber Placement: Robotics and machine learning–driven placement technologies are improving repeatability and reducing cycle times for composite parts.

-

Multifunctional Composites: Development of composites with embedded heating elements, EMI shielding, or sensor networks is expanding value propositions.

-

Green Composites: Blends of recycled fibers and bio-resins are gaining adoption, driven by vehicle end-of-life regulations and consumer sustainability preferences.

-

Digital Twins: Simulation-driven design and virtual testing of composite components are shortening development cycles and reducing prototyping costs.

Covid-19 Impact

The Covid-19 pandemic caused temporary disruptions in the automotive supply chain, including composite material production, due to factory shutdowns and logistics constraints. However, the recovery phase accelerated investments in EV programs—where composites play a critical role—supported by government stimulus packages aimed at green mobility. Manufacturers prioritized resilience by diversifying supply sources and adopting digital manufacturing tools, which are likely to benefit composite adoption in the long term.

Key Industry Developments

-

Joint Ventures: Automakers forming partnerships with composite specialists to co-develop lightweight solutions—e.g., OEM-supplier alliances for EV chassis components.

-

Facility Expansions: Tier-1 suppliers investing in new composite manufacturing plants with advanced molding and automated fiber placement capabilities.

-

Regulatory Support: Government funding for research consortia focused on advanced composites and recycling processes, particularly under clean-vehicle initiatives.

-

Acquisitions: Major resin and fiber manufacturers acquiring startups with proprietary bio-resin or sustainable fiber technologies to broaden their material portfolios.

Analyst Suggestions

-

Cost Optimization: Focus R&D on low-cost reinforcement fibers and high-speed composite processing techniques to make polymer composites competitive with metals in high-volume segments.

-

Recycling Infrastructure: Collaborate with waste management and recycling firms to establish closed-loop systems, ensuring end-of-life composite recovery and regulatory compliance.

-

Skill Development: Invest in workforce training programs for composite design, processing, and repair to build internal expertise and reduce reliance on external specialists.

-

Strategic Collaborations: Form cross-industry coalitions with policymakers, research institutions, and OEMs to drive standardization, technical innovation, and policy alignment.

Future Outlook

The Automotive Polymer Composites market is poised for sustained growth, with adoption expanding from premium and EV segments into mainstream passenger and commercial vehicles. Technological breakthroughs in low-cost carbon fibers, bio-based resins, and automated manufacturing will further drive cost parity and manufacturability. As digital design and simulation tools mature, development cycles will shrink, enabling faster time-to-market for composite-intensive vehicle architectures. Regulatory and consumer emphasis on sustainability will reinforce the shift toward recyclable and bio-derived composites. Looking ahead, polymer composites will play an integral role in realizing lightweight, safe, and eco-friendly mobility solutions worldwide.

Conclusion

The automotive industry’s imperative for lighter, safer, and more sustainable vehicles positions polymer composites as a cornerstone material for future mobility. By delivering unmatched performance-to-weight advantages, design versatility, and corrosion resistance, composites are redefining component design and production processes. While challenges around cost, recyclability, and supply chain resilience persist, ongoing innovations in materials science, processing technologies, and circular economy practices are set to overcome these hurdles. For OEMs, suppliers, and material innovators, embracing collaborative R&D, digital transformation, and green manufacturing strategies will unlock the full potential of automotive polymer composites, driving competitive differentiation and environmental stewardship in the evolving global vehicle market.