Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Paint robots deliver up to 30 % material savings and 20 % faster cycle times compared to manual spraying, enhancing cost-efficiency.

-

AI-driven path optimization reduces paint robot programming time by up to 50 %, accelerating model changeovers and color shifts.

-

Collaborative paint robots are gaining traction for small-series and custom-vehicle production, offering safe human–robot interaction.

-

Strict environmental regulations (e.g., EU’s VOC Directive) are accelerating the deployment of robots equipped with high-transfer-efficiency spray guns and closed-loop monitoring.

Market Drivers

Several factors are driving the growth of the Automotive Paint Robots market:

-

Production Efficiency: Paint robots deliver consistent, high-speed application, reducing cycle times and enabling manufacturers to meet rising vehicle production targets.

-

Quality and Precision: Automated spray control ensures uniform coating thickness and surface finish, minimizing defects and rework.

-

Environmental Compliance: Robotic systems with integrated sensor feedback optimize paint usage, reduce overspray, and help OEMs comply with stringent VOC emission limits.

-

Labor Cost Reduction: Automation mitigates reliance on manual painters, lowering labor expenses and addressing skilled-worker shortages.

-

Flexible Manufacturing: Programmable robots support quick model changeovers and color variations, catering to mass customization trends.

Market Restraints

Despite strong growth prospects, the market faces several challenges:

-

High Capital Expenditure: Initial investment in robotic paint systems—including robots, booths, and peripheral equipment—can be prohibitive for smaller manufacturers.

-

Integration Complexity: Retrofitting robots into existing paint shops requires careful engineering, programming, and safety validation, extending deployment timelines.

-

Maintenance Requirements: Paint robots operate in corrosive environments; regular maintenance, filter replacements, and protective coatings are necessary to ensure uptime.

-

Technical Expertise: Skilled personnel are needed to program, maintain, and troubleshoot complex robotic systems, creating a talent gap in some regions.

-

Material Compatibility: New paint formulations (e.g., waterborne, UV-curable) may require specialized spray equipment and robot end‐effectors, complicating standardization.

Market Opportunities

The Automotive Paint Robots market presents lucrative opportunities for growth and innovation:

-

Cobots for Low-Volume Production: Development of collaborative paint robots for safe operation alongside humans in low-volume assembly and prototyping environments.

-

Edge-AI Integration: Embedding AI at the robot controller level for real-time defect detection and adaptive spray adjustments.

-

Retrofitting Solutions: Offering modular retrofit kits to upgrade legacy manual booths with robotic capabilities at reduced cost and downtime.

-

Aftermarket Refurbishment: Expanding into automotive aftermarket and collision repair centers seeking productivity gains through automation.

-

Service and Maintenance Packages: Providing predictive maintenance services leveraging IoT connectivity to minimize unplanned paint cell downtime.

Market Dynamics

The Automotive Paint Robots market is characterized by dynamic trends, regulatory influences, and technological progress shaping competitive strategies:

-

Standardization of Interfaces: Adoption of universal communication protocols (e.g., OPC UA, Ethernet/IP) simplifies integration of robots, sensors, and paint equipment from multiple vendors.

-

Digital Twins: Virtual replicas of paint cells allow process simulation, operator training, and continuous optimization before physical deployment.

-

Sustainability Focus: Lifecycle analysis and circular economy principles drive demand for paint robots that minimize waste and energy consumption.

-

Collaborative Ecosystems: Partnerships between robot OEMs, paint suppliers, and integrators foster turnkey solutions with guaranteed performance metrics.

-

Regulatory Evolution: Updates to environmental and workplace safety regulations continue to influence robot features, such as enclosed cabins and advanced filtration systems.

Regional Analysis

The Automotive Paint Robots market exhibits regional variations in adoption rates and growth potential:

-

Asia Pacific: Market leader driven by high-volume automotive manufacturing in China, Japan, and South Korea; strong government support for factory automation.

-

Europe: Mature market with strict environmental and safety regulations; Germany, France, and Italy lead in paint robot adoption across OEMs and tier-1 suppliers.

-

North America: Growing demand fueled by reshoring trends and investments in EV production facilities in the U.S. and Mexico.

-

Latin America: Emerging market, with Brazil and Mexico investing in paint robot cells to modernize expanding automotive assembly lines.

-

Middle East & Africa: Nascent adoption hindered by infrastructure constraints, but luxury and niche OEMs in the GCC region are beginning to automate paint shops.

Competitive Landscape

Leading Companies in the Automotive Paint Robots Market

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Durr Group

- Stäubli International AG

- Comau S.p.A.

- Nachi-Fujikoshi Corporation

- Epson Robots

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

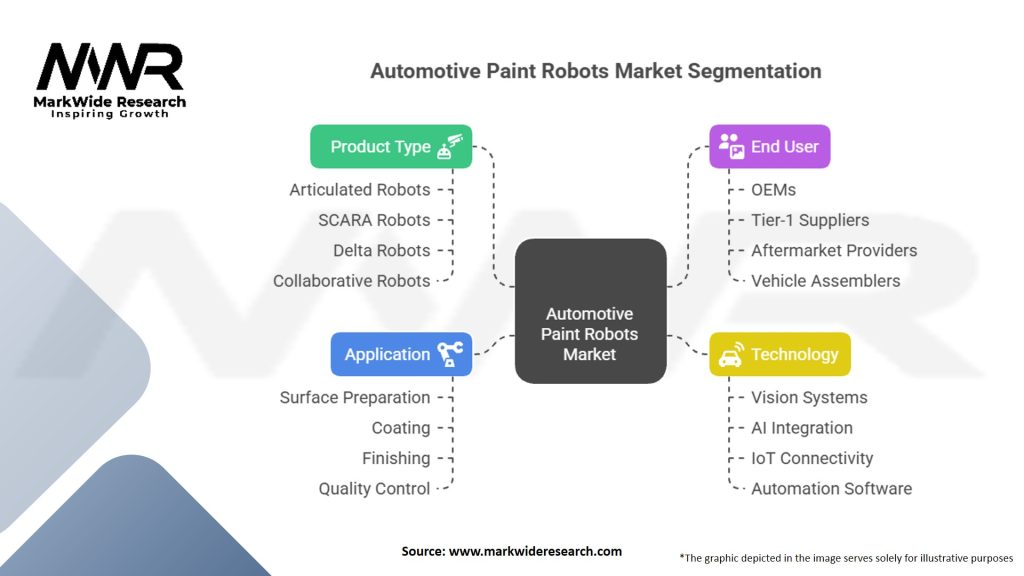

Segmentation

The Automotive Paint Robots market can be segmented based on:

-

Robot Type: Articulated, Cartesian, SCARA, Delta

-

Application Stage: Primer Application, Basecoat Application, Clearcoat Application

-

Automation Level: Fully Automated Paint Cells, Hybrid Manual–Robot Systems, Collaborative Robots

-

End User: OEM Paint Shops, Tier-1 Supplier Facilities, Aftermarket and Collision Repair Centers

Category-wise Insights

-

Articulated Robots: Offer maximum reach and flexibility for complex body shapes; ideal for high-volume OEM lines.

-

Cartesian Robots: Employed in pre- and post-paint handling tasks, such as part transfer and masking.

-

SCARA and Delta Robots: Used for component-level painting (mirrors, bumpers) due to their high speed and precision.

-

Collaborative Robots: Emerging for small-batch customization and prototyping, with safety features for human interaction.

Key Benefits for Industry Participants and Stakeholders

-

Consistent Quality: Uniform spray patterns and precise control reduce variability and defects.

-

Cost Reduction: Lower paint consumption and reduced rework translate into material and labor savings.

-

Increased Throughput: Continuous operation with minimal downtime accelerates production capacity.

-

Enhanced Safety: Robots operate in hazardous environments—protecting workers from solvent exposure and repetitive strain injuries.

-

Scalability: Modular robot cells can be replicated or redeployed easily to match production changes.

SWOT Analysis

Strengths

-

High precision and repeatability in coating applications

-

Integration with Industry 4.0 initiatives and digital tools

-

Ability to handle multiple paint types and colors with quick changeovers

Weaknesses

-

Significant upfront investment and long payback periods for small-volume plants

-

Dependence on robust infrastructure (power, ventilation, exhaust systems)

-

Complexity in programming and maintenance requiring specialized skills

Opportunities

-

Growth in electric and autonomous vehicle production requiring premium paint finishes

-

Retrofitting legacy paint shops for automation at reduced cost

-

Development of AI-driven process analytics for real-time quality assurance

Threats

-

Economic downturns impacting automotive production volumes

-

Rapid changes in paint chemistry demanding frequent equipment updates

-

Competitive pressure from low-cost regional robot suppliers

Market Key Trends

-

AI-Enhanced Path Planning: Use of machine learning to optimize spray trajectories and reduce cycle times.

-

Modular Paint Cells: Pre-engineered, plug-and-play robot booths for faster installation and scalability.

-

Edge Computing: On-device analytics for real-time defect detection and process adjustment without cloud dependencies.

-

Eco-Friendly Coatings: Integration of waterborne and UV-curable paints necessitating specialized robot end-effectors.

-

Digital Twin Deployment: Virtual commissioning and continuous simulation to refine paint processes and train staff.

Covid-19 Impact

The Covid-19 pandemic temporarily disrupted automotive production and delayed paint shop automation projects due to supply chain challenges and workforce restrictions. However, it also highlighted the value of automation for maintaining operations with reduced personnel. Post-pandemic recovery has seen renewed investment in paint robots as OEMs seek to enhance resilience, productivity, and social distancing measures within manufacturing facilities.

Key Industry Developments

-

Partnership Announcements: Collaborations between robot OEMs and paint suppliers to co-develop integrated spray solutions with guaranteed performance.

-

New Product Launches: Introduction of compact, cobot-compatible paint robots designed for low-volume and specialty vehicle applications.

-

Standardization Efforts: Industry consortia releasing guidelines for safety, data communication, and environmental performance of paint robot cells.

-

Funding Initiatives: Government grants and subsidies in key regions supporting factory automation investments under smart manufacturing programs.

Analyst Suggestions

-

Adopt Modular Approaches: Start with pilot projects using modular robot cells to validate ROI before scaling to full paint shop automation.

-

Invest in Training: Develop in-house expertise through training partnerships with robot OEMs to ensure reliable programming and maintenance.

-

Leverage Digital Tools: Utilize digital twins and edge analytics to optimize paint processes, reduce trial runs, and accelerate model changeovers.

-

Focus on Sustainability: Prioritize paint robot solutions compatible with eco-friendly coatings and energy-efficient operation to meet regulatory and CSR targets.

Future Outlook

The Automotive Paint Robots market is poised for sustained growth, with increasing automation in both high-volume and specialty production segments. The rise of electric and autonomous vehicles—demanding premium finishes—will drive further robot sophistication. Integration of AI, IoT, and digital twins will create smarter, self-optimizing paint cells. As aftermarket and small-batch customization sectors also embrace automation, the total addressable market will expand beyond traditional OEM paint shops, cementing robots as the cornerstone of future automotive finishing processes.

Conclusion

In conclusion, the Automotive Paint Robots market stands at the intersection of manufacturing efficiency, environmental compliance, and digital transformation. By delivering precision, consistency, and safety, paint robots address critical challenges in automotive finishing. While upfront costs and technical complexities remain considerations, ongoing innovations—such as collaborative robots, AI-enhanced controls, and modular cell designs—are lowering barriers and expanding use cases. Stakeholders who strategically invest in automation, workforce development, and sustainable practices will gain a competitive edge, ensuring superior paint quality and operational resilience in an increasingly dynamic automotive landscape.