444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The automotive NOR flash memory market represents a critical component in the rapidly evolving automotive electronics ecosystem. As vehicles become increasingly sophisticated with advanced driver assistance systems, infotainment platforms, and autonomous driving capabilities, the demand for reliable, high-performance memory solutions continues to surge. NOR flash memory technology serves as the backbone for storing critical automotive software, including boot code, firmware, and real-time operating systems that ensure vehicle safety and functionality.

Market dynamics indicate robust growth driven by the automotive industry’s digital transformation. The integration of electric vehicles, connected car technologies, and advanced safety systems has created unprecedented demand for memory solutions that can withstand harsh automotive environments while delivering consistent performance. Current market trends show a 12.3% CAGR growth trajectory, with Asia-Pacific leading regional adoption at approximately 45% market share.

Technological advancement in automotive NOR flash memory focuses on enhanced durability, temperature resistance, and data retention capabilities. Modern automotive applications require memory solutions that can operate reliably across extreme temperature ranges while maintaining data integrity for extended periods. The market encompasses various density configurations, from low-density solutions for basic automotive functions to high-density memory for complex infotainment and autonomous driving systems.

The automotive NOR flash memory market refers to the specialized segment of non-volatile memory solutions designed specifically for automotive applications, providing reliable data storage and code execution capabilities in vehicles’ electronic control units and advanced driver assistance systems.

NOR flash memory technology differs from NAND flash by offering faster read speeds and execute-in-place capabilities, making it ideal for storing critical automotive software that requires immediate access. This memory type enables vehicles to boot quickly and execute safety-critical functions without delay, ensuring optimal performance in mission-critical automotive applications.

Automotive-grade specifications distinguish these memory solutions from consumer electronics applications. They must meet stringent automotive quality standards, including AEC-Q100 qualification, extended temperature ranges from -40°C to +125°C, and enhanced reliability requirements. The memory solutions support various automotive communication protocols and integrate seamlessly with existing vehicle architectures.

Market expansion in the automotive NOR flash memory sector reflects the automotive industry’s accelerated digitization and electrification trends. The convergence of traditional automotive manufacturing with advanced semiconductor technologies has created substantial opportunities for memory solution providers. Electric vehicle adoption contributes approximately 28% of market growth, while advanced driver assistance systems account for an additional 35% growth contribution.

Key market drivers include increasing vehicle electronic content, regulatory mandates for safety systems, and consumer demand for enhanced connectivity features. The shift toward software-defined vehicles requires robust memory infrastructure capable of supporting over-the-air updates, real-time data processing, and complex algorithm execution. Autonomous driving development particularly drives demand for high-performance memory solutions with enhanced reliability characteristics.

Competitive landscape features established semiconductor manufacturers expanding their automotive portfolios alongside specialized automotive memory providers. Market consolidation trends indicate strategic partnerships between memory manufacturers and automotive OEMs to develop customized solutions. The industry emphasizes long-term supply agreements and collaborative development programs to ensure stable supply chains for critical automotive applications.

Strategic market insights reveal several critical trends shaping the automotive NOR flash memory landscape:

Technological advancement serves as the primary catalyst for automotive NOR flash memory market expansion. The automotive industry’s transition toward software-defined vehicles creates substantial demand for reliable memory solutions capable of supporting complex software architectures. Modern vehicles require memory systems that can handle multiple simultaneous processes while maintaining real-time responsiveness for safety-critical functions.

Regulatory compliance drives significant market growth as governments worldwide implement stricter automotive safety standards. Requirements for advanced driver assistance systems, electronic stability control, and collision avoidance systems mandate the integration of sophisticated memory solutions. Safety regulations particularly emphasize the need for memory systems with enhanced fault tolerance and diagnostic capabilities.

Consumer expectations for enhanced vehicle connectivity and infotainment capabilities fuel demand for high-capacity memory solutions. Modern consumers expect seamless smartphone integration, over-the-air software updates, and personalized driving experiences, all requiring robust memory infrastructure. The growing popularity of connected car services creates additional memory requirements for data logging, user preferences, and communication protocols.

Electric vehicle proliferation introduces new memory requirements for battery management, charging systems, and energy optimization algorithms. Electric vehicle platforms require specialized memory solutions capable of supporting complex power management software while operating in challenging electromagnetic environments. The integration of renewable energy systems and smart charging capabilities further expands memory requirements.

Cost pressures represent a significant challenge for automotive NOR flash memory market growth. Automotive manufacturers face intense competition and margin pressure, leading to aggressive cost reduction targets for electronic components. The automotive industry’s price-sensitive nature often conflicts with the premium pricing associated with automotive-grade memory solutions that meet stringent quality and reliability requirements.

Supply chain complexities create substantial challenges for market participants. The automotive industry’s just-in-time manufacturing approach conflicts with semiconductor supply chain realities, particularly during periods of high demand or supply disruptions. Long automotive qualification cycles further complicate supply chain planning, as memory solutions require extensive testing and validation before integration into vehicle platforms.

Technical limitations of current NOR flash memory technologies constrain certain automotive applications. While NOR flash excels in code execution and reliability, it faces challenges in high-density applications where cost per bit becomes prohibitive. The technology’s write speed limitations and endurance characteristics may not meet requirements for certain data-intensive automotive applications.

Standardization challenges across different automotive manufacturers create market fragmentation. Varying technical specifications, qualification requirements, and integration standards increase development costs and complexity for memory solution providers. The lack of universal automotive memory standards necessitates customized solutions for different OEM platforms, limiting economies of scale.

Autonomous vehicle development presents unprecedented opportunities for automotive NOR flash memory providers. The evolution toward higher levels of vehicle autonomy requires sophisticated memory architectures capable of supporting complex artificial intelligence algorithms and real-time decision-making systems. Level 4 and Level 5 autonomous vehicles will demand memory solutions with enhanced performance, reliability, and security features.

Edge computing integration in vehicles creates new market segments for specialized memory solutions. As vehicles become mobile computing platforms, there’s growing demand for memory systems that can support local data processing, machine learning inference, and real-time analytics. The shift toward distributed computing architectures within vehicles opens opportunities for innovative memory solutions.

Cybersecurity requirements drive demand for secure memory solutions with hardware-based security features. As vehicles become increasingly connected, the need for memory systems with built-in encryption, secure boot capabilities, and tamper resistance grows substantially. Automotive cybersecurity regulations create mandatory requirements for secure memory implementations across vehicle platforms.

Emerging market expansion offers significant growth potential as automotive electronics adoption accelerates in developing regions. Countries with growing automotive manufacturing capabilities present opportunities for memory solution providers to establish local partnerships and supply relationships. The expansion of electric vehicle infrastructure in emerging markets creates additional demand for automotive memory solutions.

Competitive dynamics in the automotive NOR flash memory market reflect the broader semiconductor industry’s evolution toward specialized automotive solutions. Traditional memory manufacturers are investing heavily in automotive-specific product development, while new entrants focus on innovative technologies tailored for next-generation vehicle architectures. Market consolidation through strategic acquisitions and partnerships continues to reshape the competitive landscape.

Technology evolution drives continuous innovation in memory architecture, manufacturing processes, and integration capabilities. The development of embedded NOR flash solutions integrated directly into automotive microcontrollers represents a significant trend toward system-level optimization. Advanced packaging technologies enable higher density solutions while maintaining automotive reliability standards.

Customer relationships in the automotive memory market emphasize long-term partnerships and collaborative development programs. Automotive OEMs increasingly seek memory suppliers capable of providing comprehensive support throughout the vehicle lifecycle, from initial design through production and field support. Design-in partnerships become critical for securing long-term revenue streams in the automotive market.

Supply chain resilience has become a critical focus following recent global disruptions. Memory manufacturers are investing in geographically diversified production capabilities and strategic inventory management to ensure stable supply for automotive customers. The industry trend toward supply chain localization creates opportunities for regional memory suppliers while challenging global supply chain models.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves direct engagement with automotive OEMs, tier-one suppliers, memory manufacturers, and technology integrators to gather firsthand market intelligence. Industry expert interviews provide qualitative insights into market trends, challenges, and future opportunities.

Secondary research encompasses extensive analysis of industry publications, technical specifications, patent filings, and regulatory documents. Market data validation occurs through cross-referencing multiple sources and applying statistical analysis techniques to ensure data accuracy. Historical market data analysis provides context for current trends and supports future market projections.

Quantitative analysis utilizes statistical modeling techniques to analyze market size, growth rates, and segmentation patterns. Data collection includes production volumes, pricing trends, and adoption rates across different automotive segments and geographic regions. Market modeling incorporates various scenarios to account for potential market disruptions and technology shifts.

Validation processes ensure research findings meet rigorous quality standards through peer review, expert consultation, and data triangulation. Market projections undergo sensitivity analysis to assess the impact of various market variables and assumptions. Continuous monitoring of market developments ensures research findings remain current and relevant for strategic decision-making.

Asia-Pacific dominance in the automotive NOR flash memory market reflects the region’s position as a global automotive manufacturing hub. Countries including China, Japan, and South Korea lead both automotive production and semiconductor manufacturing, creating synergies for memory solution development and deployment. The region accounts for approximately 45% of global market share, driven by strong domestic automotive demand and export-oriented manufacturing.

North American market characteristics emphasize advanced automotive technologies and premium vehicle segments. The region’s focus on autonomous vehicle development and electric vehicle adoption creates demand for high-performance memory solutions. Major automotive manufacturers in the United States and Canada drive innovation in automotive electronics, contributing approximately 28% of global market demand.

European market dynamics reflect stringent automotive safety regulations and environmental standards that drive demand for advanced memory solutions. The region’s leadership in automotive safety systems and luxury vehicle manufacturing creates opportunities for premium memory products. European automotive manufacturers’ emphasis on software-defined vehicles contributes approximately 22% of global market share.

Emerging markets including Latin America, Middle East, and Africa present growth opportunities as automotive electronics adoption accelerates. These regions benefit from technology transfer and localized automotive manufacturing initiatives. Infrastructure development and rising consumer purchasing power support automotive market expansion, though they currently represent a smaller portion of global memory demand.

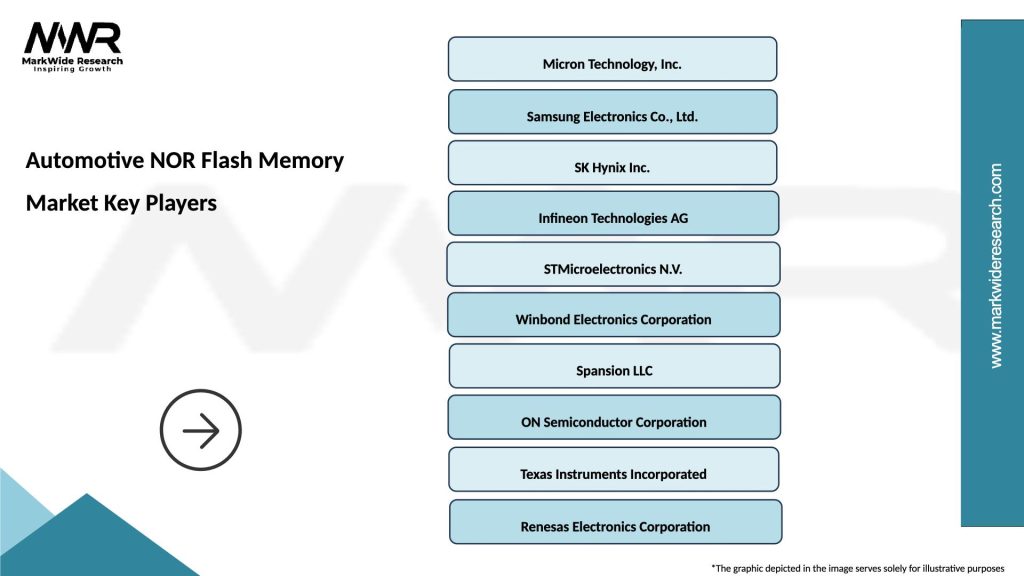

Market leadership in automotive NOR flash memory involves established semiconductor manufacturers with strong automotive portfolios:

Strategic positioning among market participants emphasizes differentiation through technology innovation, automotive qualification expertise, and comprehensive customer support. Companies invest heavily in automotive-specific R&D to develop memory solutions that meet evolving vehicle requirements while maintaining competitive pricing.

Partnership strategies play crucial roles in market success, with memory manufacturers forming alliances with automotive OEMs, tier-one suppliers, and technology integrators. These collaborations enable co-development programs for customized memory solutions and ensure long-term supply relationships in the automotive market.

Technology segmentation of the automotive NOR flash memory market encompasses various memory architectures and manufacturing processes:

Application segmentation reflects diverse automotive use cases:

Vehicle type segmentation addresses different automotive market segments:

Serial NOR flash memory represents the largest category within the automotive market, driven by its versatility and cost-effectiveness for a wide range of automotive applications. This category benefits from mature manufacturing processes and established supply chains, making it attractive for high-volume automotive production. Serial interfaces provide sufficient performance for most automotive control units while minimizing pin count and system complexity.

Parallel NOR flash memory serves specialized automotive applications requiring maximum performance and execute-in-place capabilities. This category addresses safety-critical systems where fast boot times and immediate code execution are essential. Despite higher costs compared to serial solutions, parallel NOR flash remains important for advanced driver assistance systems and real-time control applications.

Embedded NOR flash solutions represent a growing category as automotive system designers seek integration benefits and reduced component counts. This approach enables system-level optimization and improved reliability through reduced interconnections. Embedded solutions particularly benefit applications with space constraints and harsh environmental requirements common in automotive deployments.

High-density NOR flash memory addresses emerging automotive applications requiring substantial code storage capacity. As vehicle software complexity increases, demand grows for memory solutions capable of storing multiple software images and supporting over-the-air update capabilities. This category faces competition from alternative memory technologies but maintains advantages in reliability and execute-in-place functionality.

Automotive manufacturers benefit from reliable NOR flash memory solutions that enable advanced vehicle features while meeting stringent safety and quality requirements. These memory solutions support software-defined vehicle architectures that allow manufacturers to differentiate their products through software capabilities and over-the-air updates. The reliability and durability of automotive-grade NOR flash memory reduce warranty costs and enhance brand reputation.

Tier-one suppliers gain competitive advantages through partnerships with leading memory manufacturers, accessing advanced technologies and comprehensive technical support. Design-in partnerships enable suppliers to develop innovative automotive systems while ensuring stable memory supply throughout product lifecycles. Technical collaboration with memory manufacturers accelerates time-to-market for new automotive electronic systems.

Memory manufacturers benefit from the automotive market’s emphasis on long-term relationships and premium pricing for specialized solutions. The automotive industry’s quality requirements create barriers to entry that protect established suppliers from low-cost competition. Long product lifecycles in automotive applications provide stable revenue streams and opportunities for technology amortization.

Technology integrators and system designers benefit from comprehensive memory solutions that simplify system development and reduce integration risks. Automotive-qualified memory products eliminate the need for extensive in-house qualification testing, accelerating development timelines. Technical support from memory manufacturers assists in optimizing system performance and ensuring regulatory compliance.

End consumers benefit from enhanced vehicle safety, reliability, and functionality enabled by advanced memory solutions. Improved vehicle performance and new features made possible by sophisticated memory architectures enhance the overall driving experience. The reliability of automotive memory solutions contributes to reduced vehicle maintenance requirements and improved long-term ownership costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined vehicle architecture represents a fundamental shift in automotive design philosophy, driving demand for flexible and updatable memory solutions. This trend enables automotive manufacturers to differentiate through software while extending vehicle functionality throughout the ownership lifecycle. NOR flash memory’s execute-in-place capability makes it particularly suitable for supporting complex software architectures in modern vehicles.

Functional safety integration becomes increasingly critical as vehicles incorporate more safety-critical electronic systems. The automotive industry’s adoption of ISO 26262 standards drives demand for memory solutions with enhanced error detection, correction, and diagnostic capabilities. Memory manufacturers are developing specialized products that support functional safety requirements while maintaining cost-effectiveness.

Cybersecurity emphasis reflects growing concerns about vehicle security as connectivity increases. Modern automotive memory solutions incorporate hardware-based security features including secure boot, encryption, and tamper detection capabilities. The trend toward secure memory solutions addresses regulatory requirements and consumer concerns about vehicle cybersecurity.

Over-the-air update capability drives demand for memory architectures that support safe and reliable software updates. Automotive manufacturers seek memory solutions that enable dual-bank configurations and fail-safe update mechanisms. This trend requires memory solutions with enhanced endurance and reliability characteristics to support frequent software updates throughout vehicle lifecycles.

Edge computing integration in vehicles creates new requirements for memory solutions that can support local data processing and machine learning inference. The shift toward distributed computing architectures within vehicles drives demand for memory solutions optimized for real-time processing and low-latency applications.

Technology advancement in automotive NOR flash memory focuses on enhanced performance, reliability, and integration capabilities. Recent developments include advanced process nodes that enable higher density solutions while maintaining automotive reliability standards. Manufacturers are investing in specialized automotive manufacturing lines to ensure consistent quality and supply stability.

Strategic partnerships between memory manufacturers and automotive OEMs continue to shape the industry landscape. These collaborations focus on co-development programs for next-generation vehicle platforms and long-term supply agreements. According to MarkWide Research analysis, such partnerships are becoming increasingly important for securing design wins in competitive automotive markets.

Manufacturing capacity expansion reflects growing automotive memory demand and supply chain resilience initiatives. Memory manufacturers are investing in geographically diversified production capabilities to serve regional automotive markets and reduce supply chain risks. These investments include both new fabrication facilities and expansion of existing automotive-qualified production lines.

Product portfolio expansion addresses diverse automotive application requirements through specialized memory solutions. Manufacturers are developing application-specific products optimized for different automotive use cases, from basic control units to advanced autonomous driving systems. This trend toward specialization enables better performance optimization and competitive differentiation.

Quality standard evolution reflects the automotive industry’s increasing emphasis on reliability and safety. New automotive qualification standards address emerging applications including autonomous driving and electric vehicle systems. Memory manufacturers are adapting their qualification processes to meet evolving automotive requirements while maintaining cost competitiveness.

Strategic positioning recommendations for automotive NOR flash memory market participants emphasize the importance of long-term customer relationships and collaborative development approaches. Companies should focus on building comprehensive automotive portfolios that address diverse application requirements while maintaining consistent quality and supply reliability. Investment in automotive-specific R&D capabilities enables differentiation and premium positioning.

Technology development priorities should focus on emerging automotive requirements including enhanced security features, functional safety compliance, and support for over-the-air updates. Next-generation memory architectures should address the growing complexity of automotive software while maintaining the reliability and performance characteristics that make NOR flash suitable for automotive applications.

Market expansion strategies should consider both geographic diversification and application segment expansion. Emerging automotive markets present growth opportunities, while new application areas including autonomous driving and electric vehicle systems create demand for specialized memory solutions. Companies should balance market expansion with the need to maintain automotive qualification standards and supply chain reliability.

Supply chain optimization becomes critical for success in the automotive memory market. Companies should invest in supply chain resilience through geographic diversification, strategic inventory management, and long-term supplier relationships. The automotive industry’s just-in-time manufacturing approach requires memory suppliers to maintain flexible and responsive supply chain capabilities.

Partnership development with automotive ecosystem participants creates opportunities for market expansion and technology advancement. Strategic alliances with automotive OEMs, tier-one suppliers, and technology integrators enable access to market opportunities and collaborative development programs. These partnerships should focus on mutual value creation and long-term relationship building.

Market evolution in the automotive NOR flash memory sector will be driven by the continued transformation of the automotive industry toward electrification, connectivity, and autonomy. The integration of artificial intelligence and machine learning capabilities in vehicles will create new requirements for memory solutions that can support complex algorithms while maintaining automotive reliability standards. MarkWide Research projects sustained growth driven by these technological transitions.

Technology roadmap developments will focus on addressing emerging automotive requirements through enhanced memory architectures and manufacturing processes. Future NOR flash memory solutions will incorporate advanced security features, improved endurance characteristics, and optimized power consumption for electric vehicle applications. The evolution toward system-in-package solutions will enable higher integration levels and improved system performance.

Application expansion will drive market growth as vehicles incorporate more sophisticated electronic systems. The development of Level 4 and Level 5 autonomous vehicles will create substantial demand for high-reliability memory solutions capable of supporting safety-critical decision-making systems. Electric vehicle adoption will continue driving demand for specialized memory solutions optimized for power management and battery control applications.

Competitive dynamics will evolve as the market matures and new technologies emerge. Traditional memory manufacturers will face competition from specialized automotive semiconductor companies and emerging memory technologies. Success will depend on the ability to innovate continuously while maintaining the reliability and quality standards required for automotive applications. Market consolidation through strategic acquisitions and partnerships will likely continue as companies seek to strengthen their automotive market positions.

Regional market development will reflect global automotive industry trends, with Asia-Pacific maintaining leadership in both automotive production and memory manufacturing. Emerging markets will contribute to growth as automotive electronics adoption accelerates, while established markets will drive demand for advanced memory solutions supporting next-generation vehicle technologies. The trend toward supply chain localization will influence regional market dynamics and investment patterns.

The automotive NOR flash memory market stands at the intersection of two rapidly evolving industries: automotive manufacturing and semiconductor technology. As vehicles become increasingly sophisticated and software-defined, the demand for reliable, high-performance memory solutions continues to grow substantially. The market’s evolution reflects broader automotive industry trends toward electrification, connectivity, and autonomous driving capabilities.

Market fundamentals remain strong, supported by the automotive industry’s digital transformation and the unique characteristics of NOR flash memory technology that make it particularly suitable for automotive applications. The technology’s execute-in-place capability, reliability in harsh environments, and compatibility with automotive safety standards position it well for continued growth in the evolving automotive landscape.

Strategic opportunities abound for market participants who can successfully navigate the complex requirements of automotive applications while maintaining competitive cost structures. The emphasis on long-term partnerships, collaborative development, and comprehensive customer support will continue to differentiate successful companies in this market. As MWR analysis indicates, companies that invest in automotive-specific capabilities and maintain focus on quality and reliability will be best positioned for long-term success.

Future success in the automotive NOR flash memory market will depend on the ability to anticipate and respond to evolving automotive requirements while maintaining the fundamental characteristics that make NOR flash memory valuable for automotive applications. The continued growth of electric vehicles, autonomous driving systems, and connected car technologies ensures sustained demand for innovative memory solutions that can meet the unique challenges of automotive deployment.

What is Automotive NOR Flash Memory?

Automotive NOR Flash Memory refers to a type of non-volatile storage technology used in automotive applications, enabling the storage of firmware and software in vehicles. It is characterized by its fast read speeds and reliability, making it suitable for critical automotive functions such as engine control units and infotainment systems.

What are the key players in the Automotive NOR Flash Memory Market?

Key players in the Automotive NOR Flash Memory Market include Micron Technology, NXP Semiconductors, and Cypress Semiconductor, among others. These companies are known for their innovative solutions and contributions to the automotive electronics sector.

What are the growth factors driving the Automotive NOR Flash Memory Market?

The growth of the Automotive NOR Flash Memory Market is driven by the increasing demand for advanced driver-assistance systems (ADAS) and the rising trend of electric vehicles. Additionally, the need for reliable and high-performance memory solutions in automotive applications is propelling market expansion.

What challenges does the Automotive NOR Flash Memory Market face?

The Automotive NOR Flash Memory Market faces challenges such as the high cost of production and the need for stringent quality standards in automotive applications. Additionally, competition from alternative memory technologies can hinder market growth.

What opportunities exist in the Automotive NOR Flash Memory Market?

Opportunities in the Automotive NOR Flash Memory Market include the growing adoption of connected vehicles and the development of autonomous driving technologies. These trends are expected to increase the demand for reliable memory solutions in automotive systems.

What trends are shaping the Automotive NOR Flash Memory Market?

Trends shaping the Automotive NOR Flash Memory Market include the shift towards more integrated automotive electronics and the increasing use of memory in safety-critical applications. Innovations in memory technology are also enhancing performance and reliability in automotive environments.

Automotive NOR Flash Memory Market

| Segmentation Details | Description |

|---|---|

| Product Type | SLC, MLC, TLC, QLC |

| Technology | 3D NAND, 2D NAND, Flash Controller, EEPROM |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Vehicle Assemblers |

| Application | Infotainment Systems, Advanced Driver Assistance Systems, Telematics, Engine Control Units |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Automotive NOR Flash Memory Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at