444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Automotive Millimeter Wave Compatible Emblems market is witnessing significant growth due to the increasing demand for advanced driver assistance systems (ADAS) in vehicles. Millimeter wave technology has emerged as a key component in ADAS, enabling enhanced safety features such as collision avoidance, blind spot detection, and lane departure warning. Millimeter wave compatible emblems play a crucial role in the implementation of these systems by facilitating the integration of sensors and antennas into the vehicle’s body.

Meaning

Automotive millimeter wave compatible emblems refer to the emblems or badges installed on vehicles that are designed to accommodate millimeter wave sensors and antennas. These emblems are strategically placed on the vehicle’s exterior, allowing for seamless integration of millimeter wave technology without compromising the vehicle’s aesthetics. By incorporating millimeter wave compatible emblems, automakers can effectively incorporate ADAS features into their vehicles, enhancing safety and providing a better driving experience.

Executive Summary

The Automotive Millimeter Wave Compatible Emblems market is expected to witness substantial growth in the coming years. The rising adoption of ADAS and the increasing focus on vehicle safety are driving the demand for millimeter wave compatible emblems. These emblems enable automakers to integrate advanced sensors and antennas into vehicles without affecting their visual appeal. The market is characterized by intense competition among key players, who are constantly striving to develop innovative and technologically advanced millimeter wave compatible emblems.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

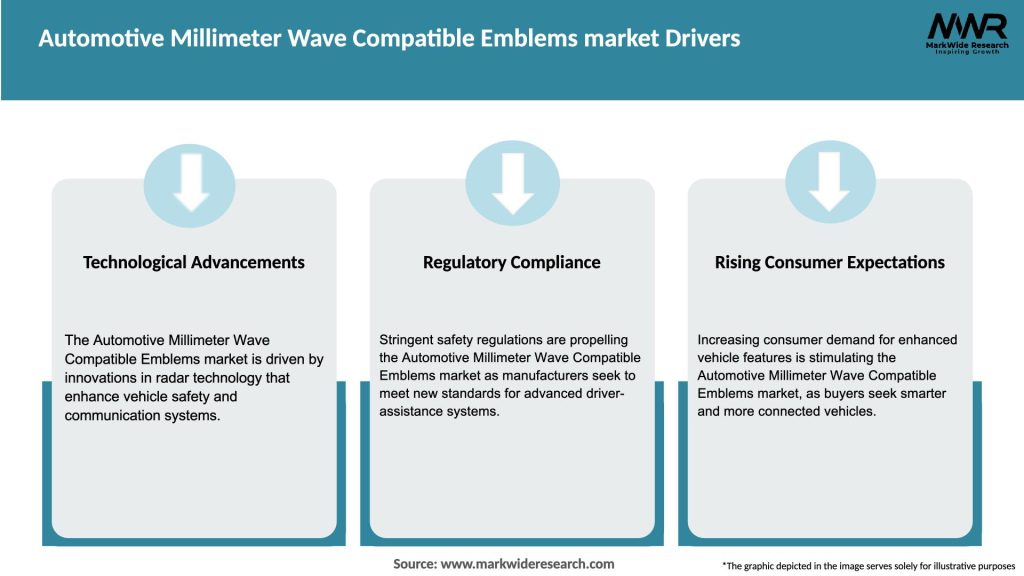

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Automotive Millimeter Wave Compatible Emblems market is driven by various factors, including the growing demand for ADAS, advancements in millimeter wave technology, and government regulations promoting vehicle safety. However, market growth may be hindered by the high implementation costs, lack of awareness and standardization, and limited infrastructure support. Nevertheless, opportunities lie in the rising demand for electric vehicles, collaborations and partnerships, integration with connected cars, and research and development activities.

Regional Analysis

The Automotive Millimeter Wave Compatible Emblems market can be analyzed based on regional segmentation, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading Companies in the Automotive Millimeter Wave Compatible Emblems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

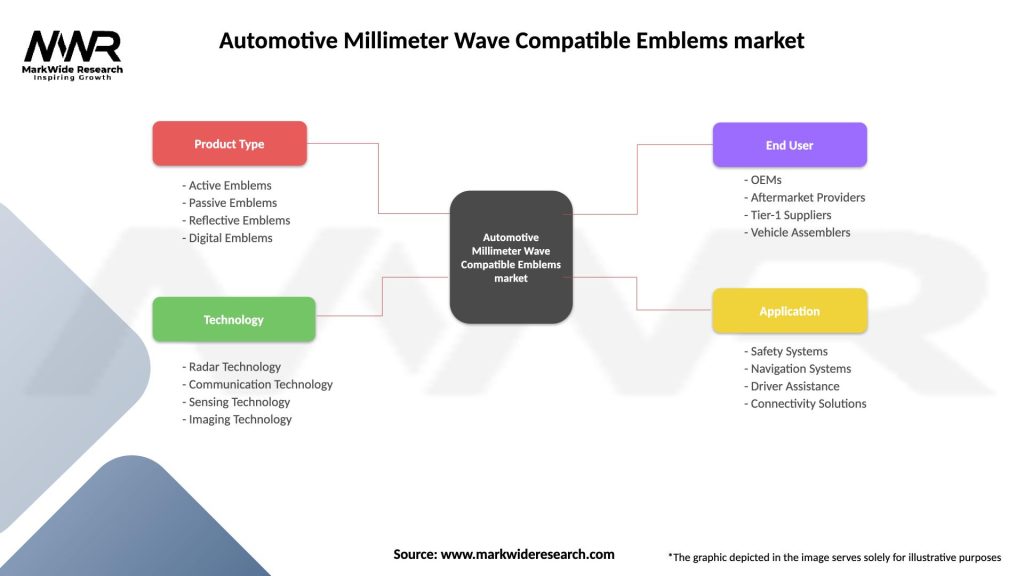

The Automotive Millimeter Wave Compatible Emblems market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the Automotive Millimeter Wave Compatible Emblems market. The global automotive industry faced disruptions in production and supply chain due to lockdowns and restrictions. As a result, the demand for millimeter wave compatible emblems witnessed a decline in the short term. However, the market has shown resilience, with the recovery of the automotive industry and the increasing emphasis on vehicle safety post-pandemic. The market is expected to regain momentum as economic activities normalize and the demand for ADAS features continues to grow.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Automotive Millimeter Wave Compatible Emblems market looks promising, with sustained growth expected in the coming years. The increasing adoption of ADAS features, the rising demand for electric vehicles, and the focus on vehicle safety are key drivers for market growth. Technological advancements, including miniaturization, lightweight design, and multi-sensor compatibility, will further propel the market. Collaborations, partnerships, and research and development activities will shape the competitive landscape, enabling market players to cater to evolving customer needs. Despite challenges such as high implementation costs and limited infrastructure support, the market holds significant opportunities for industry participants.

Conclusion

The Automotive Millimeter Wave Compatible Emblems market is witnessing substantial growth driven by the increasing demand for ADAS features and vehicle safety. Millimeter wave compatible emblems enable the seamless integration of sensors and antennas into vehicles, enhancing collision avoidance, blind spot detection, and lane departure warning systems. Despite challenges related to implementation costs and lack of awareness, the market presents opportunities in the rising adoption of electric vehicles, collaborations, and integration with connected cars. Continuous technological advancements, standardization efforts, and market strategies will shape the future of the Automotive Millimeter Wave Compatible Emblems market, ensuring enhanced safety and driving experiences for consumers.

What is Automotive Millimeter Wave Compatible Emblems?

Automotive Millimeter Wave Compatible Emblems are specialized insignias designed to function effectively with millimeter wave technology, which is increasingly used in automotive applications such as radar systems and advanced driver-assistance systems (ADAS). These emblems are engineered to maintain performance while integrating seamlessly with vehicle aesthetics.

What are the key players in the Automotive Millimeter Wave Compatible Emblems market?

Key players in the Automotive Millimeter Wave Compatible Emblems market include companies like 3M, Avery Dennison, and Nissha Printing Co., Ltd., which are known for their innovative approaches to automotive branding and technology integration. These companies focus on developing products that enhance vehicle functionality and design, among others.

What are the growth factors driving the Automotive Millimeter Wave Compatible Emblems market?

The growth of the Automotive Millimeter Wave Compatible Emblems market is driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the rising demand for enhanced vehicle safety features. Additionally, the integration of millimeter wave technology in automotive applications is propelling the need for compatible emblems.

What challenges does the Automotive Millimeter Wave Compatible Emblems market face?

Challenges in the Automotive Millimeter Wave Compatible Emblems market include the high cost of advanced materials and the complexity of integrating millimeter wave technology with traditional automotive designs. Furthermore, regulatory compliance and the need for durability in various environmental conditions pose additional hurdles.

What opportunities exist in the Automotive Millimeter Wave Compatible Emblems market?

Opportunities in the Automotive Millimeter Wave Compatible Emblems market include the potential for innovation in materials that enhance signal transmission and aesthetic appeal. As the automotive industry shifts towards electric and autonomous vehicles, there is a growing demand for emblems that can support new technologies.

What trends are shaping the Automotive Millimeter Wave Compatible Emblems market?

Trends in the Automotive Millimeter Wave Compatible Emblems market include the increasing use of smart materials that can adapt to environmental changes and the rise of customizable emblems that reflect brand identity. Additionally, the focus on sustainability is leading to the development of eco-friendly materials for automotive applications.

Automotive Millimeter Wave Compatible Emblems market

| Segmentation Details | Description |

|---|---|

| Product Type | Active Emblems, Passive Emblems, Reflective Emblems, Digital Emblems |

| Technology | Radar Technology, Communication Technology, Sensing Technology, Imaging Technology |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Vehicle Assemblers |

| Application | Safety Systems, Navigation Systems, Driver Assistance, Connectivity Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Millimeter Wave Compatible Emblems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at